MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Below is a list of the taxes for awards departing from most major European cities, flying to the United States.

My friend wrote to me:

Not sure if any of the travel websites have done this, but the taxes of the airports in Europe really can impact the cost basis.

Every time you book an award with frequent flyer miles, you are responsible for paying government taxes associated with the award ticket. Sometimes you are also responsible for paying fuel surcharges or ticketing fees.

Pay your award taxes, fees, and fuel surcharges with the Citi Prestige® Card. The first $250 in award taxes, fuel surcharges, airfare, or airline fees per calendar year are refunded to you as a statement credit. If you’ve already maxed out the statement credit, you will still earn 3x ThankYou Points on the award taxes.

My friend was looking at booking a roundtrip United award to Europe for July. United doesn’t collect fuel surcharges on any awards, and there are no fees for ticketing United awards more than 21 days before departure, so all he’d be on the hook for is the miles price and the government taxes.

Taxes vary widely based on the country and airport you depart, connections you make, and, occasionally, the cabin you fly.

Below I’ve compiled basically what my friend asked for: the taxes on a one way award from major European cities to the United States.

Why a one way award from Europe to the USA?

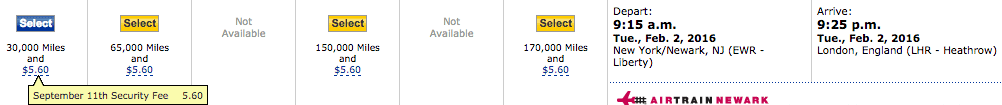

Because all direct one way awards from the USA to Europe have taxes of $5.60.

The reason is that the United States puts most of its international aviation taxes, $17.50 worth, on the return to the United States while almost every other country in the world puts its aviation taxes, ranging from $15 to $280, on departure.

Bottom line: the country you fly into on a European award doesn’t affect the taxes; only the country you return to the United States from (plus connections and occasionally the cabin you fly) affects the taxes.

For a roundtrip award to the cities below, add $5.60 in taxes.

How Did I Get the Info?

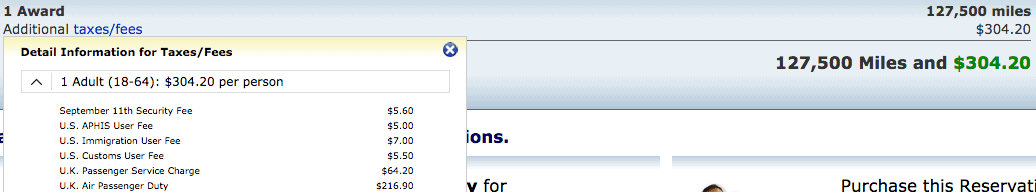

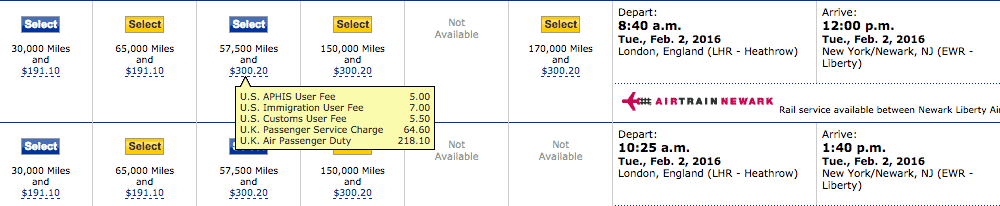

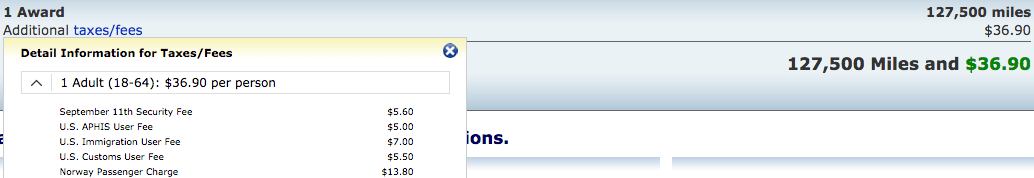

I got all the tax information from united.com. On search results, hover your cursor over the taxes for a detailed breakdown.

