MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

When it comes to earning points and miles, having a foundational understanding of credit is imperative. Unfortunately, many Americans don’t actively keep up with their credit.

Most people don’t even understand how credit works. There’s a reason why the number one question I get when explaining points and miles to people is “doesn’t that hurt your credit?” Even people who I would consider financially savvy tend to ask me this question, and it is simply because people don’t understand how credit works.

If you’re new to credit, let me start off with some calming words. Credit is easy to understand. It isn’t some mysterious black box that only Wall Street bankers understand. You too can understand credit, and that’s what I’m hoping you’ll get by the end of this article.

Stick with me, and by the end you’ll be a credit expert. You’ll no longer fear credit, as you’ll understand the factors that influence credit, and you’ll be able to easily say “No!” when your friends ask you if your points and miles hobby is hurting your credit.

What Is A Credit Score

First things first – what is a credit score? A credit score is a numerical measure of how well you manage credit that has been extended to you. It demonstrates to lenders how much of a risk lending money to you is.

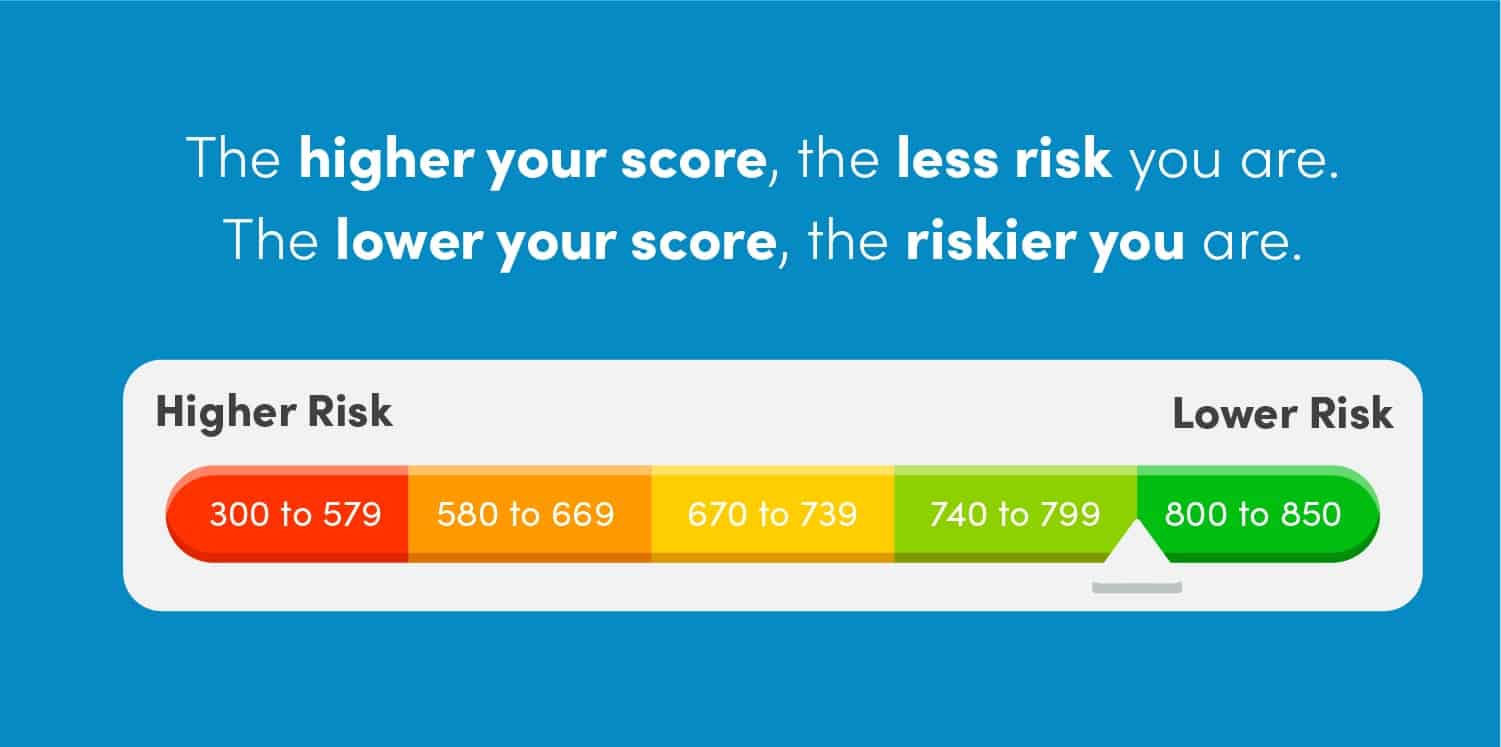

That’s it! The higher your score, the less risky you are. The lower your score, the riskier you are. That doesn’t mean you’re irresponsible, as there are a lot of reasons you may have a low credit score even if you’ve never missed a payment.

Your credit score is calculated based on the information on your credit report. Understanding this relationship is important. Your credit score doesn’t know how much money you make, how much you have in savings, or how much you have invested elsewhere. It only considers what is on your credit report which is typically information drawn from various loans and credit that you have.

Just because you make good money doesn’t mean you have good credit.

Think of your credit score like a muscle – you have to keep putting in the work to make it stronger. If you don’t do the right work, it simply won’t get stronger. This is why you may find some people who refuse to take loans on anything have bad credit. They’re not working their credit, and as a result have bad credit.

Different people have different priorities, but if you want to earn points and miles for free travel, you’ll need to have good credit. That’s not the only reason you should care about your credit though, but that is probably why you ended up here in the first place!

Why is Credit Important?

Credit is important because the less risk you pose to a lender, the more likely they are to give you favorable interest rates on loans you take out.

This covers everything from car loans to mortgages to interest rates on credit cards (although you shouldn’t be paying credit card interest in the first place).

Many people don’t start paying attention to their credit until they are looking to buy a home. Building robust credit can take months to years. It isn’t something you build in a few weeks so you can get a good interest rate on your mortgage.

