MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

The Citi Prestige® Card is one of the top all around cards for its 40,000 point sign up bonus, perks, and bonus categories. For some people, the Citi Prestige® Card‘s biggest perk is lounge access at all Priority Pass lounges worldwide, but for me the biggest perk is the $250 annual Air Travel Credit.

What is the $250 Air Travel Credit?

The Air Travel Credit is designed to offset air fares, baggage fees, award fees, lounge access, and some in-flight purchases.

Each time your statement closes, charges on that statement that coded as Air Travel are credited back to your account until $250 in credits are received for the calendar year.

I used my entire $250 credit for 2015 up on my first statement, and my entire 2016 credit on my January 2016 statement.

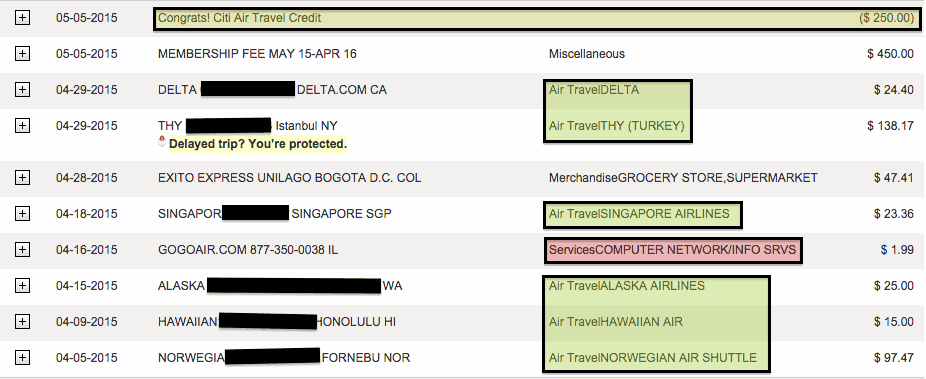

Here’s what my first statement of my Citi Prestige looked like on citi.com:

Let’s take a look at my highlights. On the top, you can see that I got the full $250 Air Travel Credit. It’s not an all-or-nothing credit; I just happened to use it all this month. If I had only made the $24.40 Delta charge, I would have gotten a $24.40 credit.

Next I highlighted in yellow all the charges that coded as Air Travel. The six charges are two award taxes, two airfares, and two bag fees.

- $24.40: Delta award tax on an award from Chicago to Buenos Aires

- $138.17: Turkish airfare for flights from Vilnius, Lithuania to Belgrade, Serbia

- $23.36: Singapore award tax on an award from Washington to Madrid that flies United

- $25: Alaska Airlines bag fee

- $15: Hawaiian Airlines bag fee

- $97.47: Norwegian airfare on a flight from Madrid to Helsinki

That adds up to $323.40 in Air Travel charges, so I got the maximum $250 Air Travel Credit.

I can’t imagine any reader of this blog not maxing out the credit each calendar year, since we hopefully all book enough award trips or low cost carrier flights.

What didn’t earn the credit?

On my Alaska Airlines flight, I paid $1.99 to watch a TV show, a purchase which was processed by Gogo, not Alaska Airlines. I highlighted the charge in red on my statement because it coded as Computer Networking and did not trigger the Air Travel Credit.

But Some People Say You Can Get $500 in Statement Credits from Citi Prestige

The Air Travel Credit resets after your December statement closes each year, so if you get the Citi Prestige® Card now, you’d have about five months to earn your first $250 statement credit. Then you’d have about seven months to earn your 2017 Air Travel Credit before a second annual fee is due.

So when people say you can get $500 in Air Travel Credits during your first year as a cardholder, that is absolutely true.

This $500 in Air Travel Credits more than offsets the annual fee for the first year, meaning you are “making money” to enjoy all these other benefits.

- 40,000 bonus ThankYou Points after $4,000 in purchases made with your card in the first 3 months the account is open

- access to the Priority Pass lounges

- the fourth night free on hotel stays

- $100 statement credit to offset the Global Entry application fee

- 3x points per dollar on air travel and hotels

- 2x points per dollar on dining out and entertainment

Bottom Line

The Citi Prestige® Card changes its offer tomorrow. I don’t think it will be good news, so if you haven’t gotten one of the best all around cards on the market, hurry!

You can get $500 in Air Travel Credits during your first 12 months as a cardholder, as long as you get $250 before 2016 ends and $250 in early 2017. This is in addition to 50,000 bonus points, lounge access, and a host of other killer perks.

Application Link: Citi Prestige® Card

Just applied today for Chase Freedom and Citi Prestige, was quite an ordeal. Credit scores in 820s. Applied first for Chase Freedom today due to 5/24 rule (I opened 4 earlier this year), approved for $28k limit. Tried to go to local branch but they would not give me better than 15k for $500 public offer, so applied online.

Then headed to Citi branch to apply for Prestige, as I wanted to try to get $450 AF reduced. My argument was I already have global entry, so I won’t get that credit. First branch no dice. Went to another branch, much more cooperative. This branch had all kinds of conflicting brochures though. She showed me docs she just printed out that had bonus of 50k for $5k spend (not $3k spend) and $350 AF. This might be what the new deal is as of tomorrow. Anyway, applied and she said she submitted for $350 AF as if I was gold client, but she wasn’t sure if they would honor it. She hit apply, then got the dreaded “We need more time to review” message. Then she sat on hold and talked with analyst, who finally approved me for only $10k credit limit. I have 2 other Citi cards with about $12k credit limit each. I was surprised they gave me a hard time and such a low limit. Not sure if they are trying to put the brakes on new apps before the change. I’ll just call back in a month or two and try to get my limit increased.

The In-Branch offer is not as good, according to a DoC post, it has a $5K min spend, no 2X TYPs for Dining, and ALL Prestige cards lose the AA Lounge access June 20 2017. On the plus side, the AF is $350 for ALL in-branch apps. As far as the CL goes, as long as it’s $5K or more, it’ll have all the better benefits of a World mastercard, which is enough for me, I’m not looking to put the MSRP of a new car on the card!…LOL

[…] Air Travel Credit: $250 statement credit per calendar year ($500 during first year of cardmembership) […]

[…] & fees/in-flight purchases/etc. in 2016 and the first $250 in plane tickets in 2017 are free. That’s another $500 in free tickets before you pay the annual fee again in 12 […]

[…] The Citi Prestige® Card offer a $250 Air Travel Credit each calendar year that offsets your first $250 in spending on airlines with the card. Taxes and fuel surcharges on an award ticket definitely count. If your taxes and fuel surcharges are less than $250, the entire amount will be credited back on your statement. If they are more than $250, $250 will be credited back. You can get $500 in Air Travel Credit within the first year of card membership. […]

[…] But do the math and these cards are all well worth it for the first year when their big bonuses and two statement credits–for $400 to $600 worth of free travel–before the second annual fee is […]