MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

The other day, I booked myself a direct flight from Tampa to Charlotte with 4,500 British Airways Avios and $5.60. Avios are the best miles when American Airlines, US Airways, or Alaska Airlines has a short, direct flight where you want to go.

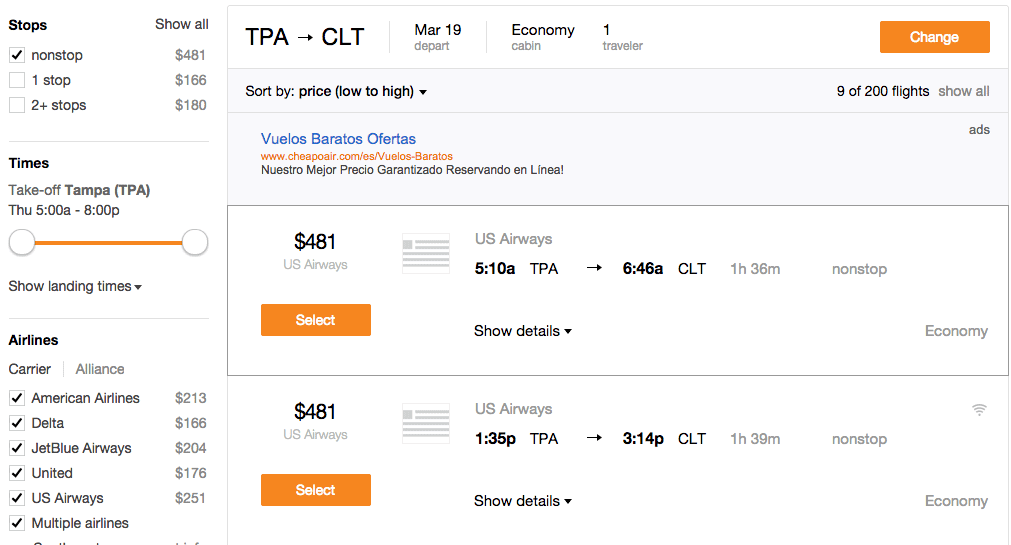

The same flight costs $481 cash.

I could pat myself on the back and say I got more than 10 cents per mile of value, but those outlandish valuations are one of my big pet peeves.

I could pat myself on the back and say I got more than 10 cents per mile of value, but those outlandish valuations are one of my big pet peeves.

I would never pay $481 for the one-and-a-half-hour flight. I would book a one stop flight for $166 or use hidden-city ticketing to get the Tampa-to-Charlotte leg as part of a cheaper, larger ticket.

I basically got a $166 ticket for 4,500 Avios in my mind, which is less than 4 cents per mile of value–still awesome!

Interestingly, though, if I were rich, I could definitely say I got 10 cents of value from my Avios. If I had millions of dollars, I wouldn’t flinch at paying $481 for the most convenient, direct flight. If I were willing to pay that for the flight, then redeeming 4,500 Avios would really have saved me $481, meaning I really would have gotten 10 cents of value from each mile.

That’s why, in some senses, the richer you are, the more your miles are worth.

The Other, Big Application of This Idea

The main time I see outlandish valuations of awards is on international First Class tickets. Someone will say something like: “I spent 67,500 American Airlines miles and $40 on a one way First Class ticket in Cathay Pacific First Class that costs $10,000, so I got 15 cents of vlaue per mile.”

I would suggest you only got that much value if you would have spent the $10,000 on the ticket in the absence of miles. That is, if you were really, really rich. If you’d only be willing to pay $1,500 for the ticket, adjust your valuation of your award accordingly.

Of course, none of this is new. I expounded on this exact point in the first ever post on this blog.

Back to My Avios Award

I’m hoping I need the flight I booked from Tampa to Charlotte, but I actually might need to fly to Louisville or Seattle or Pittsburgh that day. In that case, I can cancel my Avios award. I’ll get back my 4,500 Avios and lose only the $5.60 in taxes I paid. I have no qualms booking awards speculatively with these miles because of free or cheap cancellations.

Your Take

Am I right to call people out who would describe my award as 10 cents of value per mile? Are miles worth more in the frequent flyer accounts of rich people?

