MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

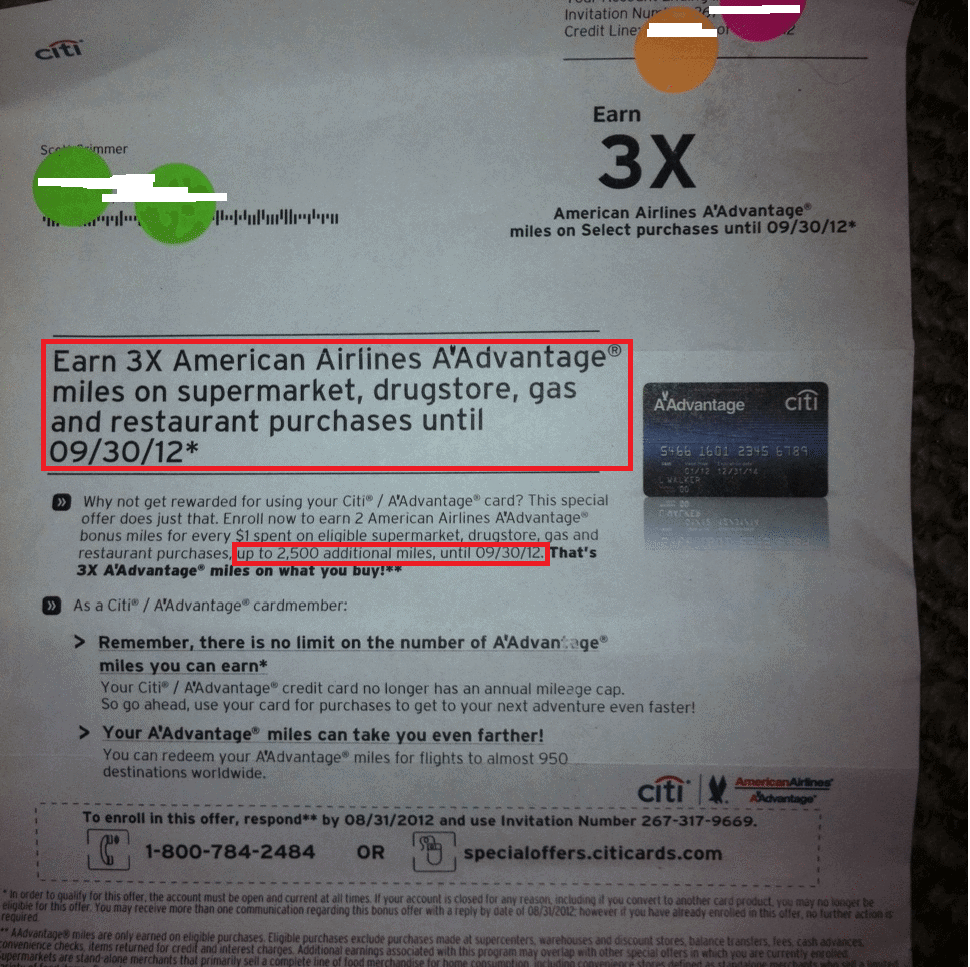

A few weeks ago I got this letter in the mail:

Always read your junk mail from credit card companies!

My offer is 3x American Airlines miles on purchases at supermarkets, restaurants, pharmacies, and gas stations up to a maximum of 2,500 bonus miles. Since I would normally earn 1x at those places on this card, I take it to mean that I get my first $1,250 at 3x miles.

I went to the website, typed in my “Invitation Number” and received confirmation I was registered. I put a tiny sticker on my card to remind me to use it at supermarkets, restaurants, pharmacies, and gas stations.

I value 3 American Airlines miles at 5.31 cents, so this spending gets a 5.31% rebate. That’s not as good as sign up bonuses or some category bonuses, but it’s better than any other offer I have at those categories between clearing sign up bonuses.

