MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

I think it’s a big mistake to be a hub-captive. There’s no reason that the credit cards you open have to be related to the dominant carrier at your airport.

Your life will be better if you instead open up the best card for the trip you want regardless of the airline that dominates your home airport.

Why should you ignore your hubby?

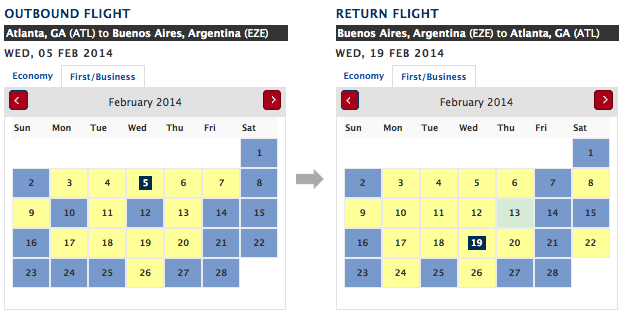

Imagine someone in Atlanta who wants to visit Buenos Aires.

Delta is the dominant carrier at ATL, and the only one with a direct flight to Buenos Aires. If an Atlantan had amassed some Delta miles by flying convenient paid tickets, he might incorrectly assume that he should open Delta credit cards to get the rest of the miles for his dream trip to the land of steak and Malbec.

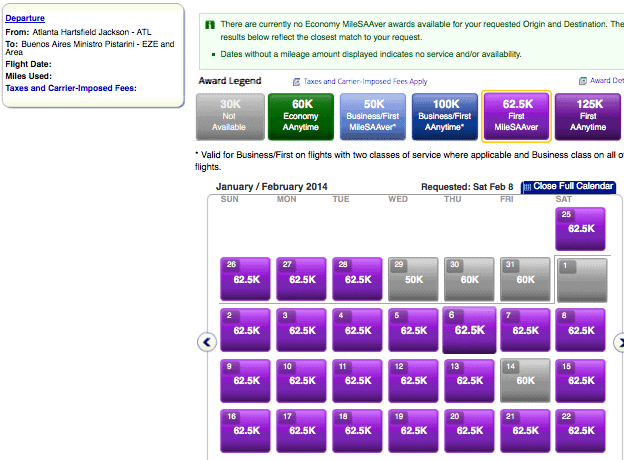

But if he wanted to take a premium cabin roundtrip in February (an incredible time to visit), Delta miles would be terrible.

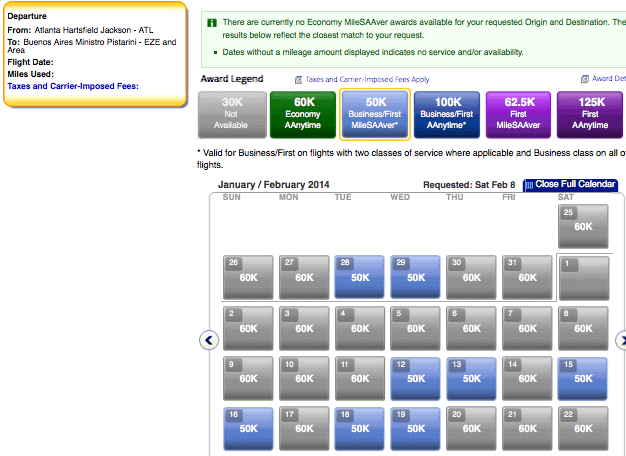

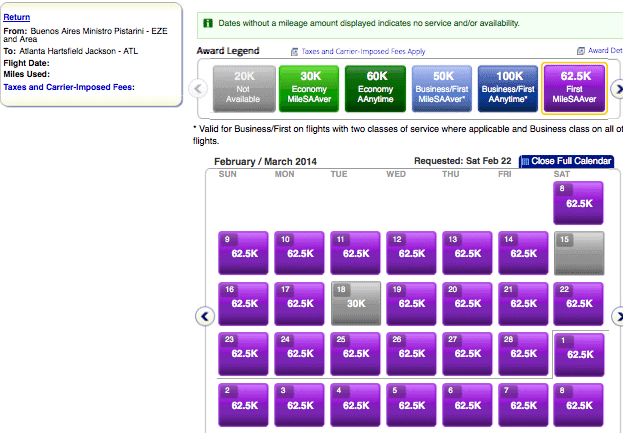

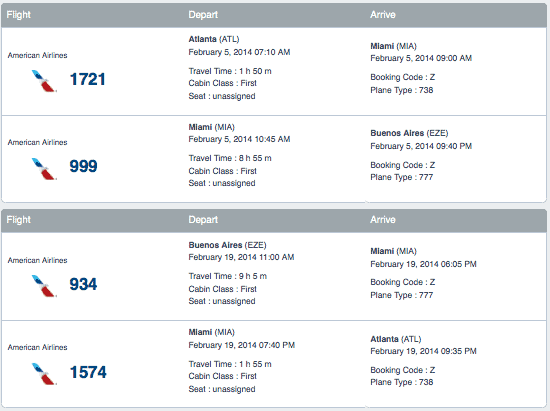

Instead an Atlantan should collect American Airlines miles for business or first class trips with a layover in Miami.

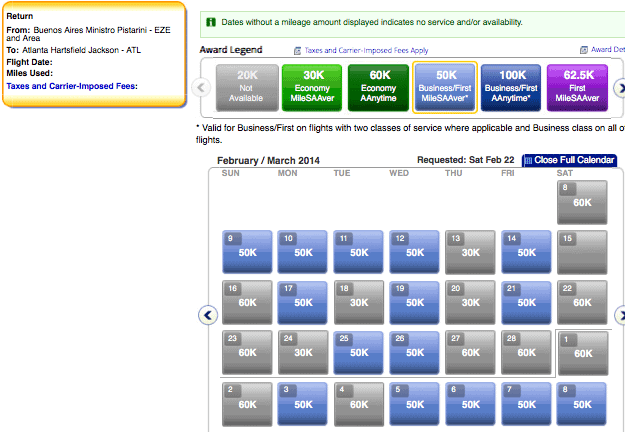

Look at how incredible the availability is with American miles the same days.

Of course, flying Delta’s direct flight from Atlanta would be ideal for our friend, but connecting on a long international itinerary only adds a little bit of time, in this case about two hours on a 12 hour itinerary.

And the conclusions in this post don’t just apply to Atlantans who want to see South America. Earning miles from flying is one thing, but picking a credit card is another thing entirely. You should figure out the best miles for your dream trip and get the appropriate card(s) without reference to the hub airline where you live.

Other applications:

- Get US Airways or United miles if you want to go to Europe, Australia from the East Coast, Hawaii from the East Coast, or Africa.

- Get Delta miles if you want to go to Australia from the West Coast.

- Get American miles if you want to fly First Class to Asia, make a round-the-world trip, or want to go South America.

- For other trips, get a Free Credit Card Consultation.

What is the route from the east coast to aus/nz that most frequently releases premium cabin award space?

You can try something like EWR-YVR-SYD on Air Canada, which typically has very good award availability on its lie-flat Business class product.

Thank you for the article. I’ve been pondering similar things because my husband insists on only using US Airways metal to get to Barcelona and Venice. Any help would be great.

What is the basis for his insistence?

[…] Don’t Limit Yourself to Your Hub Airport Submitted by Marcus • about 1 min ago Website: milevalue.com […]

Bueller?

He thinks that we HAVE to us US Airways metal because it is an open jaw flight.