MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Super Reader Jorge sent me an awesome spreadsheet that instantly does all the math on British Airways’ Cash & Avios awards, so you can quickly see whether booking one is a good deal.

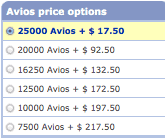

Usually when redeeming British Airways Avios for an award ticket, you are offered a menu of prices. You can pay the normal amount of miles + taxes + fuel surcharges (though there are no fuel surcharges on these partners.) Or you can pay fewer Avios and more cash. Here’s a typical menu of six options on a one way economy award from Los Angeles to Lima.

- What does Jorge’s spreadsheet do with those options?

- How can you use the spreadsheet when booking Avios awards?

Key Links:

- Cash & Avios Analysis (list of the price per Avios for every partner)

- British Airways Cash & Avios Option Quietly Got Much Better! (Now As Cheap As 1.1 Cents per Avios)

- Jorge’s Spreadsheet

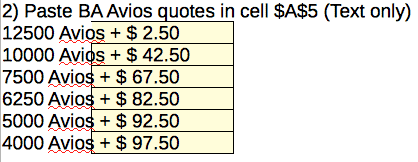

What Jorge’s spread sheet allows you to do is to literally copy that menu of options and paste it into a cell on the spreadsheet.

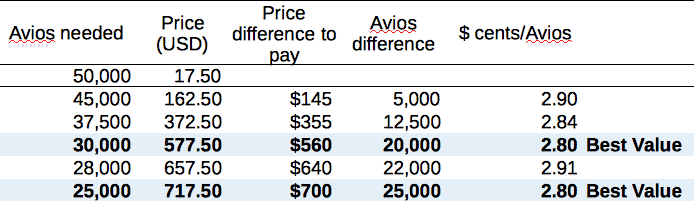

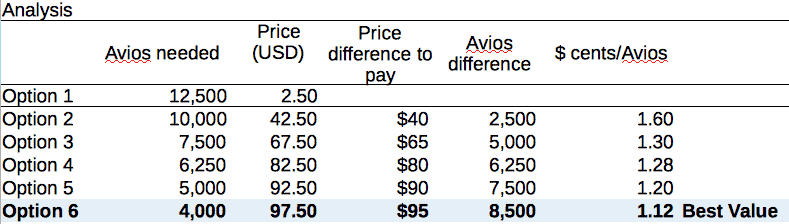

Then the spreadsheet calculates the “price” of each Avios saved by using any of the five Cash & Avios options.

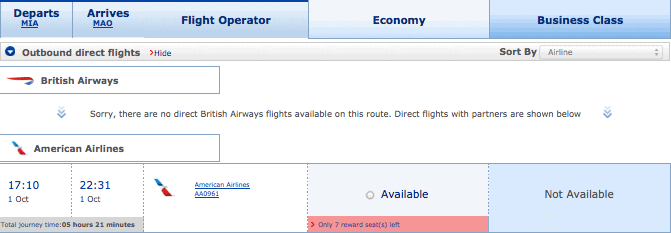

The example I’ve just shows was for a one way award from Miami to Manaus in economy on American Airlines. The options range from 12,500 Avios + $2.50 to 4,000 Avios + $97.50. (There are no fuel surcharges on Avios redemptions for American Airlines flights within the Western Hemisphere.)

The spreadsheet spits out the difference in price and the Avios saved with each option. The far right column shows the amount of money you have to put up to save each Avios.

If any of the numbers in the far right column is cheaper than your personal valuation for Avios, then you should be booking a Cash & Avios award. My personal valuation is 1.7 cents, so I would want to book Miami to Manaus in economy as a Cash & Avios award.

——–SKIP THIS IF YOU DON’T CARE TO KNOW THE DIFFERENCE BETWEEN AVERAGE AND MARGINAL————————————

But you shouldn’t necessarily choose the Cash & Avios option that says “Best Value” next to it. That’s simply measuring the cheapest per Avios price.

Instead, you should buy the option that gives you the most total value, which is the amount of Avios you save times the difference between their price and your value for them. When a Cash & Avios award is a better deal than a normal Avios award, the best deal will almost always be to use the fewest Avios and most cash possible.

——————————————————————————–

Jorge’s spreadsheet is fun to play with and does five quick arithmetic problems for you instantly.

It confirms my general advice, which is to use Cash & Avios awards for economy redemptions, where you often have to pay only 1.1 cents per Avios you save.

Avoid using Avios on business and first class awards, where the price per saved Avios routinely exceeds 2 cents.

What the Spreadsheet Doesn’t Do

The spreadsheet doesn’t set your personal valuation for Avios. You need to do that for yourself to determine at what price per Avios saved you want to book a Cash & Avios award versus a normal Avios award.

Here’s my valuation of Avios, where I came up with the 1.7 cent per Avios figure.

Your value for Avios depends on a lot of things including:

- How you’d use them

- Whether you live at a oneworld hub or not

- How many you have

- How much money you have

Bonus

Don’t forget about the list of Category 1, 2, 9, and 10 Hiltons (and why those are the only important ones) that reader Jeremy made for everyone last month and the accompanying map Dave made.

If you have an awesome resource you’ve created that you want to share with everyone, drop me an email!

You could add a simple if/then conditional formatting with your personal valuation and have it light up green or red if the $/Avios exceeds your valuation or not. 60 second improvement.

Thanks, Jorge. This is useful.

[…] Sometimes, British Airways will give an option to pay for part of an award flight with cash and part with Avios. An analysis how to take advantage of this offer can be found here and here. […]

[…] flight costs only 13,000 Avios + $257 on off peak dates even during the summer. Or you can use Cash & Avios options to pay only 4,550 Avios and […]

[…] For short and medium length flights, you can often find great value in using distance based award program points, such as British Airways Avios, to book a one-way award between the two cities. Direct flights up to 650 miles only cost 4,500 Avios and flights between 651 miles and 1,151 miles only cost 7,500 Avios. Of course, British Airways does collect fuel surcharges on most of its partners’ flights, but using Avios, especially on the partners that do not collect fuel surcharges, can be a great value. You can also use a combination of Cash & Avios to book your flight. More information about that option can be found here. […]