There’s nothing special about united.com except that it is easy to use. The same taxes would apply on awards with any other types of miles (though fuel surcharges and other fees may apply with other types of miles too.)

Extra Taxes for Flying in a Premium Cabin

Britain and France charge higher taxes for departing in Business and First Class. (I really just mean Britain, the island with England, Scotland, and Wales. Northern Ireland does not charge extra to fly a premium cabin, perhaps to compete with low Irish departure taxes.)

Britain calls its variable tax the “UK Air Passenger Duty,” and it is calculated based on the distance between London and the capital of the country where your award ends. France–hilariously–calls its variable tax the “Air Passenger Solidarity Tax.” I guess these countries figure, “From each [passenger] according to his ability [to pay punitive departure taxes]…”

Departure taxes leaving selected cities in Britain and France:

- Paris in economy: $78.80

- Paris in Business or First: $124.50

- Manchester in economy: $144.70

- Manchester in Business or First: $253.80

- Glasgow in economy: $146.10

- Glasgow in Business or First: $255.20

- Edinburgh in economy: $147.20

- Edinburgh in Business or First: $256.40

- London in economy: $191.10

- London in Business or First: $300.20

Avoid flying out of Britain on your European award, especially in a premium cabin. Britain is a lovely place that you shouldn’t skip on a big European adventure, just make sure it’s your first stop instead of your last stop, so you don’t have to pay the Air Passenger Duty.

If you do fly home from Britain, airports outside London have taxes about $45 lower.

France in economy is on the high end of the European range. In a premium cabin, departing France is better only than departing Britain.

Low Tax Countries

I’ve ordered the cities from cheapest to most expensive.

- Oslo: $31.70

- Istanbul: $32.50

- Warsaw: $33.80

- Stockholm: $36.30

- Dublin: $39

- Belfast: $42.20

- Geneva: $42.90

- Venice: $43.40

- Barcelona: $43.50

- Shannon: $43.60

- Copenhagen: $43.80

- Lisbon: $47.40

- Amsterdam: $48

- Madrid: $48.40

- Brussels: $50

- Milan: $50

- Zurich: $56.50

- Rome: $60

- Hamburg: $82.70

- Vienna: $87

- Munich: $94.80

- Frankfurt: $112.10

- Berlin: $119.20

Shockingly to me, the cheapest country to depart is Norway, which is the most expensive country I’ve ever visited.

Irish and Northern Irish cities come out well on the list between $39 and $44, making Britain’s punitive Air Passenger Duty all the starker.

Most taxes cluster in the $30 to $60 range where I don’t think the difference is big enough to affect your departure decision.

The outlier is Germany. It is the most expensive country to depart outside of Britain and France. It also shows the most variability between departure airports. Hamburg, with a direct United flight to Newark, has only $83 per departure in taxes while departing Berlin costs $119.

Connections

The above showed the taxes on a direct flight from those cities to either Newark or New York (though the American city you fly to doesn’t matter.)

Connecting increases the taxes. Here are some sample connection taxes to give you an idea:

- Oslo direct to Newark: $31.70

- Oslo to Newark to Los Angeles: $37.30

- Oslo to Copenhagen to Los Angeles: $48

- Oslo to Munich to Newark: $51

- Oslo to Frankfurt to Newark: $64.90

- Oslo to London to Newark: $80.40

If you connect in the United States, you have to pay the $5.60 September 11 security fee. If you connect in other countries, you usually pay their taxes in the range of $10 to $50.

Again, London is the worst, but transiting London is a lot cheaper than starting your award there. And there are no extra taxes for transiting London in a premium cabin.

Eastern Europe

To get home from smaller cities in Eastern Europe like Prague, Helsinki, Riga, or Ljubljana, you will need to connect. The Eastern European countries themselves have low taxes, but the connection adds to the taxes. You’re probably looking at spending about $80 to $120 in taxes one way.

Maximizing This Information

Don’t make your destination picks based on saving a few bucks in taxes, but think about the order of your destinations. On your open jaw award, fly into the higher tax country and home from the lower tax country.

As an extreme example, imagine a Business Class open jaw award where you see Oslo and London. Flying into London and out of Oslo is smart. You pay only $37 in taxes.

