MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Several months ago, American Express had a very limited time offer of 70,000 bonus SkyMiles for signing up for the American Express Delta card. Delta miles aren’t worth as much to me as miles from American, United, US Airways, Frontier, Southwest, Virgin America, or many other airlines, but 70,000 miles is a lot–especially since the normal bonus is 30,000 miles.

I jumped at the chance, and I was approved for the card. The 70,000 mile offer required $5,000 in spending, so I met that requirement, and all the bonus miles posted by mid-December.

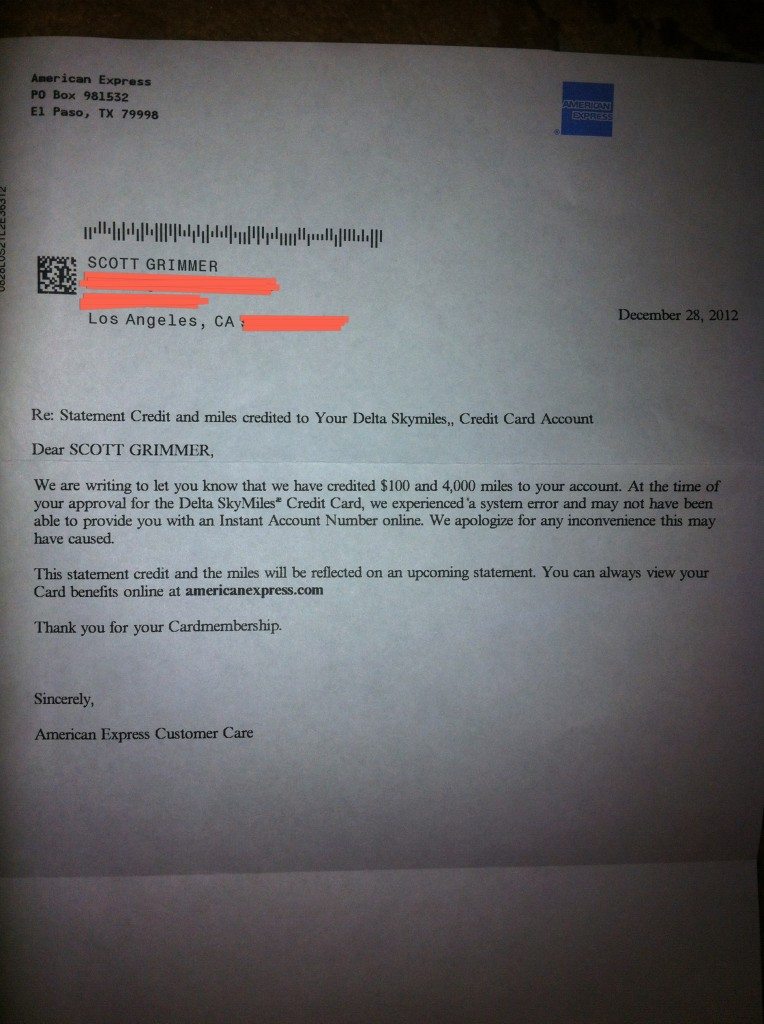

When I got back from my trip to Australia and New Zealand late last month, I had received this letter from American Express.

Dated December 28, 2012 the letter apologizes that at the time of my credit card application “a system error” had kept American Express from providing me with an “Instant Account Number.”

For those who don’t know, an Instant Account is an advertised benefit of several American Express cards including the SkyMiles card.

The Instant Account gives you the ability as soon as you are approved–and before you get the card in the mail–to charge purchases at one or more merchants to your new credit card account.

In the case of the SkyMiles card, you can use your Instant Account for purchases of up to $1,000 from Delta.com.

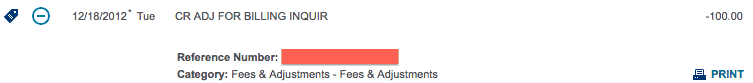

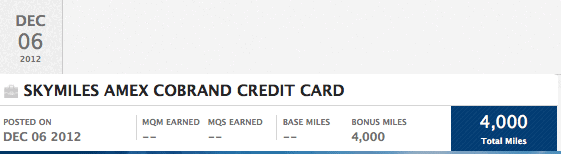

For not giving me the ability to use my Instant Account, American Express’s letter said that a $100 credit had been made to my credit card account and a 4,000 mile deposit had been made in my SkyMiles account. Both adjustments were indeed made to my accounts.

But I had been planning to use my Instant Account feature, and its unavailability had cost me miles. I sent American Express a secure message to see if they could offer me more compensation.

But I had been planning to use my Instant Account feature, and its unavailability had cost me miles. I sent American Express a secure message to see if they could offer me more compensation.

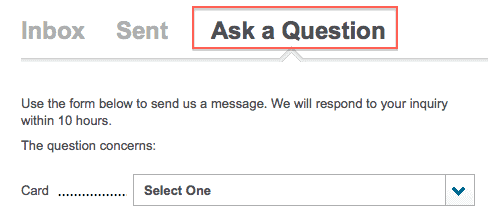

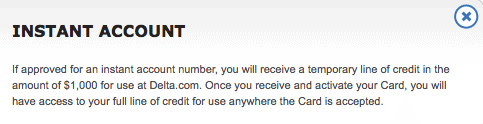

To send a secure message, click Contact Us along the bottom of the page after signing into your account.

