MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Hilton HHonors-33% Bonus on Membership Rewards Transfers

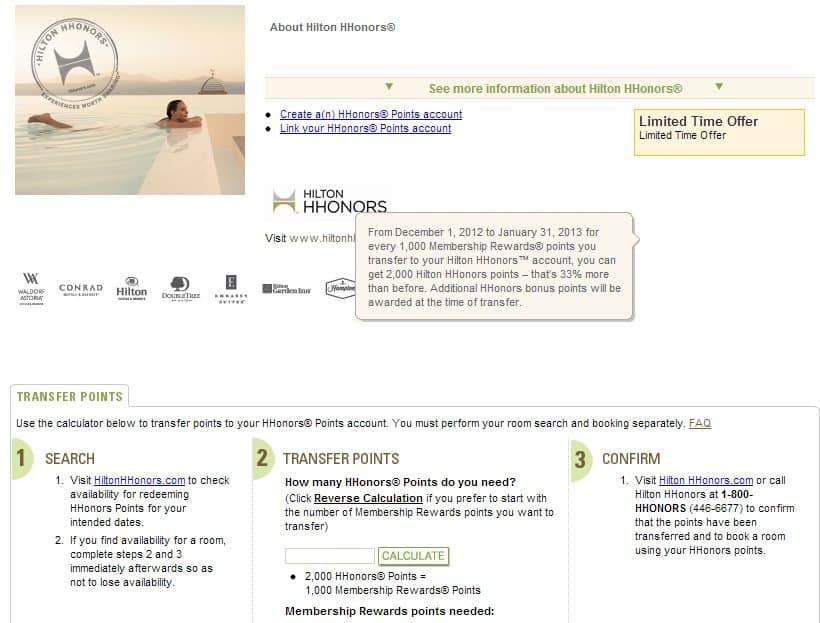

Per this thread on FlyerTalk, Hilton is offering a 33% bonus when transferring Membership Rewards into Hilton HHonors points. This offer is good for transfers through January 31st. Transfers must be made in increments of 1,000 Membership Rewards points. 1,000 Membership Rewards will convert to 2,000 HHonors points with this promotion.

The standard transfer ratio for Membership Rewards into HHonors points is 1:1.5.

Is this a good deal?

Absolutely not! Though our hotel valuations are still being discussed, the Mile Value Leaderboard values Membership Rewards at 1.79 cents. Even being extremely generous to Hilton, valuing HHonors points at 0.8 cents means this is still a poor play and loss of value.

Membership Rewards should be saved for transfers to frequent flyer programs such as British Airways Avios and Delta Skymiles. For some great redemptions using both airline programs, see Scott’s posts below:

How Much are Avios Worth? The Value of British Airways Avios

Delta Still Not Charging Surcharges on Virgin Australia Awards

If Avios are such a great transfer partner, is American Express running any transfer specials with them?

As a matter of fact, they are. Scott wrote up a quick summary of the Avios 30% transfer bonus through January 14th. For details, see Scott’s post, Avios 30% Transfer Bonus from Membership Rewards.

I really need HHonors points badly and have a stash of Membership Rewards. Is there any way to get an even better transfer ratio than 1:2?

Through December 29th, there is! Virgin America is currently offering a 35% transfer bonus for Membership Rewards. As I wrote in the AMEX/Virgin Atlantic Transfer Bonus article, you can essentially earn 2.7 HHonors points by transferring your AMEX points to Virgin Atlantic. That is ratio is still not incentive enough for a speculative transfer, but it’s certainly a better option than the direct AMEX into HHonors route. A hypothetical example is below:

15,000 Membership Rewards –> 30,000 HHonors points (with 33% bonus) OR

15,000 Membership Rewards–>20,250 Virgin Atlantic miles (with 35% bonus)

20,000 Virgin Atlantic miles–>40,000 HHonors points

Hilton Increases Qualifying Requirements for Gold/Diamond Elite Status

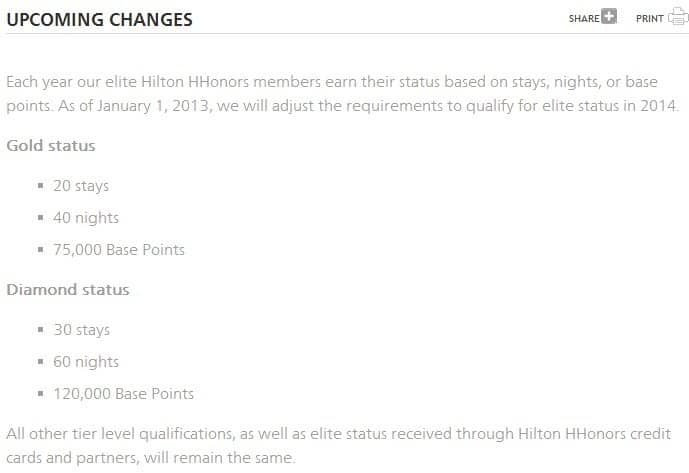

According to this thread on FlyerTalk, Hilton has quietly tweaked their terms and conditions to reflect new requirements to earn both Gold and Diamond elite status in the Hilton HHonors frequent guest program.

