MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

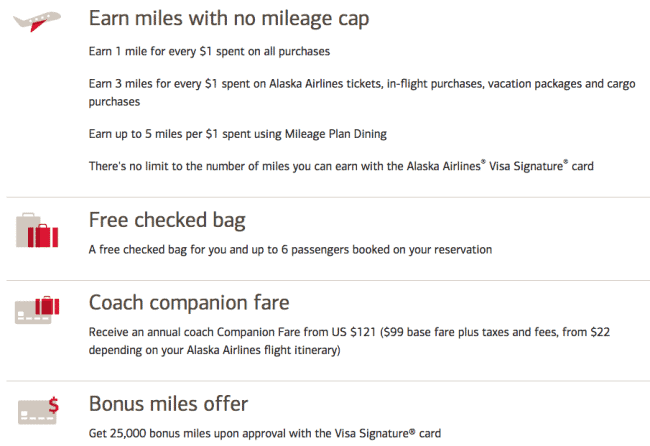

The current sign-up bonus available to the public for the Alaska Airlines Visa Signature® Card is 25,000 Alaska Airlines miles upon approval. There are higher offers out there however, and the official public offer is increasing in May, but with a new minimum spending requirement.

There is no minimum spending requirement to earn the current sign-up bonus of 25,000 miles.

There is also a $75 annual fee. I currently value Alaska Airlines miles at 1.75 cents each, so that’s like buying $437.50 worth of miles for $75.

The current public sign-up offer for the Alaska Airlines Visa® Business Card is nearly identical, except a free checked bag for yourself and six others is not a benefit, and the bonus miles are earned after your first purchase as opposed to upon approval like the Alaska Airlines Visa Signature® Card. The annual fee is $75 (unless you add an authorized user, then it will be an additional $25).

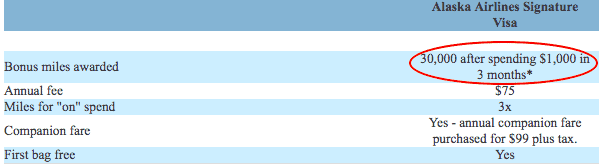

However Alaska Airlines filed a 10-K report with the SEC in February of this year (which is basically a summary of their financial performance and future plans) that revealed a new offer coming out in May. A section towards the beginning describing the Mileage Plan program states:

“…members can receive 25,000 bonus miles (30,000 beginning in the Spring of 2016) upon signing up for the Alaska Airlines Visa Signature card”

Note that there will be a minimum spending requirement of $1,000 to earn the 30,000 mile bonus. They clarify when Spring is in an asterisk underneath that table:

“*Expected launch of 30,000 bonus miles in May 2016. Currently, bonus miles are 25,000.”

These cards, issued by Bank of America, were unique in that they offered good sign-up bonuses with no minimum spending requirement. That is changing soon, albeit to a pretty minimal spending requirement. What makes them more unique is that these cards are churnable, so you can collect tons of Alaska Airlines miles relatively easily.

Or should I say what made them even more unique is that these cards were churnable, so you could collect tons of Alaska Airlines miles relatively easily?

Are the Alaska Airlines Credit Cards Still Churnable?

First, let me clarify what I mean by churnable. Generally a churnable credit card is one you can get the same sign-up bonus over and over.

From what I can see from reading through the last five weeks of the Flyertalk thread Alaska Airlines card offers, Personal & Business, 25K and up, everyone that has been churning Alaska Airlines cards in the past has continued to be approved for new cards. Most wait a span of at least 91 days before reapplying.

There is one exception– this Flyertalker who had opened 11 cards in the last six months was outright denied. Note that those weren’t 11 Bank of America cards per se, but credit cards across the board. So too many new accounts open in a shorter period of time could be a trigger for denial.

What I did see happen to more than one person was the receipt of a pending status on their applications instead of an immediate approval. But the ones who reported an update all said they were approved after calling the reconsideration line (note that phone numbers for the reconsideration line listed in the wiki summary at the top of the thread are outdated, try 1-866-811-4108 instead). This very recent post is from a Flyertalker who received a notice of pending applications for two out of the three Alaska cards he applied for, and he has not posted any update referencing a reconsideration phone call or an approval. But I wouldn’t consider this a negative data point against the churnability of the Alaska cards just yet.

A quick aside–you should always consider calling the reconsideration line if your credit card application comes back as status pending. Many times they will just ask you the same questions that were on the original application and then approve you.

So I will tentatively say that yes, Alaska Airlines credit cards are still churnable for the time being. But we will have to wait and see what May brings before I’m ready to give a firm yes to that question. The changing of a sign-up bonus offer could also mean the changing of the policies regarding that sign-up bonus offer.

