MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

If you’ve opened the Chase Sapphire Preferred® Card or the Chase Sapphire Reserve® to take advantage of a welcome bonus, you probably know that, in addition to a list of perks, you have access to Chase Travel℠, an online booking platform for Chase cardholders.

Through Chase Travel℠, you can book various travel services and use your Ultimate Rewards points to pay for them. Let’s take a look at what exactly you can book with this travel booking portal, how much your points are worth when using Chase Travel℠ and whether you should be using it at all.

Purchases You Can Make Through Chase Travel℠

When redeeming Ultimate Rewards points via Chase Travel℠, remember that the search engine acts as an online travel agency. In fact, Chase uses cxLoyalty, Inc. as its third-party travel service provider.

As a Chase card holder, you can book flight tickets, hotel rooms, activities and excursions, cruises and car rentals through Chase Travel℠.

Credit Cards That Offer Access to Chase Travel℠

To use Chase Travel℠, you need to have one of the following cards that earns Chase Ultimate Rewards:

- Chase Freedom Flex®

- Chase Freedom Unlimited®

- Chase Ink Business Cash® Credit Card

- Chase Ink Business Preferred® Credit Card

- Chase Ink Business Premier® Credit Card

- Chase Ink Business Unlimited® Credit Card

- Chase Sapphire Preferred® Card

- Chase Sapphire Reserve®

- Sapphire Reserve for Business℠

How Much Are Chase Points Worth When Redeemed Through Travel℠?

Although all of the aforementioned credit cards grant users access to Chase Travel℠, the value of your points varies and depends on the card you hold.

We recommend that you always consolidate your points to the card with the highest redemption value. It’s free and instant to transfer points between cards under your account so make sure you aren’t leaving value on the table.

Here’s how much Ultimate Rewards points are worth when redeemed for travel through Chase Travel℠.

| Chase card | Value of each point |

| Chase Freedom Flex® | 1 cent |

| Chase Freedom Unlimited® | 1 cent |

| Chase Ink Business Cash® Credit Card | 1 cent |

| Chase Ink Business Preferred® Credit Card | 1 cent |

| Chase Ink Business Premier® Credit Card | 1 cent |

| Chase Ink Business Unlimited® Credit Card | 1 cent |

| Chase Sapphire Preferred® Card | 1 to 1.75 cents |

| Chase Sapphire Reserve® | 1 to 2 cents |

| Sapphire Reserve for Business℠ | 1 cent |

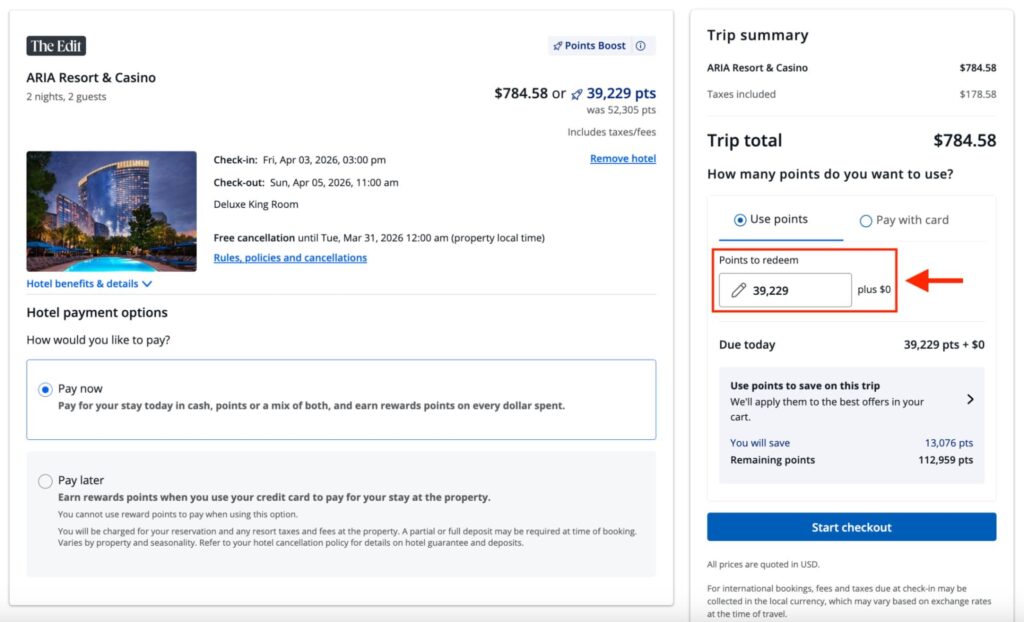

Since the Sapphire Reserve card got a refresh on June 23, 2025, its points are now worth 1 cent each when redeemed for most travel purchases in the travel portal and 2 cents each when redeemed using a Points Boost offer for select flights and hotels, including properties in The Edit℠ portfolio.

