MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

The Blue Business Plus card from American Express is an old favorite of ours. And shortly after coming out with a great welcome offer on the American Express ® Business Gold Card, American Express decided to surprise us again and came up with another incredible offer.

And don’t forget, more people are often eligible for business cards than realize it. See how you can qualify for business cards even if you don’t think you can.

Welcome Bonus

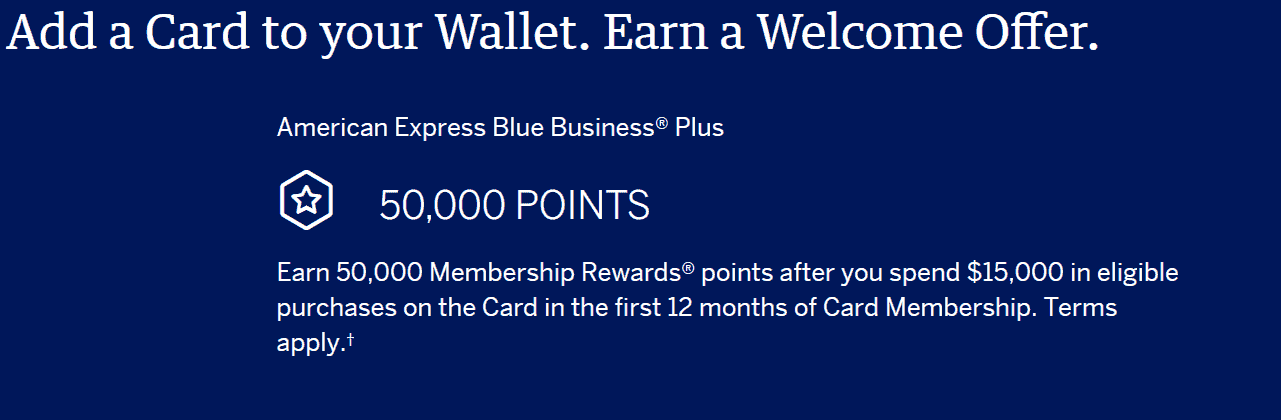

The increased welcome bonus of 50,000 is available via this link (note: not an affiliate link) (All information about The Blue Business Plus card from American Express has been collected independently by MileValue). Thanks to Doctor of Credit for finding this.

You won’t find it on front and center on the American Express website or through referral links. The minimum spending requirement is higher than normal, $15,000 in the first 12 months, but the elevated bonus is also much better than usual.

American Express bonuses are once in a lifetime. However, previous cardholders might be eligible again since the terms and conditions don’t mention any restrictions, commonly referred to as no lifetime language. So if you had this card before, you might be eligible for the welcome bonus again.

Card Details

This is one of our favorite cards because it earns 2X on all purchases up to 100,000 points in a calendar year, and 1x after that. The uncomplicated earning structure makes this a perfect card to use on all non-bonused spend. It’s also a perfect card for any small business owner who wants to use just one card for everything, instead of worrying about bonus categories and switching cards.

The Blue Business Plus card has 0% introductory APR for 12 months (Rates & Fees) on purchases from the date of account opening, so if you have any large expenses coming up, this could be a perfect solution. We usually strongly discourage carrying a balance because of interest charges, but in this case you can pay for your large purchase over time without incurring any interest. After the introductory period, the APR will be a variable rate, 13.24% – 19.24%, based on your creditworthiness and other factors as determined at the time of account opening.

Did we mention it has $0 annual fee? (Rates & Fees)

Why We Love This Card

We love this card for its simple earning structure and use it on most purchases that don’t earn bonus points with any other cards. For example, you can use Blue Business Plus to pay your utility bills (if your utility company allows credit card payment) and earn 2X.

And, if you’re under 5/24, this is a great card to get to not only stash your Membership Rewards points since it doesn’t have an annual fee, but it also won’t count towards 5/24.

It’s easy to accumulate a good stash of Membership Rewards points by using this card for your everyday expenses. You’ll have 80,000 points just after meeting minimum spending requirements – 50,000 bonus points plus 30,000 points earned by spending $15,000.

Membership Rewards points are one of our favorite transferable currencies because they are so versatile. You can go anywhere in the world by transferring Membership Rewards points to one of Amex’s partner airlines.

If you aren’t sure what to do with your newly accumulated points, here are a couple of ideas:

- Book around the world ticket by transferring Membership Rewards to ANA

- Book a one-way in business class to Europe or Israel by transferring Membership Rewards points to Air France/KLM Flying Blue for 53,000 Flying Blue miles

- Book a one-way in business class on one of the Star Alliance carries from the U.S. to Europe for 63,000 Avianca Lifemiles (or even less if you catch one of Amex’s transfer bonuses)

Unlike Chase, points earned with the no-fee Amex cards can be used for travel and be transferred to partner airlines. So even if you don’t have any premium Amex cards, and this is going to be your only Amex card, you’ll be able to book award tickets.

Final Thoughts

This is the biggest welcome offer we’ve seen on this no annual fee card. It has higher minimum spending requirements but the 2X earning rate on all purchases makes this a great deal. This is definitely an “always keep in your wallet” card and if you max it out every year, you’ll earn 100,000 Membership Rewards points annually.

The Blue Business Plus card is a business card, so it won’t count toward Chase’s 5/24 rule. If you already have four Amex credit cards, you likely won’t be approved for the Blue Business Plus because of the four credit cards limit. This offer makes a compelling case for freeing up some Amex slots if you have any cards that you don’t use on a regular basis.