MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Last week I wrote about how and why you’d to want transfer Ultimate Rewards between accounts. If you haven’t read it yet, stop and read before continuing with this post.

A reader asked me the following question in regards to that article:

Is using Ultimate Rewards to purchase air travel (1.5 cents cash value) a good use of UR, or is using UR as award points for travel a better deal?

What he was asking, more specifically, was whether he should redeem his Chase Sapphire Reserve® Ultimate Reward points for 1.5 cents via booking travel through Chase’s online travel portal, or if transferring his Ultimate Rewards to an airline or hotel loyalty program partner–like Singapore Airlines or Hyatt, for example–is a better deal. FYI: Ultimate Rewards earned by (or in the account of) the Chase Sapphire Preferred® Card or the Chase Ink Business Preferred® Credit Card account can be redeemed for only 1.25 cents each through the travel portal.

The answer is that it totally depends on each case. I gave him a general rule of thumb to follow, though, and a means of figuring out how to compare in each case.

General rule of thumb for flights: It’s a better deal redeeming Ultimate Rewards for 1.5 cents each for domestic economy travel, and as airline miles for international/premium cabin flights.

That being said, you should be checking each time which is the better deal that would have you spending less points. Personally, I like to save my Ultimate Rewards to redeem on higher values than 1.5 cents per point, because I know I can easily get 2 cents of value per point, if not higher, on international/premium cabin flights.

The Math

Here is an example that illustrates how to compare and figure out which way to redeem your points.

- A roundtrip in Delta One between Atlanta and Buenos Aires, Argentina in November (high travel season for Buenos Aires) costs $4,467* in cash. If you booked it through the Chase Travel Portal, that would cost you 297,800 Ultimate Rewards (4,467 / .015 = 297,800).

- The same roundtrip Delta One flight is available to book with just 90,000 Virgin Atlantic Flying Club miles (transfer partner of Ultimate Rewards). I know because I just recently booked and flew this award.

That’s 90,000 Ultimate Rewards versus 297,800 Ultimate Rewards.

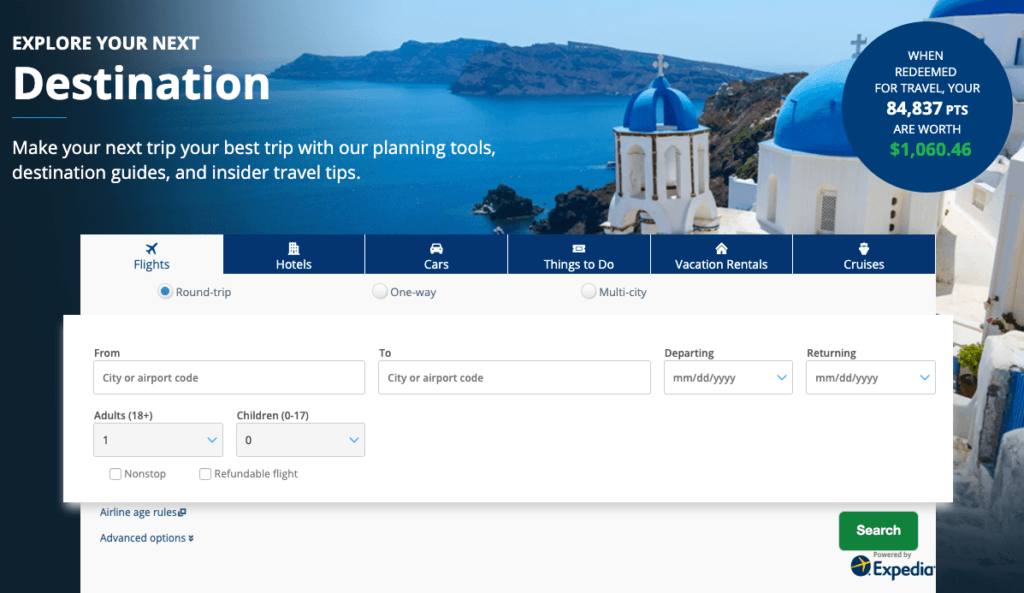

*During this comparison process, always check the cash price of the flight or hotel you want outside of the Chase travel portal as well as in it, as sometimes Chase’s price will be higher. Typically not, but you should double check anyways. In the example I gave above, the price on Google Flights, the airline’s website, and the price on Chase’s Travel Portal (powered by Expedia now) were the same.

What would likely be the case if we were looking at an economy flight between two major airports within the United states is that the cash price would be a lot cheaper, the rewards price would be comparatively higher, and if you did the same math as above (divide the cash price by .015, as that is 1.5 cents) then you’d end up needing less Ultimate Rewards to book the ticket through the Chase portal than you’d need to transfer to a mileage program and book as an award ticket. If you do tend to fly mostly in economy domestically, read about how to maximize your return on spending with the card strategy outlined in Rewards Earning Strategy for Domestic Economy Travelers.

