MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

This post is part of a four-part series. In Part 1, we looked at the mechanics of the Delta Airlines program. In Part 2, we looked at its award chart and rules to find valuable awards. In Part 3, we valued specific SkyMiles awards. In Part 4, I’ll put a number on one SkyMile.

In this post, I’ll explain why I value one SkyMile at 1.22 cents, but your value will be different. To start I’ll go back to the values for the redemptions I found in Part 3. To find your value, you’ll need to start with your possible redemptions. My redemptions:

- LAX-ATL//ATL-MSY, MSY-LAX (E) 1.52 cpm

- LAX-CDG//CDG-LOS, LOS-CDG-LAX (B) 1.40 cpm

- LAX-JFK-LHR, MAD-CDG//CDG-LAX (E) 1.38 cpm

These range from 1.38 cents per mile to 1.52 cents per mile. Here’s where the math stops and the estimation begins. We want to get a single number, so pick a number from inside the range of redemptions. Base your decision on which redemptions you’re most likely to make and which will take the bulk of your miles. I’ll pick 1.45 cents per mile.

The last step is to make adjustments to the figure you’ve chosen based on how the rules of Delta’s program differ from paying with cash and how you value these differences. We need to do this because when we value SkyMiles in cents per mile, we are putting a cash figure on a mile, thus comparing the program to cash. We talked about the rules of the program in Post 1. Here are the relevant differences between booking with SkyMiles and cash:

- Open jaws and stopovers don’t cost extra with SkyMiles. They usually cost a little extra with cash. Advantage Delta.

- Oneways cost the same amount of miles as roundtrips with SkyMiles. This is horrible for two reasons. The first is that a oneway with cash is usually less and sometimes half the cost of a roundtrip. The second is that you need to earn tons of Delta miles before you can redeem any of them. For instance, only 17,500 miles will get you oneway to Hawaii with AA miles, but with Delta miles you need 40,000 miles. Huge advantage cash.

- Delta charges a close in ticketing fee of $75 within 21 days of departure. Of course, there are no close in ticketing fees with cash, but prices tend to go way up. The SkyMiles price goes up too. Too close to call.

- Cancelling a cash ticket costs $150 for most airlines. Cancelling a SkyMiles award ticket costs the same. Wash.

- Delta’s low level award space is poor, and its partner availability is also poor. While few flights can be booked with Delta miles, every flight is available with cash. Huge advantage cash.

Delta’s main problem is its bad availability compared to other programs and especially compared to cash. This is the major drawback of all (non-fixed-value) frequent flier programs, and it’s magnified with Delta miles.

Delta has a second huge problem with its value: the inability to book oneways for half the roundtrip price. This necessitates building up your SkyMiles account to really high levels before making any redemptions and is a major drawback of Delta miles. It also means you will tend to orphan more Delta miles because you can’t usually use them in increments of fewer than 25,000 miles. Huge advantage cash.

At this stage, I lowered US Airways’ miles 0.17 cents because of its roundtrip award pricing and bad availability compared to cash. Delta has the same horrible roundtrip pricing, but it has much worse availability, so I will lower Delta’s value 0.23 from 1.45 cents above to 1.22 cents.

If you can earn huge sums of Delta miles, so the roundtrip requirement isn’t a big problem, you have complete flexibility on when you can travel, and you like to only take vacations to one or two place at a time, you should lower the value of SkyMiles less than I did.

If, instead, you have trouble running your SkyMiles balance into the mid-six-figures, and you like to travel to many places on a single vacation through oneways, you should lower the value of Delta miles more than I did.

In sum, SkyMiles are the least valuable major airline loyalty currency in the world. Delta’s poor availability, its dearth of partners, and its roundtrip requirement gut the value of SkyMiles. The “SkyPesos” crack rings true.

I value one SkyMile at 1.22 cents.

Bonus

This offer has expired. Click here for the top current credit card sign up bonuses.

