MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

5x Points Offer Has Expired

The Citi ThankYou® Premier Card is already one of the three cards I carry. I got it for the massive 40,000 ThankYou Point sign up bonus that I can transfer to airlines like Singapore and AirFrance for tricky awards. I carry it for the big category bonuses and no foreign transaction fees:

- Earn 3 ThankYou Points for every $1 spent on purchases for gas and travel

- Earn 2 ThankYou Points for every $1 spent on dining out and entertainment

Now I got an email offering even more bonus points on my Citi ThankYou® Premier Card. The email had the subject line:

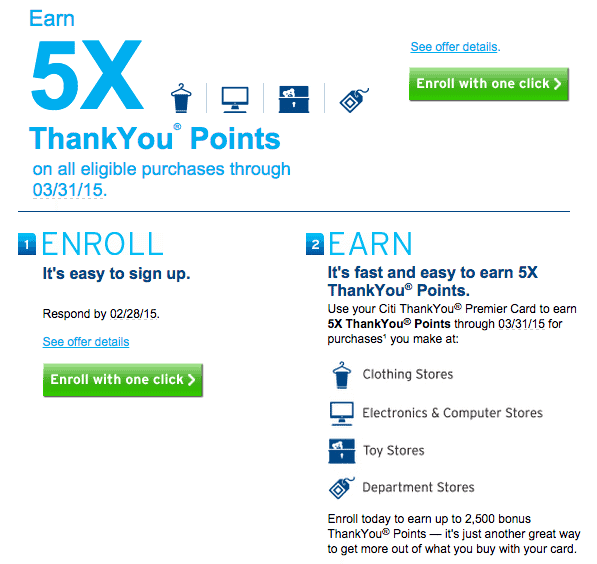

Earn 5X ThankYou® Points on eligible purchases | Enroll in one click!

I was offered 5x points per dollar at clothing stores, electronics and computer stores, toy stores, and department stores through March 31.

All these stores normally earn just 1x, so this deal offers 4 bonus points per dollar (5 total points). I am limited to 2,500 bonus points, which means only my first $625 spent in these categories will earn 5x.

I clicked “Enroll with one click” and was taken to a screen letting me know I was enrolled.

I’ll be sure to use my Citi ThankYou® Premier Card at those stores when I’m back in the States in March.

Terms and conditions:

This offer starts upon enrollment and will end on 03/31/15. Earnings associated with this program will equal 4 bonus ThankYou Point(s) per $1 spent on eligible purchases and may overlap with other special offers in which you are currently enrolled. Bonus points awarded with this offer are subject to a maximum of 2,500 additional points. Eligible purchases exclude purchases made at supercenters, warehouses & discount stores, balance transfers, cash advances, convenience checks, items returned for credit, fees and interest charges. Electronics and computer stores are classified as merchants that sell, repair or lease a wide variety of electronic goods, including computer hardware, software and related equipment. Clothing stores are classified as merchants that sell clothing and accessories geared toward a specific audience. Toy stores are classified as merchants that sell toys and games. Department stores are classified as merchants that provide a general line of merchandise from departments that usually have separate checkout counters. All purchases must be posted during the promotional period. We do not determine how merchants are classified, however, they are generally classified based upon the merchant’s primary line of business. We reserve the right to determine which purchases qualify for this offer.

[…] April 18, 2015, unless you are participating in a limited-time offer like this one for 5x, you will […]

[…] April 18, 2015, unless you are participating in a limited-time offer like this one for 5x, you will […]