MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

With US Airways’ official oneworld join date still over two months away (March 30), speculation is rampant over the design of their combined frequent flyer program. What will the new award chart look like, especially in light of United’s massive devaluation and Delta’s unprecedented double devaluation? Which routing rules will the program establish?

Because everyone loves to wonder, this post is meant to highlight the strengths of each program. Though its wishful thinking, hopefully the new frequent flyer program combines the best aspects of each program and establishes itself as the premier US frequent flyer program.

Below is a head to head comparison of the AAdvantage and Dividend Miles program, including a (subjective) opinion on which pieces should be used from each to make the final product that is hopefully an award booker’s dream.

Which award chart has the most sweet spots? Are the stopover rules more fair with American or US Airways? What’s the perfect world scenario for the new program?

One Way Awards

US Airways prices all award itineraries at the round trip price, even if you only fly one way. That’s lousy for frequent flyers, especially if you discover award space in one direction but no availability in the other. The AAdvantage program allows one ways for half the cost of a roundtrip. Their system treats roundtrips as two one ways, so flexibility is clearly American’s strength.

Better: American

Open Jaws

US Airways permits one open jaw on award tickets (or one stopover, but not both.)

As mentioned above, American one ways cost half the price of a roundtrip, so you can book two separate one ways for your trip, perhaps Miami-Madrid on Iberia and Zurich-New York-Los Angeles on American for 100k AAdvantage miles in business class. Such a trip would include two open jaws. The AAdvantage program wins again with its ability to book two open jaws on a single ticket.

Make sure to check out Scott’s post, What is an Open Jaw? How Can an Itinerary Have Two Open Jaws? if you need to brush up on the subject.

Better: American

Stopover Rules

Dividend Miles awards allow one open jaw or one stopover on an itinerary, but not both. You can take your stopover in any city on the itinerary, even if it’s in a more expensive region than your origin-destination pair. Some US Airways agents will tell you that the stopover city must be a Star Alliance hub, but we’ve proved that “rule” is not enforced.

American’s stopover rules are quite a bit different. You can have a stopover on both the outbound and inbound of your award, provided that the stopover city is the North American International Gateway City (the last city you transit on awards leaving North America or the first North American city in which you arrive on international trips). This quirky rule leads to the ability to tack free one ways onto American awards and squeeze great value out of your AAdvantage miles.

This is a tough call, but I give the edge to US Airways. The ability to add free one ways onto awards is incredible, but I derive more value from international stopovers, especially in Europe en route to Asia.

Better: US Airways (for me, for you the AA rule may be better)

Award Routing Rules

Scott published the succinct Five Cardinal Rules of American Airlines Awards which is a must read for any award booker. Some of the most frustrating are the strict regional transit issues, including the fact you can’t connect in the Middle East en route to Africa from North America (you technically can, but American computers will break the award into two separate and thus more expensive awards).

The routing rules on US Airways awards are a lot looser. Because itineraries are priced manually, and not by a computer, you can get away with almost anything, including an amazing four continent adventure in flat bed seats for 100k miles and nine segment award that traverses two more expensive regions en route to North Asia. It used to be a real Wild West in terms of what you could construct, but in recent months I’ve noticed their agents being much more strict.

Even with slight tightening from US Airways agents, we’re always going to better off with a poorly-trained human trying to enforce routing rules instead of a computer.

Better: US Airways

Award Chart Sweet Spots

US Airways wins this contest in a landlside. The 90k business class award to North Asia is likely going the way of the dinosaur post-merger. That’s not the only one we love, as there are plenty of way to save massive amounts of miles on travel to Southeast Asia using a great trick, intra-South Asian travel, and flights within South America. Even business class awards to Oceania and Africa (110k Dividend Miles) are tens of thousands of miles cheaper than other carriers.

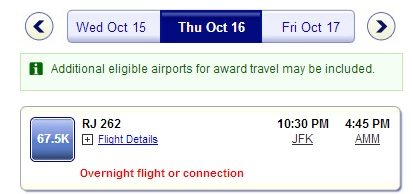

There are fewer sweet spots on American’s chart. However, there are still some good values, such as a one way first class ticket to “Asia Zone 2”, which includes Singapore, Thailand, and Vietnam for only 67.5k AAdvantage miles.

Better: US Airways

Website Functionality

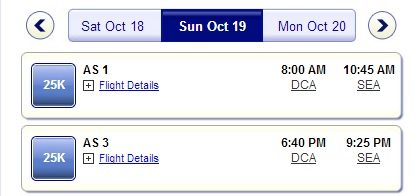

American easily routs US Airways in this category. American continues to improve its online booking tool, including relatively recent additions of oneworld partners Royal Jordanian, airberlin, and Finnair.

American even shows non-oneworld partner availability on Hawaiian and Alaska Air.

For booking partners that don’t appear on aa.com, including Cathay Pacific and JAL, you need to call 800-882-8880 and pay a $25/ticket phone reservation fee.

The only airlines that show up on usarways.com are US Airways and American. Any partner awards include a phone call.

Better: American

Phone Agents

I’ve always had positive experiences with AAdvantage agents. They are competent, sharp, and quick to answer most of your questions. Many have a surprising breadth of knowledge of their own program, including identifying non-oneworld partners such as Etihad.

The Dividend Miles desk is a mixed bag, putting it kindly. Basic geography eludes many of their phone agents, and I dread explaining the international date line when booking transpacific flights (“You can’t travel back in time, sir!”).

Better: American

Recap

American and US Airways will eventually combine frequent flyer programs and introduce a new award chart and routing rules. Combining the best aspects of each program is wishful thinking, but it’s fun wishful thinking that highlights the value of each program.

The programs differ wildly in many areas, so it will be interesting to see what type of award structure is ultimately created between the two airlines.

What aspects of the current American Airlines and US Airways programs do you most hope survive?

For American, I’m hoping, but not very confidently, that the prolonged off’-season awards to several regions survive. US Airways dabbles in it, but for short windows and only on their own metal.

I am very hopeful the detestable US Airways booking fee on award tickets meets its much deserved demise.

I think for the expert to opportunity to manipulate the clueless US Airways agents and get great rewards is nice, but for the typical flyer their incompetence is a royal pain in trying to get anything done.