MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

On Friday, I wrote about a revolutionary idea:

You can use the Barclaycard Arrival PlusTM World Elite MasterCard® to get 1.52 LifeMiles per dollar on all purchases. Read the whole post to find out how.

The Barclaycard Arrival PlusTM World Elite MasterCard® is the king of cash back cards (without even being one) because it offers 2.28% back on all purchases toward travel on top of 40,000 bonus miles after spending $3,000 in the first 90 days, which is worth over $500 in free travel.

But Arrival miles are terrible, no good, very bad miles for premium cabin redemptions just like all fixed-value points earned on bank cards.

That’s why you’d convert Arrival miles to LifeMiles, the miles of Star Alliance carrier Avianca, at a rate of 1 Arrival mile to 0.76 LifeMiles: to book business class and first class awards on Star Alliance carriers like Lufthansa, United, Austrian, ANA, Thai, and South African.

Getting 1.52 LifeMiles per dollar on all purchases through the Arrival Plus would be the highest rate of airline miles per dollar of any card. But that doesn’t mean anything if the LifeMiles chart isn’t any good.

Luckily the LifeMiles chart is solid, much better than United’s for instance, for Star Alliance redemptions.

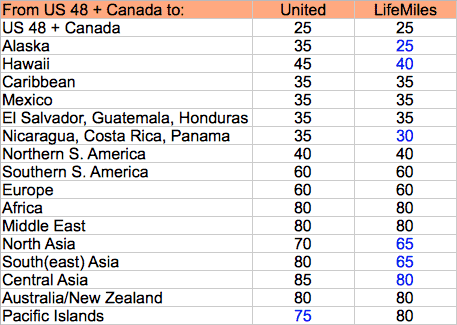

I’ve prepared side-by-side comparisons of United’s and LifeMiles’ award charts from the United States.

All award charts show the roundtrip price in thousands of miles.

Both programs allow one way redemptions for half price. Neither program ever collects fuel surcharges on any awards. Government taxes should be the same no matter which miles you use, but might differ by a few cents depending on currency conversions.

Economy Award Charts

United miles offer cheaper awards from the United States to Pacific Islands like Guam. (Though Guam is famous with LifeMiles for another reason. 😉 )

LifeMiles offer cheaper awards to Asia, Alaska, Hawaii, and part of Central America.

For many regions, the two programs would charge the same price, but even to those regions LifeMiles are better than United miles because there is no card that earns 1.52 United miles per dollar on all purchases.

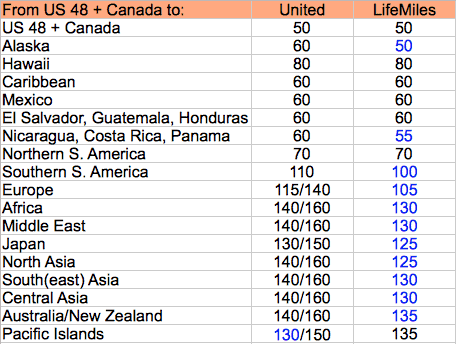

Business Class Award Charts

Slashes indicate the price for United metal/partner metal. Since United’s February 2014 devaluation, it charges extra miles to fly partner Business and First Class.

LifeMiles offer a far better deal on Business Class awards to most of the world.

The most popular award at the MileValue Award Booking Service is a couple taking a roundtrip to Europe in Business Class.

If the couple flies Lufthansa or Austrian or Swiss, it would cost 280k United miles versus only 210k LifeMiles.

Remember that United and LifeMiles have access to the exact same award space on other Star Alliance airlines.

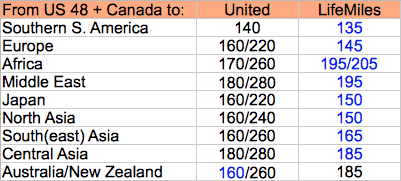

First Class Award Charts

LifeMiles charges 195k miles roundtrip to North Africa and 205k to South Africa.

Here LifeMiles is usually cheaper than United. Remember that you can’t fly United Global First Class to a lot of the world, so you’d have to use partner airlines and incur that higher, partner price on United’s chart.

United and LifeMiles have access to the exact same access to the top First Class space in the Star Alliance like Lufthansa First Class and Thai First Class. But while United wants 110,000 miles each way for Lufthansa First Class to Europe, LifeMiles charges a much more reasonable 72,500 miles each way and with no $75 fee for booking within 21 days of departure.