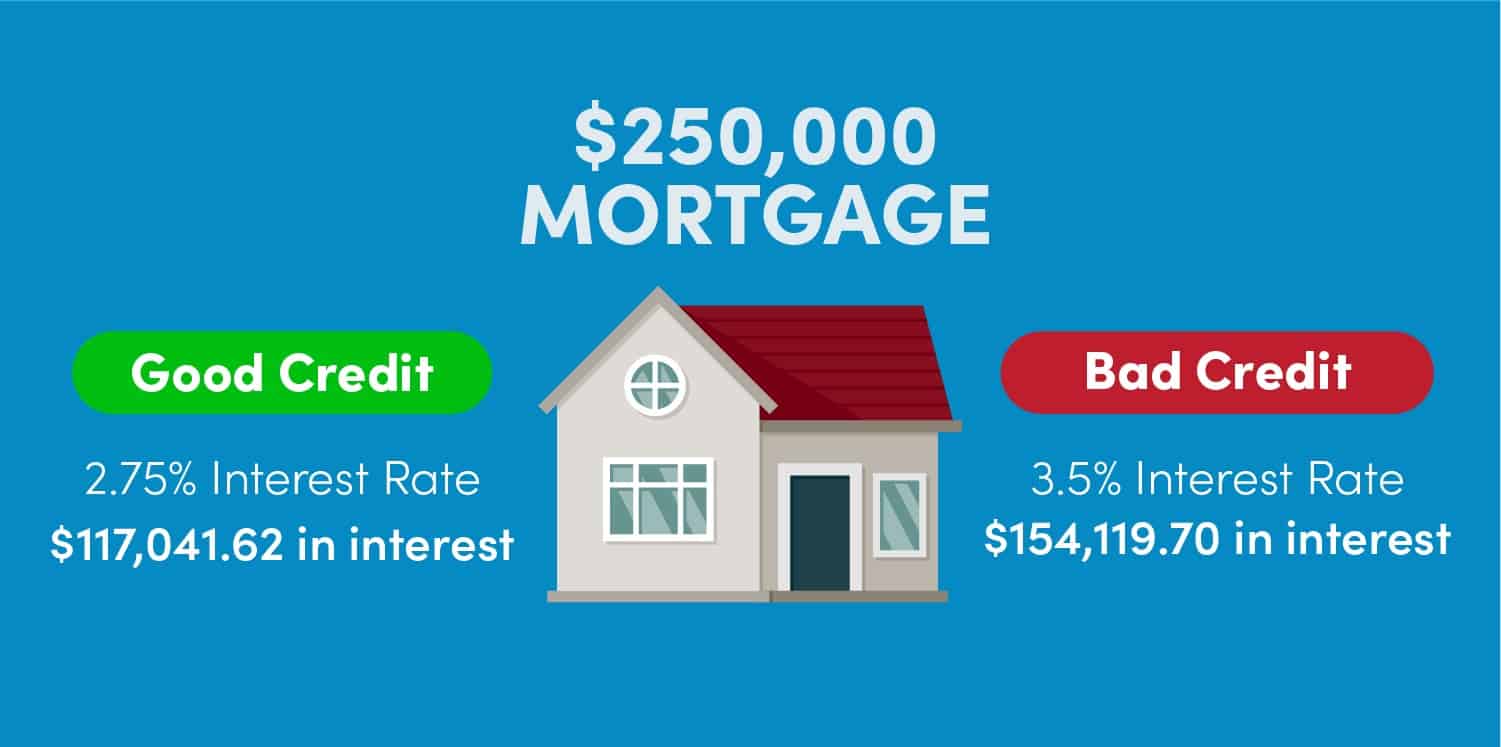

Good credit can save you thousands of dollars over your lifetime. If you are looking to take out a $250,000 mortgage and you have good credit, you may get rates around 2.75% right now. Over the life of your loan you will pay $117,041.62 in interest.

If your credit isn’t as good, you may get a 3.5% rate. You may not think that 0.75% difference is that much, but over the life of your mortgage you would pay $154,119.70 in interest. That’s about $35,000 more that you’ll have to pay, or about $100 more per month that you have to spend to buy the same house.

On car loans, I’ve seen it vary even more. Borrowers with good credit can get rates below 2.0% right now on car loans. If you don’t have good credit, you may see rates even as high as 20 or 25%.

To put it briefly – having good credit will save you a lot of money paid in interest because the banks know you’re more likely to pay them the money you owe. If you have bad credit, you’ll have to pay more to make up for the risk the banks are taking to lend money to you.

That’s why knowing credit is important, but if you’re brand new to credit, you need to know where to find your credit score.

How to Get Your Credit Report and Credit Score

Before you can really dig into your credit score and start working on it, you need to know how to find your credit score.

If you’re a millennial like me, you may remember the freecreditreport.com commercials. While I hope “F-R-E-E that spells free! Creditreport.com baby!” popped back into your head, that isn’t the best way to get your credit report and score anymore.

For starters, there are lots of services out there that will charge you money for the information that you can get for free.

The first place you should start is annualcreditreport.com. The Federal Government allows you to get access to all of your credit reports issued by each major credit bureau (more on them later) once a year. The only place you can get these is at annualcreditreport.com.

This should be your starting point if you’re new to credit. You’ll get copies of your entire credit history. It will be long. It will be a lot of information. But be sure to get through it.

The only catch is the info you get from annualcreditreport.com is just your credit report. It doesn’t include your score. You’ll be able to get all the information that is available on your credit report with all three credit bureaus. Review it for accuracy.

If it is your credit score you’re after, your best way to see your real FICO credit score is by signing up with Discover Scorecard. Discover will provide you with your FICO credit score, even if you’re not a Discover customer.

