MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Hey! You’re reading an outdated Free First Class Next Month series. Check out the latest version published in April of 2015 here.

This is the third post in a monthlong series that started here. Each post will take about two minutes to read and may include an action item that takes the reader another two minutes to complete. I am writing this for an audience of people who know nothing about frequent flier miles, and my goal is that by the end, you know enough to fly for free anywhere you want to go. Previously Signing Up for Travel Loyalty Programs.

Yesterday you signed up for airline programs. Today I’ll tell you how I keep track of my miles and points: awardwallet.com.

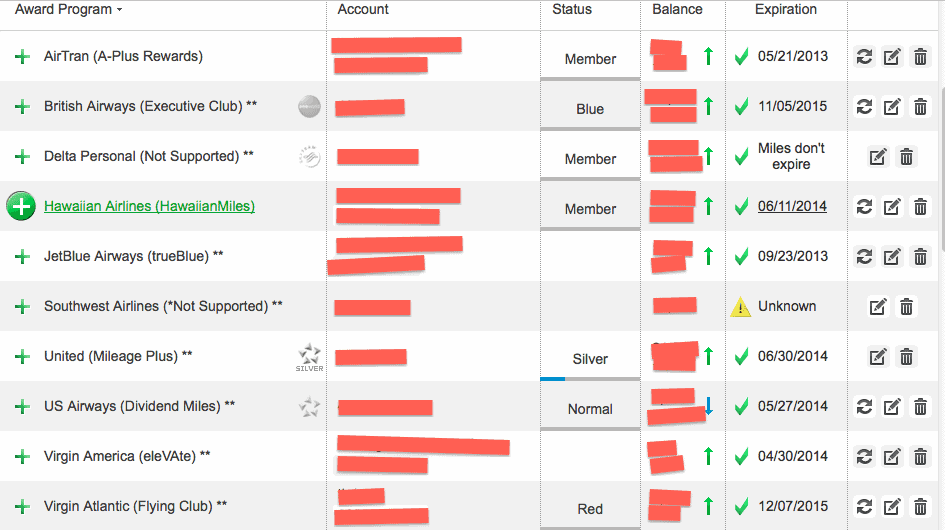

Award Wallet is a free service that tracks your balance, status, user name, and password in nearly every airline, hotel, credit card, rental car, and loyalty program there is in one place.

Or at least that used to be true. In the last few months, United, Delta, American, and Southwest have all blocked Award Wallet from accessing account information to display on its site.

But I still use Award Wallet because it tracks US Airways, Hawaiian, Jet Blue, Virgin America, and Virgin Atlantic for me plus my transferable points–Ultimate Rewards and Membership Rewards–and hotel points. (More on transferable points and hotel points later.)

Not only are your balances now listed in one place, but you can click the Update All button to see them all updated in a fraction of the time it would take to go to every program’s site.

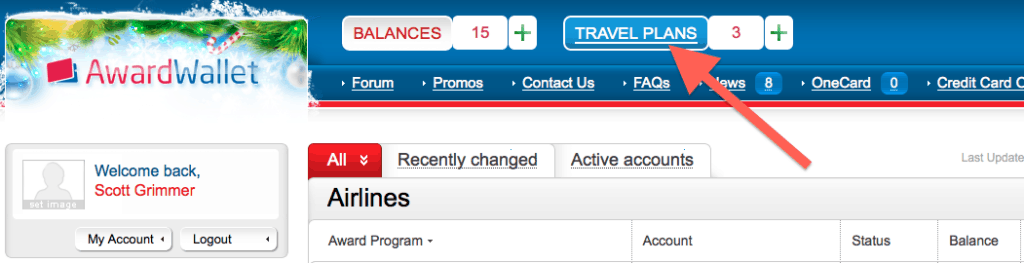

Another great feature of Award Wallet is that it automatically enters your programs and finds your upcoming travel plans and puts them in one place, the Travel Plans tab.

Award Wallet is a fantastic resource that I use every day to keep track of almost all my balances in one place.

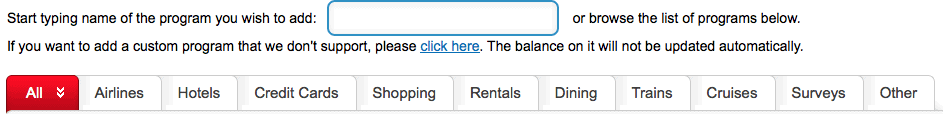

So what are you waiting for? Go to the site now, and open your free account. Populate it with the accounts you set up in Free First Class Next Month: Signing Up for Airline Programs by clicking the Add a Program Link, then searching for its name or finding it listed alphabetically by category.

By doing this, you can forget about memorizing account numbers and passwords, they are all stored by Award Wallet. You can also substantially cut down on the number of programs you have to log into to see your award balances.

By doing this, you can forget about memorizing account numbers and passwords, they are all stored by Award Wallet. You can also substantially cut down on the number of programs you have to log into to see your award balances.

