MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

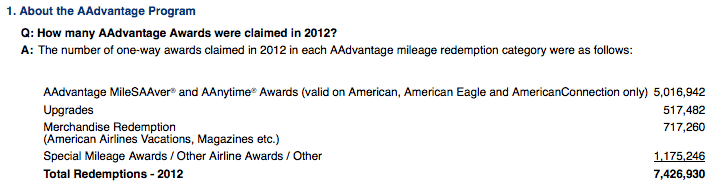

I love stats, so the 2012 AAdvantage stats at the top of the AAdvantage FAQ caught my eye.

For all of 2012, there were 7,426,930 redemptions of American Airlines miles.

For all of 2012, there were 7,426,930 redemptions of American Airlines miles.

Over 700,000 were for “merchandise” including vacations, which I don’t consider merchandise. Let’s say the vast majority of these redemptions were awful values. Not all non-airfare redemptions are awful–Mommy Points found a good deal for Cubs tickets and experiences with Starpoints–but I rarely see values of even one cent per mile on these types of redemptions.

Over half a million were for upgrades. Upgrades must have been a good deal at some point in history because I am frequently asked about helping people with upgrades. Upgrades are currently an awful deal on American Airlines and on most of its competitors.

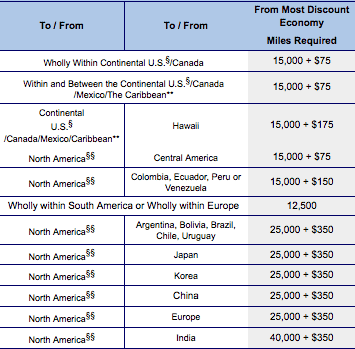

Look at this upgrade chart:

There isn’t one upgrade on that chart that would give me more than one cent worth of value per mile. For instance, I would not pay $600 to upgrade a flight to Europe in one direction to business class. At 25,000 miles plus $350, $600 is the price even valuing the miles at one cent each. And of course I value American miles much higher than one cent.

That’s 1.25 million awful redemptions, and we haven’t gotten to the biggest category: AAdvantage MileSAAver and AAnytime awards, of which there were over 5 million awards. I wish these were separated because they are very different. In my life, I have booked two high-miles-price awards (what American calls AAnytime) out of the hundreds of awards I’ve booked. In both cases, I did a cost/benefit analysis and determined that the award was worth paying miles through the nose because the flights were needed, and the cash price was through the roof.

But in the vast majority of cases, high-miles-price awards are an awful deal. MileSAAver awards–low-mile-price awards–will often be a good deal, but not always. I would imagine that a very high percentage of the awards booked were domestic awards and economy awards. Both of those types of awards will struggle to reach the values of international premium awards.

For more info on low-mile-price and high-miles-price awards, check out Rookie Alli’s Do I Have Enough Miles? A Beginner’s Guide to Navigating Award Charts.

The last category, with 1.2 million redemptions is almost certainly the category with the highest value redemptions: Special Mileage Awards / Other Airlines Awards / Other.

This category would include awards on the incredible-value Explorer Award Chart. It would also include any partner awards. Partner awards are always at the low-miles-price, so they’re efficient in that sense. Partner awards–other than some on Hawaiian and Alaska–are also international awards, another type of award that tends to have higher value.

I bet the vast majority of these awards are awards that got fair or excellent value for miles, while the vast minority of other awards got fair or excellent value for miles.

Why does this matter?

Miles are weird. They take some skill, persistence, and creativity to use well. Cash back cards are easy. They take no skill to redeem for maximum value.

If you have international, luxury tastes and the necessary skill, persistence, and creativity, miles are for you, and you’ll be constantly redeeming for 2 cents or more of value per mile.

If you have simpler tastes in travel, or you don’t apply yourself, you’ll get 1 cent of value per mile or less.

There are a lot of people in that second category who are collecting miles on credit cards through every day spending. They shouldn’t be. They should just get a cash back card that earns them 2% or more on all their spending.

Best and Worst of 2012 Awards

My favorite award of 2012 was an award I booked for myself that includes 40 hours of flat-bed business class, four continents, helped me crack free oneways on US Airways, and cost only 100k US Airways miles. See South America, Africa, Europe, and North America in Biz for 100k Miles.

My least favorite award was the Million Mile Award that blew about $20,000 worth of points for one roundtrip in business class.

How do you think AAdvantage members did in 2012? What was your best or worst award of the year?

“If you don’t apply yourself” made me laugh. It sounds like I’m getting a report card comment – Lisa likes miles and travel, but she just doesn’t apply herself. 🙂 Though actually I was pretty happy with my off peak USAir trip to Europe in February.

Managed 2 F trips for 2 of us on CX to SE Asia. First for 2 weeks in DPS (April 12) and then to SIN for a cruise Jan 13. Both times returned to LAX then added on a later continuation to YYZ. Got the value I was hoping for.

Thanks to your information, it is possible for a newbie like me to book awards successfully. Best award trip last year was 5 roundtrip business class trips to South Africa and Zimbabwe for our family on 3 different itineraries (2+2+1) within two days. We all met up at Victoria Falls! We used UA miles and had flights on a combination of business class on UA, SAA, Turkish, and Lufthansa. A great deal and one heck of a great use of miles in comfortable business class for such long flights (120,00 miles each roundtrip).

I redeemed 40K AA miles from Papeete, Tahiti to Nadi, Fiji. The AA award chart says South Pacific to South Pacific is 20K but all the agents I talked to were pricing the ticket at 40K because the two legs were operated by different carriers with a quick layover in NZ (Kayak routed the trip on one ticket). With bad internet and no phone, I could only call and try new agents a few times. The tickets still had over $.1 value and were worth not paying the $700+ ticket price but didn’t have nearly the value I was hoping for.

I am a newbie to your highly informative site.

I have what may be a challenge to your expertise.

I was compelled to “use or lose” my pre-1989 miles by AA when it

Reneged on it’s promise to keep the miles without expiring…

So I had to book a 20K (under olde miles rules) to upgrade from the lowest economy fare to “C” in business ORD>NRT requested a 5 day layover, for which I was charged $250 then NRT >BKK on JAL and return.

Yes, it is a great award,never to be had again…but AA used “n” fare on JAL that only provides 0.5 AA miles, but also does not provide advance seating nor “preferred” I.e. exit row, as I am a LT gold…

Appreciate any insight you may have on better utilization of this award possibly even a ‘free one way’ extension ?

THX

Are you incommunicado in Argentina ?

or is my question too …………..?