MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

According to the Wall Street Journal, airlines are opening up more award space this year compared to last year because of pressure from banks, accounting rules, and consultant studies.

In the short term, that’s good for us. More award space: woohoo!

But in the long run, these pressures could cause more airlines to move to revenue-based frequent flyer programs. Revenue-based redemptions: boohoo!

Every year IdeaWorks comes out with one of the worst-conceived studies imaginable in an attempt to quantify which frequent flyer programs make redemptions the easiest. Every year, Gary Leff makes correct points about why the study is so dumb.

The yearly IdeaWorks study makes no sense because it compares all frequent flyer programs without differentiating which offer revenue-based redemptions, distance-based redemptions, and chart-based redemptions.

It ignores prices on the award chart, international flights by United States carriers, partner award availability, and the imposition of fuel surcharges.

Even with all those flaws, the study gets picked up in the Wall Street Journal and parroted as gospel about which programs are better for consumers.

That’s why it’s dangerous for us.

- Why is the IdeaWorks study producing positive changes in the short run?

- Why might the IdeaWorks study produce negative changes in the long run?

- What pressures are on airlines to increase award availability and how can we increase those pressures?

The Short Run Good News

The good news is that airlines pay attention to the IdeaWorks study and are motivated to score well.

The way to do well is to open more award space.

From the article: “Airline executives admit that Mr. Sorensen’s five-year-old availability survey has also had an impact, quantifying seats available for the first time and comparing airlines head-to-head. United began advertising its strong showing last year; Delta says its low ranking prompted internal debate that pushed changes.”

And: “‘We are taking a slightly less conservative approach in how we manage flights far out,’ said Delta Vice President Jeff Robertson, who said lack of award availability was Delta’s top customer gripe.”

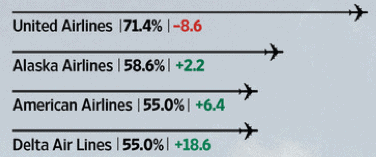

If there’s one thing, the study can do pretty validly, it’s track how one program’s award space changes, and Delta made the biggest improvement from 2013 to 2014 of any US-based airline after being embarrassed by its 2013 result. We benefit from that.

The Long Run Bad News

The bad news is that airlines pay attention to the IdeaWorks study and are motivated to score well.

The way to do well is to open more award space. The easiest way to open more award space is to make all flights available with points at a fixed value for the points, exactly like Southwest currently does.

The flawed methodology gave Southwest a 100% rating for award availability because on all the Southwest routes checked, a Wanna Get Away? fare was available for under 25,000 points. Of course all Southwest flights are available with points at the exact same Wanna Get Away? rate as long as they aren’t sold out or within a few days of departure. (At the time of the study, it cost 60 Southwest points per dollar to book a Wanna Get Away? fare. It now costs 70 points per dollar.)

Southwest has a great loyalty program, but we don’t want a bunch of Southwests. Southwest’s program leaves no room for creative routings, first class redemptions, or outsized value. Every redemption gets you about 1.43 cents per point of value, which is far less than I get from United, American, and US Airways miles.

But remember that Southwest dominated this study with a 100% rating versus scores in the 50s to 70s for other US-based airlines.

And remember that both United and Delta admitted to reacting to the last survey. What if their management teams decide that this study resonates with people enough that they want to score 100%? The obvious way to do that is to move to revenue-based redemptions.

That would mean the end of creative awards, first class redemptions for only double the price of economy redemptions, and the fun of the miles game.

This could be the long run bad news if this silly study is taken too seriously, and we know it is being taken seriously by Delta, United, and the Wall Street Journal.

What Pressures Can We Put on the Airlines?

The article claims that several pressures are converging on the airlines to open up more award space:

“Airlines have been under intense pressure from customers, accountants and banks to make more seats available for awards so consumers can use their miles. It’s the accounting rule changes and pressure from banks that seem to be driving the most change now.

The majority of airline miles and points are sold to banks, which give them out as credit card rewards. When customers have a difficult time cashing in the miles, they may switch to other cards. In addition, accounting rules adopted by many airlines now let carriers record only a portion of revenue when miles are sold to banks and defer the rest until miles are redeemed.”

One of the pressures detailed is accounting changes. Airlines are no longer fully accounting for the revenue from selling miles to banks at the time of the sale, but are now waiting for the time of redemption. That means they want us to redeem our miles, so they can claim that revenue. That’s an interesting tid bit, but there’s no way we can use it to get airlines to open more award space.

The more interesting tid bit is that banks are sick of losing credit card customers because the customers couldn’t redeem their miles, so the customers decided to close their cards. Banks buy billions of dollars of miles every year from airlines, so when banks are upset, airlines want to appease them.

One way we can speed this along is by telling the retention agent with whom we speak about cancelling a card that the reason for our cancellation is lack of award space. Of course, as I noted above, we might not want to agitate for more award space if it leads to revenue-based programs.

Instead we can say we’re cancelling our cards because our “free” award ticket had unexpected fuel surcharges. Or because the airline whose card we had made no-notice devaluations to its award chart or stopover rules.

If enough of us complain to the bank, the bank will complain to the airline. It sure would be nice for banks to be going to bat for us against airlines adding fuel surcharges to award tickets and making changes to their award charts and rules without notice.

Recap

The IdeaWorks study that purports to show which airlines have the best award availability is poorly done, but airlines and the mainstream media pay attention.

Airlines want to do well in the study, so they have been opening up more award space this year, particularly Delta.

Southwest scored 100% in the study, so I am worried that some airlines might be tempted to copy Southwest’s revenue-based redemptions to do well in the study.

Accounting rules, banks, and the study itself were cited as reasons for improving award availability. We may be able to pressure banks to pressure airlines to make changes to award programs we’ll like.

(Hat Tip to JB for passing along the WSJ article)

Southwest has been a purely domestic carrier (now adding a few nearby foreign destinations) with no partners, so the way they manage their program may not be a ready model for the others to emulate, with their w0rldwide alliance structures. And the others’ current structure allows them better to target seats that would otherwise go unsold as bait for reward tickets. That’s not to say I’m sure they won’t try something at some point.

I fully agree with your suggestions on how to approach the credit card “Why do you want to cancel” question? I pretty bluntly told AMEX I was letting go of the Delta card because I can never find any seats; and Barclay that the Miles and More card wasn’t serving my needs because of the horrendous fuel surcharges. And the foreign exchange fees get into the conversation somewhere too, whenever applicable.