MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Every time you use your credit card, the bank is earning swipe fees from the merchant. It’s these swipe fees plus other ways that banks profit off credit cards–interest fees, late fees, advertising to cardholders–that pay for the perks we get from credit cards.

How much of these fees are rebated to us? According to a recent article in The Economist:

[C]ard issuers are providing bigger rebates on purchases, more frequent-flyer miles as a sign-up bonus and longer interest-free periods for those who transfer balances from other cards. Mercator Advisory Group, a consultancy, estimates that the amount of revenue from each transaction passed back to the customer has been growing for years. In 2012 it put it at 47% for three of the biggest issuers, up from 39% in 2010.

According to the Mercator Advisory Group (according to The Economist) we got back 47% of the revenue from each transaction three years ago. Unfortunately I couldn’t find the underlying study or press release anywhere online by googling all the relevant keywords. If you can, please post a link in the comments.

I get back a lot more than 47% of the swipe fees the bank collects on me. So much of my spending is going toward clearing sign up bonuses and maximizing category bonuses, that I definitely average more than 3 miles per dollar across all my spending. Even assuming credit card companies can buy miles for 1 cent each (I don’t think they get them that cheaply), that works out to costing credit card companies at least 3% of my purchases in rewards. There’s no way they are making that back off swipe fees (or any other fees, since I don’t ever pay interest.)

Of course, there’s nothing average about the way I approach credit cards.

———————————————

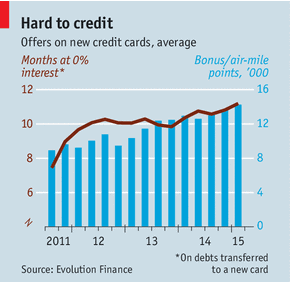

One other interesting chart from the article:

Ignore the red line and focus on the blue bars, which show that the average bonus miles offered on new cards rose from about 9,000 in 2011 to about 14,000 in 2015.

What? Huh? What?

The only time I see an airline card with such a putrid bonus is the 10,000 mile offer on the JetBlue card. Every other airline card offers 25,000, 30,000, 40,000, or 50,000 miles (like on the American Airlines card at the moment.) And sometimes airline bonuses hit as high as 100,000 miles like on the American Airlines Executive card last year.

The only possible way to get such tiny averages (9,000 and 14,000) is if the calculation includes all credit cards, many of which come with zero bonus. That’s a weird way to construct the average: averaging in a bunch of zeros.

Bottom line: it’s always fascinating for me to read the mainstream media on credit cards and miles because, on the one hand, they have better access to certain data and can do more research, and on the other hand, they don’t get it.

I think the mainstream media just reflects the mainstream approach to credit cards, and for that reason, I think the averaging of zeros in the calculation is also valid. Bloggers like you are the media for people who do approach credit cards like we do (:)). I think we should be thankful. An ecosystem where we were the majority would not be sustainable!

I need to get a lot of Jetblue miles! That are the only non-stop between Boston and Sarasota. What do you suggest? I’m assuming I’ll have to use a partner airline.

They don’t have a lot of partner airlines. You’ll need JetBlue miles–they have a credit card–or miles that can be used on any flight, any time with no blackouts like Arrival miles: https://milevalu.wpengine.com/barclaycard-arrvial-world-mastercard-2-22-cash-back-card-with-444-sign-up-bonus/

I really think banks paying 1 cent per mile is crazy. I wouldn’t be surprised if they negotiated somewhere around 1/4-1/3 of a cent each. I’m sure the exclusive partnership plays into as well. When you’re buying hundreds of millions of miles I’m sure you get them at a nice discount.

No way! They’re paying over 1 cent per mile I think. Although I’ve read that they pay less for the bonus miles at sign up than the ongoing miles.

Slight quibble, the current Amex/JetBlue deal offers 20,000 miles after 1k spend. (double what it was)

Know this as I’m about to make my first flight with them, from Montego Bay to FLL…. I was impressed JetBlue kept is cash prices on seats very cheap, even on last seats.

I also priced out reward travel on JetBlue…. looks similar to the much appreciate Southwest structure…. flights as low as 3,000 miles.

And then there’s the wee matter of JetBlue apparently being a more “comfortable” way to travel in coach…. (compared esp. to the likes of Delta and USAir)….. and I’m wondering why I didn’t try JB before. (perhaps because SWA spoiled me)

I’ve always wondered this information. I luckily have a grandfathered Citi Forward card so I get 5x value at restaurants and Amazon, amazing value but it makes me wonder just how much is left for Citi after the swipe. Consider that I usually travel AA and get 1.6 cents value with the Prestige, that means I get 8 cents back on the dollar. Killer deal.

For every person like us that knows how to use their miles and points tho I’m sure there are 9 that redeem for half a cent per point or don’t even keep track of their points. That and most of our favorite cards have around $100 in annual fee.

I know someone who charged all of his business supplies to his AMEX card and had racked up 500k MRs. I’m not sure what happened but they ended up canceling the card and didn’t utilize any of those points. I wanted to kill him haha

Wow that’s a lot of travel left on the table!