While you may be tempted to sign up with a service like Credit Karma, you should know that the score you get from Credit Karma is not your FICO score, it is your VantageScore. The differences are subtle, but important. Credit Karma is a great reference, but don’t be surprised if there’s some deviation between Credit Karma and your actual FICO score.

FICO vs VantageScore

Your credit score is a calculation, and how it is calculated depends on who is doing the calculating. FICO scores are calculated using FICO’s model whereas VantageScore uses their own model.

FICO and VantageScore don’t treat information the same. They use different aspects of your credit report differently to come up with your credit score.

The reason you should use Discover Scorecard over Credit Karma is because your FICO score is what over 90% of all lenders use to determine your creditworthiness. That’s why knowing your FICO score is more important than your VantageScore.

The Three Credit Bureaus: Experian, Equifax, TransUnion

Even though your credit score is likely calculated using the FICO model, it relies on the data available. There are three credit bureaus that creditors report your data to.

The reason you may get different credit scores from each bureau is because not all creditors report to every credit bureau. Some creditors may only send information to Equifax while others send only to TransUnion or Experian. Others may go ahead and report their information to all three.

Since each bureau is calculating your score based on the information provided to them, you will likely have a different score from each one. Don’t be shocked, as they’ll likely be within a few points of each other. A difference of 10-20 points is pretty common, but if you notice a bigger discrepancy, it can signal that maybe you need to review the information on your credit report deeper.

When you apply for credit, most lenders will only pull your credit report from one credit bureau. There are some exceptions to this, such as when you’re applying for a mortgage or with Capital One, but otherwise most will only check one bureau.

Credit Score Range

So… how does your credit stack up? Your score means nothing without context.

Your FICO score ranges from 300 to 850. Your score reflects your creditworthiness as a borrower:

- 300 to 579: poor credit

- 580 to 669: fair credit

- 670 to 739: good credit

- 740 to 799: very good credit

- 800 to 850: exceptional credit

Typically, anything in the good credit or better is enough to be approved for most credit cards and to receive competitive rates on your loans. You likely will find marginal differences between very good and exceptional credit levels.

Although these are general ranges, there are often some benchmarks in between as well. One of the biggest milestones is having a score above 700. Even though a 699 and 700 are both considered “good” credit, 700 is the magic number where you’ll typically receive the best rates and find the least issues when applying for credit.

What Influences Your Credit Score?

If you’re wanting to gain control over your credit score, the only way to make the right moves is to understand what influences your credit score. Let’s take a look at what matters when calculating your FICO score from most to least important.

Payment History – 35%

Payment history is by far the most important aspect of your credit score, making up 35% of your score.

Making payments on time is the best way to maintain good credit. Many people keep as much as possible on automatic payments to make sure that they don’t miss a payment.

Unfortunately, making payments on time isn’t as important as avoiding missed payments. That may seem like the same thing, but one on time payment won’t help your score all that much, but one missed payment will have a significant impact on your credit score.

Late payments are broken up by how late they were. Typically you’ll see 30 days late, 60 days late, 90 or more days late. The later a payment is, the worse impact it will have on your credit score.

Although payments such as rent and utilities won’t report on time payments, they often will report late payments to credit bureaus, especially if they’re turned over to a collections agency.

If you do miss a payment, try to get a payment made as soon as possible. Late payments don’t fall off your credit report until 7 years after the date the last late payment was recorded. Since payment history is the most important part of your credit score, you should do everything you can to avoid missing a payment.

Amount Owed – 30%

The second most important part of your credit score is the amount you owe. This is usually issued as a ratio of the amount of revolving debt you owe vs the amount of credit extended to you.

For example, if you have a credit card with a $20,000 line of credit, and you’ve spent $2,000 on it, then you have 10% credit utilization. Keep in mind, if you pay off the balance before a statement closes it will not report to the credit bureau and you’ll have a 0% utilization on that account.

