MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Over the weekend, I manufactured $506.23 in spending at a cost of $6.93 (1.37%) and 3 minutes of time.

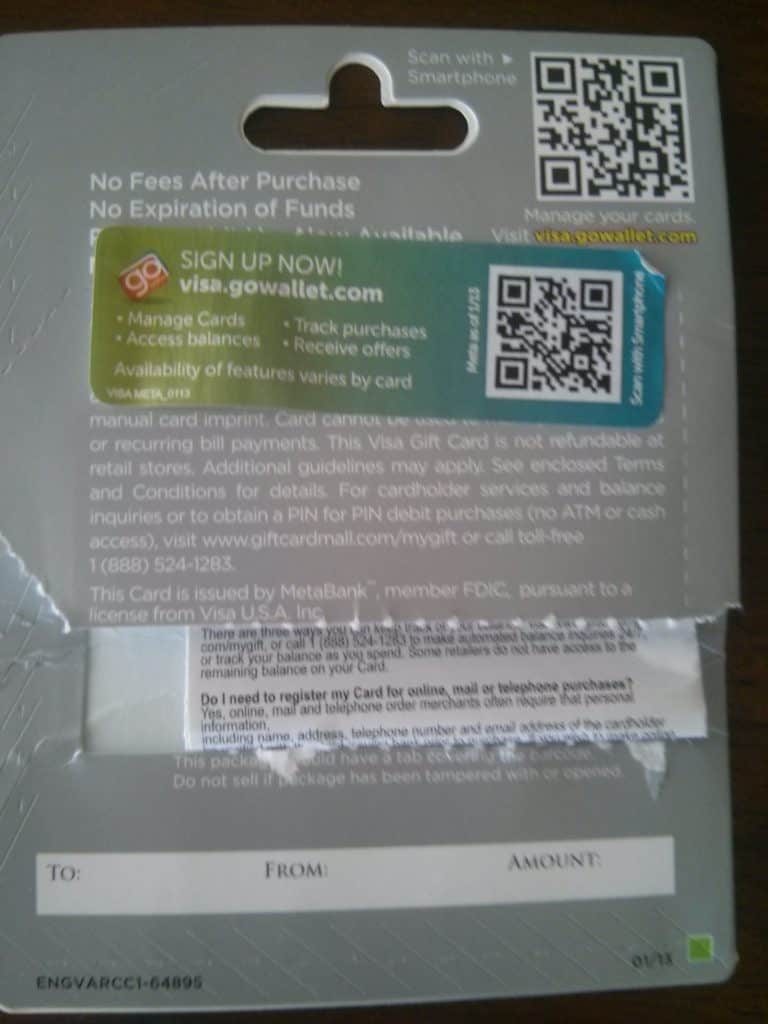

The first step was to buy a reloadable Visa gift card with my credit card. I live in Hawaii where the options for this are bleak. I found a Safeway with a sign saying that variable value gift cards had to be purchased with cash, but I decided to see if the sign was mistaken and took this Visa gift card issued by MetaBank to the register.

- What were the rest of the steps?

- Why did I unload the gift card on a money order?

At the register, I swiped my credit card and the register gave an error message to the cashier. I presume the message told him I needed to pay with cash, but I can’t be sure. His response was to call a manager over to get her card to override the register.

The manager seemed none too interested in why he needed the card. He overrode his register and my purchase went through.

The MetaBank gift card had a $5.95 fee, and I was charged sales tax on that amount, which has never happened before. My total charge was $506.23.

I headed to a Walmart and went to the Money Center in the back. There are a lot of forms set out in the Money Center, but if you just want a money order, you go straight to the cashier without filling out a form.

I waited in line for three minutes, during which time I used my smart phone to set a PIN for the gift card at www.giftcardmall.com/mygift. (This is where my card’s PIN is set, not all cards’ PINs.)

