MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

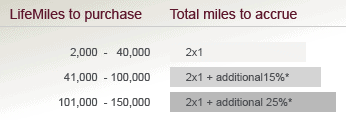

Avianca LifeMiles is offering a bonus of up to 125% on purchased miles through December 18, 2015. You can buy up to 150,000 LifeMiles during the sale and get up to 187,500 bonus miles.

LifeMiles cost 3.3 cents each, so with a 125% bonus, you get the miles for 1.47 cents each. For instance, 227,250 total miles would be $3,333 or 1.47 cents each.

The cheapest I’ve ever seen LifeMiles was 1.4 cents each.

When to Buy (Math)

Here are the prices for each number of miles (including bonus) that you can purchase.

- 4,000 to 80,000 miles for 1.65 cents each

- 88,150 to 215,000 miles for 1.53 cents each

- 227,250 to 337,500 miles for 1.47 cents each

I value LifeMiles at 1.5 cents per mile at the moment. Buying them for 1.47 cents per mile is not enough of an inducement for me because I don’t have an immediate use for them, and miles get devalued all the time. I don’t want to shell out $3,000+ on such an uncertain investment.

Many people should have a similar view of this sale and buy zero miles. As with most mile sales, the main way it make sense to buy miles at these prices is if you have an immediate high value use for them.

Possible Immediate High Value Uses

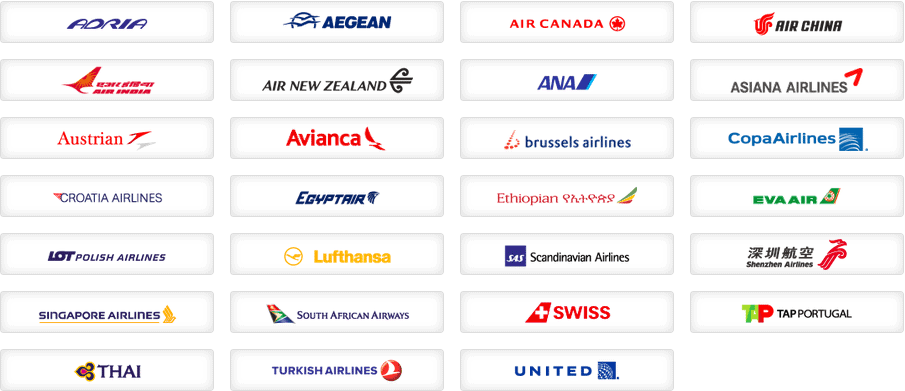

There are a ton of deals on the LifeMiles award chart, which allows one way redemptions with no fuel surcharges on all 27 Star Alliance partners, so an immediate high value use is very possible.

Do not just use the award chart, though. Make sure you can book what you want to book on lifemiles.com. You can do an award search with zero miles in your account. The reason for this extra step is that if you can’t book your award online, LifeMiles call centers are nearly useless.

Also remember that you cannot mix cabins on LifeMiles awards. That means you can’t fly domestic economy to connect to international Business Class. And your international First Class awards are probably only going to be one segment, since they cannot connect to Business Class regional flights.

