MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

If you’re looking to score some serious credit card reward points, you’re in luck. The Capital One Venture Rewards Credit Card comes with an impressive welcome bonus of 75,000 Capital One Miles. After spending $4,000 in the first three months, you can take to the sky with a fresh batch of rewards points.

Capital One’s 18 transfer partners give you plenty of options for booking a dream getaway. Whether you’re heading to Europe, Asia or you prefer to vacation domestically, 75,000 Capital One Miles can get you pretty far.

Capital One Miles are one of the most versatile points in the credit card industry. If you can’t find somewhere you’d like to transfer them to, you can always book travel through Capital One’s online portal or redeem them for any purchase that codes as travel.

So, if you’re a wanderlust-filled adventurer looking for a credit card that will take your travels to new heights (literally), the Capital One Venture Card and its incredible welcome bonus are definitely worth considering.

Let’s discover what you can do with 75,000 Capital One Miles and whether the Venture Rewards from Capital One is the card for you.

How to Use 75,000 Capital One Miles

Once you’ve got 75,000 Capital One Miles burning a hole in your pocket, deciding where to put those miles to good use is the hard part.

Whether you transfer them, use them to book travel online or simply offset travel purchases, 75,000 Capital One Miles is enough to get a fun-filled trip started. Let’s explore some of the best options for your miles.

Transfer Partners

Capital One has 18 transfer partners, most of which receive transfers at a 1:1 ratio. The two that have different conversion ratios are marked below:

| Aeroméxico Club Premier | Etihad Guest |

| Air Canada Aeroplan | EVA Infinity MileageLands (2:1.5) |

| Air France-KLM Flying Blue | Finnair Plus |

| ALL Accor Live Limitless (2:1) | Qantas Frequent Flyer |

| Avianca LifeMiles | Singapore Airlines KrisFlyer |

| British Airways Executive Club | TAP Air Portugal Miles&Go |

| Cathay Pacific Asia Miles | Turkish Airlines Miles&Smiles |

| Choice Privileges | Virgin Red |

| Emirates Skywards | Wyndham Rewards |

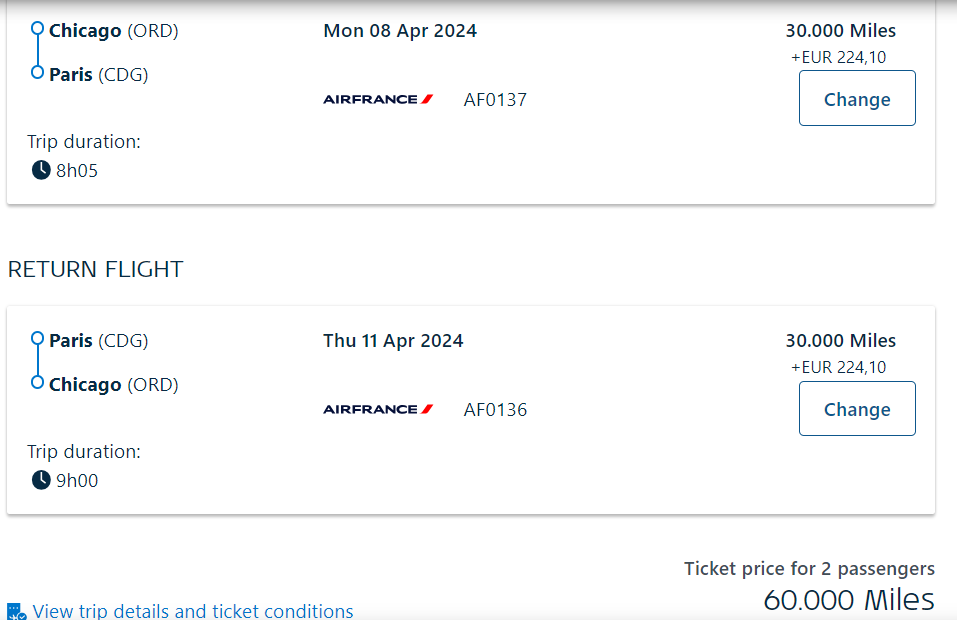

To give you an idea of the power of Capital One transfers, check out this pair of round-trip tickets to the beautiful city of Paris for 30,0000 Flying Blue miles per person.

Imagine strolling along the romantic streets of Paris, indulging in delicious pastries at local bakeries and exploring iconic landmarks like the Eiffel Tower and Louvre Museum. You’ll enjoy this experience more when you remember that your Capital One Miles paid for it.

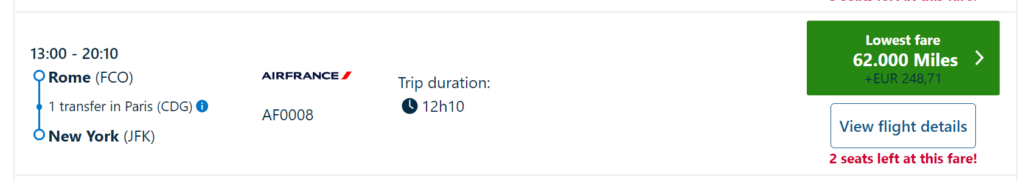

If you’re traveling alone, 75,000 Flying Blue miles can afford traveling in style with this one-way business-class ticket to Rome.