Then click the icon that looks like an envelope.

![]() Finally click the Ask a Question tab.

Finally click the Ask a Question tab.

Select the card that the secure message is in reference to and the appropriate department to handle the inquiry.

Select the card that the secure message is in reference to and the appropriate department to handle the inquiry.

I sent the following message:

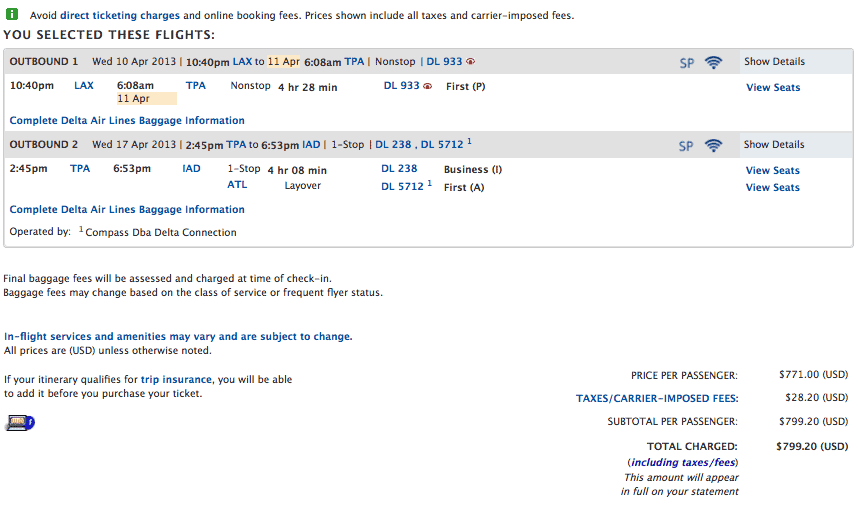

“I applied for my Delta SkyMiles Credit Card, knowing that I could get an instant account number to use on Delta.com for up to $1,000. I was planning on booking a first class itinerary from Los Angeles to Tampa and Tampa to Washington DC for $799.20. But when I tried to use the instant account number, I wasn’t able to get one. This cost me a lot of potential miles. I’d be happy to provide you screen shots of the itinerary I wanted, and the one I took. I hope American Express can make this situation right for me. Thanks.”

I had the following screen shot ready in case they wanted to see it.

My secure message followed my standard procedure when contacting banks or airlines for compensation:

My secure message followed my standard procedure when contacting banks or airlines for compensation:

- Keep it polite.

- Keep it simple. Don’t add in other complaints unrelated to the main one.

“And one time I called and your agent was rude, which makes me rethink my relationship with American Express.” - Make it specific. “I was planning on booking a first class itinerary from Los Angeles to Tampa and Tampa to Washington DC for $799.20.”

- Ask for compensation. “I hope American Express can make things right for me.”

About six hours after I sent the secure message–American Express says it will answer within ten hours–I received a response. An American Express agent apologized again and said that 1,599 more miles would be credited to my SkyMiles account in the next few days.

He didn’t say it, but that represents two miles per dollar on the contemplated $799.20 Delta purchase.

Of course, I would have earned many more redeemable and status miles from flying that first class itinerary, but I was happy with the show of goodwill from American Express and decided not to push it any further. That’s $100 and 5,599 miles for a temporary delay in being able to use my new card.

Has anyone gotten a similar letter and credits? Have you successfully asked for more compensation? What compensation have you received from banks or airlines in the past by asking?

I received the same 4,000 miles and $100 without saying or doing anything.

I received the same 4,000 miles and $100 without saying or doing anything.

Thanks for the reminder. My wife and I received the letter too, but I just checked my account and it never got applied. I just sent a secure message to inquire about it.

Thanks for the reminder. My wife and I received the letter too, but I just checked my account and it never got applied. I just sent a secure message to inquire about it.

Chase refused to send my dad his Ink Bolds in a quick amount of time – all 3 took about 2-3 weeks. This was after some rigamorale with Chase CSRs about having 3 seperate cards for 3 legitimate, but similarly named businesses. Pops called up and was able to get 10UR points for each due to the delay.

Chase refused to send my dad his Ink Bolds in a quick amount of time – all 3 took about 2-3 weeks. This was after some rigamorale with Chase CSRs about having 3 seperate cards for 3 legitimate, but similarly named businesses. Pops called up and was able to get 10UR points for each due to the delay.

10 Ultimate Rewards or 10,000?

10k sorry!

Hi Scott,

I got the same offer,on FT threads it seems that AE and Delta had a glitch in their systems last year that caused the instant card not to be active.

How did you get such a low price for a 1st class RT? I’ve tried to book Delta a few times on shorter route in Economy that priced out almost as much!

I just found that price on Delta.com

Hi Scott,

I got the same offer,on FT threads it seems that AE and Delta had a glitch in their systems last year that caused the instant card not to be active.

How did you get such a low price for a 1st class RT? I’ve tried to book Delta a few times on shorter route in Economy that priced out almost as much!

I got something similar from AmEx with the Blue Cash card. About a month after I got the card, they sent me a letter telling me they were refunding the $75 annual fee because they realized the paperwork they originally sent me didn’t note this fee. I would never have noticed because I knew there was a fee, but I thought that was pretty awesome of them to be so proactive.