MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

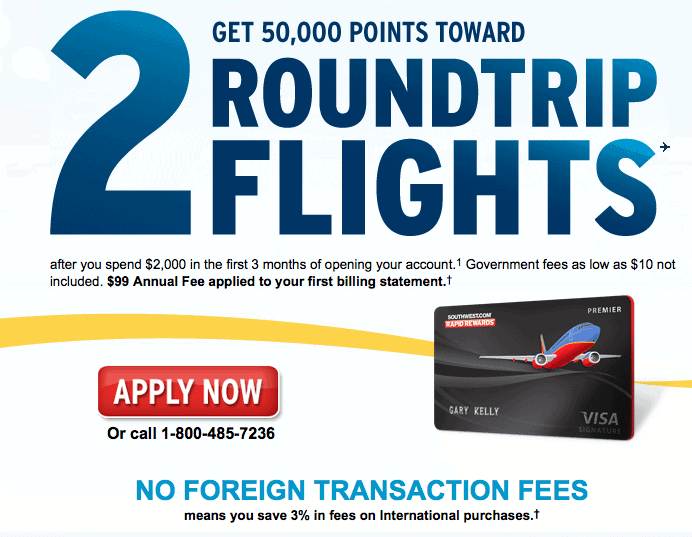

Southwest and Chase market their Southwest card in a misleading way. The big bold letters say:

The 50,000 points the card offers in no way correlate with two roundtrips. All Southwest Wanna Get Away fares are available for 70 points per dollar, so 50,000 points are worth about $714 in Southwest flights, however many one ways or roundtrips that is.

What I find really strange about the marketing, though, is that it still says “2 Roundtrips.”

That’s the same thing it said when Wanna Get Away fares were available for 60 points per dollar up until last month.

Now the points are worth 17% less.

Shouldn’t the bold letters now say “1 and 5/7 Roundtrips“?

I am under the impression that after a very critical moment which was “CVS no more accepting CC for purchases of VR card” a few weeks ago, there’s hardly anything to draw attention of readers nowadays on any blogger’s website. Unless I am wrong, it may be due to Happy Easter Time / weekend and/or other Spring Break observations.

Didn’t the 50K offer expired few weeks back? Did the Chase SWA 50K came back again? There used to be 3 more 50K cards. Are those back as well?

In some cases you can get more than 2 roundtrips. If you book far enough in advance, you can get some decent value out of your points.

Just for fun, I checked LGA/PHX in October. You can fly for 18,600 pints roundtrip. That’s 6400 miles/points less than the legacy carriers charge of 25,000 miles.

That example would give you 2 1/2 roundtrips or 5 one-way flights.

Their wording still works fine, it says 50,000 points TOWARD 2 roundtrip flights.

“2 roundtrip flights” is so irrelevant that it’s misleading. You could get more than 2 or fewer than 2. I think it’s easier just to say that the points are worth $xxx toward free flights in the case of fixed-value Southwest points.

I concur with dhammer53. Redemption costs vary by the distance you are traveling and how far out in advance you purchase. I just flew RT MSP-DEN for 15,100 pints, which translates to over 3 roundtrips. As always, your mileage may vary.

There is a certain market segment that loves the Southwest program, which does have its good features. But their devaluation was pretty severe, and it was a straight devaluation, not a change in features that hit some people more than others like recent ones from the legacy carriers. Southwest just decided their points were worth too much and by fiat cut the value.

Seems like Two Roundtrips! is much better marketing than Several Segments Depending on The Dollar Cost and Conversion Rate!