Unfortunately the free version of Award Wallet only shows expiration dates for three programs’ miles. I have a free code to upgrade, which will cause Award Wallet to display all your expiration dates. First ten come, first ten served: free-nzulqx (all gone). Here are five more six-month upgrade codes, soon to disappear soon too:

Invite-55486-DVFKM

Invite-55486-ETGFA

Invite-55486-GCDYJ

Invite-55486-GISOQ

Invite-55486-JLTKC

In the comments, TATravelers generously left his code. If you have free codes, leave yours here please.

Continue to Check Your Credit Score.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

I would love a code.

Thanks for the free upgrade code Scott. It worked like a charm. I just found your site from the NY Times article and am really enjoying it. For the first time, you have enabled and motivated me to get all these travel incentives organized. Prior to now, I have been haphazard about using and applying them because it was just too much work and was always secondary to the actual reasons that I was traveling (work, vacation, etc.) Thanks for your efforts to make sense out of all these promotions and to help us get the most out of them!

I think you’ll be very happy with your decision to get organized. More and better awards are in your future. And this is all pretty fun–at least for me!

I love award wallet! I store all my programs there, not just travel-related ones. I’d love the free code, but when I tried it said that the number of times used has been exceeded. Darn!

Most of the airline and hotel reward accounts are just that. The Ultimate Rewards account though provides access to the actual credit cards management associated with the UR account. I don’t know how people feel about it, but I do not feel comfortable giving award wallet access to my credit card accounts. The Chase rep too advised against doing so.

I do. I’ve heard people express this, and it’s something or people to consider: their own comfort level.

I’d appreciate a free code 🙂

I would love a free code too. Thanks!

I tried to use the coupon code but it said the number of times it can be used has been exceeded. It must be dead?

Must be; it was only good for ten people. A few more codes in the post and comments. Good luck.

Really appreciate your free code. Thanks!

Free upgrade coupon for the first time users: free-nqrhgl

great blog. I would appreciate a free code.

check the post again and comments–more added

I still use Award Wallet for my login info and total miles for the program I can’t directly connect to. I had to make up a fake program name for American and manually update the miles, but at least the info is all in one place.

Yes, I do too. Great tip!

Here you go!!

free-cixfig

Thanks for the code!

Thanks. I too came in via the NYTimes. If you have a code I would like to try to use it.

10 free upgrade coupon codes for first time users of AwardWallet.com:

free-djmpzw

10 free upgrade coupon codes for first time users of AwardWallet.com:

free-nmyhhe

Here are ten more free codes..

free-ejmqwn

Ten more free codes…

free-vvvpsj

Thanks Christian!

Thanks Christian!

[…] to Sign Up for Award Wallet. This entry was posted in Free First Class Next Month and tagged Free First Class Next Month. […]

Hi all!

Any chance somone may spare a fre code? if so may the generous one let me know?

thanks!

free-qhbtsu

Thx but the code is “invalid or expired” when used at awardswallet 🙁

free-foljcb

Here is another free code link. Award Wallet rocks!

http://AwardWallet.com/?refCode=letfiefg

free-cjhnem

free-lblbez

[…] Sign Up for Award Wallet […]

1o more upgrade coupons:

free-bhviqr

Hooray, thanks!

Thanks for the code MattE! Over 5 months later and it worked!!

paying it back for the awesome advice on MileValue!

free-osyaay

thanks!

Re upgrade codes for Award Wallet. Is there any code for existing users to upgrade for free as when I try to upgrade the App only gives me the choice of paying $5.49 through iTunes.

Thanks in advance. Love your blog.

John.

Hey, here’s my code for anyone who needs it!

free-hvzpdc

[…] I use Award Wallet to track all my airline mile, hotel point, and credit card point balances; my loyalty program passwords; and any extras (like companion passes and free night certificates) in one place. Here’s an Award Wallet tutorial I wrote. […]

Here’s another coupon code, enjoy!

free-dynduu

Paying it forward. Thanks Joseph for the code.

Here is mine: free-zziiin

if I already signed up for award wallet where can I apply a coupon code, if i still can (hoping one of these work)? Thanks

On the left of award wallet, “Upgrade Using a Coupon.” Here are 5 more codes:

Invite-55486-PJVNU – use coupon

Invite-55486-DKEDF – use coupon

Invite-55486-JDKZK – use coupon

Invite-55486-TOYVD – use coupon

Invite-55486-FSLHJ – use coupon

[…] Read more about Award Wallet. […]

Here’s another one

free-hcegzz

[…] Read more about Award Wallet. […]

[…] Read more about Award Wallet. […]

[…] Read more about Award Wallet. […]

[…] Read more about Award Wallet. […]

[…] Read more about Award Wallet. […]

[…] Read more about Award Wallet. […]

[…] Read more about Award Wallet. […]

[…] Read more about Award Wallet. […]

[…] Read more about Award Wallet. […]

[…] Read more about Award Wallet. […]

[…] Continue to Sign Up for Award Wallet. […]

[…] save yourself the hassle of having to keep track of all your login information by putting it in AwardWallet, which is a service that helps you keep track of the miles and points you have collected in each […]

[…] expire and have to pay the fee. To keep track of all your loyalty programs and miles balances, try Award Wallet. It will help you keep tabs on the expiration […]

[…] sure you they don’t expire in the first place by keeping tabs on your expiration dates with Award Wallet. It will keep track of all your loyalty programs and miles balances. And bookmark our Guide to […]