These are simplified examples, because in reality there are other factors that could influence your decision. Maybe there isn’t award space on the exact day you want to travel. Maybe the flight available to book with miles and the cash flight aren’t the same and the routing of one is better than the other. But finding the price of an acceptable flight to your desired destination around your desired date through the Chase Travel Portal (that uses your points as 1.5 cents each towards the cash price), and comparing that amount of Ultimate Rewards needed to the amount you need for an acceptable award flight is where you start. Of course, this requires some knowledge (also known as googling) of loyalty programs, which ones have good prices to where, and how best to search for that award space. This is why many people just use the Chase Travel Portal (or whatever the equivalent is for their transferrable point type) without thinking twice about complicating the equation and utilizing mileage programs… but look how many points you can save with some research! TONS. Or you could just use our Award Booking Service instead if don’t have time/confidence you are finding the best award flight/price.

Is it a Third Party?

The same reader emailed again and asked another good question, which I think is important to share with you guys:

If I do buy through Chase, it is a direct ticket with the airline, or is it a third-party Orbitz type ticket? I have seen a few instances where the agent says: “This sounds harsh, but it is the truth. You are not our customer. You are Orbitz’s customer. Therefore, we cannot do a single thing with your ticket. We want to help you, but the record is locked against changes. It’s between you and Orbitz, sadly”.

The Chase Ultimate Rewards Travel Portal is a third party. You are not buying a ticket directly from an airline (nor the hotels room directly from a hotel), therefore changes need to be made through Chase’s call center and not directly with the airline or hotel. I have never booked anything through the portal, as I said above I can consistently get 2+ cents of value for my Ultimate Rewards so I don’t use them for 1.5 cents each. If anyone reading has and has had issues changing a booking, please leave intel in the comments.

We fly between CMH (Columbus OH) and SJO (San Jose, Costa Rica) several times per year, in 1st class. Days of the week and times of day not very flexible. Delta usually offers the best route & price. UR points are easier to earn due to bonus categories, but don’t transfer to Delta. I can never find this route on Flying Blue or Virgin Atlantic. For upcoming travel, price was $1,231.82 per ticket; or 104,000 Delta miles + $86.12. Booking through Chase travel portal, flights were 82,121 UR points. And I earn Delta miles because I “paid” for the tickets. Let me know if I’m missing something, but I think this was a win with UR, given the limitations on our travel flexibility. As to changing flights, I believe you can do it either through the airline or Chase; the change fee is that of the airline. This was in my confirmation email: “We understand that sometimes plans change. We do not charge a cancel or change fee. When the airline charges such fees in accordance with its own policies, the cost will be passed on to you.”

That’s a win… as you saved almost 20k Ultimate Rewards per ticket (and your other mileage options were nil).

It costs only 60k Virgin Atlantic miles to fly Delta One to Costa Rica from the US roundtrip, but the reason you don’t see that award space online is because the 30k one way/60k roundtrip price only applies for direct flights (in this case to Atlanta and Los Angeles). If you happen to already be in or near one of those cities before your Costa Rica trip though, make sure you consider that option as it’s by far the cheapest. You could consider getting separate positioning flights to take advantage of that price from ATL or LAX, but I kind of doubt it would be worth it.

Thanks for the intel on flights booked through the Chase portal!

This is the first I’m hearing that Chase Sapphire Reserve UR points are worth more than Chase Sapphire Preferred UR points. I have a Chase Sapphire Reserve card for my personal spending and a Chase Business Ink for my business. My Business Ink card is pretty new. I worked with Chase customer support to create an online account that merged my business and personal cards. While my UR points total also merged, the actual points did not. When I click on the UR total, it takes me to a screen that delineates which points are Reserve vs Ink. Is the valuation a likely reason why? How do I know what each Chase product UR points are worth?

Yes, their different values (at least when redeeming through the Chase travel portal) is why they are separated. Your Ink Business Preferred Ultimate Rewards are worth 1.25 cents each towards travel booked through the Chase travel portal. Alternatively, you can transfer them 1:1 to any of the Ultimate Rewards travel partners (like United MileagePlus or World of Hyatt) and redeem them as airline miles or hotel points. Your Sapphire Reserve Ultimate Rewards are worth 1.5 cents each towards travel booked through the Chase travel portal, or alternatively you can also transfer them 1:1 to all the same travel partners you have the option to with your Ink Business Preferred. How and Why to Combine Points Between Ultimate Reward Accounts goes over these concepts.

What the post is encouraging is to compare how many points you’d use redeeming through the Chase travel portal (in other words, the cash price divided by .015 as Reserve points are worth 1.5 cents each) to how many you’d need to redeem transferring to an airline mileage/hotel point program, and then choose the option that has you spending less points. You will always want to look up the travel portal point price through your Sapphire Reserve card, as like I said, those points are worth 1.5 cents while the Ink Business Preferred just 1.25 cents each. What’s great though is that you can easily boost your points’ fixed cent value, by simply moving your Ink Business Preferred Ultimate Rewards to your Sapphire Reserve Ultimate Rewards account. That makes those points then worth 1.5 cents each instead of 1.25, as you’d be redeeming them out of your Reserve account.

If you will use less points transferring to an airline mileage program/hotel loyalty program, then it doesn’t matter which UR account you transfer your points from. Both Ink Business Preferred and Sapphire Reserve Ultimate Rewards can be transferred to all the Ultimate Rewards travel partners at a rate of 1:1.