Chase Sapphire Preferred Card members also get 1 cent per point with most purchases made through Chase Travel℠ but can get up to 1.5 cents per point in value when redeeming points for select flights and hotels. It’s possible to increase that value to 1.75 cents by redeeming Chase points for premium-cabin flights on select carriers using the Points Boost feature.

The airlines and hotels to which Points Boost offers apply will vary and rotate constantly.

It’s worth noting that if you held the Chase Sapphire Reserve card before June 23, you’ll still be able to redeem the points earned prior to Oct. 26, 2025, at a value of 1.5 cents apiece with Chase Travel℠ until Oct. 26, 2027, when the grace period ends.

Those who held the Chase Sapphire Preferred Card before June 23 will also be able to redeem points earned before Oct. 26, 2025, at a value of 1.25 cents per point through Chase Travel℠ until Oct. 26, 2027.

How to Book Travel Through Chase Travel℠

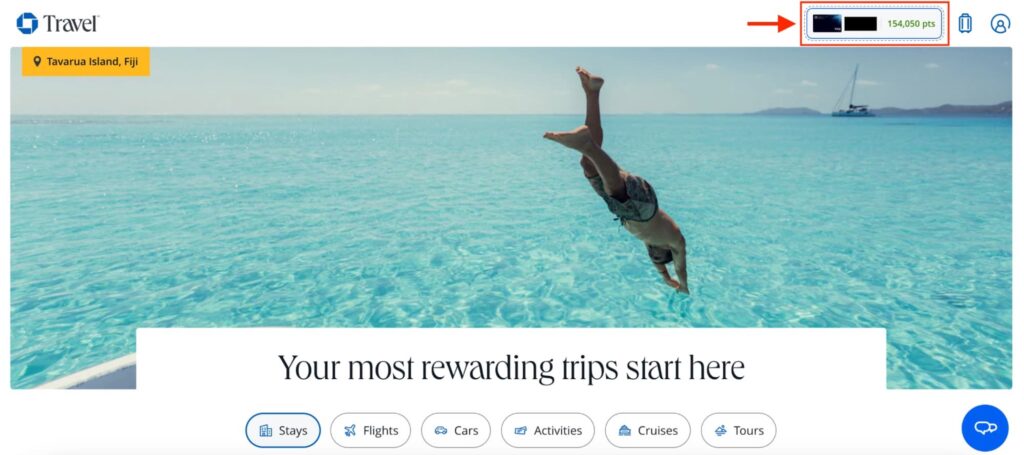

If this is your first time using Chase Travel℠, you’ll want to take a minute to familiarize yourself with the initial dashboard. It has a few handy tabs to manage your account.

The first tab you will see at the top right of the screen is an image of the card you are currently set to as well as the current points balance of that card. To switch between cards (if you hold multiple Chase cards that is), simply click on the card and a menu will drop down with all the cards associated with your account along with each card’s point total.

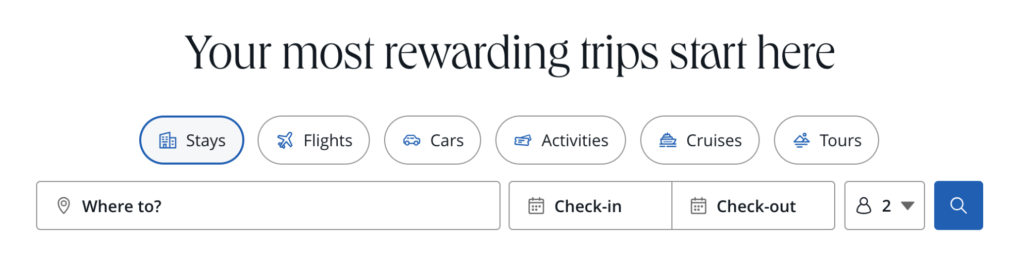

To start the booking process, first log in to your Ultimate Rewards account and navigate to the Travel tab. From there, you can search for the travel component you need: stays, flights, cars, activities, cruises or tours.

