MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Hey! You’re reading an outdated Free First Class Next Month series. Check out the latest version published in April of 2015 here.

This is the fourth post in a monthlong series that started here. Each post will take about two minutes to read and may include an action item that takes the reader another two minutes to complete. I am writing this for an audience of people who know nothing about frequent flier miles, and my goal is that by the end, you know enough to fly for free anywhere you want to go. Previously Signing Up for Travel Loyalty Programs.

The main source of frequent-flier miles is credit card sign up bonuses. If managed correctly, they can be used to earn millions of miles without negatively impacting your credit score. In the game of flying for free, your most valuable asset is your credit score.

So today’s post will focus on getting your free credit reports from the three main credit bureaus and a little explanation of the credit score. Start by going to annualcreditreport.com, the only site where you can get a free, no-strings-attached credit report from the three bureaus once a year.

Type in the information and look at or print out all three reports, which should all be slightly different. Make sure the information is accurate and that no one has stolen your identity.

The reports don’t include your credit score. If you think you’re right around 700, a generally accepted cutoff for getting in on some of the mega-sign-up bonuses, you may want to purchase your score for $8 as offered from one of the individual agencies.

From talking to people, the number one thing that holds people back from Free First Class is a fear of harming their credit scores. Simply put, if you manage your applications well, and you don’t have a mortgage or refinance application coming up, you can apply for 3-4 credit cards every few months without fear!

If you’ve heard any semblance of a personal-finance talk, alarm bells are probably going off in your head. But FICO is the most widely-used credit scoring model in the US, and FICO’s official website lists “My score will drop if I apply for new credit” as a fallacy.

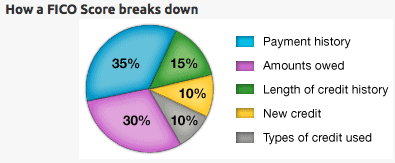

Only 10% of your credit score is based on inquiries derived from applying for new credit like credit cards. That 10% is swamped by other factors, all of which are helped by getting more credit cards!

Specifically, a big part of the 30% listed as “Amounts owed” is percentage of credit utilized. A new credit card will come with a new credit line, say $5,000. If your monthly spending on that card is just $500, then your credit utilization is only 10%. This will make you look like a good credit risk, causing your score to rise.

The extra credit lines from new cards, the payment histories you generate, and the relationships you establish with banks will all help your credit score over time.

If you monitor your credit score closely, you will notice a decline in your credit score from each new credit card application. I see my score fall 2-5 points when I apply for a card. Then you will see your score rise slowly over time until you are at or above where you started.

I’ve gotten more than a dozen cards in the last year, and my credit score is higher now than ever. Other people with longer histories of even more extreme credit card “churning” as we call it have similar stories of maintaining extremely high credit. Here’s a documented example of someone applying for 11 cards in a year and seeing his score rise.

Read this short post by Gary Leff in which he explains how applying for cards will impact your score. His explanation is better than mine, but here are my cliff notes:

- Applications for a new credit card have a small negative effect on your credit that totally falls off within two years.

- Getting approved for new cards increases your total credit line. This decreases the ratio of how much credit you’re using to how much you have. This helps your credit score.

- New accounts decrease the average age of your credit lines, which hurts your score at first. But as those accounts age, this effect reverses and having the old accounts helps your score.

- Scores above 760 are gravy. 760 qualifies for the best rates, so anything above that isn’t helpful.

- The biggest exploiters of credit card sign ups and bonuses have maintained their great credit scores.

You’ve checked your reports and hopefully had your fears of hurting your credit assuaged. In just a few days, we’ll be applying for the biggest bonuses out there. Tomorrow we’ll discover how many you can apply for with your spending patterns.

Continue to Putting All Your Spending on Credit Cards.

Two things:

1. Looking at one report every 4 months should be adequate enough to make sure there are no errors on your report. It is like getting free quasi-credit monitoring when you space them out.

2. On your best practices page you mention applying for a personal and a business card from each major issuer.. which is about 8 cards per AOR. Here you say get 3-4 cards. Which is it?

Great tip! I think you can go 8-9, but I also think 3-4 is fine. People can go as high as they are comfortable with and as many spends as they can meet.

My scores are above 760. If my score is this high why should it matter if I’m going to be applying for a mortgage and how soon before doing so should I slow down the new card apps? Is it the score alone that mortgage lenders look at? If so, I’m can continue to pursue new cards and not worry about the mortgage app, right?

I am unqualified to answer this question. Ask a financial professional for your specific case.

Just wanted to let you know I really enjoy your blog. I’ve been following a dozen or so travel/points related blogs for about a year now and MileValue is my clear favorite. I love the Anatomy of an Award and Free First Class Next Month posts (especially how you continually update the FFCNM series). I appreciate your style and how you come across as a real, relatable person, not a prima donna as some others. Keep up the great work!

As a data point on the credit scores: I applied for and received 11 new cards in the last 9 months. My score started at just over 800 and stayed within +- 15 points of that through the first 8 cards. The 9-11th cards saw my score fall to 750, No late payments, all balances paid in full every month, etc. Top reasons from the credit reports are too many recent inquiries (experian), and average age of accounts (trans-union). I’m going to lay low for another 4 months or so before applying for more cards and will probably cancel some of the new cards before the annual fee comes due. Hopefully I’ll see my scores back up above 780 by summer.

Thanks for the praise and data point. I think you’ll see the score rebound to where it was. And I think at 750, you’ll still get all the approvals you want.

Hi

I love your site, your information is amazing and I cant wait to use my miles to upgrade my tickets. Finally travelling once a month for work at least so hopefully it will be worth at least one ticket or an upgrade.

Danni

As you’ll soon learn, you will not want to upgrade your tickets. You will want to use the miles to book business class or first class awards. But either way, you’ll be in the front of the plane soon.

I’ve already used up my annualcreditreports. Do you know of any free or cheap one-month trials for credit reports?

No. I’ll look into it.

[…] already opened your loyalty accounts and checked your credit; today and tomorrow we figure out how much you can spend on credit cards each month and how you can […]

I’ve been told (and believe I’ve read) multiple times that a credit score of 740 is the cutoff for the best available rates – any idea where the 20-point difference comes from?

I have heard 740 before also. I am not sure there is one exact answer that is the same for every loan and person, so I think it’s just two different estimates.

[…] to Check Your Credit Score. This entry was posted in Free First Class Next Month and tagged Free First Class Next Month. […]

[…] to Check Your Credit Score. This entry was posted in Anatomy of an Award, Free First Class Next Month. Bookmark the […]

Any advice for someone who has never had a credit card at all? Are these the one’s to start with?

Thanks,

What’s your travel goal?

Hi Scott,

Because of my work right now i only have time for domestic travel. I’m wanting to work on hitting all the 50 states. Hopefully international travel next year or ASAP. I’ve done a little overseas travel, but always paid full price. Reading around on milevalue has me pretty excited!

For domestic travel, you want to focus on cards that earn great rewards for economy travel with no blackout dates. Specifically you want one or more of these cards –> https://milevalu.wpengine.com/comparison-table-of-fixed-value-bank-point-cards/

[…] While this isn’t a huge deal–your score will eventually recover / change because of the other factors that play into your credit score–it’s still wise to be discerning when it comes to what cards you sign up for. […]