MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

The Chase IHG Rewards Club Select comes with 60,000 IHG points after spending just $1,000 in the first three months in which you open it.

The bonus isn’t what really makes this card valuable and worth keeping year after year, however.

Along with Platinum status at IHG Properties (think InterContinental, Crown Plaza, Holiday Inn, Hotel Indigo), you’ll earn a free night at ANY IHG hotel each year after your card member anniversary. For an annual fee of only $49, that’s stellar. And yea–the card is issued by Chase. But the 5/24 rule is known not to apply.

Credit card links have been removed from posts and added to the menu bar at the top of every page of MileValue under the heading Top Travel Credit Cards.

Quick Facts

- Sign Up Bonus: 60,000 IHG points after spending $1,000 in the first three months

- Category Bonuses: 5 points per dollar spent at IHG properties, 2 points per dollar spent on purchases at gas stations, grocery stores, and restaurants

- Cardmember Anniversary Bonus: Free night at any IHG property

- Elite Status: IHG Platinum status

- 10% rebate on IHG points you redeem each year

- No foreign transaction fees

- Annual fee: $49, waived the first year

- Eligibility: Not subject to Chase 5/24 rule

Sign Up Bonus

IHG points are good for booking stays at all of the following properties…

- InterContinental Hotels & Resorts

- Crowne Plaza

- Hotel Indigo

- Holiday Inn

- Holiday Inn Express

- Holiday Inn Resort

- Holiday Inn Club Vacations

- Staybridge Suites

- Candlewood Suites

- EVEN Hotels

- HUALUXE Hotels & Resorts

Check out Travel is Free’s list of hotels whose rooms are cheap in points for inspiration of where to stretch your sign up bonus. The list includes other major chains as well–would be useful to bookmark.

I don’t use hotel points/stay at hotels enough to have my own IHG point valuation, but I’ve seen varying valuations between .5 cents and .7 cents a piece, so let’s say they’re worth .6 cents each. That would make the 60,000 points bonus worth $360. Not super exciting, but also not the main reason to get this card. See it as icing on the cake.

IHG PointBreaks

Perhaps the best use of IHG points is for their rooms they put on sale for only 5,000 points a night called PointBreaks.

IHG Rewards Club normally charges 10,000 to 50,000 points for a free night depending on the property. But every few months, IHG Rewards Club releases a list of a select few hotels where you can stay for 5,000 points per night. That’s a 90% discount on some hotels!

The new list of PointBreaks hotels is good for stays now through April 30, 2017. You can read an overview of current the list here.

Category Bonuses

Every dollar you spend at an IHG hotel earns 5 IHG points. Every dollar you spend at gas stations, grocery stores, and restaurants earns 2 IHG points. All other purchases earn 1 point.

Status

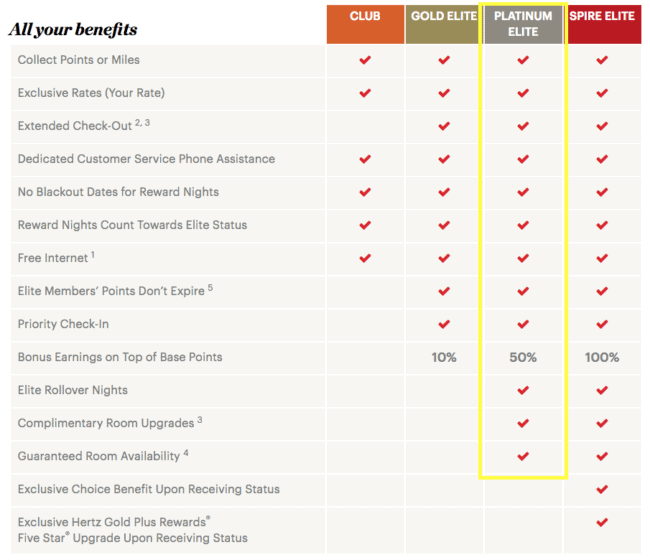

For as long as you have this card open, you’ll have IHG Platinum status. That entails everything outlined in the Platinum Elite column:

Again, nothing earth-shattering is listed there, but it sure doesn’t hurt.

