MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Tom writes:

I’ve seen you mention wikipedia a couple of times when talking about building awards and figuring out where airlines fly – what exactly do you use wikipedia for? Have you done a post about this?

I did write one post that touched on using wikipedia: Book Awards Like a Pro: Routing Ideas. But I’ll answer the question of how I use wikipedia more fully.

For me, the two best places to get routing ideas are kayak.com and wikipedia. If a client for my award booking service says he wants to go from LAX to Phuket, Thailand with United miles, I don’t instantly know all the routing possibilities.

My first thought would be that the last leg will probably be Bangkok to Phuket on Thai Airways, since I’m sure such a flight exists. But I want to know all the possibilities to figure out the best routing in terms of duration, layover quality, and airline quality.

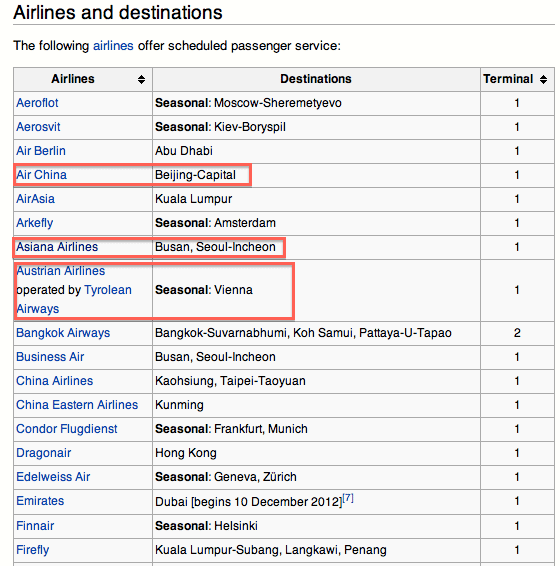

So first I would search “phuket airport wiki.” Every wikipedia page for an airport contains a section entitled “Airlines and destinations,” which I scroll down to.

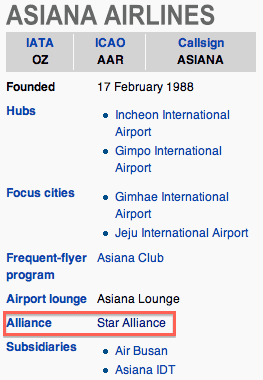

In this example, I’ve specified using United miles, so I’ll scan the list for all Star Alliance partners. If you’re not sure about an airline’s alliance, you can click on the airline’s name. Its wikipedia page will list its alliance on the quick-facts info box on the right of its page.

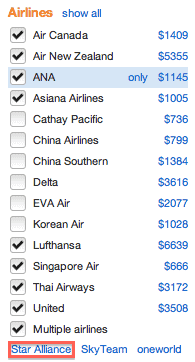

Once I’ve noted all the ways to get there on the Star Alliance–on Air China, Asiana, Austrian, and Thai– I’ll move on to kayak.com. At kayak.com, I’ll search LAX to HKT for one passenger in economy near the dates my client wants. I’ll make sure to search +/- 3 days, so I can catch routings that are only possible once a week because of non-daily flight schedules.

Once I’ve noted all the ways to get there on the Star Alliance–on Air China, Asiana, Austrian, and Thai– I’ll move on to kayak.com. At kayak.com, I’ll search LAX to HKT for one passenger in economy near the dates my client wants. I’ll make sure to search +/- 3 days, so I can catch routings that are only possible once a week because of non-daily flight schedules.

I sort the kayak.com results by alliance and duration.

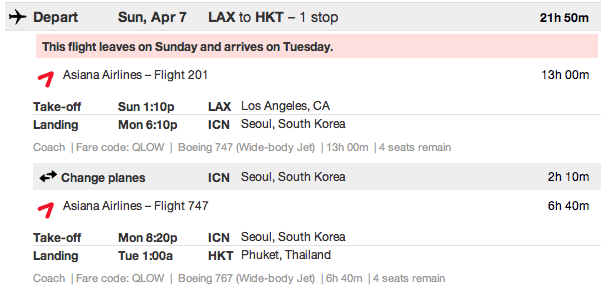

Such filtering allows me to see that the shortest itinerary bookable with United miles is LAX-ICN-HKT on Asiana.

Such filtering allows me to see that the shortest itinerary bookable with United miles is LAX-ICN-HKT on Asiana.

I also note the information about what aircraft operates each segment, which I take to seatguru.com to figure out which itineraries have the best seats.

I also note the information about what aircraft operates each segment, which I take to seatguru.com to figure out which itineraries have the best seats.

Now ideally I’d then be able to go and book a short, comfortable itinerary. But if I run into trouble, I’ll go right back to wikipedia.

Say I can’t find any simple one stop itineraries between LA and Phuket. If I’ve found space from Seoul to Phuket, I would go look at the Seoul-Incheon page to see how I can get to Seoul.

Or I might go to the LAX page to see how I can get to Asia from LAX. Then I’d go search LAX to Asia flights or flights to Seoul for award space.

I constantly check wikipedia for information on where airlines fly–major airlines have an article listing all their destinations that is linked to the airline’s wiki page–and where it’s possible to fly from an airport. It’s an incredibly helpful weapon when booking awards.

Thanks for the question, Tom, and I hope everyone now understands how I use wikipedia to aid me in booking awards.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

Thanks Scott, this is great info! Much appreciated

I often tell people Wikipedia and ITA are my favorite flight tools, no matter how obscure the airport and airline, the information is often spot on.

Another quick and dirty way is using google, if you know the airport codes, For example, if you want to know flights between HKG and DPS, type in “HKG to DPS flights” The resulting page will display flights numbers, days of the week, and departure and arrival times.

There’s some limitations to this, in that, it doesn’t display U.S. domestic routings, rather it displays fare prices. Also if you type an airport code that departs from the U.S, it also displays flights.

A few years ago, it displayed routings no matter what airport codes you typed in, but now that all changed presumable because google bought ITA software.

[…] I use wikipedia to determine possible routings before searching. See How to Use Wikipedia to Book Awards Like a Pro. […]

[…] of airline alliances and flight routes really comes in handy. I first got the idea from milevalue.com of searching wikipedia to determine what airlines fly to a given airport. It’s really […]

[…] actual route one would take from Salt Lake City to Cozumel. You could go to kayak.com and search or go to wikipedia for the options. The three shortest in this case are through Houston on United, Dallas on American, […]

[…] Europe she’d need to be to get a direct flight to Tel Aviv on a British Airways partner, so I used wikikpedia. There are seven routes operated by four airlines from Europe to Israel with Avios. from […]

[…] quick look at wikipedia shows Bilbao airport with a ton more service than Pamplona, so you’ll probably have better […]