Cuba

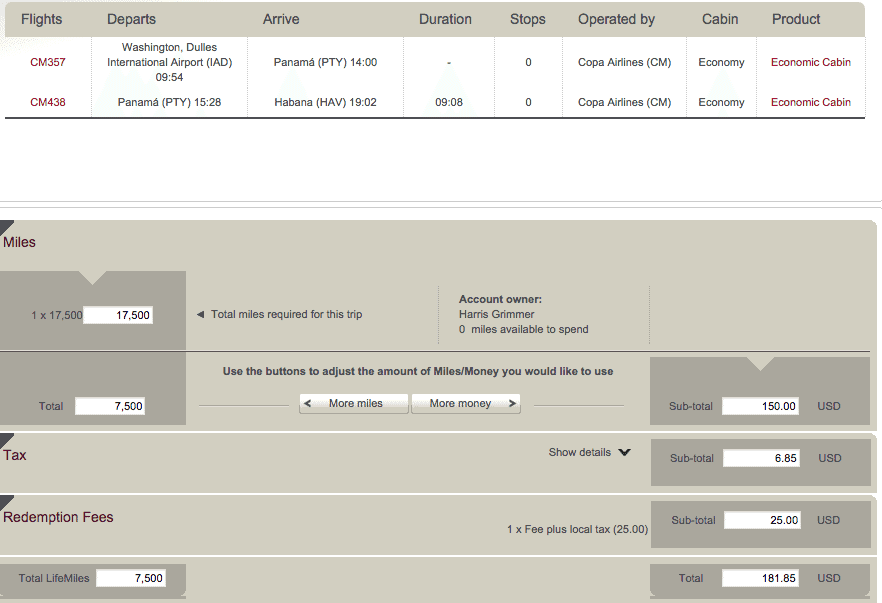

Americans can book awards to Cuba with LifeMiles. For instance, here is a search from Washington-Dulles to Havana, Cuba. It costs 17,500 LifeMiles + $31.65 or 7,500 miles + $181.65.

Buying miles during the award booking often costs 1.5 cents per mile as in this case.

If you bought all the miles for a one way award to Cuba during the current sale, you’d pay:

- $297: 18,000 miles at 1.65 cents each

- $31.65: taxes and fees

- $328.65 total, unbeatable for a one way award to Cuba

Europe in Business Class

The United States to Europe is 63,000 miles each way in Business Class. The Star Alliance has great award space.

You could buy 26,000 miles (13,000 + bonus) for $429 and buy the last 37,000 miles for $555 at the time of booking. That would get you a one way in Business Class for about $1,000 total after taxes.

See How to Consistently Buy Business Class Tickets to Europe for about $1,000 and Anatomy of an Award: Using LifeMiles to Buy Business Class Ticket Between Europe and USA for $1,040 for full details on these awards.

There are similar deals all over the world and in all cabins through this sale, too many to list here. Investigate where you want to go on the award chart and then make sure you can book the award you want. If the math works out, buy LifeMiles.

Buy LifeMiles with These Credit Cards

LifeMiles purchases are processed directly by Avianca. That’s great news!

It means you can buy them with your Citi Prestige® Card, and its $250 Air Travel Credit will refund you the first $250 of the purchase price of the miles (plus you’ll earn 4x ThankYou Points on the first $250 of the miles purchase.)

It means that the Citi ThankYou® Premier Card offers 3x ThankYou Points on the purchase of LifeMiles.

It means you can purchase LifeMiles with your Barclaycard Arrival Plus™ World Elite MasterCard®, then use your Arrival miles for an offsetting statement credit.

Bottom Line

You can buy 227,250 Avianca LifeMiles for $3,333 or 1.47 cents each. That’s too high to buy speculatively, but there are a lot of immediate awards you can book where that price offers great value.

The LifeMiles sales are now processed by Avianca itself, so you can get category bonuses on cards that bonus airline or travel purchases like my latest card, the Citi Prestige® Card which offers 3x on purchases from airlines and a $250 Air Travel Credit, or you can use your Barclaycard Arrival Plus™ World Elite MasterCard® to get Avianca miles for zero cash.

Every time one of these sales comes up, I want to take advantage but don’t want to make the cash outlay.

Any way to transfer these points in from one of the major bank programs? I looked but didn’t even see them on SPG. Maybe I’m missing something.

No way to transfer to LifeMiles

Every time one of these sales comes up, I want to take advantage but don’t want to make the cash outlay.

Any way to transfer these points in from one of the major bank programs? I looked but didn’t even see them on SPG. Maybe I’m missing something.

No way to transfer to LifeMiles

[…] Last week I posted that LifeMiles were being sold with a 125% bonus, bringing the price down to 1.47 cents per mile. In the past I have purchased LifeMiles when the price dipped to 1.5 cents or less because that allows for a one way ticket in Business Class to Europe for about $1,000. […]

[…] Last week I posted that LifeMiles were being sold with a 125% bonus, bringing the price down to 1.47 cents per mile. In the past I have purchased LifeMiles when the price dipped to 1.5 cents or less because that allows for a one way ticket in Business Class to Europe for about $1,000. […]