MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Spooky season is upon us, and Companion Pass season is heating up!

Getting the Southwest Companion Pass is all about the timing. You don’t want to be too early or too late to get the best value possible.

Let’s take a deep dive and cover everything you need to know about earning the Southwest Companion Pass for 2024.

What is the Southwest Companion Pass?

The Southwest Companion Pass is a buy-one-get-one-free(ish) ticket on Southwest Airlines for you and a designated companion. The best part about it is the Companion Pass has unlimited uses for the year you earn it and the following year.

There are a few more details than that, but that’s the quick overview.

For starters, you get BOGO tickets for you and your plus-one. The person who earns the Companion Pass gets to name one person as their companion. When the Companion Pass holder books a ticket on Southwest, either with cash or points, their named companion gets to fly for almost free. You’ll still have to pay taxes and fees on their ticket, which start at $5.60 each way.

When you earn the Companion Pass, you get to designate someone as your companion. You can have only one person listed as your companion at a time, but you can change your companion up to three times per year.

There are no limitations on the Companion Pass that you’ll find from other airlines. For example, there are no blackout dates; it doesn’t rely on there being low-level Saver availability; and it isn’t simply a discount.

As long as there’s an open seat on the plane, your companion can fly with you for the cost of taxes and fees. You could fly to Hawaii 50 times per year, and your companion can come with you on every flight.

The last part to keep in mind is probably the most important. The Southwest Companion Pass is good for the remainder of the year in which you earn it plus the following calendar year.

Why is this so powerful? If you earn your Companion Pass by Dec. 31, 2023, then it would be good through Dec. 31, 2024. And although one whole year of buy-one-get-one-free(ish) flights is great, two years is even better.

If you earned the Companion Pass on Jan. 1, 2024, then it will be good until Dec. 31, 2025. That’s 365 more days to take advantage of the BOGO tickets simply by earning it one day later.

If that sounds interesting to you, and it likely does, let’s talk about how you can earn the Southwest Companion Pass.

How to Earn the Southwest Companion Pass

The requirements to earn the Southwest Companion Pass are fairly straightforward. All you have to do is fly 100 Southwest flight segments in a calendar year or earn 135,000 Southwest Rapid Rewards points in a calendar year.

Fasten your seatbelts because if you want the Southwest Companion Pass as early as possible, you need to fly 100 flights on New Year’s Day!

Kidding, of course!

Thankfully, there’s an easier way. Instead of flying 100 flight segments, we’re going to focus on earning 135,000 Southwest Rapid Rewards points in a calendar year without ever stepping on a Southwest flight.

How You Can Earn The Southwest Companion Pass Without Stepping On A Plane

Instead of flying 100 flights, all you’ll need to do to earn the Southwest Companion Pass is earn 135,000 Southwest Rapid Rewards points in a calendar year. Now, before you start transferring Chase Ultimate Rewards to Southwest, let’s dig a bit deeper.

Southwest specifies that points accrued through the following methods count towards your Companion Pass:

- Points earned from flying on paid flights booked through Southwest

- Points earned from the Southwest Rapid Rewards credit cards

- Points earned from Rapid Rewards partners

This means that you can’t simply buy 135,000 Rapid Rewards points, nor can you transfer the points from Chase. However, Southwest Rapid Rewards credit cards are fair game. And since we don’t want you to have to fly to earn points, and earning from partners can take a long time (and a lot of money), we’re going to focus on earning the Southwest Companion Pass using the Southwest credit cards.

Before we go on, we must tell you—read everything before proceeding. There are a lot of small nuances to earning the Companion Pass, so be sure you understand everything entirely before opening any credit cards.