Gold elite status used to take 16 stays, 36 nights, or 60,000 base points earned in a calendar year to earn.

Diamond elite status used to take 28 stays, 60 nights, or 100,000 base points.

Per Hilton’s site, the new earning requirements are below:

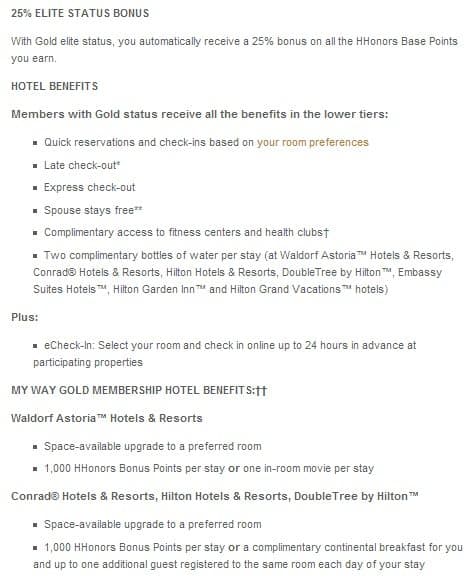

I have absolutely no problem with the increases. Hotel chains will often do this in an attempt to “thin the herd,” so to speak, and cut down on the number of elite members they have. Hilton Gold and Diamond elites, in particular, receive a generous number of benefits in relation to other chains. Hilton’s mid-tier Gold members receive continental breakfast at Conrad, Hilton, and DoubleTree properties. A sampling of Hilton Gold status perks can be found below:

Starwood’s top-tier Platinum elites receive this breakfast benefit. Marriot’s top- tier Platinum elites only receive breakfast when there is no club lounge (and weekends are excluded). Priority Club’s own top-tier Platinums don’t receive breakfast at all!

These changes shouldn’t keep any of us from elite status with Hilton, which is quite easy to acquire. Both American Express and Citi offer credit cards with instant Gold status. The American Express Hilton HHonors Surpass card grants Gold status for the first year of card membership. To requalify, you need to spend $20,000 each subsequent year on the card. The American Express comes with a $75 annual fee.

The Citi Hilton HHonors Reserve Visa comes with Gold status for the life of the card without any future requalification via spend. The Citi card comes with a $95 annual fee. Both the Citi and American Express cards simply offer a far less painful way to quickly boost up to Gold status.

My real issue with this announcement, as echoed by other FlyerTalkers, is this information dropping with no notice for 2013. These last minute (or no notice) changes set a really dangerous precedent in the loyalty community. Mistrust is not a feeling that should resonate between traveler and frequent flyer/guest program.

Cornell University Study Links Hotel Reviews to Room Rates

According to this blog post on FlyerTalk, a new study by the Cornell University School of Hotel Administration links favorable hotel reviews to higher rates at those properties. Granted, this is a very common sense approach to room rates in general: the better the property, the more favorable review, the greater the demand, the higher the room rate.

However, as many of you know, sites like TripAdvisor or even Hotels.com are filled with questionable reviews from unknown sources. It would be quite easy for a hotel chain to paper its own properties with smashing reviews while panning its competitors.

I bring up this blog post because MileValue will soon begin releasing hotel point valuations and the methodology behind our numbers. Room rates are tied to redemptive value, but only if you are otherwise willing to pay the full price without points. For example, if you redeem 10,000 Starpoints for a $600/night room, you only receive 6.0 cents per point in value if you would have otherwise paid that sky-high room rate. Depending on the property, very few people I know would do so. Room rates aren’t necessarily tied to value, so tread lightly when crunching the numbers.

Recap

American Express is promoting a 33% bonus on Membership Rewards transfers to Hilton HHonors points. Making such a transfer, bonus or not, is really wasting the value of Membership Rewards especially when there is a method for an even more favorable transfer to HHonors points (via Virgin Atlantic) makes this promotion not worth your time.

Hilton also changed their elite qualification requirements for Gold and Diamond elites. The changes are relatively minor, but they come very late in the year, so many have booked travel for 2013. The adjustments weren’t announced publicly either. Poor form, Hilton. I’ll continue to maintain Hilton status through credit cards.

The FlyerTalk blog posted an interesting article from Cornell University regarding travel reviews and room rates. I’m passing it along simply to remind everyone that room rates are not always products of expected value, but a myriad of factors including location, reputation, and demand.

What do you mean by “no notice”? I received an email from Hilton detailing the changes. Did you mean advance notice?

Yes, little advance notice was given. Most are reporting getting the email in the last few days. I’m Gold and still haven’t received notification. I prefer when loyalty programs announce changes to qualification or overall structure at least several months before changes take place.

[…] The 1:1.5 ratio falls in line with the American Express Membership Rewards transfer ratio. Take note that until January 31, American Express is actually offering a better 1:2 transfer ratio. For more details on that, check out my post Hilton HHonors-33% Bonus on Membership Rewards Transfers. […]