Agreed. For coach valuation, I use the value of a flight I would’ve been able to afford… But sometimes the expensive non-stop is the only option available, and this is when you’re happy to have miles 🙂

Agreed. For coach valuation, I use the value of a flight I would’ve been able to afford… But sometimes the expensive non-stop is the only option available, and this is when you’re happy to have miles 🙂

Very happy

Have you had any trouble cancelling Avios tickets last-minute lately? It seems that they changed their cancellation process. It used to be instantaneous but now you have to submit a form and wait a week for the cancellation to go through.

Have you also noticed this?

Have you had any trouble cancelling Avios tickets last-minute lately? It seems that they changed their cancellation process. It used to be instantaneous but now you have to submit a form and wait a week for the cancellation to go through.

Have you also noticed this?

Haven’t tried to cancel in a about six months, but never had a problem. I believe the rule is you can only cancel until 24 hours before flight.

I see your point, and think you’re right. But I keep a running tab of all of my hotel and flight redemptions, and value them based on the cash price of the exact flight or hotel they’re replacing. It’s more of a feelgood spreadsheet than anything else. I would never pay the $17,000 for an first class flight to Japan that I booked, so I guess it’s worth much less than that to me. But I still like to see that 13.6 cents per mile valuation.

I see your point, and think you’re right. But I keep a running tab of all of my hotel and flight redemptions, and value them based on the cash price of the exact flight or hotel they’re replacing. It’s more of a feelgood spreadsheet than anything else. I would never pay the $17,000 for an first class flight to Japan that I booked, so I guess it’s worth much less than that to me. But I still like to see that 13.6 cents per mile valuation.

You’re not hurting anyone by enjoying those big numbers. Enjoy away!

Concur 100%. It’s even worse when you see the links… sign up for this credit card and save $10K in airfare.

Concur 100%. It’s even worse when you see the links… sign up for this credit card and save $10K in airfare.

This explains the bloggers, but I even see a fair number of non-bloggers putting out numbers like that.

I think this is a great point, but using miles for things “worth” 5 figures makes a better headline 😉

I think for some of us, though, using the “what would I be willing to pay for this flight if I had to spend cash” method actually sells the value of miles short. I’m on a business class award ticket to Australia with a stopover in Hong Kong later this month. I imagine an economy class ticket for this trip, or even just one portion of the trip, would likely be $1,500+ (Maybe a bit lower with patience and flexibility).

To be honest, I probably wouldn’t pay $1,500 for this ticket. I don’t really have the cash sitting around nor the desire to spend $3k on airfare for my wife and I, on top of the expenses once we get there. If someone offered me a $500 ticket to take this trip would I take it? Yea we’re probably more in the ballpark there, but that would put a really low value on these miles, and that ticket would never be offered. What I’m really getting here (in business class, no less) is a product I wouldn’t pay for except at the most ridiculous possible price.

So what is the value of my miles here? is it the half-a-cent I’d be willing to pay in cash for my ticket? Or is it an almost infinite value, in that it’s giving me an incredible experience I simply couldn’t possible have without these miles?

Obviously putting values on our miles is an important thing to be able to do, and I usually try to use ~$0.02 as a guideline, but even doing that sometimes doesn’t do justice to this hobby!

I think this is a great point, but using miles for things “worth” 5 figures makes a better headline 😉

I think for some of us, though, using the “what would I be willing to pay for this flight if I had to spend cash” method actually sells the value of miles short. I’m on a business class award ticket to Australia with a stopover in Hong Kong later this month. I imagine an economy class ticket for this trip, or even just one portion of the trip, would likely be $1,500+ (Maybe a bit lower with patience and flexibility).

To be honest, I probably wouldn’t pay $1,500 for this ticket. I don’t really have the cash sitting around nor the desire to spend $3k on airfare for my wife and I, on top of the expenses once we get there. If someone offered me a $500 ticket to take this trip would I take it? Yea we’re probably more in the ballpark there, but that would put a really low value on these miles, and that ticket would never be offered. What I’m really getting here (in business class, no less) is a product I wouldn’t pay for except at the most ridiculous possible price.

