MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

US Airways has announced its plans to leave the Star Alliance for the oneworld alliance and later merge wither American Airlines.

But for the time being US Airways is in the Star Alliance and its miles can be used on its own flights or its Star Alliance partners.

At least in theory.

In practice, for the past few months US Airways agents have not been able to see award space on Lufthansa, the Star Alliance airline that releases the most space between the US and Europe.

You could find award space on united.com, call US Airways, and the agent would tell you there was no space on the flight. Counter with the fact that you know there is space because you found it on united.com, and you’d get a highly misleading claim that “Different partners have access to different award space.”

This glitch–unintentional or otherwise–that was causing US Airways agents not to be able to book Lufthansa award space was a major hassle for our Award Booking Service and its clients.

The good news is that I have now solved the problem and know exactly how to book Lufthansa award space with US Airways miles. The technique requires specialized knowledge, some confidence, politeness, and the ability to lead a phone call.

Using the technique, all the Lufthansa space that you can book on united.com is bookable with US Airways miles (except Lufthansa First Class space, which is explicitly not bookable with US Airways miles.)

I know many of us have freshly bulked up US Airways miles because of the recent sale of miles for 1.13 cents or because we rushed to get the US Airways Premier World MasterCard® and its 30,000 bonus miles before it disappears during the merger with American Airlines.

What is the technique to book Lufthansa award space with US Airways miles? What was the US Airways agent’s reaction to my teaching her a new trick?

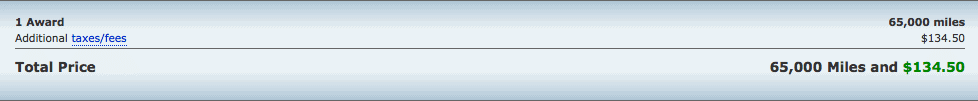

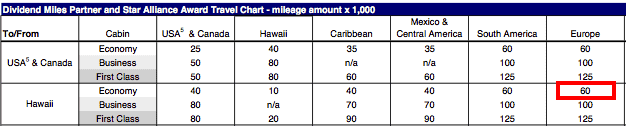

My friend wanted to book a roundtrip economy award from Frankfurt to Honolulu in December. US Airways charges only 60k miles roundtrip + $50 + government taxes for this twelve time zone trip.

I attacked this US Airways award like I attack all US Airways awards:

- I searched online at united.com for Saver award space on any Star Alliance partner.

- I called US Airways at 800-622-1015 to book the award space I had found and noted to myself.

Step one was very easy. December is not a peak time between the US and Europe. Space abounded.

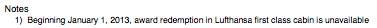

For the outbound, I found a nice one stop itinerary via Vancouver on Lufthansa and Air Canada. I liked that the first place she would land in the US was Honolulu, so she wouldn’t have to collect and re-check her bags en route after passing through Customs.

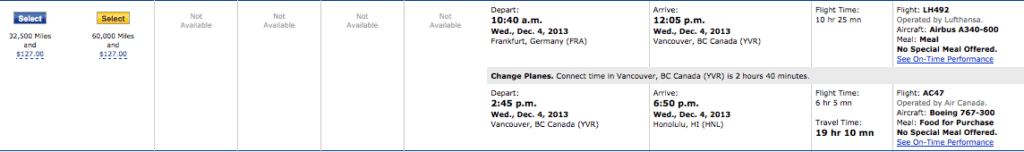

The return flight times either require two stops or one stop with a very long layover. She preferred a two stop itinerary on all United flights.

I went to the payment screen on united.com to check the taxes.

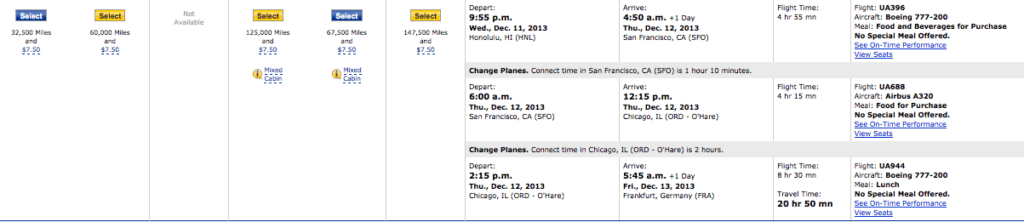

Government taxes on the award are $134.50. US Airways collects government taxes plus a $50 award processing fees on international awards, so the award would cost $184.50 out of pocket.

The tax information was useful, but the miles United would charge is irrelevant. US Airways has a totally different chart than United, and most awards are cheaper with US Airways miles including this one, for which US Airways would charge only 60k miles.

I knew the five segments and had them written down, including flight number and operating carrier. I knew the price–60k US Airways miles + $184.50. All that was left was to call US Airways at 800-622-1015 to book the ticket.