Hotel Stays

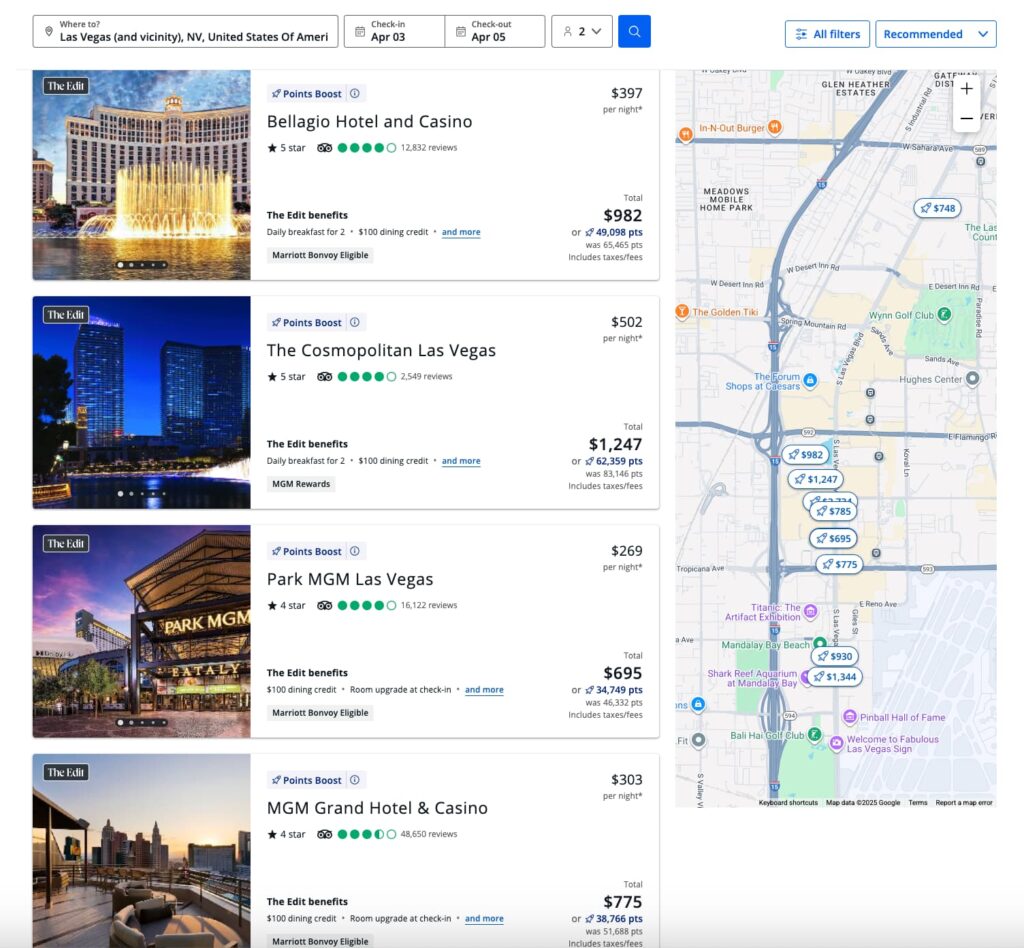

Let’s say you need to book a hotel stay in Las Vegas, so enter your search parameters the same as always by specifying your destination, travel dates and the number of travelers. The Points Boost options show up first.

