MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

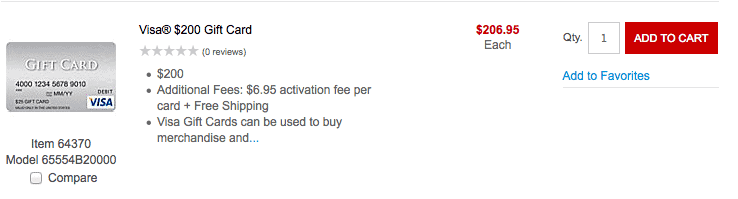

Staples.com is selling $200 Visa gift cards online. That’s good news if you’re not near a Staples that carries $200 Visa gift cards.

By purchasing the $200 Visa gift cards, you can earn Ultimate Rewards for only 0.47 cents each. Ultimate Rewards transfer 1:1 to United, British Airways, Hyatt, Southwest, Virgin Atlantic, and many more partners or they can be used for 1.25 cents toward most flights.

By purchasing the $200 Visa gift cards, you can earn Ultimate Rewards for only 0.47 cents each. Ultimate Rewards transfer 1:1 to United, British Airways, Hyatt, Southwest, Virgin Atlantic, and many more partners or they can be used for 1.25 cents toward most flights.

- How do you earn Ultimate Rewards for 0.47 cents each?

- How can you save $2 off the price of the gift cards?

- What can you do with your gift cards?

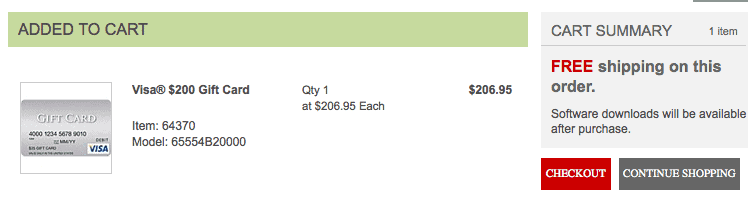

Staples.com is selling $200 Visa gift cards for $206.95 on this page. Shipping is free on gift card orders, and no tax is collected, so $206.95 is the all in price.

You can even get $2.07 (1%) off the price by using a Visa business card that you have first registered at visasavingsedge.com to purchase the gift cards.

That means the all in price is only $204.88.

Each $200 Visa gift card from staples.com earns 1,035 Ultimate Rewards if purchased with an Ink Bold, Ink Plus, or Ink Cash.

If you get a full $200 worth of value from your gift card, you are out only $4.88 and have earned 1,035 Ultimate Rewards at a cost of 0.47 cents each, which is a phenomenal deal.

To get the full $200 worth of value from your gift card, you can use it for day-to-day purchases, buy a money order with it, load it to a Bluebird, or use it to send money on Amazon Payments. When using the gift card, the PIN is automatically set to be the last four digits of the card number.

You learned about this from Dans Deals.

http://www.dansdeals.com/archives/43596

How does someone from Hawaii can take advantage of this? Mahalo!

The same way as anyone else in the country as laid out in this post and the linked posts.

But staples doesnt ship to hawaii.

AARRG, I didn’t check that. I guess we’re out of luck.

Except every shopping portal I go has T&C saying NOT eligible for gift card purchase…

Can these definitely be used to load to bluebird? How many can you buy and load onto bluebird at one time?

Be careful about using too many of these with Amazon payments. They track this and if too many card in/out, they can freeze your payments/account.

Now this offer gets better with the new 60 Ink card links.

I’ve been reading endlessly about using bluebird via the prepaid cards. My only concern is the two 100k offers I am sitting on today…I know the AMEX platinum says no prepaids, cash equivalents…Do you know if this charge from Staples would appear as a cash equivalent/card, or just look like merchandise from Staples? My other offer is from Citi/American Advantage miles. Would it work for that one? Thanks, I’m still new at this.

I believe the discover shopping portal you have to use your discover card to get 5% back. Dont think the chase cards will get you 5%