Rebate on Points

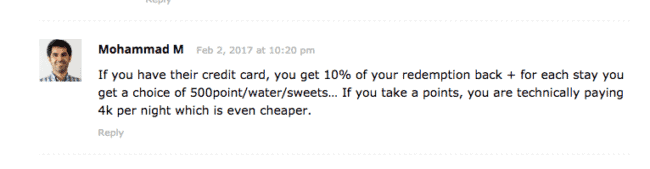

You’ll get 10% of the points you redeem each year refunded, up to the 100,000 points cap.

A reader pointed out that thanks to this rebate, plus a gift for being a cardholder/member and staying at IHG, you’ll pay just 4k IHG points for a PointBreaks room.

Free Night Every Year

This is possibly the single most value benefit of the card and what makes it worth keeping year after year. Every year following your cardmember anniversary (note, not the first year, but there’s also no annual fee the first year), you will receive a Free Night certificate to redeem at absolutely any IHG property of your choosing. The annual fee is $49, but there are IHG hotels that cost over to $500 a night. It’s more common for them to cost $100 to $300 a night, but either way, you’re winning.

Here are some fantastic properties you may want to consider using your Free Night certificate on:

- One block from the White House at the InterContinental The Willard Washington, D.C.

- On a canal at the InterContinental Amsterdam Amstel

- Blocks from the Jardin des Tuileres and the Siene at the InterContinental Paris Le Grand

Chances are this hotel with its overwater bungalows and ridiculously scenic surroundings is someone’s desktop background. You know you’ve seen it before.

This hotel is known for having spotty award rooms available. If it doesn’t, the InterContinental Resort & Spa Moorea is another great option in Bora Bora.

Read this post from milecards.com that details how to go about redeeming the certificate.

Eligibility

IHG Rewards Club Select is not subject to Chase 5/24 rule, meaning that even if you opened five cards or more in the last 24 months, you can still get approved for this card.

Fees

The card charges no foreign transaction fees and waives the $49 annual fee the first year you hold the card.

Bottom Line

I think there are two big reasons you should get this card:

- For the annual free night certificate

- To book PointBreaks Hotels for 4,000 points a night (with the 60k bonus you’ll earn for spending $1,000 in three months)

As long as an IHG property fits into your travel plans, the first reason is enough to merit keeping the card open year after year since the annual fee is just $49 starting the second year and IHG hotel rooms can be much more expensive than that.

Quick facts say 60k AA Miles. Copy paste error?

Yep, fixed.

Great Card get it !! AFTER the 60K it’s still a Keeper . I booked the Holiday inn express for 1/2017 in KONA before my annual date then after so I got TWO FREE nites there for the 50+50=$100 total worth $400+ . They give the best deals too on their websites .

Thank You

You mention Kimpton Hotels – yes it is part of the IHG family but I am fairly sure you cannot redeem IHG points for a Kipmton stay. Their programs are still independent and you cannot even earn IHG points for a stay at Kipmton or vice versa.

IHG points are absolute no-no’s at any Kimpton. The two companies might as well not even be merged. They might eventually offer some sort of reciprocity, but as of now they are totally separate.

Geoff and Eric, have you tried recently? I do not have any personal experience redeeming IHG points at Kimptons but on Kimpton’s FAQ page it says you can redeem them at Kimptons, just can’t earn them.

Actually no. I figured if we could burn up low value IHG points at Kimptons the bloggers would be ALL over it.

I figure any Kimpton would be priced at 50-60,000/night.

We have welcomed Kimpton® Hotels & Restaurants into our extended IHG® family. We are sending you over to KimptonHotels.com to take a look (and book) for yourself.

Please note that Kimpton® hotels are not yet included in the IHG® Rewards Club program. Kimpton Karma® rules apply to stays at Kimpton hotels.

Ah ok, I was reading a different section of the FAQ and must have misunderstood. Thanks for clarifying.

Hi Sarah, is it possible to transfer IHG points from my account to another family member? Do IHG points ever expire? Thanks!

IHG points will expire after 12 months of inactivity. You can transfer them to anyone in 1,000 point increments for $5 USD per 1,000 points but you probably don’t want to do that.

Thanks!

Can you have more than one of these cards at a time?

[…] You’ll also earn Platinum status at IHG Properties and a free night at ANY IHG hotel each year after your card member anniversary. For an annual fee of only $49, that’s stellar. And yea–the card is issued by Chase. But the 5/24 rule is known not to apply. Read more about why the IHG Card is worth consideration. […]