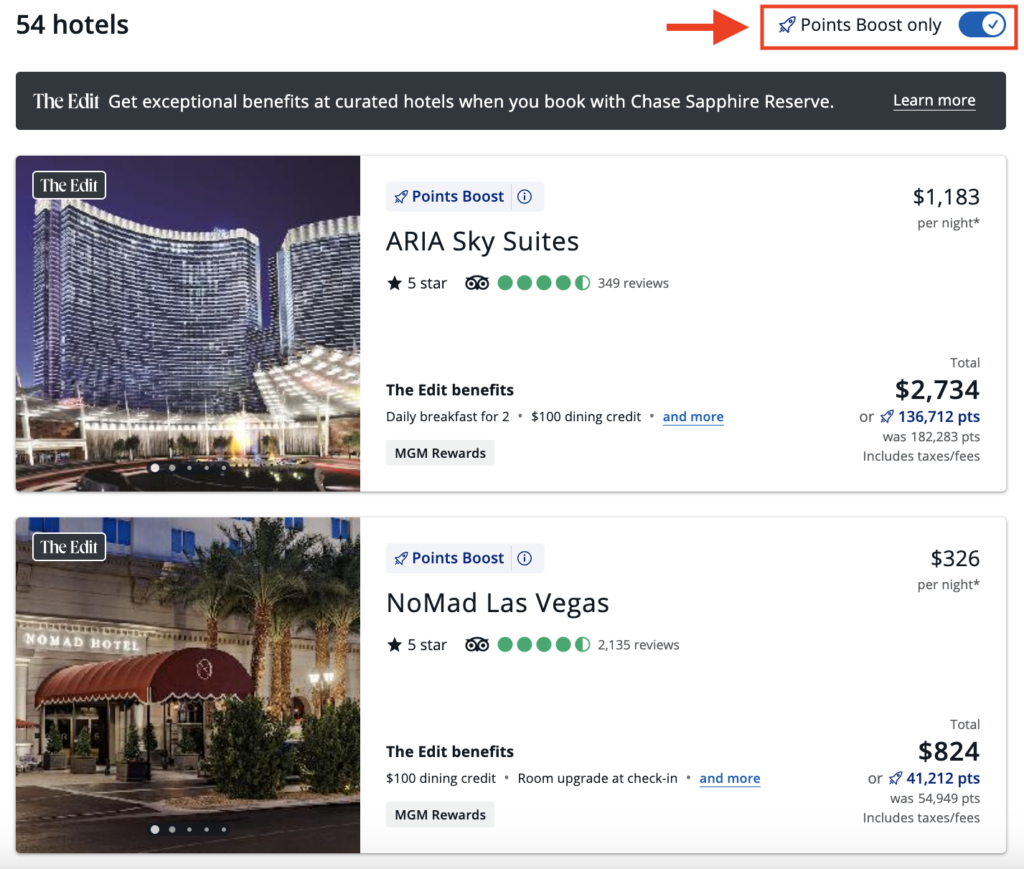

If you’d like the available hotel options to increase your rewards value and include Points Boost only, then turn on the toggle in the upper right corner to reflect that preference.

Make a room selection and continue the booking process to finish making a reservation. At checkout, you’ll have the option to pay for your stay with points, cash or a mix of cash and points. You’ll still earn rewards on the cash portion of your payment.

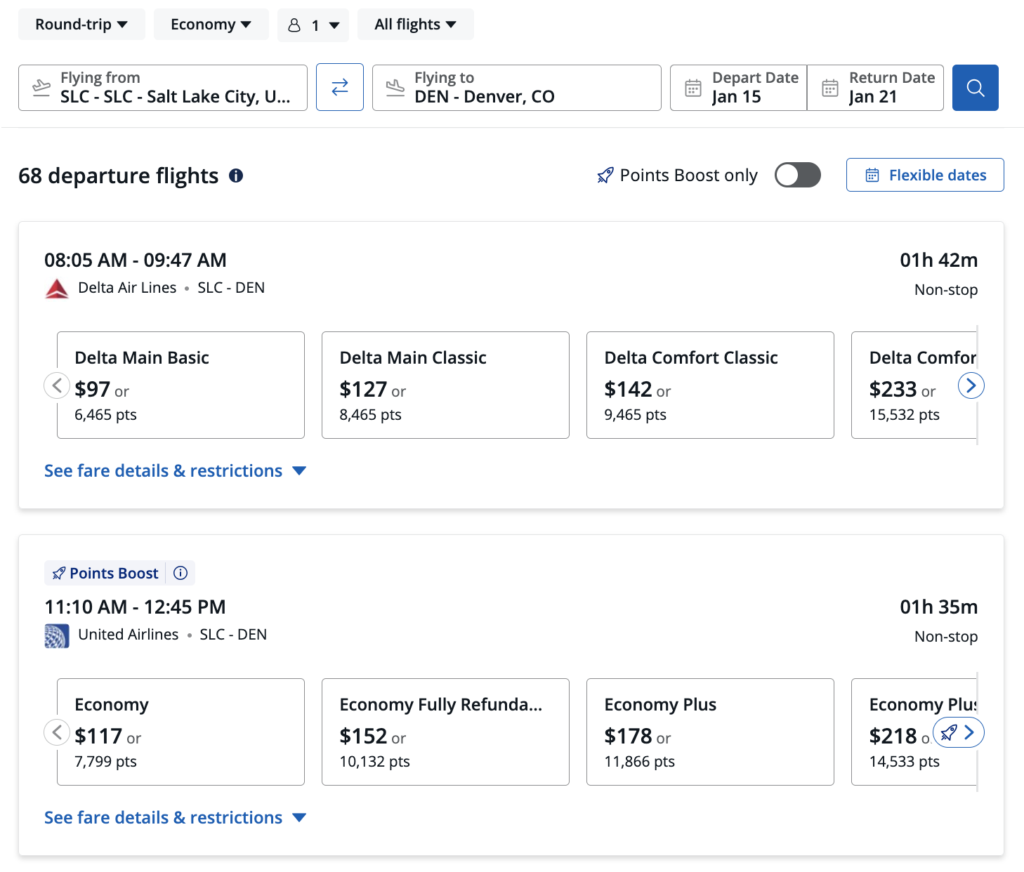

Flights

Before you start the booking process, choose “Flights” from the main Travel booking page and fill out the search parameters as you normally do—by inputting your flight origin and destination, travel dates and the number of travelers.

The results are sorted by “Recommended” when they’re displayed, but feel free to sort them by whatever is more important to you: the lowest price, the shortest duration or the earliest departure.

Keep in mind that basic-economy flights show up in the search, and you’ll need to be careful when selecting an itinerary if you’re trying to avoid those bare-bones tickets.