Until September 30, it looks like my Citi AA American Express is back in my wallet. I know there are other versions of this offer out there. Reader DaveS told me about his:

I just got a letter in the mail yesterday from Citi offering 10x AAdvantage miles on purchases at amazon.com through Sept. 30, and 3x on a wide range of purchases from different kinds of targeted merchants – clothing, electronics, department stores, office supply stores. However each offer is limited to 2,500 bonus miles, so while they’re nice, they’re capped. This appears to be carefully targeted as there’s a registration with an enclosed lengthy code that is necessary. I’ll definitely clear the Amazon offer (rebate 17% at my valuation of AA miles), and perhaps the other too (5%), or at least use that card when shopping anyway at those specific places, since I’m just about done clearing signup bonuses, and don’t have another application planned right away. Don’t throw away any envelopes from Citi that look like junk mail.

His would be exhausted by a $250 purchase at Amazon.com. But otherwise his categories are weak. 3x at office supply stores? I get 5x with my Ink Bold.

Have you gotten an offer that you’ll take advantage of? What was it?

I got the Amazon 10x promo and my wife got the 3x restaurants one, but we’re curious if there’s any chance of getting Citi to offer her the 10x promo too (or, failing that, offer it to me on my AA Amex in addition to the Visa). We’re likely to be able to spend more than $2500 on Amazon by the deadline, and even if not it’d be great to balance the bonus across both our AA accounts. Any thoughts on the likelihood of this being possible?

I don’t think you’ll get 10x points on $2,500 spent at Amazon. My letter says bonus points are limited to 2,500. Since normally Amazon purchases earn 1x, 10x is a 9x bonus. Which means only the first $278 (2,500 / 9) spent at Amazon would earn bonus points. You can ask whether she can get your offer. I doubt they will give it to you though.

I also got 10x Amazon, you think it would work with a gift card bought through Amazon?

I would think so, but I don’t know. Report back if you try it.

I just got my AA Amex and Visa this week , so no targeted offers yet.

Can you share your code , and would it accept it if I tried to use it

I just got my AA Amex and Visa this week , so no targeted offers yet.

Can you share your code , and would it accept it if I tried to use it ??

I think my code is visible in the image, but I would not expect it to work if you tried it.

I think I got an email back in July or JUne that said I got 1.25 miles per dollar til end of august. NO good mailed offers though

too expensive to mail to Hawaii 😉

I got the same one you did.

Also: US Airways offered me 15,000 bonus miles for spending $750 each month in August, September and October.

That’s much better than the $1,250 offer I got on my last US Airways card. I hope I get this lower-spend-threshold offer for my new US Airways card.

This offer and all Citi AAdvantage offers are only for the personal card. Citi has stated that they do not have promotions for the business card.

Snail mail today- 3X airline,hotel and car rental, until 9/30/12

Whole family has 1x Amex and 1x Visa Aadvantage card each.. We got the promo for the 10x amazon/ 3x other in the mail. 4 letters all were got the Visa cards alone not the Amex version

I got an offer on my AMEX not my Visa.

I got the same offer, but I already have an offer on this card (retention bonus). Do you think I can earn miles from two offers at the same time?

I don’t know for sure, but if they offered you both, I’d hope they’d honor both.

I didn’t get anything. Not a single offer, zip, nada. Since my annual fee is coming up, I called Citibank to see if it would waive the annual fee and maybe throw in some bonus miles after reaching a monthly spend of $750 or $1000. No waiving fee but Citibank offered me 4X miles on everything with a maximum of 20,000 miles.

Did you have both or just one Citi AA card?

Just one, VISA. Haven’t got around and do the 2 cards yet because I am refinancing my house.

Hey big man, how many credit cards do you think is too many in terms of credit inquiries each year? I’ve seen someone say 12-16 for two years! I want to do 40 in two years!

I would suggest having a number in mind for the lowest you’re willing to let your credit score hit, and don’t go below that. I hope you can hit 40 without dipping below a good score.

I got the same one you did, for my Amex.