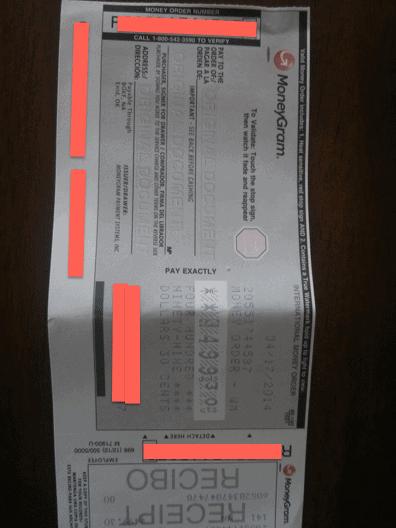

When I got to the front of the line, I said I asked for a $499.30 money order, since I could see behind the counter that the money order fee was $0.70 and my gift card had $500 on it.

The $499.30 money order printed out without the name of the recipient.

I headed to my bank and deposited the money order in my account after filling in my own name as the recipient.

Cost

I paid $506.23 for the gift card and deposited $499.30 in my bank account for a cost of $6.93 (1.37%).

I don’t consider the trip to Safeway to be a time cost since I had to get groceries. Same with the trip to Walmart because I needed to pick something up there. Even the trip to the bank wasn’t an extra trip because I needed to make another deposit.

I see the total time cost at about 3 minutes between the time at the Safeway register for the register override and the time in the Walmart Money Center line.

Worth It?

I’m not particularly eager to earn points at a 1x rate for 1.37 cents each, so I’d need a category bonus or minimum spending requirement to make this worthwhile.

I could have lowered the cost 0.14% by putting the gift card balance on Bluebird instead of a money order. Some will prefer that option.

I won’t be repeating this again because Hawaii has very poor options for buying gift cards. I think I got lucky at Safeway, and the other grocery stores and pharmacies I visited didn’t have gift cards for purchase with a credit card.

Two mistakes….there should be NO tax on these, and the type of card you got (US Bank Visa GC) has the last 4 digits of the card as initial PIN already set.

Why didn’t you just deposit it into BlueBird and then pay your CC bill off that way?

@RickB- You are incorrect-actually, that is a Metabank gift card and you must call their 800 number to pick a PIN. I do it all the time with gift cards purchased from Safeway. Look closely at the packaging.

I use Safeway as my primary outlet to buy gift cards. Safeway will sell you ANY type of gift card (except cards that can be reloaded) with the credit card. The ONLY was I see this is worthwhile is using a card with a category bonus. I use my United Select Visa and generate about 12,000 miles monthly with this technique.

you’re correct that it’s Metabank…my mistake, but I’ve bought tons of these during the OfficeMax promo and last 4 digits work as PIN. Try it next time.

@Rick b – its. Metabank visa, not US Bank. Says Meta right on the back. That said, pin on meta’s is autoset as last 4 of card number.

I live in Hawaii too! Kailua 🙂

Since i cant find a place to buy vanilla reloads with a credit card, or buy amex prepaid card online, giftcards are pretty much what’s left. And not all safeways allow credit card purchase.

Happy to find a blogger from Hawaii though! 🙂 aloha!

Do you know which Safeways do regularly allow purchase with credit card? I know the one at Aikahi does NOT. I didn’t check the one in Kailua town.

Similarly, the Safeways in Northern Virginia do not allow the purchase of variable load GCs with a CC. Not to say that it doesn’t work, especially when they are busy, but generally they ask for cash/debit.

You could lower your cost marginally by combining two gift cards for a $999.30 MO (max that WM allows). Mine lets me pay for one order with two gift cards. One vanilla is usually cheaper for purchase fees if you can find it (4.95). Works out to 56 cpm which is not ideal but not too bad.

Ooops, my bad on the calculation, that is 1.05 cpm, not 56. Still ok for a sign up bonus for me.

Aloha, Tried this last weekend in Oahu at Mililani Safeway and the one in Pearl City. Both stores said cash only?

Thank you.. btw when are you having another hawaii get together?

Scott

Thanks for the report. Hopefully in the next month or two.

Has anyone had any problems using a gift card to buy a money order at a walmart?

This is a *nearly* dead angle. I mean, you’re not wrong…this is still possible. But it is on it’s way out. Too many people have been doing this for too long and all the stores have started wising up. All the walmarts I’ve been to in Houston are now asking to see the card before letting you buy MO with it. They insist that it is a bank issued card. Same goes for Kroger, Randalls, HEB…who all sell money orders for 70 cents or less. You might have the occasional untrained employee who doesn’t know better and lets you do it, and it will work because most of these registers are not coded to deny it yet. But otherwise you will get denied.