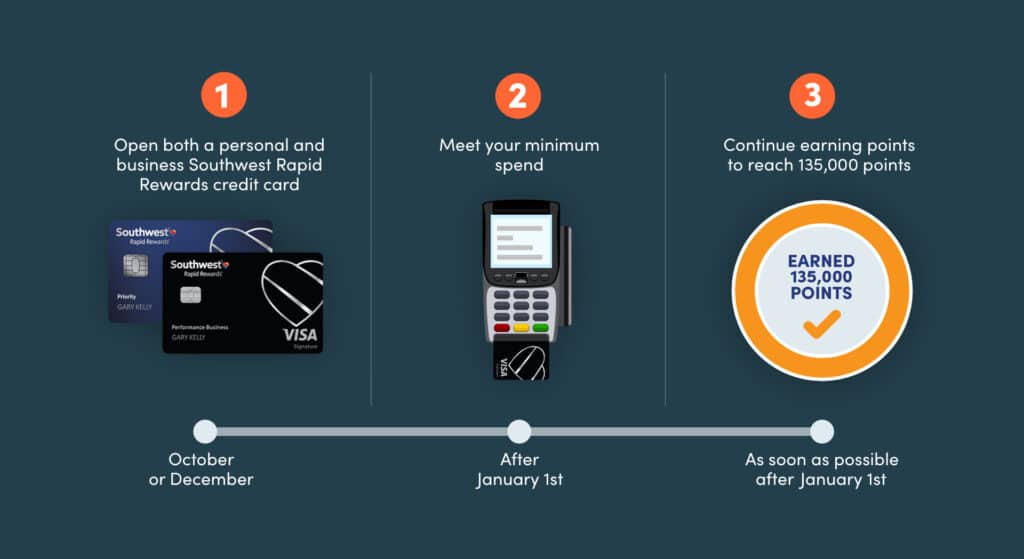

Step 1: Open a Personal and a Business Southwest Credit Card

Southwest partners with Chase and offers three personal credit cards and two business credit cards.

The personal cards are:

- Southwest Rapid Rewards® Plus Credit Card

- Southwest Rapid Rewards® Premier Credit Card

- Southwest Rapid Rewards® Priority Credit Card

The information for the Southwest Rapid Rewards Premier Credit Card has been collected independently by MileValue. The card details on this page have not been reviewed or provided by the card issuer.

Southwest Rapid Rewards® Priority Credit Card

Earn 50,000 points after you spend $1,000 on purchases in the first 3 months from account opening.

The business cards are:

- Southwest® Rapid Rewards® Performance Business Credit Card

- Southwest® Rapid Rewards® Premier Business Credit Card

Southwest® Rapid Rewards® Performance Business Credit Card

Earn 80,000 points after you spend $5,000 on purchases in the first 3 months from account opening.

Unfortunately, it isn’t quite as easy as that. Of course there are some rules we’re going to have to consider.

First things first, you’ll need to be sure you’re under the 5/24 card count with Chase, meaning you haven’t opened five or more consumer credit cards from any bank in the last 24 months.

If you’re at 4/24, be sure to apply for a Southwest business card first. By opening a business card first, you’ll remain at 4/24 if your application is successful, as Chase business cards don’t add to your count. That way, you’ll then be able to apply for a personal card after.

Second, Chase won’t let you get a new Southwest welcome bonus on any of the personal cards if you currently have one of the personal Southwest cards open or if you received a bonus in the past 24 months. Luckily, this rule doesn’t apply to business cards, meaning you can get one personal card and one business card and earn the welcome bonuses on both.

Third, be sure the bonuses are high enough for you to earn or at least get close to the Companion Pass. Around this time of year, you’ll see the Southwest credit card bonuses start rising. Wait until the bonuses are at about 40,000 to 80,000 Rapid Rewards points before applying.

When opening your cards, don’t rush. These bonuses tend to stay around through November or December, sometimes even later. Timing is crucial to get the longest duration of your Companion Pass.

Southwest® Rapid Rewards® Premier Business Credit Card

Earn 60,000 points after you spend $3,000 on purchases in the first 3 months your account is open.

Step 2: Meet the Minimum Spends in January 2024

This is probably the biggest area where we see people mess up earning the Companion Pass.

You must earn 135,000 in a calendar year—not in a 12-month period, but in a calendar year. That means you have from Jan. 1, 2023, to Dec. 31, 2023, to earn it in 2023. If you’re looking to earn it in 2024, any points earned in 2023 will not count. Remember, you want to try to earn it at the start of the year, so you want your bonus points to post in 2024.