Lowering Credit Limits of Existing Cards Before Re-Applying

What is abundantly clear from nearly everyone’s posts in the Alaska Airlines card offers, Personal & Business, 25K and up Flyertalk thread is that if you are planning on opening another Alaska Airlines credit card and you already have one or more, the best way to improve your chances of approval for another one is to lower the credit limit on the ones you already have. Think about it this way– Bank of America isn’t blind to your already existing credit lines, and they only want to lend you a certain amount of credit to minimize their risk. How much credit they will give you depends on the person and their credit score, but it certainly won’t hurt to get the credit limits dropped of your already existing Alaska Airlines cards. As you aren’t (or shouldn’t be!) holding a balance on any of them, this doesn’t matter anyways.

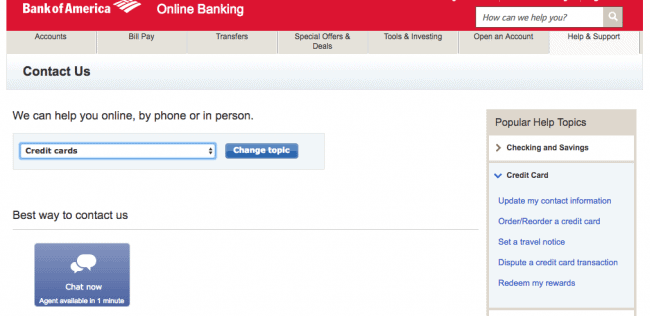

You can accomplish this by signing in to your Bank of America account online and going to the Contact Us page (accessible from the Help & Support drop down menu). From there choose credit cards in the drop down menu and a box will pop up like this one:

You can also call 1.800.732.9194 (for help with the personal card) or 1.800.673.1044 (for help with the business card) but people have reported a smoother process using the chat function.

Current Best Sign-up Bonus Offers

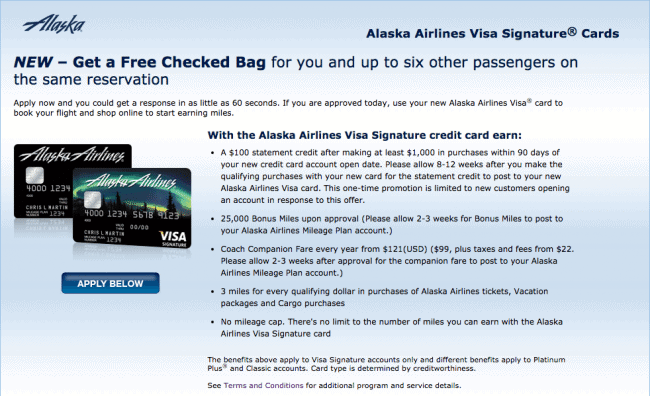

25,000 Alaska Miles is what is being offered to the public for signing up for either the Alaska Airlines Visa Signature® Card and the Alaska Airlines Visa® Business Card. But there are better offers out there:

- Follow this specific link and you will find an offer for a 25,000 mile sign-up bonus plus a $100 statement credit for spending $1,000 within three months of opening the account. This card offer also includes the $75 annual fee like the public offers, but the statement credit more than the annual fee.

- If you are a member of Alaska Airlines Mileage Plan, their frequent flyer program, check your email. You might have a targeted offer for a 50,000 mile sign-up bonus for spending $2,000 waiting for you. If not, become a member and opt in to receive partner offers. This could help your chances for the targeted offer according to the opinon of some Flyertalkers.

Coolest Things You Can Do With Alaska Miles

While not a part of any of three major alliances, Alaska Airlines miles can be used to book a diverse array of oneworld, SkyTeam, and non-alliance partners.

There are some great redemption options and they are flexible with routing and award rules.

You can…

- book High Value Awards: USA to Fiji to New Zealand or Australia for only 55,000 miles one way in Business Class with a free stopover in Fiji; USA to Southern South America in AeroMexico Business Class for 45,000 miles (temporarily unbookable); Cathay Pacific First Class to Asia plus Business Class to South Africa for 70,000 miles total with free stopover

- book awards on American Airlines flights at the pre-devaluation prices. This includes some Off Peak award prices that don’t exist anymore (like 20,000 miles to Southern South America). You also have a larger range of dates to book Off Peak awards with since American Airlines narrowed their Off Peak date ranges as part of the devaluation.

- book one way awards for half the price of a roundtrip, and you can have stopovers on one way awards! This also means you can book Free One Ways on Alaska Airlines awards.

While I can not directly link to the current public Alaska Airlines Visa Signature® Card offer, you may find it by clicking below if you decide to apply. (I receive a commission, and your support keeps this blog going.)

Bottom Line

The Alaska Airlines Visa Signature® Card’s and the Alaska Airlines Visa® Business Card’s current public offers are 25,000 miles for each of them, but it is possible to get an even better offer from this link or by checking your email for the targeted promotion with a 50,000 mile sign-up bonus. The public offer will increase to 30,000 miles in May, but you will be required to spend $1,000 in the first three months to earn it.