Preparing for the Call

I knew the call would require me to convince a US Airways agent to do something she might not want to do. Matthew at Upgrd wrote a great post on getting US Airways to ticket Lufthansa awards. The takeaways:

- US Airways brass knows there is a problem with their computers not displaying Lufthansa award space and claim it is not deliberate.

- To see Lufthansa award space, an agent needs to manually request Lufthansa space in a separate way than how they normally query award space. This process is called a “long sell” or “need-need” request.

- Dividend Miles Marketing Manager Brenda Middleton says: “Our DM agents have not been instructed to specifically refuse any long sells, they simply do not know how to process this function even if a customer asks. Unless they are a seasoned agent, this is not provided in training as we don’t do this type of function in Shares and is considered a workaround and again only to those agents that have been around a long time and even then they may not know how to do this function.”

That means you have to request that an agent manually request space on Lufthansa flights. They are allowed to do this, but might not know how. Even worse they might think they are not allowed to do this because memos have gone out to them in the past prohibiting manual requests in certain situations.

The Call

After giving the Dividend Miles number, origin, destination, and number of passengers, I told the agent I had all the flights picked out if she’d like me to read them.

She was happy to agree, since it would save her some work.

Scott: “The first flight departs Frankfurt December 4 and arrives in Vancouver the same day–Lufthansa flight 492 in economy.”

US Airways agent: “I’m sorry. There is no space on that flight.”

This is where I had to confidently and politely request that she attempt a manual request. To assuage her doubts, I tried to sound like I knew what I was talking about and had talked to her bosses about it.

Scott: “That doesn’t surprise me. I’ve had this problem in the past few weeks trying to book Lufthansa flights. I even talked to a manager in the Dividend Miles department, Brenda Middleton, about the issue.

She said that Lufthansa space was incorrectly displaying in SHARES, and that I should ask agents to manually request it through a long sell or need-need request.

If we do that, the space should appear because from searching on united.com and aeroplan.com I know that Lufthansa has released award space to its partners on this flight.”

Key components:

- I name dropped one of her superiors and said that the superior had directed me to ask the agents for a long sell.

- I sounded knowledgeable about the situation by saying I’d had and solved the problem before and knew the name of the SHARES system. I was clearly not just some idiot asking for her to double check whether space was available on a certain flight for no reason.

- I used all three terms “manual request,” “long sell,” and “need-need,” so that it didn’t matter which she name she knew that process by.

She wasn’t totally convinced I was right, but she was convinced to give it a shot.

Agent: “Wow! It worked. There is space on the flight.”

Scott: “Excellent! Let me give you the rest of the flights.”

I gave her the rest of the flights, none of which were on Lufthansa, so she added them quickly. She priced the award at 60k US Airways miles + $184.50 as expected. I put the award on hold for my friend, so she could call in to ticket it herself with her credit card.

Putting the award on hold might seem to contradict past advice I’ve given about not putting Dividend Miles awards on hold because a new agent might not be as friendly as the first. That advice applies when you have a “creative” routing that the next agent might think violates US Airways rules.

My award was obviously in compliance with US Airways rules, and I knew that once the Lufthansa space was on the itinerary, it was held, so I had no fear of holding the award.

After the award was on hold, the agent was still marveling that manually requesting the Lufthansa space had worked.

Agent: “You’ve enlightened me. The space showed as zero, but after completing the record, it shows up as confirmed. Booking Dividend Miles tickets is my forte, but I learned something today.”

She shouldn’t feel bad. Booking Dividend Miles tickets is my forte too, and I have an incentive to get them booked–payment from clients–while US Airways agents don’t.

Booking

My friend called back the next day, gave the six digit confirmation number I had given her, and ticketed the award in a few minutes for 60k miles + $184.50.

Seat Selection

Seat selection usually has to be done with the operating carrier, so it took three calls to United, Lufthansa, and Air Canada to select aisle seats for the flights.

Getting the Miles

US Airways miles are pretty easy to get. We often see them sold for 1.88 cents. Once a year they are sold for 1.13 cents. And of course you can get the US Airways Premier World MasterCard® and Starwood Preferred Guest® Credit Card from American Express for 65,000 US Airways miles combined.

US Airways Premier World MasterCard® with 30,000 US Airways miles after first purchase

- Earn up to 40,000 bonus miles with qualifying transactions

- Exclusive: Book award flights for 5,000 fewer miles – award travel starts at just 20,000 miles for cardmembers

- Zone 2 boarding on all US Airways flights

- Earn 2 miles per $1 on US Airways purchases

- Earn 1 mile per $1 on purchases everywhere else

- Annual companion certificate good for up to 2 companion tickets at $99 each, plus taxes and fees

- First Class check-in

- Please see terms and conditions for complete details

Application Link: US Airways Premier World MasterCard

Starwood Preferred Guest® Credit Card from American Express with 25,000 bonus Starpoints!