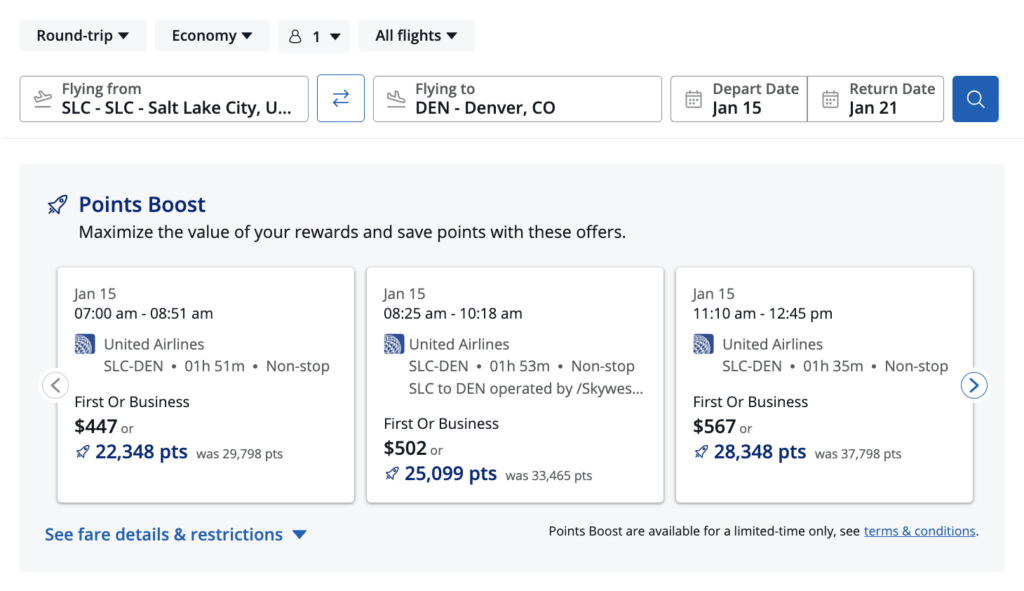

Points Boost offers apply to select airlines in premium travel classes. For example, the United Airlines flight below booked in domestic first class offers a value of 2 cents per point if you hold the Chase Sapphire Reserve and 1.75 cents per point if you hold the Chase Sapphire Preferred.

So, keep an eye out for these deals if you’re looking to redeem Ultimate Rewards for flights in premium cabins.

