MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Hey! You’re reading an outdated Free First Class Next Month series. Check out the latest version published in April of 2015 here.

This is the second post in a monthlong series that started here. Each post will take about two minutes to read and may include an action item that takes the reader another two minutes to complete. I am writing this for an audience of people who know nothing about frequent flier miles, and my goal is that by the end, you know enough to fly for free anywhere you want to go. Previously An Updated Guide to Free Travel with Miles and Points.

In just a few days, you’ll be earning hundreds of thousands of frequent flier miles, and you need a place to put them. Below are the bare minimum programs you need to be a member of as a US-based flyer, and as you get more involved with the miles game, you’ll probably sign up for more.

By signing up for these programs, you’ll be able to take advantage of every major miles promotion, and you’ll be able to fly domestically and internationally for pennies.

Each one should just take a moment to sign up for, and don’t skip any even if you’ve never flown the airline. Trust me that they all have a lot of value. For instance, you might not expect that British Airways is the best program for US domestic flights. If you already have an account, then try to sign into it, so you can figure out your account number and password. Write down your user name or number and passwords all in one place, we’ll need them again very soon.

Airlines

AirTran (recently bought by Southwest, so joining unlocks a trick with Southwest points)

United Airlines (if you had a Continental Onepass account, United automatically rolled that into a Mileage Plus account)

Hotels

If you fly any other carriers like Virgin America or JetBlue, you should also sign up for their programs, but if you don’t fly them, you can stick to the eight listed airlines. If you’re an avid couchsurfer, you can skip signing up for the hotels.

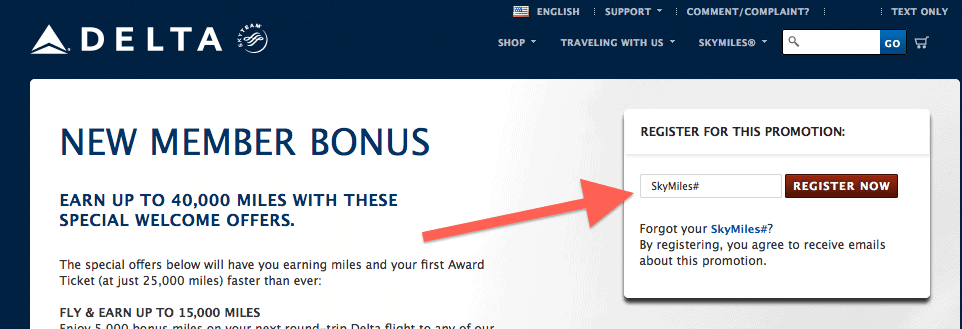

**After signing up for these programs, register your new Delta account here. It’s a promo for new Delta accounts that is free to sign up for. Then in the next 12 months, you can earn 5,000 miles for your first paid Delta roundtrip, and 2,500 miles for each roundtrip thereafter up to 15,000 miles total. You can also get a 5,000 mile rebate the first time you redeem 10,000+ miles. These are free miles, and it doesn’t cost you anything if you don’t meet the promo criteria, so do yourself a favor and type your new SkyMiles number into the page. Hat Tip Rene.

Continue to Sign Up for Award Wallet.

Hi MileValue,

I just signed up for a Delta new account and tried to register it for the promotion link you provided, somehow it said “…You do not meet the eligibility criteria listed below and may not register for this promotion. ”

This is indeed a new account, but do you know why it’s invalid?

Jeff

No, email Delta customer support, and let me know its answer please.

You have to accept Delta’s promotional emails for 30 days. I went and changed my preferences and it allowed me to sign up.

I’m unable to make an Executive’s Club account on BA site. It won’t let me fill things in completely.

Anyone else experiencing this?

I had the same problem with the link from this post. Try the following link and see if it works. I was able to join from this.

https://www.britishairways.com/travel/execenrol/public/en_us?source=MNVEXC1join_the_executive_club&link=main_nav

Thanks. I changed the link to this.

much appreciated

[…] for? Go to the site now, and open your free account. Populate it with the accounts you set up in Free First Class Next Month: Signing Up for Airline Programs by clicking the Add a Program Link, then searching for its name or finding it listed alphabetically […]

[…] Mile Value Calculator ← Emirates A380 First Class: Seat and Suite Free First Class Next Month: Signing Up for Travel Loyalty Programs → […]

[…] This is the third post in a monthlong series that started here. Each post will take about two minutes to read and may include an action item that takes the reader another two minutes to complete. I am writing this for an audience of people who know nothing about frequent flier miles, and my goal is that by the end, you know enough to fly for free anywhere you want to go. Previously Signing Up for Travel Loyalty Programs. […]

[…] already opened your loyalty accounts and checked your credit; today and tomorrow we figure out how much you can spend on credit cards […]

Can so one help me to travel noxt month

milevalue.com/award-booking-service

Sign up code: ree-wkartw

I don’t get it.. how come you dont recommend Marriott ? is that something to do with your deals with the other hotels ?

I’ve never taken advantage of a Marriott promo. If I had, I would have recommended it.

Hi Milevalue,

are any of these available to people in Australia. Or is everything on this blog targeted for the American audience.

Regards,

Niki

All the award programs are open to anyone. Opening credit cards to get miles is basically only open to Americans.

Scott, just found your site and want to say thanks for all the fantastic content. I’m new to the travel rewards churning but trying to learn quickly so my wife and I can take a few vacations next year. Should we both make separate accounts at all these places or just make one for the both of us?

Each should make a separate account. When you see a credit card you like, each should open it to get double the miles.

Thank you for the great and informative content. Any other programs for someone based in Japan who travels to other parts of Asia/Europe/Middle East in addition to the US?

No, most non-US programs are rubbish.

Yeah, ive experienced that with my fiances ANA membership. Guess ill just stick to your guidelines here and enjoy the perks of their partners.

That program is fine as long as you only redeem for flights operated by United and US Airways –> https://milevalu.wpengine.com/how-to-save-thousands-of-miles-booking-united-flights-use-membership-rewards-on-ana/

Makes sense. What mileage program do you feel would most take advantage of flights on Etihad and Qatar?

Hi Scott,

First, thanks for all the great information you’re providing here!

Since, I just discovered your site, I am a complete newbie at this but a world traveler at heart. My family will be going to Thailand next week (Tokyo-Narita to Bangkok to Ko Samui) via Thai Airways. Is it best to sign up for United (Star Alliance) or the Thai program?

All I have is a Delta Skymiles account at the moment.

Thanks and I appreciate all your help.

United, definitely. Have them add their new United acct numbers to the Thai tickets either online in advance, by phone in advance, or at check in. Make sure the account number prints onto the boarding pass. You can get credit after the fact, but it’s much more cumbersome. Enjoy the trip.

Should we stay signed up for the email subsciptions for these programs? Or can we turn these off? Thanks

Up to you. You will get some good promos from the programs and a lot of junk. I cover all the good promos here.

[…] Sign Up for Travel Loyalty Programs […]