You may have heard that you should let your statement close before paying off your cards, but this isn’t true. While anything below about 30% utilization is fine, the lower the better. Even high utilization on a single account while total utilization being low can negatively impact your score.

The reason people say to wait for the statement to close before paying off the balance is so that the bank does report the balance to the credit bureau. As long as you’re actively using the card, automatic systems will update with the credit bureaus monthly.

Keep in mind, this mostly applies to revolving credit. Revolving credit are loans such as credit cards or home equity lines of credit where you have a cap you can spend.

Other loans, such as mortgage or car loans, are called installment loans and have a starting balance that is paid off over time. Your utilization will always start off at 100% and go down over time, but installment loans aren’t counted the same towards your utilization. Primarily, utilization focuses on revolving lines of credit.

Length of Credit History – 15%

Your length of credit history, also sometimes known as the “average age of credit” accounts for 15% of your credit score.

You may have heard, or experienced yourself, that when paying off a car loan or your mortgage, your credit score actually drops. That’s because longer term loans tend to be the oldest on your credit report, so when you pay them off, your length of credit history decreases which can negatively impact your credit score.

The reasoning behind the length of credit history as a credit factor is that if you’re able to keep accounts open for a long time, it shows you’re a responsible credit user.

Credit Mix – 10%

Your credit will improve if you have a greater variety of credit. Simply having one type of credit doesn’t show your ability to manage multiple types of credit.

That being said, the credit mix factor is not weighted heavily. Most people find simply having a few credit cards and your typical mortgage or car loan is enough to keep a good credit mix. There’s no need to open another loan just to improve your credit mix.

New Credit – 10%

When you add new credit to your account, it is risky. You don’t have the history to show that you’ve balanced it with your existing credit.

Typically, what drives this factor is when you apply for new credit. This is reflected in the number of credit inquiries that you have on your account.

It is important to understand that not all inquiries are treated the same. Creditors expect you to shop for credit, so having 3 or 4 mortgage applications when you’re buying a house will typically be treated as shopping for credit and they’ll really only count it as one credit inquiry.

When applying for new credit, inquiries stay on your report for 2 years. What you’ll find, however, is once you have over about 20 to 25 inquiries for credit that it won’t really impact your credit much to add more inquiries.

How to Protect Your Credit

Now that you understand how your credit works, it is important to be proactive to protect and build a robust credit profile.

The number one thing you can do to protect your credit is actively monitor it. That’s where sites such as Credit Karma come in handy as they reflect the information that is available on your credit report for free. Now, you can keep up with it regularly instead of just checking the information you get from your free credit report once a year.

If you find something wrong with your credit report, you can dispute it with the credit bureaus. Using Credit Karma, you can file a dispute directly with the bureaus.

Additionally, you should do your best to avoid any true issues appearing on your credit report. Putting everything you can on automatic payments, even just the minimum, so that you never miss a payment is one of the easiest ways to make sure you never miss a payment.

If you do miss a payment, don’t just let it be. Reach out to the bank and try to make it up somehow, apologize and take responsibility, but see if they’ll forgive it this one time. You may find them more likely to do this, especially if you have a very good credit history. The worst they can do is say no, leaving you in the same spot you would be in if you didn’t try.

Final Thoughts

Credit isn’t so scary after all. Once you understand the system and how to stay on top of your credit it will be easier to manage than you first may have thought.

If your credit isn’t great but you’re wanting to get started in points and miles, feel free to reach out to us here at MileValue and we will help point you in the right direction to help build your credit and make it stronger than it ever was.

Travis

Good post on Credit as in FICO scores. A credit card is one thing but a home loan is different u really need 2 watch what ur doing for like 2.3 years BEFORE u apply as in keeping the same job ect. Do the Travelcards and Car loans AFTER u get the house or 3 years beforehand.

Money is Cheap so don’t overspend on Cheap rates which can change quickly.

#stayincave