MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Chase has come out with new sign up bonus eligibility rules that make earning a Southwest Companion Pass more complicated.

As of April 5, if you already have a personal Southwest credit card open (the Personal Plus or the Premier Plus), you are no longer eligible for the other personal Southwest credit card. You are also ineligible for the bonus on a Southwest personal card if you have earned a bonus on the other one in the last 24 months.

Many people’s strategy to earn the 110,000 Southwest Rapid Rewards required to qualify for a Companion Pass is via the bonuses on each personal card. That strategy has been rendered unviable by these new eligibility rules. Thankfully the scope of these new rules does not effect eligibility for the Southwest business card, so earning the bonus on one personal card and the business card is still a viable means of earning the Companion Pass.

What’s a Companion Pass?

The Southwest Companion pass allows you to designate companions who fly for just the taxes on every Southwest flight you fly. That’s $5.60 each way within the United States and a bit more on Southwest’s international routes.

The Cards

There are three Southwest credit cards: Premier Personal, Premier Business, Plus Personal.

- Personal Plus: 40,000 bonus points after spending $2,000 in three months, $69 annual fee NOT waived for the first year, 3,000 bonus points each year you renew

- Premier Plus: 40,000 bonus points after spending $2,000 in three months, $99 annual fee NOT waived for the first year, 6,000 bonus points each year you renew

- Southwest Rapid Rewards Premier Business Card: 60,000 bonus points after spending $3,000 in three months, $99 annual fee NOT waived for the first year, 6,000 bonus points each year you renew

Now, the easiest way of securing 110,000 Rapid Rewards is by opening and earning the bonus on one personal card + the business card. Read How to Get Approved for Business Cards if you’re not sure about them. You may be eligible and not realize it (for example, you don’t need an EIN, it is 100% OK to open a business card under your own name and social security number).

I wouldn’t aim to earn the Companion Pass right now, though.

All that being said, right now is not the optimal time to earn a Companion Pass. You get the Companion Pass for the entirety of the year in which you earn the qualifying Rapid Rewards, as well as the following calendar year. If you opened two cards and earned their bonuses by, say, June, that means you’d get the Companion Pass for June – December 2018, and January – December of 2019. But if you earned it in January of 2019, you’d have it for all of 2019 and 2020.

40k bonuses on the personal cards are also not historically high. They are known to increase to as much as 60k. If you don’t want to have to put extra spending on your card (or earn points another way), then wait until the bonus on the personal card hits at least 50k. A 50k bonus + 60k bonus gets you to the 110k benchmark without any extra effort.

Other Ways to Earn Points that Count Towards Companion Pass Aside from Sign Up Bonuses

While sign up bonuses are the easiest and fastest way to earn Rapid Rewards that count towards the Companion Pass, not everyone is going to be able to/want to open a business credit card. Obviously you can earn Rapid Rewards from flying paid Southwest tickets, but there are various other ways to help boost your balance.

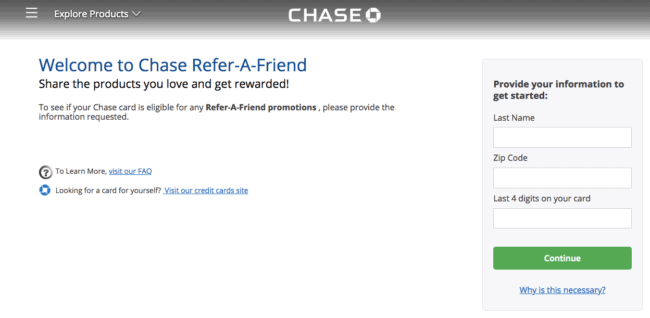

Refer friends for the Southwest Cards

Check here if you have any referral links available to you for the Southwest credit cards. The standard offer is 5,000 Rapid Rewards per referral, with a cap at 50,000 points per year.