Flying into Oslo and out of London is silly. You pay $304 in taxes–$267 more than the other way.

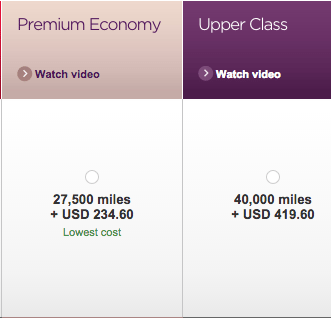

Similarly if you want to take advantage of the current 25% transfer bonus from Citi ThankYou Points to Virgin Atlantic miles to fly Premium Economy or Upper Class to Europe, I suggest booking that award one way to London and returning from a low tax country.

Flying Newark to London in Premium Economy would cost 27,500 Virgin Atlantic miles (22,000 ThankYou Points) + $234.60. In Upper Class, you’d pay 40,000 miles (32,000 ThankYou Points) + $419.60 for a flat bed.

Then return from Madrid for 30,000 United miles (or 27,500 Singapore miles/ThankYou Points) + $48.

Then return from Madrid for 30,000 United miles (or 27,500 Singapore miles/ThankYou Points) + $48.

Bottom Line

Taxes vary widely on awards that include a return from Europe. Taxes are based on the country and airport you depart, countries you transit, and occasionally cabin you fly.

Avoid departing Britain, France, or Germany. Most of the rest of Europe has taxes in the $40 to $70 range for a roundtrip. On open jaw awards, fly into the more expensive country and return from the cheaper country.

Pay your award taxes, fees, and fuel surcharges with the Citi Prestige® Card. The first $250 in award taxes, fuel surcharges, airfare, or airline fees per calendar year are refunded to you as a statement credit. If you’ve already maxed out the statement credit, you will still earn 3x ThankYou Points on the award taxes.

If I were to route Rome – Munich – USA would I pay the lower Rome tax or would Munich throw something in there as well?

Patrick, I paid $68.30 in taxes on that exact route.

Did you see the section on connections? You will pay both Rome departure taxes and Munich connection taxes. You can price it out on united.com.

If I were to route Rome – Munich – USA would I pay the lower Rome tax or would Munich throw something in there as well?

Patrick, I paid $68.30 in taxes on that exact route.

Did you see the section on connections? You will pay both Rome departure taxes and Munich connection taxes. You can price it out on united.com.

Scott, would love to see an article enumerating the lowest European taxes from *connection* cities. Recently flew MAD-CDG-ORD-DCA and found MAD-PHL-DCA was ~ $50 and MAD-CDG-ORD-DCA was ~ $ 120. A pretty big difference, IMO, to connect in Paris. I’d not been, so I did it anyway, as I figured it was worthwhile for 24 hours.

France, Germany, and Britain are bad for connections as far as I know, but not as bad as for departures.

Hey Scott. Does this apply to paid tickets too, or just award tickets? Very good recs! Thanks!

Hey Scott. Does this apply to paid tickets too, or just award tickets? Very good recs! Thanks!

These taxes are definitely part of cash tickets, but they are not usually broken out to see them. You just see the final all in price.

These taxes are definitely part of cash tickets, but they are not usually broken out to see them. You just see the final all in price.

Hi Scott –

I think this is another masterpiece. I’ve picked up some clues from your previous articles / QnAs – that returning from Spain/Portugal is cheaper. But, I want to commend your systematic approach and the thoroughness / effort that went into putting this info together. Much appreciated! Thank you!

-G

You’re welcome.

Hi Scott –

I think this is another masterpiece. I’ve picked up some clues from your previous articles / QnAs – that returning from Spain/Portugal is cheaper. But, I want to commend your systematic approach and the thoroughness / effort that went into putting this info together. Much appreciated! Thank you!

-G

You’re welcome.

Great post Scott!

Can u do a post on getting to these low cost dept cty from LHR including other modes of travel?

Use a train or a low cost carrier.

Great post Scott!

Can u do a post on getting to these low cost dept cty from LHR including other modes of travel?

Use a train or a low cost carrier.

this is a gem.. now can you also tell us which countries to depart/fly into to avoid YQ.

programs with YQ like you mentioned asiana are interesting for europe.