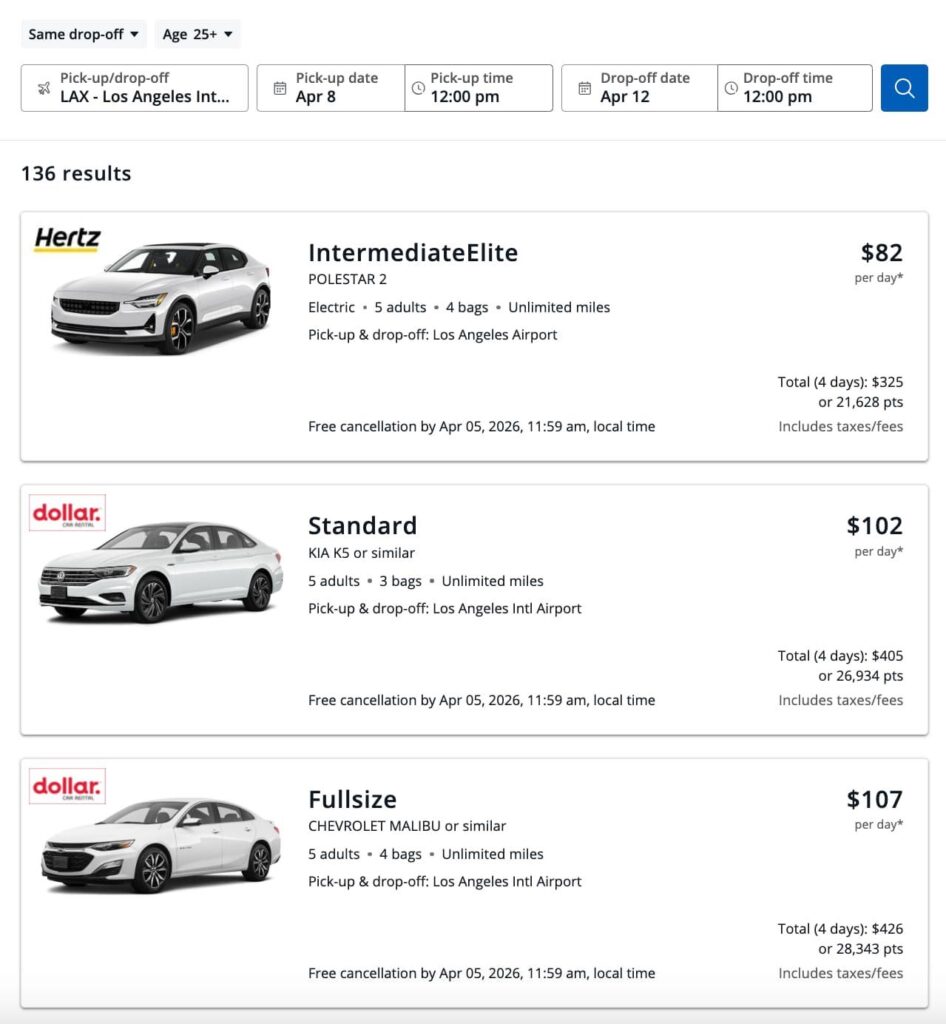

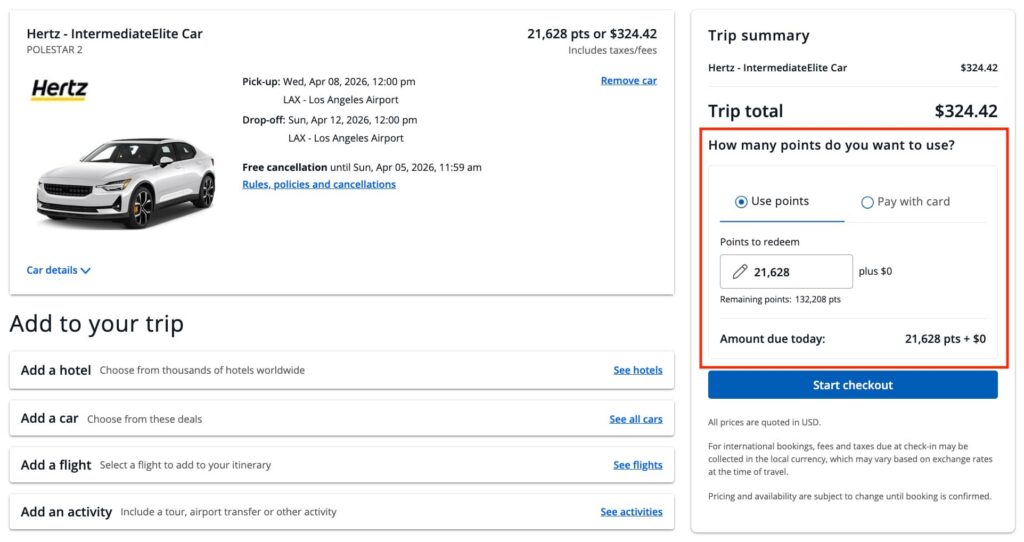

Rental Cars

When searching for car rentals, enter your pick-up and drop-off location, pick-up date and time, and drop-off date and time. Once you see search results, which are automatically sorted by “Recommended,” you can filter them by price, rental company or car type.

Same as with hotels and flights, you can pay with points, card or a combination of both.

There’s no Points Boost offered on rental cars, so you can’t increase the value of your Chase Ultimate Rewards in this case.