Booking Hotels Through Rocketmiles

Rocketmiles is a hotel booking site. Hotel booking sites have huge margins, but they can’t usually undersell the price on the hotel’s site, so most simply offer the same price without differentiation. Rocketmiles is totally different. It takes those huge margins and rebates as much as it can to its customers in the form of frequent flyer miles in any of nine programs. Each night booked at a hotel earns 1,000 or more miles to be accredited to the loyalty program of you’re choosing. Affiliated loyalty programs are at the bottom of the homepage, and include:

Haven’t used Rocketmiles before? Use my referral link to sign up and your first booking will earn you an extra 1,000 airline miles (they will not count for towards the Companion Pass, however).

Book a hotel through Rocketmiles you’ll earn anywhere from 1,000 to 10,000 miles per night based on the price of the hotel nights. Note however that you won’t earn Hotel points if you choose to book this way. And be sure to double check that the price of your desired hotel isn’t cheaper off of Rockemiles before booking.

1-800 Flowers

For spending $29.99 or more on 1800flowers.com and entering promo code RR22 at checkout, you will earn 1,000 Rapid Rewards.

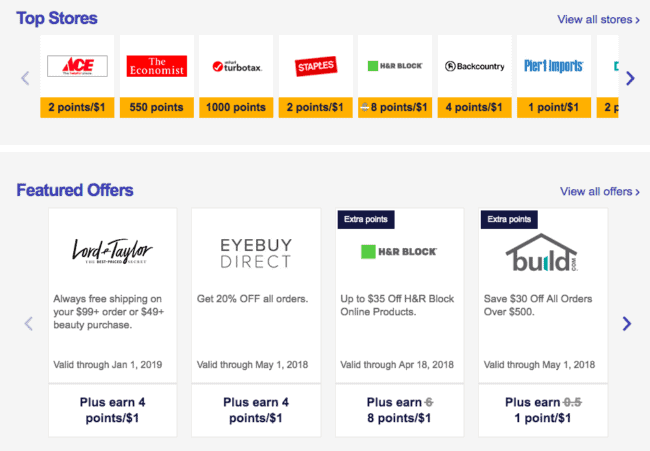

Rapid Rewards Shopping Portal*

Check the Rapid Rewards Shopping Portal to see if you any of your planned online shopping can be done through their links for extra Rapid Reward points.

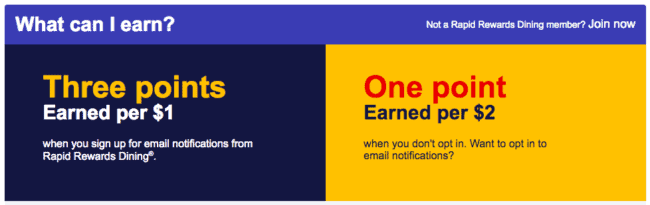

Rapid Rewards Dining Program*

Sign up for Rapid Rewards Dining to link your credit card and start earning up to 3 Rapid Rewards per dollar spent on participating restaurants.

*Note that spending threshold bonuses for the Dining program and Shopping Portal do NOT count towards the Companion Pass.

Bottom Line

Chase is enforcing two new rules when it comes to eligibility for the bonus on the Southwest consumer credit cards:

- If you have one Southwest consumer credit card open, you are not eligible for the other.

- If you have earned a sign up bonus on a Southwest consumer credit card in the last 24 months, you are not eligible for the bonus on the other Southwest consumer credit card.

This means going forward, the easiest strategy to earn the 110,000 points necessary for a Companion Pass will be to open one Southwest consumer credit card and one Southwest business credit card. If you can’t open a business card, then you’ll have to get creative with a mixture of points earned from paid flights, referral bonuses, 1-800 Flowers purchases, or though Rapid Rewards’ dining program or shopping portal.

If you opened two cards and earned their bonuses by, say, June, that means you’d get the Companion Pass for June – December 2018, and January – December of 2019. But if you earned it in January of 2019, you’d have it for all of 2018 and 2019.

-this does not make sense to me-the last sentence. Do you mean 2019-2020. I am interested bc I live in Hawaii and Southwest is planning routes

Yes, I meant 2019-2020. Edited!

Thank you!