If you meet your minimum spend too early, your points may post early. You want to avoid this at all costs. Thankfully, this is pretty avoidable with some care.

First, we don’t recommend adding anyone as an authorized user. Plenty of people have had the best of intentions. “Honey, I used the Southwest Card for gas since I know you wanted everything on the card.”

Trust us—it happens more often than you’d think.

Second, don’t rush to apply. If you open your card in the next few days, your window to finish your minimum spend in January shrinks. You’ll only have about a two-week window to finish the spend. Waiting until the end of October or early November to open a Southwest card will give you plenty of time in the new year to finish your spending.

Third, don’t get too close to meeting your spending requirements. We recommend spending within about $500 required for your bonus and socking the card away until Jan. 1. With two cards, you’ll have a few weeks to meet the rest of your bonus spend.

Remember, the bonuses will be the biggest point balances you earn toward your Companion Pass. Earning them too soon means you’ll either lose an entire year off your Companion Pass or you’ll need to make up the 40,000- to 80,000-point difference in spending in 2024.

Finally, be meticulous. We’re not here to tell you how to manage your finances, but be sure to track how much you’ve spent on your card. Take screenshots of your bonus offer when you apply—you don’t want to think your spend requirement was $3,000 when it was really $2,000.

If you’ve already opened the card and you can’t quite remember the offer terms, your best bet is to send a secure message to Chase asking them what your bonus offer was.

Southwest Rapid Rewards® Plus Credit Card

Earn 50,000 points after you spend $1,000 on purchases in the first 3 months from account opening.

Step 3: Earn Any Remaining Necessary Rapid Rewards Points

So, you opened the cards, you waited until Jan. 1, and now you have 120,000 to 130,000 Rapid Rewards in your account. How do you earn the rest of the points toward your Companion Pass?

First, keep putting all your spend on the card. Earning the Companion Pass isn’t a race. Yes, some people earn it the first few weeks of January, but most likely you won’t be using it until spring or summer anyway. Use those extra months to keep putting the spend on your card. You’ll still get 18 to 23 months to use your Companion Pass.

Second, take advantage of Southwest’s earning partners. You can use the Rapid Rewards Shopping portal to earn more points on top of most purchases you make online. Yes, these count toward the Companion Pass, and yes, they will stack with the points earned from your card.

Third, keep in mind that all co-branded Southwest cards (consumer and business versions) give you a boost of 10,000 Companion Pass qualifying points per calendar year.

You’re eligible to receive one boost per calendar year only, regardless of how many Southwest Rapid Rewards cards you have open. The annual point boost is posted to your account by Jan. 31 of each calendar year or up to 30 days after opening your account. This is an easy way to rack up your final 10,000 points.

Finally, fly Southwest. If you find a cheap fare, you’ll earn Rapid Rewards on your ticket. Save your points for later when you have your Companion Pass (if that works with your points and miles plans).

Once you hit 135,000 points, you’ll see your Companion Pass in your Rapid Rewards account. That’s it! You don’t have to redeem points for it, as you’ll still have all your points available to use.

Speaking of using those points…

Southwest Rapid Rewards® Premier Credit Card

Earn 50,000 points after you spend $1,000 on purchases in the first 3 months from account opening.

How to Use the Southwest Companion Pass

Using the Companion Pass is pretty simple.

Remember, the 135,000 points you earned to get your Companion Pass aren’t cashed in. You still get to use them for award flights.

As a reminder, the Companion Pass can be used on any flight, whether you’re paying cash or points. That’s 135,000 points you get to redeem and bring your companion with you for almost free.

Once you’ve earned your Companion Pass, you’ll be able to add your companion to any ticket you’ve booked, as long as there’s an open seat on the plane.

To add a companion, book a flight, then go to “My Account” and locate the flight on which you want to bring a plus-one. You’ll notice in the lower right hand corner the option to “Add Companion.” Simply click this button, fill out the relevant info, pay the necessary taxes and fees, and you’ll receive confirmation shortly that your companion has been added.

Frequently Asked Questions

What is the Southwest Companion Pass Worth?