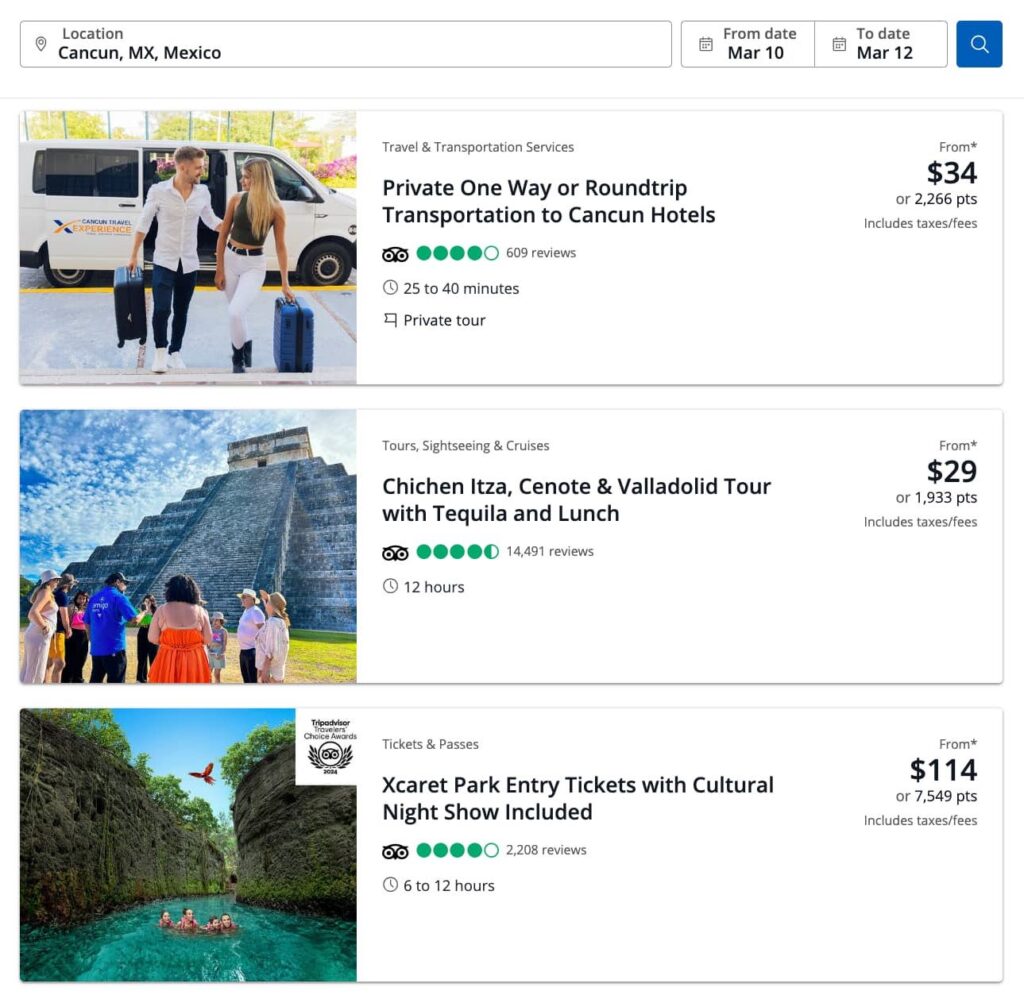

Activities

Once you book your flights, accommodation and a rental car, you need to start budgeting for activities, and luckily, it’s another vacation component you can book through Chase Travel℠.

The booking process is easy. From the Travel tab, simply select “Activities” and enter your destination and dates in the search bar.

You’ll be able to book a bunch of excursions, activities and even private airport transfers with your Chase points, leaving more room in the budget for dining.

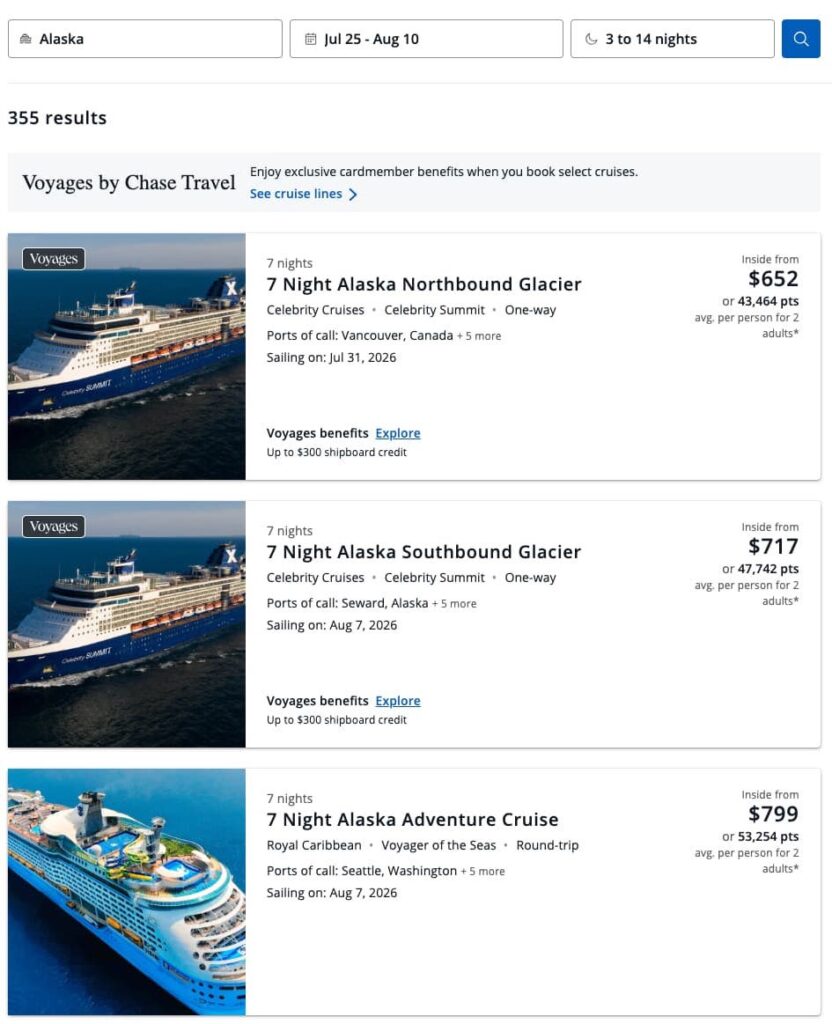

Cruises

Redeem your Ultimate Rewards points through Voyages by Chase Travel℠ and set sails for an adventure by sea. Whether you’ve been dying to cruise Alaska, the Caribbean or the Mediterranean, Voyages by Chase Travel℠ has plenty of options for you.

To search for options, simply enter your destination, travel dates and preferred cruise length.