To AVOID fuel surcharges, you have to pick an airline that doesn’t have them or an airline that doesn’t implement them on awards. Changing countries might reduce fuel surcharges, but it won’t take them to zero.

this is a gem.. now can you also tell us which countries to depart/fly into to avoid YQ.

programs with YQ like you mentioned asiana are interesting for europe.

To AVOID fuel surcharges, you have to pick an airline that doesn’t have them or an airline that doesn’t implement them on awards. Changing countries might reduce fuel surcharges, but it won’t take them to zero.

[…] While the Alitalia flight I showed above has fuel surcharges of only about $140 + taxes, many awards have fuel surcharges that are a lot higher. Delta from Paris to New York would cost over $340 one way between fuel surcharges and high taxes you can avoid if you read this. […]

[…] While the Alitalia flight I showed above has fuel surcharges of only about $140 + taxes, many awards have fuel surcharges that are a lot higher. Delta from Paris to New York would cost over $340 one way between fuel surcharges and high taxes you can avoid if you read this. […]

Man, you and Travel is Free are killing it. BoardingArea blogs are turning into a joke compared to you two offering real value.

Man, you and Travel is Free are killing it. BoardingArea blogs are turning into a joke compared to you two offering real value.

[…] addition to the miles, you’ll pay award taxes of about $55 on a roundtrip to Brussels and different prices if you connect to other cities in Europe or Africa. United awards never have fuel […]

[…] addition to the miles, you’ll pay award taxes of about $55 on a roundtrip to Brussels and different prices if you connect to other cities in Europe or Africa. United awards never have fuel […]

[…] figure out the taxes for your one way award from Europe to the United States, check this list of award taxes from Europe sorted by departure city. The worst departure point in Europe is Great Britain. A one way from […]

[…] figure out the taxes for your one way award from Europe to the United States, check this list of award taxes from Europe sorted by departure city. The worst departure point in Europe is Great Britain. A one way from […]

[…] a one way from the eastern United States to Europe for 14k ThankYou Points plus $131 and return from a low tax country–like Spain or Switzerland–to the United States on a one way award with United or American miles for a very cheap European […]

[…] Taxes vary greatly by city of departure in Europe, and so do fuel surcharges, which British Airways changes based on competition in the market and other factors that have nothing to do with the price of fuel. […]

[…] All award tickets, using all types of miles, require you to pay the government taxes associated with your ticket. These are $5.60 per one way on domestic tickets and a lot more on international tickets, ranging from $50 to $300 roundtrip. (Also see List of Award Taxes from Major Cities in Europe.) […]

[…] Roundtrip taxes to Rome should be $60 according to my List of Award Taxes from Major Cities in Europe, So You Return from Low Tax Countries. […]

[…] don’t want to return to the United States from London. Taxes for departing London are outrageous. After five days in London, head to […]

[…] I think of UK to Australia/New Zealand, I think about taxes and fuel surcharges. You would save a LOT on taxes by starting somewhere other than London. You would save a lot on fuel surcharges by booking an […]

[…] to Brazil are under $100 roundtrip. Taxes to Europe vary from $50 to $300 roundtrip depending on the city of departure and sometimes the cabin of […]

[…] of those listed sweetspots fly to London, instead of from London. That’s because there are massive taxes on flights leaving Great Britain that you have to pay on awards. Avoid them by booking one way to London with Virgin Atlantic miles, […]

[…] 40,000 Etihad miles + taxes = United States to Europe roundtrip in American Airlines Economy (however that out of pocket amount would skyrocket if you returned from London because of departure taxes, choose one of these European cities with lower taxes instead) […]

[…] by using this sale to book one way awards to London only. Then use a different type of miles to return from a low tax city in Europe. You see more of Europe for very few miles and very low out of pocket […]

[…] vary by city, country, and airport. Here is a list of low tax cities in Europe. Fuel surcharges vary by market. They are much lower from Europe to the United States than vice […]

[…] a one way from the eastern United States to Europe for 14k ThankYou Points plus $135 and return from a low tax country–like Spain or Switzerland–to the United States on a one way award with United or American miles for a very cheap European […]