Southwest Rapid Rewards points are usually worth around 1.3 to 1.6 cents each. So, 135,000 Rapid Rewards points are worth between $1,755 and $2,160 worth of travel on Southwest, give or take.

Since you can redeem these for a BOGO flight, that effectively makes the Companion Pass worth between about $3,150 and $4,320.

How do I book a flight for my companion?

To book a flight for your companion, you first have to book your own flight. Then, go to “My Account” on the Southwest website. All your existing flight reservations will have the option to add a companion. As long as another seat is available, your companion can be added to your trip.

Do I have to cash in my points for the Companion Pass?

Nope! You get to keep the points in your account. In fact, you can use those points to book flights for free(ish) and add your companion.

What happens if I spend my points before hitting 135,000?

Don’t worry, Southwest keeps track of the total number of points you earn during the year. You can spend them before earning the Companion Pass. Once you hit 135,000 points for the calendar year, you’ll see the Companion Pass in your account, even if you’ve redeemed some points before earning it.

Can I purchase 135,000 Rapid Rewards and earn the Companion Pass?

No.

Can I add my Companion to a flight booked with points?

Yes! You can add your companion to any flight you’re taking.

If I booked a flight before earning the Companion Pass, can I still add my companion?

Yes, you can. Once you earn the Companion Pass, you can add your companion to any existing reservation.

Can I transfer 135,000 Chase Ultimate Rewards to earn the Companion Pass?

No, transferred points don’t count toward Companion Pass.

TL;DR The Steps To The Companion Pass

For those who don’t want to digest the entire article or want to find a quick reference point in the future:

- Open both a personal and a business Southwest Rapid Rewards credit card in November or December when the welcome bonuses are around 40,000 to 80,000 points.

- Meet your minimum spend AFTER Jan. 1, 2024.

- Continue spending on the cards, flying Southwest or earning points from online shopping partners to get the full 135,000 points needed for the Companion Pass.

- Choose your companion and start adding them to any flights you want them to fly with you.

- Enjoy your Companion Pass for the remainder of 2024 and all of 2025.

Southwest® Rapid Rewards® Performance Business Credit Card

Earn 80,000 points after you spend $5,000 on purchases in the first 3 months from account opening.

Welcome to the Companion Pass Club

That’s it! If you follow these steps, you’ll be on your way to having your Companion Pass solidified for 2024 and 2025. Remember, be patient. Rushing your Companion Pass is the best way to miss out on earning it.

If you want to chat more or learn how the Southwest Companion Pass could fit into your long-term credit card strategy, feel free to book one of our free credit card consultations. We can dive a bit deeper into your personal points situation to find out if the Companion Pass is right for you.

Great article, thought I would add a couple of additional tips. I have achieved the companion pass once before and now targeting Jan 2022 for a new one because it expires Dec 2021. A twist to consider: reaching the spend limits (and point accrual minimum) can be difficult to do early in the year if your big bills don’t happen to occur then. I use insurance premium bills that come late in the year or early in the next year to meet the bulk of the spending. Requires scheduling the payments to maximize spend in January either by paying new or upcoming policies in full then or paying off previous year premiums which you have delayed by paying only the minimum monthly requirement until the new year rolls around. Finally the ace-in-the-hole to cross the 125,000 point threshold on the Jan date desired is advance paying utility bills. Some utilities have a minimal charge to put advance bills on your credit card, allowing a credit balance for over-paying the current bill. You’re going to spend the money anyway, you just do it a little early. The last thing you want to do is go out and buy something you would not normally buy just to meet a spend requirement, a practice known as financial suicide.

I’ve done this before and will again in January 22. When I did this 2 years ago, I discovered that the points needed for a free companion pass were increased from 110,000 to 125,000. Are you confident that the points needed in calendar 2022 are going to remain at 125,000??

SW has not announced any changes to the companion pass requirements for 2022 at this time. If for some reason they were to change (we don’t anticipate them to), they would announce it like they did previously with a bit of a heads up.

I just spoke to a customer service agent who said that if I achieve my 125,000 early in the year, say February or March — that it applies to a free companion in 2023, NOT the remainder of 2022. Can you confirm that it counts for the remainder of the year I reach it in, plus the following year?