Keep in mind that although you can browse cruises and see their departure dates, itineraries and pricing, it’s not possible to book a sailing online. You must call 1-855-234-2542 and book a voyage with a cruise specialist using either points or cash.

Benefits of Using Chase Travel℠

Earn Elevated Rewards with Select Chase Cards

One of the primary benefits of using Chase Travel℠ is earning elevated rewards on travel bookings when paying with select Chase credit cards.

Here’s how many points / how much cash back you can earn by using the following cards on Chase Travel℠ purchases.

| Chase card | Earning rates with Chase Travel℠ |

| Chase Freedom Flex® | 5% cash back |

| Chase Freedom Unlimited® | 5% cash back |

| Chase Sapphire Preferred® Card | 5X Ultimate Rewards points (excluding hotels that qualify for the $50 credit) |

| Chase Sapphire Reserve® | 8X Ultimate Rewards points |

| Sapphire Reserve for Business℠ | 8X Ultimate Rewards points |

Get a Higher Value for Your Rewards

Certain cardholders can exchange their Ultimate Rewards points for higher value than 1 cent per point for travel purchases made through Chase Travel℠.

If you hold the following cards, your points get a redemption boost when used in the travel portal:

- Chase Ink Business Preferred® Credit Card – 1.25 to 1.75 cent per point

- Chase Sapphire Preferred® Card – 1.25 to 1.75 cents per point

- Chase Sapphire Reserve® – 1 to 2 cents per point

Combine Rewards and Cash Payments

As mentioned above, it’s possible to pay for your travel purchases booked through the portal with a mix of points and cash. It’s a useful option for card members who don’t have enough rewards to cover an entire purchase.

Earn Airline Miles

Flights booked through Chase Travel℠ are considered revenue flights—even if you redeem rewards to book them—and earn frequent-flyer miles. So, don’t forget to credit these flights to an airline program of your choice and earn miles toward another trip.

Forget Blackout Dates

If you’ve ever tried redeeming points or miles through an airline loyalty program, you know that award availability is scarce at best, even in economy class. Oftentimes, you have to be flexible with travel dates, settle for undesirable routing or adjust trip length based on said availability.

When you redeem points through a portal, you book seats that are still available for cash bookings, so you have more options for a better routing or departure time.

Drawbacks of Using Chase Travel℠

Hotel Elite Status Isn’t Recognized

When you book flights through a third-party service, such as Expedia, Booking.com or Chase Travel℠, you typically earn redeemable miles and perks are awarded if you’re an elite flyer.

However, the same rules don’t apply to hotel bookings. In fact, if you book a stay at a chain hotel through an online travel agency, not only will your elite status not be recognized, you won’t earn points or elite night credits for the stay, either. Likewise, you can say goodbye to room upgrades and complimentary breakfast. This can be a huge drawback for guests with high-tier status who receive elite benefits in exchange for loyalty.

If you still plan on using Chase Travel℠ to book hotel stays, we recommend choosing boutique hotels that aren’t part of a loyalty program so that you’re not missing out on any benefits.

You Might Encounter Inconsistent Prices

Many airlines and hotels advertise that they offer the lowest prices in exchange for booking directly with them, and oftentimes it’s true. Travelers who book with an online travel agency, Chase Travel℠ included, might encounter higher flight and hotel prices than what’s available directly from travel providers.

Yes, you might be able to earn elevated rewards by paying with your credit card or redeem rewards for a flight or a hotel stay, but the all-in costs could be higher, so it’s always best to compare prices from multiple websites while online shopping.

You Won’t Deal Directly with Travel Providers

When you book a flight directly with an airline or a room directly with a hotel, you can modify your reservation by dealing directly with the travel provider. More often than not, you can make a free change in the app and continue living your life.

However, when you book travel with a third-party service, like an online travel agency, it becomes an intermediary between you and a travel provider.

So, let’s say something unexpected occurred after you booked a flight and you need to change or cancel a reservation after it’s made. Well, you can no longer make a quick change in the airline’s app and instead must deal with Chase Travel℠ customer service representatives, which can require multiple lengthy phone calls, depending on the situation.

Additionally, if you’re due a flight credit for a canceled itinerary, the credit might be less flexible when used through Chase Travel℠ than it is when it’s in your airline account.

Chase Travel℠: Is It Worth Using It?

At the end of the day, it’s up to you to decide whether Chase Travel℠ is worth using for booking travel services. The extra points on cash bookings are hard to ignore, and using rewards toward travel bookings keeps more cash in your wallet, especially if you can get increased value on Points Boost bookings.

However, the potential rebooking hurdles might not be worth it to someone looking for a quick solution and a seamless service if a flight change or a cancellation is needed. In addition, don’t forget to check and compare costs of booking the same travel components on multiple platforms. You might be surprised to find different prices in the portal versus direct with a hotel or an airline.