MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

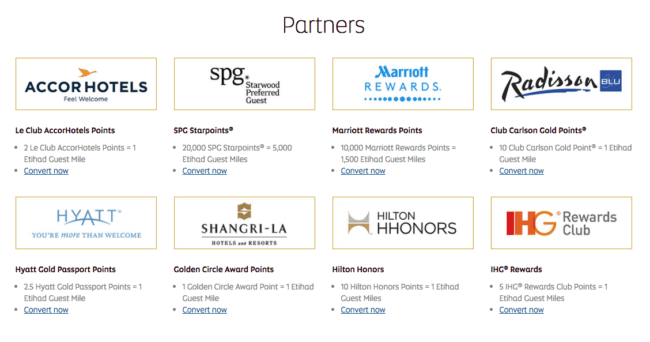

Through April 30, 2017, transfers from hotel partners to Etihad Guest will earn a 20% bonus.

Your best transfer options are probably between Starwood Preferred Guest and Etihad, or purchasing a Marriott Hotel + Air Travel Package that contains Etihad miles.

- Normally, 20,000 SPG points = 25,000 Etihad miles (thanks to the everyday 5k bonus you get on transferring in increments of 20k), so with the current transfer bonus, 20,000 SPG points = 30,000 Etihad miles.

- As One Mile at a Time pointed out, normally for Marriott Hotel + Air Package 2, you’d pay 270,000 Marriott Rewards for seven nights in a Category 1 – 5 Marriott and 85,000 Etihad miles. With the current transfer bonus, for 270k Marriott Rewards you’d get seven nights in a Category 1 – 5 Marriott and 102,000 Etihad miles.

I wouldn’t transfer speculatively, but if you have a high value use for Etihad miles (like one of the awards listed below), transfer away!

Using Etihad Miles for Etihad Flights

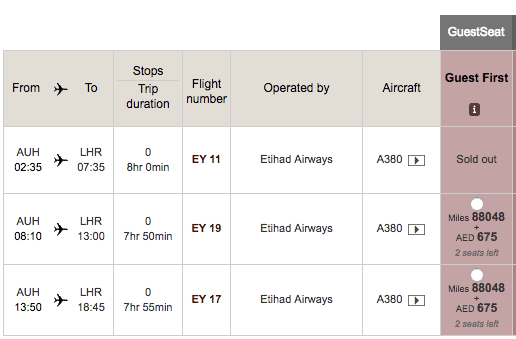

Etihad Guest Miles aren’t very good for booking First Class on the Etihad A380.

For instance, Etihad would charge 88,048 Etihad miles + $183 to book Abu Dhabi to London in First Class on the Etihad A380.

During the transfer bonus, that’s 60,000 SPG points. I’d rather spend 62,500 American Airlines miles and no fuel surcharges than 60,000 SPG points + $183, as SPG points are much more valuable than American Airlines miles.

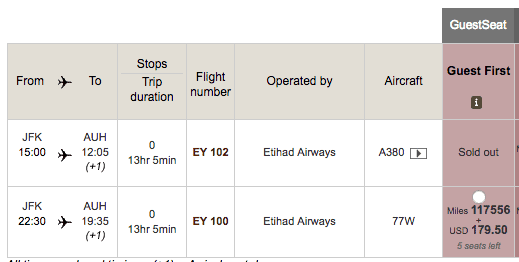

A better deal, but not a great one, is booking JFK to Abu Dhabi in Etihad First Class for 117,556 Etihad miles + $179, which would be 80,000 SPG points during the transfer bonus. You could book the same flight for 115,000 American Airlines miles + $6.

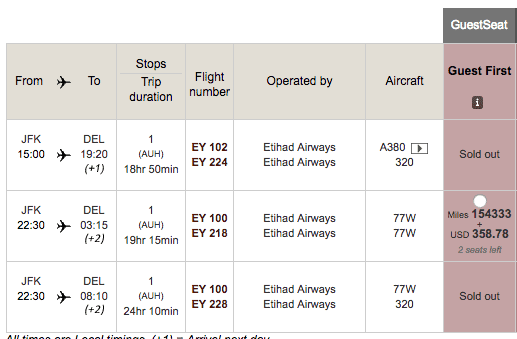

JFK to Delhi, which would feature two flights in First Class is 105,000 SPG points during the promotion. Again, this would cost 115,000 American Airlines miles.

JFK to Delhi, which would feature two flights in First Class is 105,000 SPG points during the promotion. Again, this would cost 115,000 American Airlines miles.

So Etihad miles are competitive with American Airlines miles to book Etihad flights during this transfer bonus, but that’s not saying much. Both types of miles are still expensive for booking Etihad flights. The real value of Etihad miles is to book other airlines’ flights.

Using Etihad Miles for Other Flights

Etihad Guest miles can be used on 27 other airlines. On Etihad’s page, you can click on “Know more” and then click to bring up the redemption table for that airline’s flights.

For redeeming Etihad miles on American Airlines flights, Etihad’s award chart is nearly identical to the old American Airlines award chart before the devaluation that happened March 22, 2016, at least for now. Remember 62,500 miles one way to Australia in Business Class and 20,000 miles one way to Europe in Economy? You can’t book those with American Airlines miles anymore, but you can with Etihad miles!

- 125,000 Etihad miles (85,000 SPG points w/transfer bonus) + taxes = United States to Australia roundtrip in American Airlines Business Class…to be fair though, First Class award space to Australia can be very difficult to find

- 40,000 Etihad miles (30,000 SPG points w/transfer bonus) + taxes = United States to Europe roundtrip in American Airlines Economy (however that out of pocket amount would skyrocket if you returned from London because of departure taxes, choose one of these European cities with lower taxes instead)

A few months ago I wrote about how you can fly to Europe in a flat bed for 37,000 ThankYou Points. That’s because it costs:

- 36,620 Etihad miles (29,000 Membership Rewards) + $94.70 in taxes = New York to Brussels roundtrip in Brussels Airlines Business Class (featuring a flat bed)

This is technically still speculative, as I eventually found an Etihad Guest agent who found a Business Class award seat on this flight but I did not actually carry out the booking.

I wouldn’t exactly call this a sweetspot, but it is useful to know that if you ever need to book a flight on Air Serbia for some reason, hopping over to Romania on a Eurotrip perhaps, the only miles you can use to book their awards are Etihad miles. I just booked an award for 5,000 Etihad Miles + $23 from Prague to Belgrade.

Bottom Line

Etihad Guest is offering a 20% bonus on hotel point partners transferred to Etihad Guest Miles through April 30, 2017. Most hotel point to Etihad transfer ratios are pretty bad, even with the transfer bonus, with the exception of SPG > Etihad (20k SPG = 30k Etihad miles with transfer bonus) and Marriott Travel Package 2.

This does not offer great value for booking Etihad First Class, but it does offer great value for booking partner flights like American Airlines, Air Serbia, and 23 other partners.

Check out the full terms & conditions of the promotion.

[…] Hotel points to Etihad Guest 20% transfer bonus by Milevalue. Read the article to see why this may be a good deal for some. Those who are looking […]