Much easier, done at home: pay (estimated) taxes with 1.88% fee;

have wondered about purposely overestimating for the points-miles…?

there must be some overestimate upper limit set by IRS which triggers penalty??

PS. of course, overestimate = lost savings interest

Scott, great post as usual. Do you consider it worth it to do this with a card that does earn a category bonus like the Amex PRG (2 pts at grocery stores + 15k bonus after 30k in spending)?

I don’t, but we might have very different appetites for this kind of thing. More importantly, do you?

Well, in lieu of applying for new cards, I figure i’ll just use the category bonuses on my current cards to maximize their value. I am however a bit surprised that you wouldn’t do this with a card that gives 2x points plus a bonus after x annual spending. Care to share your manufactured spending strategy?

As far as I know..most hawaii safeways won’t allow you to buy the variable rate visa gc with credit cards..or at least its coded into system to error out…but the $100 or $50 ones work..although i don’t think they sell the $200 ones…

i’m pretty sure both beretania and aikahi don’t allow credit card purchase

I have bought from beretania before. The cashiers require the card from the manager to override but have had no issues so far

Been doing these same Visa Debuts for the last 6 months now and transferring at wal-mart to BB. Went yesterday and was unable to load on BB ATM or at register with lady. Got Debit declined message? So I went with plan B and tried my first Money Order))–Success.. Thanks for the other tip..thought I was stuck with 1k of debut( Kind of weird the timing of the post and BB not working. Glad I have a plan B now

[…] get the full $200 worth of value from your gift card, you can use it for day-to-day purchases, buy a money order with it, load it to a Bluebird, or use it to send money on Amazon Payments. When using the gift card, the […]

Yes, rickb is correct — that’s a fact: the last 4 digits of the MetaBank VISA cards are, in fact, its automatic PIN. I frequently buy the MetaBank VISA gift cards at Office Max or Office Depot with our Chase INK card for 5x the points, then load them on our Bluebird card at Wal-Mart, always using the last 4 digits on the card as the PIN. Works EVERY time. When I buy $2000 worth of gift cards, I get 10,000 Ultimate Rewards Points. Eazy-peazy. Then we pay our Chae INK card bill with the Bluebird card.

[…] Nor would I take advantage of one of the current similar schemes, where you buy gift cards with a credit card, turn those gift cards into money orders, and then deposit them back in to your account, all for a few dollars in fees. […]

went to Wmart and tried the tricks discussed to get the Vanilla Debit Visa giftcard to be recognized as a Debit instead of how Wmart has reprogrammed it 5/30/14 to recognize as a credit card. Didn’t work. Tried twice with 2 different clerks. We don’t have a kiosk so had to go to moneycenter/customer service desk. So since I had read before on different threads that you can purchase Money Orders at Wmart using debit cards I tried to buy (2) $499.30 money orders paying for them with my One Vanilla Visa Gift Cards—epic fail on that too. Register is recognizing the One Vanilla’s as CREDIT and not giving any options as to changing payment type to debit. Does anyone have ideas how I can convert these One Vanillas to money orders and then to cash???

Did you set a PIN on the card? Can you? If not, there is no way to unload it as discussed in this post.

Western union money orders still allow gift cards. Find a store that sells them

does anyone know how using a personal card reader would work to manufacture money?

[…] now allow you to add a PIN to the card. This allows the cards to be liquidated by Amazon Payments, to buy a money order, or to load […]

Does it not violate Visa/MC tos for a retailer to decline a purchase with one of these cards when they otherwise accept the card? I understand “minimum charge of…” violates, why wouldn’t this?

[…] How do you manage to meet the minimum spend on bonus offers? I will usually find a way to ‘Manufacture Spend’. This is when you make purchases on your card to meet the minimum spend or just to accumulate points. Usually gift cards are the easiest way to accomplish this. Using the PIN# that comes with the gift card, I’ll unload them by buying money orders or loading up my Target RedCard. MillionMileSecrets wrote a great post on 40 ways to meet minimum spend requirements. MileValue has another great article with step-by-step directions on how to manufacture spend with gift cards. […]