MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

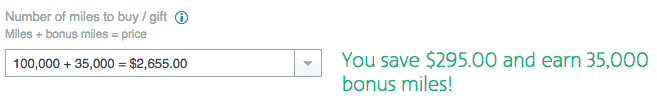

American Airlines is running a sale on the purchase of their miles through November 13, 2015. You can buy up to 125,000 American Airlines miles during the sale and get up to 35,000 bonus miles plus 10% off the normal price.

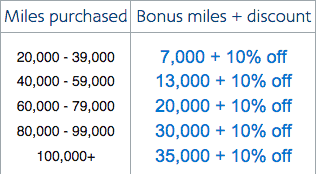

The discount is fixed, but the bonus miles are tiered, based on how many miles you purchase.

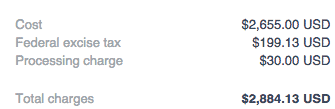

American Airlines miles cost 2.95 cents each plus a 7.5% excise tax, and every purchase has a $30 processing fee. The cheapest per-mile price comes from purchasing 100,000 American Airlines miles + 35,000 bonus miles for $2,884.13.

That works out to getting 135,000 miles for 2.14 cents each.

A recent sale offered miles for 2.00 cents each, so this isn’t the best sale of the year, but it’s only 7% worse.

With many of American’s sales, you need to buy the maximum number of miles to get a decent price near 2 cents per mile. With this sale, the lower denominations are much cheaper than normal.

- 27,000 miles (20k + 7k bonus) are only 2.23 cents each

- 53,000 miles (40k + 13k bonus) are only 2.21 cents each

This sale offers a much better chance than usual to make a small top up of your account for an award you have wanted to book.

Math

The cheapest miles cost 2.14 cents each during this promotion, and that requires shelling out $2,100. I value American Airlines miles around 1.8 cents each, so there is no way I would buy these miles speculatively for 2.14 cents. The only way it could possibly make sense to buy miles at these prices is if you had an immediate high value use for them.

To figure out if you have a high value use, use this simple expression:

(A – B) / (C + D)

- A: Value of the award. Important: this is the lesser of the cash price and your subjective value.

- B: Taxes on the award

- C: Miles used on the award

- D: Miles you would earn if you purchased the award ticket with cash

This will spit out the dollar value you are getting for your miles. If that number is greater than 0.0214, and you can book the dream award now, buy during this promotion. Otherwise, don’t buy.

Buy AAdvantage Miles with These Credit Cards

AAdvantage miles purchases are processed directly by American Airlines. That’s great news!

It means you can buy them with your Citi Prestige® Card, and its $250 Air Travel Credit will refund you the first $250 of the purchase price of the miles (plus you’ll earn 4x ThankYou Points on the first $250 of the miles purchase.)

It means you can purchase American Airlines miles, then use your Arrival miles for an offsetting statement credit.

Bottom Line

You can buy 135,000 American Airlines for $2,884 or 2.14 cents each. That’s way too high to buy speculatively. Hopefully cheaper sales come along.

The American Airlines miles sales are now processed by American Airlines itself, so you can get category bonuses on cards that bonus airline or travel purchases like my latest card, the Citi Prestige® Card which offers 3x on purchases from airlines, or you can use your Arrival Plus to get American Airlines miles for zero cash.