Caveats

Benefits of LifeMiles

- One way awards

- Up to two open jaws on roundtrips

- Much better award chart than United

- Access to all the same Star Alliance award space that United miles can access

- $50 Award Cancellations (vs. $200 on a United award)

- Easy online searching and booking tool

Drawbacks of LifeMiles

- No stopovers on LifeMiles awards

- All flights on an award be in the same cabin of service

- No-notice devaluations have occurred to the LifeMiles chart in the past

If you want to convert Arrival miles to LifeMiles, keep the Arrival miles until you are ready to book an award with LifeMiles. The best way to buy LifeMiles is AFTER award searching and IMMEDIATELY BEFORE award booking. Your LifeMiles balance should almost always be zero, and you should really only have the miles in your account for a few minutes while you book an award.

Recap

The LifeMiles award chart is much cheaper than the United award to most regions in most cabins for the exact same flights. You can effectively get 1.52 LifeMiles per dollar on all purchases by using your Barclaycard Arrival PlusTM World Elite MasterCard® and converting Arrival miles to LifeMiles during the frequent 2 x 1 sales on LifeMiles.

I use the Lifemiles search took almost everyday, and I fail to understand why you say that two open-jaws are allowed. I have never used the call center, but everyone invariably agrees that they cannot book anything that is not bookable online. Please explain.

Also, even though most of your readers may live in the US, I will point out that in Japan it is very easy to get cards the will earn 1.5 mileage plus miles per dollar spent, or per 100 yen, which is pretty much the same thing.

If you can book one way awards, you can always book two open jaws on a “roundtrip” by definition as two awards. For instance, you can easily book LAX-FRA, MUC-SFO as two awards with LifeMiles, which is a classic double open jaw.

Sure, Scott. We can no doubt book two separate one-way awards, and I have definitely done it with Lifemiles. I just thought the wording in the article was a bit misleading, since booking two one-way awards is not equal to booking a return trip than includes two stopovers, which is how you stated it. Two one-ways is two one-ways; it is not a booking for a “return trip.” As you well know, many readers have no clue how anything works, and the statement in the article will mislead people into believing that return trip award bookings with Lifemiles are as wonderful as that type of booking with United, which gets you a stopover and two open-jaws, and does it without forcing you to have to book THREE separate one-ways, as you would have to do with Lifemiles, which I might add, then increases the number of miles needed, which is not the case with United. As you know, with a Lifemiles multi-city booking, NO open jaws are allowed. The system forces you to have each consecutive leg originate where the previous leg terminated, and the final destination has to be the same place you started.

I am no fan of United anymore, since they changed their award chart, but I have to admit that the flexibility they allow you when you book a return or multi-city itinerary is in the realm of cool. Of course, it is less cool now with the increases on their award chart.

can they finally book Autrian flights? Last time LifeMiles wasn’t displaying any…

There are cards, earning 5 miles/points per $1, with basically same fee – $95. And let’s not forget that at least before if you don’t redeem Arrival miles within I think 3 months for travel (in this case LifeMiles purchase, then NaDa) Correct me if I’m wrong. other than that MileValue great comparison of both programs. However LifeMiles search is still far from perfect. Many routes within Europe where Lufthansa flies according to United aren’t shown on LifeMiles. Until they fix it, I stick to United, which has Understanding English Customer Service and great search options! And I wonder why Citibank is issuer of LM credit cards in South America, but US Bank in the USA. I wish Citi will get into the game, because US Bank is such a stringent and NOT-Frequent Flyer Friendly (FFF) bank! )))

The Inks earn 5x at office supply stores and telecom bills. Those are great categories and an unrivaled bonus, but they are not 5x on everything.

You are INCORRECT about how redeeming Arrival miles works. Arrival miles NEVER expire if you don’t close the card. Use them whenever you want. You have 120 days from the purchase of any travel item to redeem Arrival miles for that item.

There is a card that gives you 1.5 United miles/$ and it’s the Chase United Club card. Annual fee very high $395 but comes with Club membership and a very decent earn rate. Also don’t dismiss the incredible flexibility of United miles in terms of much more generous routing rules, mixed cabin awards, etc. If United miles were as cheap as Life miles to buy nobody would ever bother with Life miles especially now that many of the old tricks are gone. Also good luck getting an English speaking agent if you need to call to change or cancel. Only use Life miles when 100% sure you’re gonna travel and won’t change

Please explain more. I have about 60 k on my united mileage plus…if I convert would that be 90K? what does balance transfer mean?

You cannot transfer United miles to any other type of miles. This post references converting Arrival miles to LifeMiles. Give it another close reading and click the link to the original article on converting Arrival to LifeMiles.

[…] also my United Award Chart vs. LifeMiles Award Chart post from a few weeks […]

[…] also my United Award Chart vs. LifeMiles Award Chart post and United Award Chart vs. Lufthansa Award Chart post from a few weeks […]