Alaska Airlines has some high value redemption opportunities and allows for flexible routings, so take advantage while you can. All signs point to these cards still being churnable–for now. We can reevaluate once the first hand reports start rolling in later in the year about how or if Bank of America’s policies change post-May (when the sign-up bonus offer changes).

Help the Milevalue community make informed decisions about their own Alaska Airlines credit card strategy by leaving your experiences in the comments.

I currently have 3 Alaska Airlines credit cards. Two personal and one business. All 3 received in the last 6 months. The last one was a fluke. I was cashing in points for Emirates (before the devaluation–I was very lucky) and an application popped up. It was the one you just described. 25000 points with an annual fee, but $100 statement credit after spending $1000). I had not planned on applying for another card so soon, but I figured what the heck. So, that’s another possibility if the link you have fails. Pretend you’re booking an award and watch for the popup. I think we’ve seen this before. I hesitate to apply too many times for fear that this, like many other repeatable offers will become overused and eliminated. I’m also waiting to see what other changes might occur with Alaska air’s program after the merger and the changes with Emirates. Hey, I like the word repeatable instead of churnable, it sounds less devious.

Any idea of what lower credit limit to use for existing cards before applying for a new one? I gather not lower than 5,000 but advice would be appreciated.

I hear they stop approving you beyond 3 cards and it’s advisable to close some of the previous cards before applying for the new ones.

I currently have 2 personal and one business and thinking of closing one to be able to apply for the one with increased offer (perhaps will close the most recent one even though some people suggest closing the oldest).

Don’t know if any of it is true, but hoping someone would comment.

If I applied for the personal and business today, get the 25K offers, then in 91 days am I eligible to open another personal (hopefully at 30K) card? Without closing the first one? I just open another? Looking to build Alaska miles and quickly so I can go to Australia next year…

My wife and I each had 6 Alaska BOA cards (3 Biz, 3 personal each) by applying for one of each card every 91+ days. After six cards total we each were rejected applying for a 7th, even after dropping our credit line on the existing cards. We will try again in May after closing most or all of the cards.

South Africa redemption question – any experience on booking KLM/Air France Business Class with Alaska miles? Seems like a you’d save a few vacation days of flying by instead of Cathay Pacific going east coast US to Hong Kong to Johannesburg. Delta non-stop from Atlanta would be best, but availability in Biz Class at saver level is likely rare. . Thanks – great post!

No experience booking those carriers with Alaska miles, but you can search them on alaskaair.com

I’ve had mine for a little over a year. I applied shortly after the 50,000 mile bonus (with $3000 in spending) disappeared. I asked for it and they gave it to me anyway even though they weren’t publicizing the offer.

It can’t hurt to ask for the 50k.

Do you call them to ask? Or do it via chat? Do you offer to bring your spending to $3000?

I called. Keep in mind this was quite a while ago when the 50k offer had just disappeared.

I couldn’t find a link to the 50 k offer so I called and asked the lady if she could find it. She did and signed me up for that one.

[…] 25,000 Alaska miles is the public sign-up offer for both the Alaska Airlines Visa Signature® Card and the Alaska Airlines Visa® Business Card. The personal card gives you the bonus upon signing up, and the business card after one purchase. Although this is planned to change in May, when the sign-up bonus for the personal card will increase to 30,000 Alaska miles after spending $1,000 withi…. […]

[…] You can get this card and its bonus multiple times. […]

[…] already have two Alaska cards, one personal and one business card, but all evidence I read still points to the Alaska Airlines credit cards as being churnable. I decided to proceed with applying for two more (one each of the personal and business […]

[…] Alaska miles are easy to accrue since the Alaska credit cards are still churnable. […]

[…] The Alaska Airlines Visa Signature® Card’s and the Alaska Airlines Visa® Business Card’s are both currently offering 30,000 miles for spending $1,000 within three months of opening the account (on each). Alaska cards are, as far as I know, still churnable. […]

[…] easy to collect since the cards that earn them have low minimum spending requirements (and are still churnable). You can fly from the United States to all over Asia for 60,000 Alaska Airlines miles roundtrip […]

[…] cards for years now. These type of loopholes tend to tighten over time, but at least for now the Alaska Airlines cards still look churnable. Does this mean the Asiana card is churnable? Maybe. We won’t know until we see more data […]

Hi Scott

Is churning with only business credit card possible? Chase has too many good credit cards that i would like to get again so have to keep that 5/24 in check 🙁

[…] If you are interested in Alaska Air co-branded credit card, check out this post on Milevalue. This is a very competitive mileage program for those who need to fly to South America, and getting […]