MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Citi offers you the chance to create Virtual Account Numbers for any of your credit cards to add an extra level of security for online purchases.

You can set how long you want a new virtual account number to last and how much can be charged to it. With your new virtual account number, virtual account expiration date, and virtual account three-digit code on the back, you can make purchases wherever cards don’t need to be swiped, and the purchases will be charged to your account.

The merchant never knows your “real” account details.

How to Create a Virtual Account Number for Your Citi Card

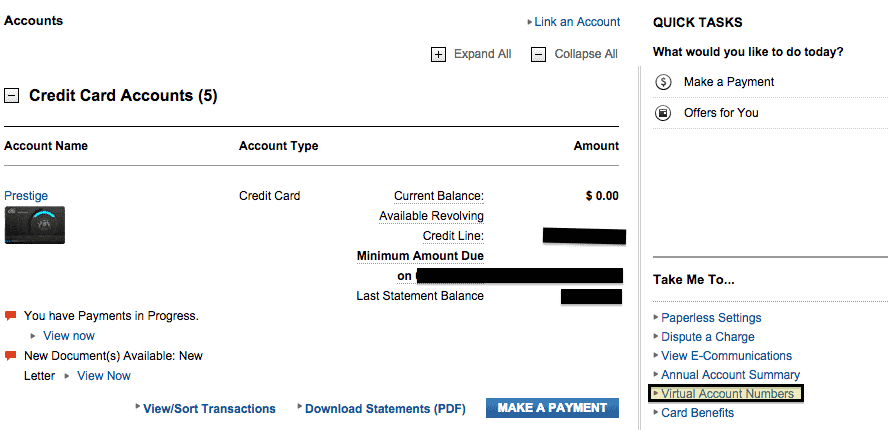

Inside your citicards.com account, click Virtual Account Numbers on the right hand menu.

Don’t worry if the top of the next page features one of your credit cards and you want a Virtual Account Number for a different card; you have the chance to choose later.

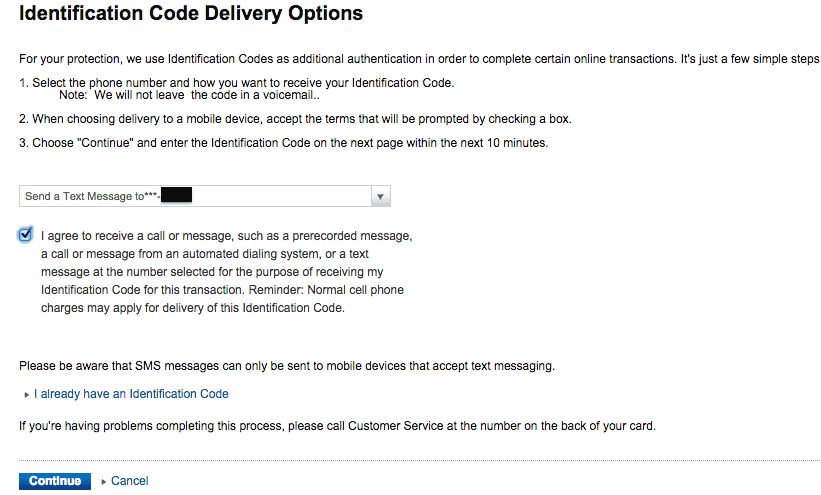

Both times I’ve tried to create a Virtual Account Number, Citi has made me type in an identification code that they text to the phone number in my account.

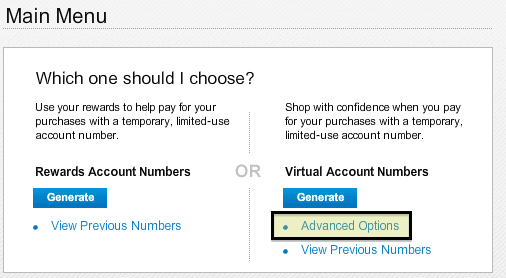

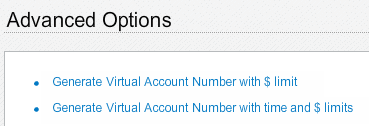

After entering the Identification Code, I chose to launch the Virtual Account Number generator. Then under Virtual Account Numbers, I chose Advanced Options to select the card for which I want a virtual number.

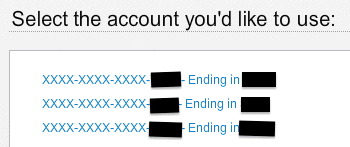

My three active Citi cards were listed, and I chose my American Airlines Executive card by number.

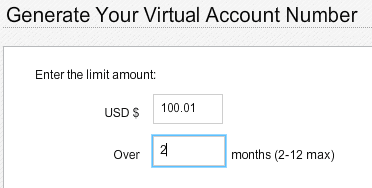

I chose to generate a Virtual Account Number with both a time and dollar limit.

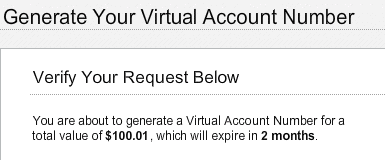

The time limit must be between two and 12 months. After clicking a few times that I really, really wanted the Virtual Account Number generated, it finally appeared on a generic blue credit card on my screen. The card lists a new credit card number, expiration date, and three-digit code.

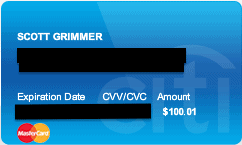

After clicking a few times that I really, really wanted the Virtual Account Number generated, it finally appeared on a generic blue credit card on my screen. The card lists a new credit card number, expiration date, and three-digit code.

I can use this number for the next two months for up to $100.01 in spending. All charges will go to my American Airlines Executive card statement.

I can use this number for the next two months for up to $100.01 in spending. All charges will go to my American Airlines Executive card statement.

Citi Virtual Account Numbers are easy to create and can be very useful. If you are buying something online from a site about which you have your doubts, you can create virtual number, so the site doesn’t have your details. If you want your kid at college to buy something online with your credit card number, but don’t want him to buy anything else, use a virtual account number.

What happens if you get a refund after the virtual account number is dead?

[…] Yes, either give them your credit card number to pay the fee or give them a Citi Virtual Account Number with a $100 limit. […]

[…] The annual fee is $450 per year. The first year you get a $100 statement credit that you can use for your own Global Entry application or someone else’s. […]

Is there a virtual address as well that masks your real physical address?

[…] The annual fee is $450 per year. The first year you get a $100 statement credit that you can use for your own Global Entry application or someone else’s. […]

[…] If you already have Global Entry, you can use the credit to pay someone else’s $100 fee (either give them your credit card number to pay the fee or give them a Citi Virtual Account Number with a $100 limit.) […]