So what is the value of my miles here? is it the half-a-cent I’d be willing to pay in cash for my ticket? Or is it an almost infinite value, in that it’s giving me an incredible experience I simply couldn’t possible have without these miles?

Obviously putting values on our miles is an important thing to be able to do, and I usually try to use ~$0.02 as a guideline, but even doing that sometimes doesn’t do justice to this hobby!

Zach, there are tradeoffs every time you earn a mile from a credit card. Instead of earning those airline miles, you could have earned cash back or Arrival miles (which are basically cash back.) The fact that you didn’t means that hopefully you value those airline miles more than the cash back you would have earned.

I see your point and generally agree. However, there are times when I think people would pay higher prices. I’m not rich by any means (grad student) but I’ve been saving a long time for my honeymoon and really wanted it in business because it’s such a special event. I normally wouldn’t pay $4k per person for a ticket but in this case I would because I’ve been saving for it. Others may not and that’s ok too. Since I was able to use miles I really did get 4cpm.

If you would have paid that cash, that’s a fair valuation.

I see your point and generally agree. However, there are times when I think people would pay higher prices. I’m not rich by any means (grad student) but I’ve been saving a long time for my honeymoon and really wanted it in business because it’s such a special event. I normally wouldn’t pay $4k per person for a ticket but in this case I would because I’ve been saving for it. Others may not and that’s ok too. Since I was able to use miles I really did get 4cpm.

Agree with adjusting to what you would normally pay 100% . However when it comes to being rich and affording these 10k flights, I’d argue miles are worthless to them since the extra learning curve isn’t worth their time.

Well they could just hire an Award Booking Service for $125 per passenger –> milevalue.com/award-booking-service

And get a free credit card consultation to get that part of their strategy fixed –> milevalue.com/free-credit-card-consultation

I think it’s actually somewhere in between for most people. You should value it at what you would have paid for the flight you got. It’s worth more than $166, because you’re getting a more convenient flight than the $166 option with one stop. Figure out what you would have paid for the nonstop (say… $200), and use that to value your miles. I just booked booked 4 economy saver seats for my family to go to Hawaii, booked United saver each way, and got very convenient flights. These exact tickets would have cost me about $10k for the 4 of us, round trip. But if I was paying cash I would have gone with a much cheaper and less convenient itinerary. So I value the reward at about what I guess I would have been willing to pay for this more convenient itinerary.

I agree though, the more you’re willing to pay for convenience, the more potential value you can get out of your miles. If I would have been willing to pay $10k for the convenient flights, then I would have gotten a much better value.

Thanks for making the exact point I would have made, but decided to cut from the post for the sake of length.

You even nailed my valuation of the direct flight: $200.

Totally disagree. The only question to ask and answer regarding cash value per point is how much the seat you’re sitting would have cost if you had paid cash. Period. Value per point is not subjective.

Not to mention that you’re still getting the benefit of a direct flight to Charlotte or, even better, Cathay Pacific first class on that long-haul international flight. Regardless of what they’re subjectively worth to you, these benefits are real and need to be factored in to the value calculation.

That’s the only question you’re asking, and that’s certainly your prerogative, but there are many other questions other people can legitimately ask. I ask, how many trips can I take with those miles? How many places can I visit? I can spend all those miles on that Cathay Pacific first class seat and live luxuriously for 15 hours, or I can take a bunch of trips to several different places with the same miles. To me the value of the miles is where they will take me, not how luxuriously.

Thus, to me the sticker price I would have to pay for the flight for which I’m redeeming miles becomes relevant only when it’s cheap enough that I would consider paying cash and saving the miles for something else later.

That will never happen on the Cathay Pacific first class flight, unless there’s some weird mistake fare, so whether that sticker price is $2,000 or $20,000 cash is absolutely irrelevant to my miles use strategy and valuation. I think most flyers should look at it that way, but clearly not all. Scott says it’s more likely the wealthy who don’t, though I think it’s probably more nuanced than that – how many miles you have, how easily you acquire them, and of course, your relative desire for in-flight experience vs. more trips.

If this logic were true, and someone offered to buy my Avios for 9 cents per mile, I’d have to say no. I could book this direct flight instead and be better off.

