MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

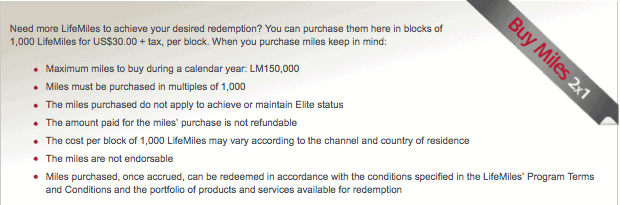

TACA/Avianca LifeMiles are being sold for 1.5 cents until December 30, 2013. The normal price is 3 cents per mile, but LifeMiles is running one of its frequent 2 x 1 sales.

Your LifeMiles account must have already been open on December 3, 2013 to enjoy this promotion. Since these sales happen every few months, sign up now to be eligible for the next sale if you aren’t eligible for this one.

Your LifeMiles account must have already been open on December 3, 2013 to enjoy this promotion. Since these sales happen every few months, sign up now to be eligible for the next sale if you aren’t eligible for this one.

What are TACA/Avianca LifeMiles? What are their best uses? Should you participate in this promo?

LifeMiles Rundown:

- TACA/Avianca is a Star Alliance carrier, based in Colmbia and Central America.

- It has a competitive chart, though not quite as good as US Airways’. You can see the LifeMiles Star Alliance Chart by clicking the link here.

- One way tickets are bookable at half the roundtrip price.

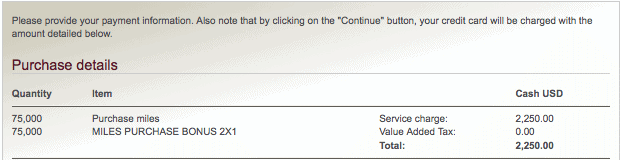

- During this promotion, you can buy up to 150k LifeMiles for $2,250.

Miles purchases are processed by TACA/Avianca, so this should count as an airfare purchase and earn 3x points if you use The Enhanced Business Gold Rewards Card from American Express OPEN or American Express® Premier Rewards Gold Card. However the transaction will probably also code as a foreign transaction with a foreign transaction fee, so I recommend using a fee-free card.

The Barclaycard Arrival Plus™ World Elite MasterCard® has no foreign transaction fees, and you should be able to redeem Arrival miles for the purchase price of the LifeMiles, since it will look like an airfare purchase on your credit card statement.

Outright buying of miles during this promotion can lead to some very low prices for tickets.

- Business class to Europe for $1,575 + tax roundtrip.

- Business class to Australia for $2,025 + tax roundtrip.

Booking LifeMiles Awards

LifeMiles has a very strange rule that you cannot mix cabins on an award ticket. That means no domestic economy to connect to an international business flight.

LifeMiles.com has a solid booking engine for award tickets. Search united.com first, find the space you want, and try to recreate it on LifeMiles.com.

If you can’t book online, you can book by phone by calling 800-284-2622, and entering the following menu choices: 2-3-1-2-1

Further Reading

Here is a post about using the 2 x 1 LifeMiles promotion to get a roundtrip award to Europe for only $1,575 + tax. It also includes an FAQ about the TACA 100% buy miles promotion.

Link

[…] TACA/Avianca LifeMiles 2 x 1 Sale Means 1.5 Cent Miles […]

Scott, I am skeptical about the LifeMiles search feature. I am currently searching for flights between NRT/HND and Laos. While the UA site offers many choices, a few of which have all legs in business, the LifeMiles site shows no availability for the same time period. It is October and November 2014 that I am searching for. I set it up to search all Star Alliance options. Also, the site does not even recognize the existence of Luang Prabang.

anyone know where i can read about the “remote russian city trick” please?

does anyone have a lifemiles account number–opened before dec 3–that i could use to buy these 2-for-1 miles (I’d then immediately redeem these miles). I’d like to take advantage of the deal but I didn’t have a lifemiles account before dec 3…

i do, but why would you want to risk it

what risk? absolute worst case scenario, i lose $190 for a shot at getting to japan for peanuts. and i doubt that would happen. in all likelihood the biggest risk is that they won’t honor the award redemption and will simply redeposit the 25k miles, in which case i’ll take a different trip down the road using lifemiles. the only potential drawback of that is that my 25k miles would be stuck in the account of a quasi-stranger, but i have faith in ppl and so i’m not too worried about that 🙂

your call

purcitron at hotmail dot com

But most of us would have to get back home from Japan. How do we do that without paying the full one-way fare?

One way award ticket.

[…] ← TACA/Avianca LifeMiles 2 x 1 Sale Means 1.5 Cent Miles Killing Deals is Good → […]

Scott–do you know if these credit your account immediately or if there is a lag like US Airways? Thanks

[…] a great alternative, but only for the next three months, since US Airways joins oneworld in March. TACA miles are great to buy, but hard to earn cheaply otherwise. Lufthansa, Singapore, ANA, and Air Canada miles all impose […]

[…] a great alternative, but only for the next three months, since US Airways joins oneworld in March. TACA miles are great to buy, but hard to earn cheaply otherwise. Lufthansa, Singapore, ANA, and Air Canada miles all impose […]