Thanks

They’re incorrect. You’ll have the pass for the remainder of the year you earn in PLUS the entire year following. So if you earn it in early 2022, you’ll have it for the rest of 2022, as well as the entirety of 2023.

Matt Brown is correct about the start/ending dates for a SW CP. I know this from the many times I have had the CP, earning it usually in January of a given year.

I’m considering to apply for a Southwest credit card to reach companion level. Since now is almost July 2022, do I need to wait until Jan 2023 to cross the 125,000 threshold? I do need to fly this with family companion in 2022 so waiting til Jan 2023 does not make sense.. please advise.

Your points earned in 2022 will reset. Best guidance will be to wait until end of this year, and start opening both a biz and personal SW card, but waiting until January 2023 to meet the bonus. That way, you’ll earn it for almost 2 years.

Hi I opened a sw card in February 2022. I received a companion pass as a bonus until February 2023. I am at about 115,000 thousand points on my card and have stopped spending on it. I want to get the companion pass again for all of 2023 and 2024. I am confused about the rule. If I earned the remainder 10,000 points in the beginning of January 2023 wouldn’t that be a different calendar year than the points I earned in 2022?

You got it. All 125k points have to be earned in the same calendar year. So your best option here will be to open a SW Biz card towards the end of 2022, or early 2023, but WAIT to hit the bonus until 2023 so the points post then and count towards your Companion Pass earning for 2023. You can then either spend your way to the remaining points, or open a 2nd biz card and meet the bonus to surpass the 125k.

If I open a personal SW card and a biz SW card am I able to view both in one account in the Chase mobile app? I currently have a CSP and a Chase Ink business card and login separately to view each one. My question is, how would I accumulate 125000 points for the SW companion if I have to login separately to personal and biz accounts?

When applying, put your same Southwest account number on both applications and the points will go to the same account. If you want to merge the logins, you can do it online at https://www.chase.com/digital/customer-service/helpful-tips/business-banking/general/cbo-account-linking

If that doesn’t work, you can call in to Chase and they can do it as well.

I currently have the CSP and the Chase Ink business cards. I login to the mobile App separately to view each card. My question is, how do I accumulate 125000 points to earn SW companion pass if some points would be in the business account and some in the personal account?

I earned a SW rewards on April 11, 2021. My account was closed on March 2022. There is a new offer to spend 4000 and get a companion pass good until February 28, 2024. When should I apply for the card and spend to try to earn my points. Offer ends 3/13/2023. Do I have to wait to apply for the card until the last day? Can I get the card now and just wait to spend the 4000 so its not on my statement before April 2023? Thank you.

You can only earn the bonus on a Southwest Card every 24 months. So you’d need to wait 24 months from when the bonus was earned. You’d need to know when you last received the bonus to time it appropriately

I got the CP in early 2022 (now expiring 12/31/23) using your suggested method of getting new Chase bus & personal cards, and my bonuses were posted 1/23/22 and 1/27/22. I want to to the same thing – should I cancel both Chase cards, then wait 30 days or so to re-apply? I would then meet the spending requirements sometime in Feb 2024.

Yep. You could go ahead and do the other business card now, since having one doesn’t preclude you from getting the bonus on the other. But on the personal it will be 24 months from earning the last bonus, so you would need to wait on that one.

Thanks – does that mean I need to wait to apply for the new personal card until after the 24 months? I went ahead & cancelled the bus card – do I need to wait 30 days to apply for a new one?

Travis – I just looked at the Performance Business Card, and it has the same restriction – if I’ve received a mileage bonus in the last 24 months, I’m not eligible. Since my previous cards gave me bonuses in Jan 2022, I’d have to wait to apply after those dates, correct? And it looks like these SW bonus offers will expire before then. Am I missing something?

To clarify – the Personal cards have the restriction that you can’t get the bonus if you’ve received one in the past 24 months on any personal cards. The business card restriction is only for the same card. So you could do the Premier business card now if you did the Performance last time.

On the business card side, since you cancelled the performance and you can do the premier now, no need to wait the 30 days.