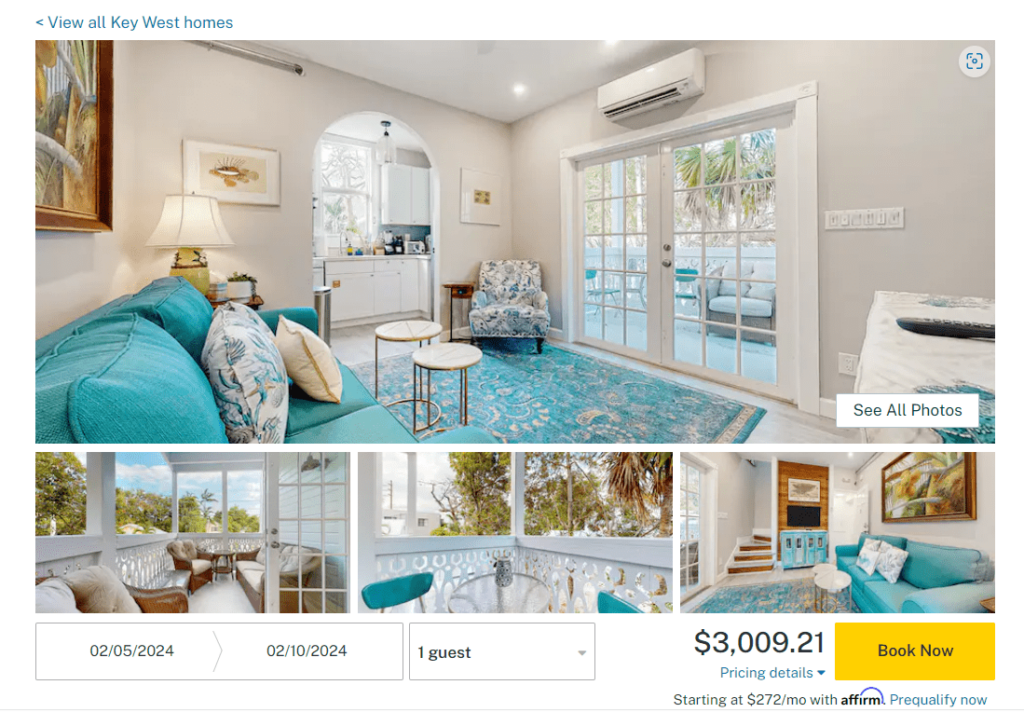

Prefer to vacation domestically with the sand between your toes? Why not consider staying at a Vacasa vacation rental? Wyndham Rewards allows you to book Vacasa rental properties for just 15,000 points per bedroom per night. Your 75,000 Capital One Miles are worth a five-night stay in a one-bedroom beach house in Key West, Florida.

This redemption turns 75,000 miles into more than $3,000 worth of value.

Redeem Miles to Offset Travel Purchases

One of the most heavily marketed benefits of the Venture Rewards card is its ability to redeem miles to offset travel expenses. Since Capital One has added transfer partners and made most transfer ratios to 1:1, the travel purchase rebate has become less appealing. However, it still comes in handy in certain circumstances.

One of the most common ways to redeem Capital One Miles for travel purchases is when booking a vacation rental. Since sites like Airbnb and Vrbo don’t have loyalty rewards, you can use your Capital One Venture card to book your stay, then simply select the charge and use your miles to reimburse yourself for the purchase at a rate of 1 cent per mile.

The key is to ensure your charges code as “travel.” If not, you won’t be able to redeem your Capital Miles for the charge. This code is determined by the category the merchant selects with their credit card processor. While Airbnb generally codes as travel, VRBO can be hit or miss depending on if it’s an individually managed or professionally managed home.

Charging your meals or other on-site expenses to your hotel room allows these expenses to be coded as travel. When at a resort or dining at a hotel, always charge expenses to a room either to accumulate more points or so they’re eligible for a statement credit with the Venture Rewards credit card.

Book Travel via Capital One Travel

Like all credit card companies, Capital One has a travel portal where you can use miles to book travel. While Capital One has many transfer partners, its miles don’t transfer to every airline. Capital One Travel works like any other online travel agency, like Expedia or Orbitz. Each Capital One Mile is worth 1 cent, so you can easily calculate how many miles you’ll need for your desired flight.

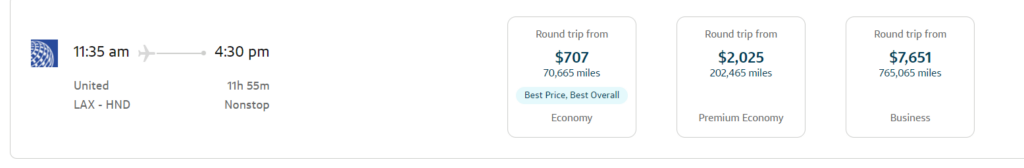

For instance, while Capital One Miles don’t transfer directly to United Airlines, you can still book a round-trip ticket to Tokyo with your 75,000 Capital One Miles. This means your options are virtually limitless when searching for the best flight for your trip.

