MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

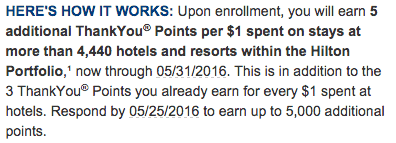

If you have a Citi ThankYou® Premier Card, check your email for the subject line “Earn 5 additional ThankYou® Points on stays within the Hilton Portfolio | Enroll in one click!”

The Citi ThankYou® Premier Card already earns 3x points on gas and travel, including of course hotel stays, so once enrolled you will earn 8 total ThankYou Points per dollar on Hilton stays, the normal 3 plus the bonus 5.

The Citi ThankYou® Premier Card already earns 3x points on gas and travel, including of course hotel stays, so once enrolled you will earn 8 total ThankYou Points per dollar on Hilton stays, the normal 3 plus the bonus 5.

The 8x is valid through May 31, 2016 on your first $1,000 spent at Hilton hotels, including all these brands.

I value ThankYou Points at 1.9 cents each, so that’s an amazing 15.2% rebate on Hilton stays.

Unfortunately the one click enrollment isn’t working for me. I got this message on different days of trying.

I haven’t called in to activate the deal because I don’t have any plans for hotel stays before the end of May.

Did anyone else get the offer? Did you have any trouble signing up?

Full terms and conditions from the email:

This offer starts upon enrollment. Earnings associated with this offer will equal 5 ThankYou® Point(s) per $1 spent on stays at hotels and resorts within the Hilton Portfolio on top of the 3 points per $1 you ordinarily earn, and may overlap with other offers in which you are enrolled. Your stay must be completed and paid by05/31/2016 to earn the additional ThankYou® Point(s). You may earn a maximum of 5,000 additional ThankYou® Point(s) with this offer. You will not earn anyThankYou® Points on returns or credits. It may take 1 to 2 billing cycles from your stay for the additional ThankYou® Point(s) to appear in the primary cardmember’s account. This offer applies to the account referenced in this offer, is not transferable or valid for groups, and cannot be combined with other select offers from Hilton. To qualify for this offer, purchases including but not limited to charges at hotel restaurants, lounges, retail stores, or spas, must be charged to a cardmember’s hotel room bill and settled using the Citi ThankYou® Premier Card upon checkout. Certain on-property vendors may not permit cardmember to charge to their hotel room, and such charges are not eligible to earn additional ThankYou® Point(s). Hotels are responsible for classifying transactions to enable Citi® to recognize which ones qualify for this promotion. If Citi® receives a transaction without that information, Citi® is unable to recognize that it qualifies. Citi®reserves the right to determine which transactions qualify for this promotion.

I received the email, enrolled and got the page that said I’m enrolled. I did it on Saturday evening.

I have a Hilton stay in about a month.

Have the Citi Preferred, Premier and Prestige. Got this offer on the Preferred only.

Thanks for sharing!

I have the prestige and premier and got the offer only on the premier. I have signed up and am staying at a Hilton next week.

Awesome!