MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Last week I booked myself an award from Chicago to Buenos Aires in United economy for 30,000 United miles + $5.60. This award was very simple, but it illustrated three interesting concepts:

- When will last second award space open up?

- United’s secret extra award space.

- The trick to save $75 on last second United award bookings.

Last Second Award Space

I had been searching award space for months from Chicago to Buenos Aires, and there was never any on the inflexible date I wanted to fly. But I noticed that American Airlines opened up some Business and First Class award space within two days of departure, and United opened up lots of economy award space within a week of departure (via Houston) and some Business Class award space at the same time (via Sao Paulo.)

This is how I always recommend that people figure out if there will be award space available to them at the last minute. From my searches, I thought it was very likely I would find United award space and American Airlines award space was a good back up.

I most wanted to book United award space with my Singapore miles because I have more Singapore miles than United miles and the award in economy would be the same price with either type of miles. (I don’t have either miles, but I have transferable points. Singapore is a partner of all transferable points; United only partners with Marriott Bonvoy and Ultimate Rewards.)

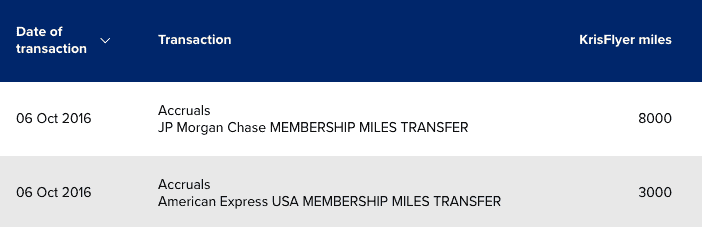

Since Singapore transfers are not instantaneous, I transferred points from my Ultimate Rewards, Membership Rewards, and ThankYou Points 10 days before the trip, and a few days before I was hoping award space would open up.

Interestingly the Chase and American Express points showed up within 14 hours. The Citi points arrived 24 hours later.

United’s Secret Award Space

A week before departure, I woke up in a tent in Hawaii a little before anyone else was stirring, so I pulled out my phone and searched the United app for award space from Chicago to Buenos Aires. The United app makes you sign in before performing the award search.

I found great economy award space with one stop in Houston on the day I needed to fly.

Did you catch that I signed in, though? United offers extra Saver economy award space to all elites and credit cardholders. I have a United credit card. They know if you are in those categories only if you sign in.

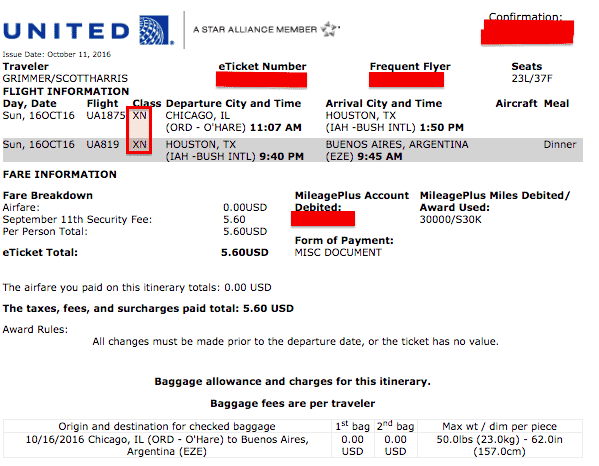

This is an awesome, unadvertised perk of the credit card that I’ve written about before, but the extra award space is not available with partner miles. (The extra space is fare code “XN” and partners can only book fare code “X” in economy.)

To see if I had stumbled upon this extra award space, I went to united.com and searched without signing in. There was no award space, meaning the space I had found was extra space for elites. I could book it with 30,000 United miles, but not 30,000 Singapore miles.

When I got home from camping, I investigated the award space further. I signed into united.com and searched again, activating Expert Mode, and saw that there were 5 seats in the XN bucket on the flights I needed.

Of course, United could always have pulled those seats at any time, but I figured so many were available because there were plenty of unsold seats on the flights I wanted, which means that the award space will likely remain.

This gave me the confidence to NOT book the award space for a few days, hoping that regular X award space could open that I could book with my new Singapore miles. Unfortunately three days before the trip, United hadn’t opened up regular economy award space (or Business Class award space), and I decided I could not wait longer and had to book.

Below is my receipt, which shows clearly I booked XN award space, the extra Saver economy space set aside for elites and credit card holders, not X space, which is normal Saver economy space.

(The eight hour layover was intentional to leave the airport and hang out with a buddy in Houston. Short layovers were available. Luckily the long layover was shown as an option on United.com because if I had requested it without it showing on united.com, I would have paid for two award as of two weeks ago.)

Getting the Miles

The best card to get United miles is to get the best card ever: Chase Sapphire Reserve®

Credit card links have been removed from posts and added to the menu bar at the top of every page of MileValue under the heading Top Travel Credit Cards.

The card earns Ultimate Rewards that transfer 1:1 instantly.

Bottom Line

Instead of giving up because my award didn’t have award space for months, I confidently kept searching expecting the space to open up at the last minute.

In the end, United only released the extra award space that it makes available to elites and cardholders, meaning I had to book with United miles and not Singapore miles as I’d hoped.

MileValue can book your dream trip with your miles through the MileValue Award Booking Service.

Interesting, thanks. I guess you ended up with some Singapore miles that you now have to spend within a certain time, right?

Where were u camping in Hawaii?