Need a rental car for your trip? No problem. Simply use your miles to rent a vehicle through Capital One Travel. If you’re looking for accommodations, whether it’s a hotel room or vacation rental, you can also use Capital One Miles towards those expenses. However, hotels often won’t earn elite night credits or points for stays reserved through a third-party site.

Are You Eligible for the Venture Rewards Card Bonus?

Before you pull the trigger on the Capital One Venture, let’s see if you meet the eligibility criteria to earn a welcome offer. Capital One has some specific rules when it comes to approvals and sign-up bonuses.

Most importantly, Capital One will approve only one credit card application per person every six months. This includes both consumer and business cards. So, if you just applied for the Capital One Spark Miles for Business Card, you’ll have to wait six months before applying for the Capital One Venture.

Additionally, Capital One customers can carry no more than two personal and two business cards at the same time. If you have two other Capital One cards and you want the Venture, you’ll have to decide which one to close.

Lastly, Capital One states that you can’t have received a bonus on any of their cards in the last 48 months. However, there are some instances where this rule may not be strictly followed, according to certain data points.

To increase your chances of approval, having an excellent credit score (around 740) is recommended.

So, before diving into those sweet Capital One Miles, make sure to double-check your card history and credit score to see if you meet all the requirements.

Capital One Venture Rewards Credit Card

Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

Should You Get the Capital One Venture Rewards Card?

While the Capital One Venture welcome bonus is a lucrative option, it may not be the move for you at the moment.

If you happen to fall under Chase’s 5/24 rule, you might want to consider applying for other Chase cards instead. This rule states that if you’ve opened five or more credit card accounts within the past 24 months, Chase won’t approve any credit card applications. Since Chase offers some of the more powerful cards in the industry, it’s worth checking if this applies to you before taking up one of the five spots with the Venture card.

After meeting the minimum spending requirement, you’d have earned 83,000 Capital One Miles (75,000 + 2X miles on the $4,000 spent). At the absolute minimum, these miles are worth $830. Compared to other opportunities in the credit card space, this is a solid deal. With most partner transfer rates at a 1:1 ratio, you can transfer your miles to various airline or hotel partners and get even more value out of them.

The Venture Rewards from Capital One is right for almost anyone regardless of their personal travel goals or spending habits. Just make sure you’re not preventing yourself from getting another card by opening up a Venture card.

Final Thoughts

The Capital One Venture Rewards card offers a great opportunity for travelers to earn and redeem their miles. With a generous welcome bonus of 75,000 miles, 18 transfer partners and a low $95 annual fee, it’s a tempting offer for anyone looking to maximize their travel rewards.

One of the key advantages of the Capital One Venture Rewards card is its flexibility in redemption options. Cardholders can choose to redeem their miles with transfer partners, offset travel purchases or even book travel directly through the travel portal. This gives you the freedom to use your miles in a way that suits your travel preferences.

If you’re under 5/24, have applied for a Capital One card in the last six months or already hold two personal Capital One cards, you may want to skip this card at the moment. If not, the Capital One Venture Rewards card provides an excellent opportunity for travelers to earn valuable rewards and enjoy flexible redemption options.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

Hey Anya! What you don’t mention (because you earn a referral fee whenever you convince anyone to apply), is that Cap One has decided to fish for lower-qualified cardholders. People like me, with 800+ scores, are being rejected because Cap One would rather have customers with marginal credit histories, so they can milk them for 24.99% interest for years. My wife and I were both immediately rejected, but my son, who has a spotty credit history and absolutely nothing in the bank, was accepted. Go figure. Read other blogs before applying. Cap One used to be a slam dunk (we’ve had this card twice), but no more.

Geoff, thank you for your comment. Perhaps you skimmed the article without seeing both sides of the argument. I mention that the bonus is high, yes, but that the value isn’t as great as it first seems. It takes a lot of spend to earn the full 100,000 miles, plus the transfer rates to partners are sub-par. In fact, I’m advocating that the offer is a good one, not a great one in the final paragraph, implying to wait for a better bonus with a lower spending requirement. As for approval rates, these vary person to person. What was the reason for rejection Cap One gave you in the mail?

Also Geoff – you might want to double check things before making claims because you won’t find one single Capital One Venture card affiliate link in this entire post. So it has nothing to do with whether or not we get paid on this particular product.

Further, Capital One is extremely inquiry sensitive. If you have more than 1 or 2 inquiries in the preceding 6 months, they likely won’t approve you for most Capital One cards. So this was more likely the reason for the denial for you and your wife compared to your son. Additionally, they’re also accounting for more factors these days in approvals, a primary one being the value of the customer. Having the card twice before definitely hurts you in this new metric they’re using as well.

My FICO is 812 and Capital One TOLD me hit the road like 3x in 10 years.