MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Until December 10, 2014, you can purchase Hyatt Gold Passport points for 1.85 cents each.

The sale offers a 30% bonus on the number of miles you receive for all purchases of at least 5,000 points, and you can purchase up to 55,000 points per calendar year. (If you purchases 55,000 points, you’d receive 71,500 points after the bonus.)

Since the bonus is constant, and the price of Gold Passport points is constant at 2.4 cents each, you pay 1.85 cents each for any purchase of at least 5,000 points (6,500 after bonus.)

Since the bonus is constant, and the price of Gold Passport points is constant at 2.4 cents each, you pay 1.85 cents each for any purchase of at least 5,000 points (6,500 after bonus.)

In general, I’d value Hyatt points at 1.2 cents, so as usual, this sale is not the time to stock up on points. However, there are a lot of uses, for which buying points now and then immediately redeeming them makes great sense.

- Under what circumstances, should you buy Hyatt points for 1.85 cents?

When I say I value Hyatt points at 1.2 cents, I am considering the average value I will get from redeeming them, and remember that I value hotel stays much less than the average person because I enjoy hostels and Airbnb more, and they’re cheaper.

There are certainly redemptions on which you can get more than 1.85 cents worth of value though.

In general, you will get more value out of Hyatt points when you value the hotel room at its retail value, when you can book under-categorized hotels, and when you can book cash & points awards.

Retail Value

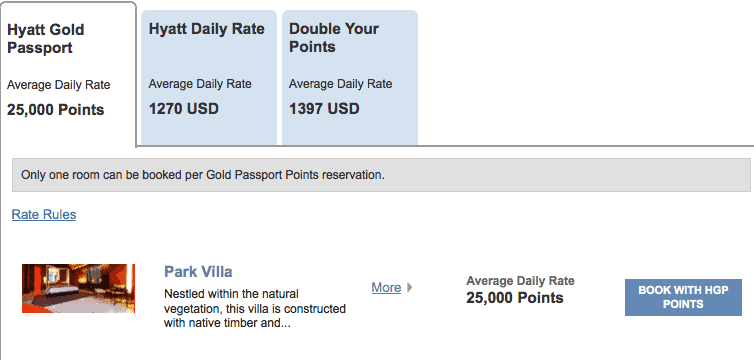

The Park Hyatt in the Maldives goes for $1,270 or 25,000 points per night.

If you’re so rich, that you would pay cash to stay at this stunning property, you could reap huge savings by buying points instead. During this sale, you can buy 25,000 points for about $462, which is a 64% savings off the retail price of the hotel.

During this sale, you can buy 25,000 points for about $462, which is a 64% savings off the retail price of the hotel.

BUT if you don’t value a night at the retail price–be honest: would you pay cash for the retail amount?–then this is bogus math, and buying the points might not be such a great deal.

Under-Categorized Hotels

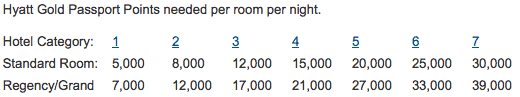

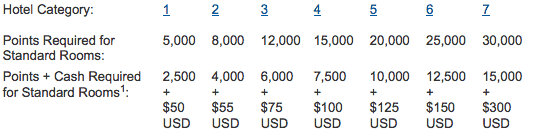

Here is the Hyatt award chart for free nights.

Generally hotel chains do a good job of categorizing hotels in relation to their average price. Sometimes a hotel is under-categorized. I don’t have any specific Hyatt examples, but imagine a Category 1 hotel that usually goes for $125 that you’d be willing to book with cash.

Buying points instead for 1.85 cents each would be like lopping a quarter off the retail price.

Points + Cash

Unlike free nights, which are available whenever a standard room is for sale, “Points + Cash” awards are capacity controlled. When they are available, they can offer a great deal.

For instance, the Andaz Maui at Wailea is a Category 6 and costs 12,500 points + $150 (+ tax on the $150) per night when Points + Cash stays are available. Here’s my trip report from a recent stay at the property.

The property goes for about $600 per night, which I am not rich enough to afford. If you could buy the 12,500 points for 1.85 cents each ($231) and then pay the cash co-pay of $150, that would be about $400 total after tax. That’s still more than I can pay for a night at a hotel, but it’s 1/3 off the normal rate, and some people might find it to be a good deal for a special occasion.

Bottom Line

This sale offers Hyatt points for 1.85 cents each. That’s not a good price to stock up, but it may be a good price for some uses.

If you do buy the points, make sure you award search first, run the math first, and burn the points immediately!

Its bogus math to the same degree that getting a $50K Ferrari is a deal. For 70% of the guests at the PH Maldives, that would be a great discount that they gladly accept.

Title needs to be changed… They are point, not miles.