[…] Taxes are higher on awards leaving Great Britain and France than most places in Europe, and can really start to add up when factoring for multiple people. Avoid Paris’ departure taxes by taking a train or low cost carrier flight elsewhere and continuing your journey home from a low tax country. […]

[…] by using this sale to book one way awards to London only. Then use a different type of miles to return from a low tax city in Europe. You see more of Europe for very few miles and very low out of pocket […]

[…] taxes to leave Europe on an award from London. That is atrocious and can easily be avoided by returning home from a low tax country instead. You can use British Airways Avios or a low cost carrier to get to the low tax […]

[…] you start in a low tax country, like Helsinki, and fly a no-surcharge partner, like Finnair, you’ll save over […]

[…] is a list of award taxes from major cities in europe, so you return from low tax countries (transiting through London is a lot cheaper, and skipping […]

[…] even if you start your trip in Britain, return from one these low tax cities instead to avoid costly departure taxes and see way more of Europe. Just take a low cost carrier like Ryanair, use Avios, or take trains […]

[…] (or transfer your Membership Rewards to Avios with the current 50% transfer bonus) to hop over to a low departure tax city, just choose one that Etihad flies to from Abu Dhabi, and then continue the trip from there. But […]

[…] carrier to hop somewhere else in Europe and return home with a different type of miles from a low tax country. Have United miles? There’s heaps of Star Alliance Business Class award space returning to […]

[…] by using this sale to book one way awards to London only. Then use a different type of miles to return from a low tax city in Europe. You see more of Europe for very few miles and very low out of pocket […]

[…] higher taxes for departing in Business and First Class (ridiculous I know). Check out this article for additional detail on taxes and fees in […]

[…] the other hand, Helsinki is a low tax country. It will only cost $32.86 out of pocket to return to the United States from […]

Do these departure taxes apply to the cheaper intra-Europe flights? Ie, if we fly into London then take Ryanair to another European destination will London hit you with the steep departure tax?

No they don’t.

[…] bearable because of how few miles you need. Limit the taxes by only booking awards to London and not home from London. (Use United miles or another type of miles for the return from […]

[…] a one way from the eastern United States to Europe for 14k ThankYou Points plus $135 and return from a low tax country–like Spain or Switzerland–to the United States on a one way award with United or American miles for a very cheap European […]

[…] of those listed sweetspots fly to London, instead of from London. That’s because there are massive taxes on flights leaving Great Britain that you have to pay on awards. Avoid them by booking one way to London with Virgin Atlantic miles, […]

[…] a one way from the eastern United States to Europe for 8k Membership Rewards plus $148.60 and return from a low tax country–like Spain or Switzerland–to the United States on a one way award with Singapore miles (on a United flight) for a very […]

[…] cabin awards that originate in the United Kingdom are the most expensive. Avoid those–see List of Award Taxes from Major Cities in Europe so you can plan a return to the US from a low tax […]

[…] an open jaw and see two or more cities in Europe and start the return on the continent in a low tax country like Helsinki to save yourself extra cash and enhance your […]

[…] way back home (especially if you want to fly a premium cabin back to the United States). There are massive taxes on flights leaving Great Britain that you have to pay on awards. Avoid them by booking one way to London with Virgin Atlantic miles, […]

[…] cheap one way Virgin Atlantic award from the eastern United States to Europe and return from a low tax country–like Spain or Switzerland–to the United States on a one way award with Singapore miles (on a United flight) for a very […]

[…] Do an open jaw and see two or more cities in Europe and start the return on the continent in a low tax country like Helsinki to save yourself extra cash and enhance your […]

[…] Do an open jaw and see two or more cities in Europe and start the return on the continent in a low tax country like Helsinki to save yourself extra cash and enhance your […]

[…] one way from the eastern United States to Europe for 8k Membership Rewards plus $148.60 and return from a low tax country–like Spain or Switzerland–to the United States on a one way award with Singapore miles (on a United flight) for a very […]

[…] of returning to the US from London, return from one of these cities instead that charges lower departure taxes. Or if you really want to return from London, be prepared to swallow almost $300 in […]

[…] you start in a low tax country, like Helsinki, and fly a no-surcharge partner, like Finnair, you’ll save over […]