But I would gladly sell Avios for 9 cents per mile. And then with my $405 from selling 4,500 Avios, I would buy the $166 one-stop flight and still have $239 in cash, and be way happier than booking the direct flight and having no cash.

To me that shows that this argument is simply not true. Miles have a subjective value different to everyone.

This is a spurious argument. “Miles” or “points” in the abstract may have subjective value to you, me or anyone else, but your examples are not abstract. In fact, the actual use of miles and points is NEVER abstract. When put into use, miles have no subjective value at all — they are worth the value you get out of them for any given redemption. Nothing more and certainly nothing less.

Agree with milevalue. You would only save when you actually would or must buy something for real cash. Since you would not spend $10,000 on a ticket (max $1500) the real value to you is $1500. For the millionaire he would spend $10,000 so that’s the real value to him.

Have your wife ever come home and said something ” Look I just saved $400 on the sweater retailed at $600!”.

Noooo, you just SPENT $200!!!

Haha

Hahahhaaa!!! My ex-wife used to say this all the time. It was more along the lines of “I just ‘made’ $400!!’

It was totally an understood joke ‘cuz we were both deal-seekers (and didn’t create unrealistic spending).

My experience cancelling Avios awards (last fall) is that, if I cancel the award online and forfeit the taxes, the miles re-appear in my account immediately. But, if there is a schedule change, so that BA offers a truly free cancel option online, the refund must be processed manually, and this takes several days. Not sure if anything has changed in the last few months.

Good to know about schedule changes producing the option to cancel for free online. I hadn’t seen that.

Totally disagree. Devil’s Advocate recently discussed this and I agree with his argument. If other people are paying that amount, thats the fair market value. Your personal valuation of it has nothing to do with the FMV. If you would/could never splurge on a Ferrari, that doesn’t affect the FMV if someone gave you one. You may not care as much, but its a separate issue as to what is the value of what you got.

And of course that’s bunk. See my response to Jim. If this argument were true, I wouldn’t be willing to sell my Avios for 9 cents each because I get 10 cents of value from them. But I don’t get 10 cents of value from them, so of course I am willing to sell them for 9 cents each (or at least would be in a world where free selling of miles were allowed.)

The only way you can objectively justify this way of valuing miles (what would I sell them for) is if there was a way that buyers and sellers could transact in an open and free market, then whatever price they settled out at would be the objective value of those miles, however, that is not an available option. The best equivalent we have for an objective value is to use flight prices as a proxy, which means that you have to use the actual ticket price to get the objective valuation for each individual transaction. If you were to aggregate this across all redemptions for all consumers, then you would get a market value for miles. No other objective measure exists.

If you want to use a subjective value, then there is no valuation method that people “should” use, because it is subjective, so people should use whatever valuation method suits them and not take someone else’s viewpoint of valuing miles. Subjective valuation is only useful to the person who evaluated it. On the other hand, there is a way to objectively evaluate the cost, as everyone is free to collect cash back instead miles and therefore, cash back can be used as a proxy for miles valuation.

I am with the person above who subjectively valued them as priceless. I have taken my four children to see New York, London, Paris, Berlin and Munich and will be taking them to see Athens, the great pyramids, Petra, and Istanbul. I would have been able to do none of this without miles and points, therefore, the points value is subjectively either infinite or 0, but that is a useless measure, so I will stick with the objective valuation and the objective cost.

I disagree completely, but because you and others are using the same term __for two different concepts__.

What you’re arguing for is recognizing only exchange-value. The other side of the proverbial coin is use-value.

Exchange value is what you would have paid for the basic product. In your example, it is “a trip’s transportation by air” from point A to point B, and would have cost $1500.

Use-value is realized only in the process of consumption. This is your where the $10k ticket price comes into play.

If, you could buy a coach ticket for $1500, but instead booked a $10k first class ticket (you’re still buying the same basic product: the trip transportation by air) then your miles replaced the $1500 expenditure, so the *exchange-value* of those miles is only $1500.

BUT, that doesn’t get at actual value *received* and enjoyed: which is the use-value.