- Starpoints® bonus: earn up to 25,000 bonus points: 10,000 after your first purchase and another 15,000 after you spend $5,000 within the first 6 months of Cardmembership

- That’s enough for a weekend getaway to a Category 4 Hotel.

- Earn up to 5 Starpoints® for each dollar of eligible purchases at participating SPG hotels and resorts – that’s 2 Starpoints for using the Card in addition to the Starpoints you earn as an SPG member. Earn 1 Starpoint for all other purchases.

- Free Hotel Nights: redeem Starpoints at over 1,100 hotels in nearly 100 countries worldwide – with no blackout dates. Some hotels may have mandatory service and resort charges.

- Free Flights: redeem Starpoints on over 350 airlines with SPG Flights – with no blackout dates

- No limits on the number of Starpoints you can earn

- $0 introductory annual fee for the first year, then $65

- Terms and Restrictions apply.

Application Link: Starwood Preferred Guest® Credit Card from American Express

Getting both cards would give you more than the 60k miles needed for a roundtrip award from anywhere in the US to anywhere in Europe.

Recap

For a few months, US Airways agents haven’t seen Lufthansa award space on their computers. You need to request them to long sell the space, perhaps with some name dropping mixed in. If you can talk them into manually requesting the space, they will see the same space that you can see on united.com.

Great post!

Thanks. Hope it helps people.

Do you expect this issue to be fixed in the coming future? If not, can we use the name of the supervisor that you used when trying to make a reservation? Thanks

I don’t expect it to be fixed. Feel free to name drop anyone you’d like 😉

Is this process useful for other partner airlines? I recently tried calling a US Airways agent for flights on Air New Zealand, which at united.com were available on close to half the dates in a month I was interested in. The US Airways agent couldn’t find a single available flight. Same issue? Same solution? I was talking to one of those agents who wouldn’t know whether Fiji is in the South Pacific or South Carolina, if that matters. This stuff is why, to me, United miles are so much more valuable than US Airways miles.

This should solve most problems when US Airways doesn’t see award space. I can’t guarantee it will work in all situations though.

Are you not able to book Lufthansa FC space with US Air miles even within 14 days?

You are never allowed to book it according to the chart.

Can you book Lufthansa First class (when available on united.com) using the same method?

One supervisor bragged to a MileValue award booker that she still could with a long sell. Lufthansa F is what I was referring to when I said they had received a memo not to long sell.

Basically I think it is technically possible, but it is against US Airways rules–and it’s a pretty well known rule among agents–so I don’t think you’ll have a lot of success booking Lufthansa F with US Airways miles.

Great post! I wish I had known about this about a month ago…I knew there was something funky going on, I just couldn’t get around it.

Hope you got that award sorted even without this.

Boom! with a little more research, I got them to waive the change fee since they made a change to the reservation (one flight was going to arrive 3 minutes later), and got them to switch to an LH flight with much better routing. Funny thing though, this time around, they saw the space on LH, which they didn’t before even though it was wide open.

SFO-LHR direct on united

LHR-FRA-EZE on LH (this was previously on TAM with a long layover in GIG)

EZE-YYZ-SFO on AC

What kind of an award is it? USA to South America via Europe? This is permitted?

Exactly, and yes US Air allows them. The stop-over is in London and the final destination is Buenos Aires. Scott has written quite a bit about them.

Love it!

Cory/Scott — did you make that change given the 3minute flight schedule change; before you commenced award travel or after?

I know the fine print is that US Airways doesn’t allow for any changes on Star carriers after travel has commenced, but is there any way to persuade them otherwise to do so?

It was before any travel started. Not sure if I could have gotten away with that if it was after the first flight. Normally there are no changes allowed whatsoever after travel commences.

So you “solved” it by following the advice of somebody else? It sounds more like they solved it…

US is only leaving Star if they merge with AA. So other than the first line being a bit off the post is pretty solid. 😉

Sorry if the first line was misunderstood. I was trying to express my confidence that the merger will happen.

[…] explained how to solve that problem in Anatomy of an Award: Booking Lufthansa Flights with US Airways Miles. You instructed the agent to do a “long sell” and she would find the space, which was […]

[…] *Exception: US Airways is still blocking some Lufthansa award space. You have to call US Airways to ask if the agent sees the specific Lufthansa award space you found on united.com. If not, you can ask for a manual sell, but most of the agents will now refuse. For more, see Booking Lufthansa Flights with US Airways Miles. […]