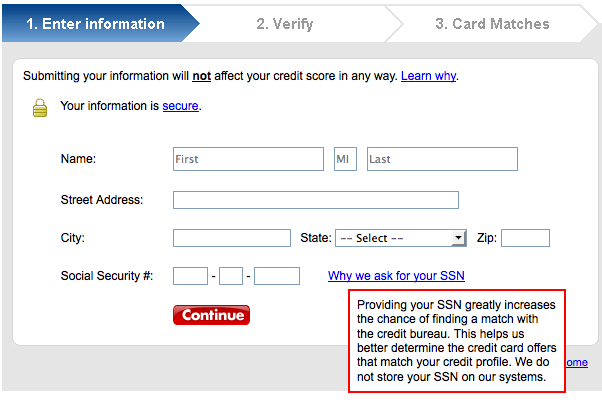

1. Go to CARDMATCH and enter in your personal data.

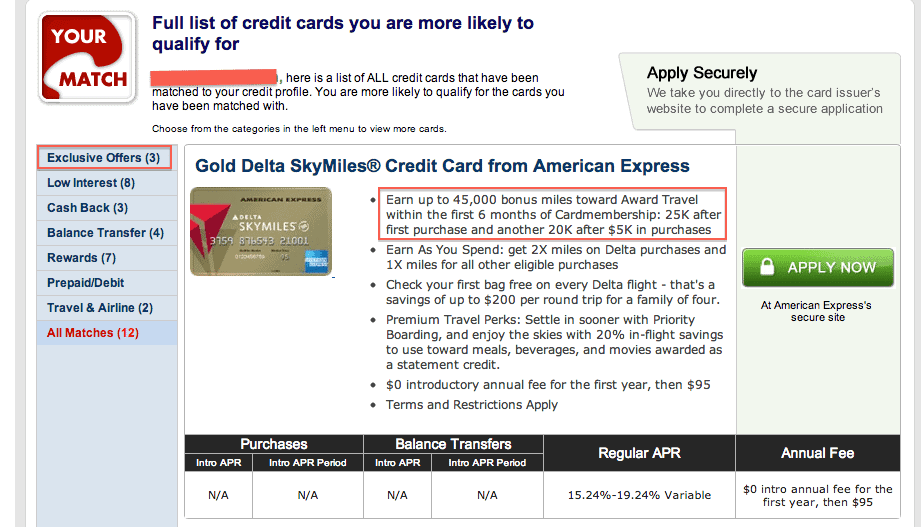

2. Click on Exclusive Offers if the opportunity presents itself.

3. Apply?

After meeting the minimum spending requirement you’d have 50,000 Delta miles–enough for two roundtrips within the continental US. I probably wouldn’t apply for this card though if I wanted to use the miles that way though.

SkyMiles are best for trips to Australia, Asia, Tahiti, Africa, and Europe. To get to any of these places, you’ll need a few more SkyMiles, which are easy to come by by way of 1:1 transfers from Membership Rewards.

I would certainly apply for this card if I didn’t have a SkyMiles card already. While Delta miles are tougher to use than American, United, and US Airways miles, that doesn’t mean they should be ignored.

Here is the full offer that I can glean from my friend’s offer page:

Gold Delta SkyMiles Personal Card

The SkyMiles personal card comes with 45,000 total bonus Delta miles–25k on first purchase and 20k more after $5,000 in purchases in the first six months.You earn one SkyMile per dollar on all spending plus 2 per dollar on Delta purchasesYou get a free checked bag for you and up to eight companions on Delta flightsZone 1 Boarding20% off onboard purchasesThere is no annual fee the first year, then $95 thereafter.

What are the chances CARDMATCH will offer you the SkyMiles offer?

I’m not sure, and please report your data point in the comments. I didn’t get the increased offer (although I currently have a Delta SkyMiles card). My first friend didn’t get the offer. My second friend did.

It only takes about twenty seconds to find out if you are targeted for the 45k SkyMiles offer, so you might as well find out.

Great work scott, would like your opinion on something very trivial. I am 1500 miles short of Gold on delta, and have around 72000 miles remaining. Would they be well spent on getting a sky miles membership which gives me 1500 MQM’s (cost is 70,000 miles) or better to pony up 395 for the status. Appreciate your thoughts. I see that you value them at 1.22 cents, which definately makes paying cash better, but redemption options are so bad that sometimes i feel it is better through miles.

I would MUCH rather spend $395 than 72k miles. You can do a lot with 72k miles going forward. At a minimum, you can get 1 cent per mile by redeeming them this way –> http://www.delta.com/content/nas/content/live/milevalu/en_US/skymiles/use-miles/pay-with-miles.html

[…] of a four-part series. In Part 1, we will look at the mechanics of the Delta Airlines program. In Part 2, we’ll look at its award chart and rules to find valuable awards. In Part 3, we’ll value […]