Easy, relatable example: Paying $10 for a burger and fries and a Coke because you do need to eat. Or, through discounts or other cash-back means make it possible to have a top grade rib eye, gourmet sides and a glass of wine for $10 outlay. You still just ate, but very different thing received.

You can’t argue your singular “value” for your efforts was the burger meal for $10. You got a top notch experience and product *worth*, let’s say $75. So the use-value received for whatever you did or redeemed was $75. There’s no arguing that, right? Just because you wouldn’t have chosen that under non-discount circumstances doesn’t change what you got and consumed.

Personal example: 90k US Airways miles for the North Asia via Europe redemption. Flew Austrian Air, Swiss Air, and Air Canada (*cough*) business class around the world. Priced the tickets were about $20k each. Would I ever purchase those out of pocket?? Of course not!! Similar tickets coach were about $2500. Would I have purchases that?!? Probably not, but the philosophical argument that the miles change rational behavior is separate… (it was awesome… but maybe only *that* awesome because the travel itself was enjoyable… ohhh the paradox!!).

Exchange-valuation: $2500 / 90,000 = 2.7 cpm. Meh (In reality this is slightly mitigated by some costs, taxes, purchased miles to top-up, etc etc etc. But simple math for this reply)

*Actual cost of product received* Use-Valuation: $20,000 / 90,000 = 22.2 cpm Yay! (again, this is slightly mitigated by some costs, taxes, purchased miles to top-up, etc etc etc.)

I see no harm in feeling GREAT about the latter valuation. That’s what I *received for those miles*. Inarguable. It doesn’t mean all my USA miles are worth 22.2 cpm. As we all know, they have no solid value until you use them!

And so what I think is the mistake is everyone trying to put a single valuation on miles before and after they’ve been redeemed. There are two that exist. But every person can decide whether they want to acknowledge and rejoice on use-value, or only exchange-value.

I definitely think it is fair and OK to put an average exchange/use-value estimation on points you are *accumulating*, for planning and expectations purposes. They don’t have a concrete value until used, so estimation is alright.

But once you’ve used them they have very definite, inarguable value figures. (two of them!)

Final note for your example, to properly calculate use-value you would take the $10,000, minus the $40 paid out, divided by the points redemption (cuz in truth you only got $9,960 use-value for 67,500 miles). So, 14.7 cpm. Nit picking, but just wanted to fully explain the methodology I use.

^^^This.

“I see no harm in feeling GREAT about the latter valuation.” <-- Agree Imagine a credit card offered as a reward $1 of jet fuel for every $1 you spend, but there is no re-sale or barter market for jet fuel and you have no jet. This card does not off you a 100% rebate (more like 0%) or a good deal is my contention. Your argument, logically extended, is that the card does offer a 100% rebate on spending. Imagine a credit card offered you a 50,000 mile sign up bonus that can be used for a one way business class fare that costs $3,000. Imagine there is no re-sale or barter market for this reward, and you value the the flight at $1,000. By the same reasoning, I believe this sign up bonus is worth $1,000 to you. You believe it is worth $3,000 to you. If the latter were true, and a re-sale market magically appeared, you should be unwilling to sell the flight for $1,500. But of course you would be willing to sell it for $1,500 since you only value it at $1,000.

I agree with RS. The cost of an international first-class ticket is $10,000 regardless of what you would pay for it. So if you redeem miles for it and get 15 cents of value per mile, then that’s what you get. Congratulations!

You can’t say you would have paid only $1,000 for the ticket because a $1,000 international first-class ticket doesn’t exist _ it’s $10,000, and there’s no changing that. So if you redeemed miles for it, you can’t arbitrarily decide what the value of your miles redemption was just because you feel like it.

I’m piling up the AVIOS right now on the BA card.

Living in San Diego, there are so many non-stops from here and LAX it’s a great deal for trips to Mexico and Hawaii. (all non-stops on Alaska).

We’re going to Vallarta in June. I’m so glad I found this blog!

Way to take advantage of the high value uses of Avios! Remember that Alaska flights are not searchable on ba.com. Search them on aa.com, then call BA. BA should be able to access all the Alaska award space on aa.com.

[…] (I booked the award speculatively because the cancellation fee is only $5.60.) […]