MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

1. Frugal Travel Guy posted an awesome rundown of the major credit-card issuers’ rules on how far apart applications must be and how churnable their bonuses are. I have it bookmarked for my future use. Highlights:

- An AMEX card must be closed one year to get a new bonus on the exact same card. Cannot open “similar” products within 90 days of each other and get both bonuses.

- A CHASE account must be closed two years to get a new bonus on the exact same card.

- CITI applications must be 18 months apart to get a new bonus on the exact same card. (Note the difference. This clock has to do with applications. The other two have to do with account closures.)

2. Earn double Rapid Rewards on Southwest flights between now and November 15 by signing up for the promotion at the link.

Hopefully most of your Southwest flights are the cheapest Wanna Get Away variety. Normally those earn 6 Rapid Rewards per dollar, but under this promotion you will earn 12 Rapid Rewards per dollar for flights flown by 11/15.

Twelve Rapid Rewards are worth 20.3 cents, so this is a substantial rebate.

3. Earn double A+ Credits on AirTran flights between now and November 14. Earn triple A+ credits on international flights.

A+ credits can be converted to 1,200 Rapid Rewards each, so a oneway AirTran ticket would earn $40.56 cents worth of future Southwest flights. That’s a substantial rebate too!

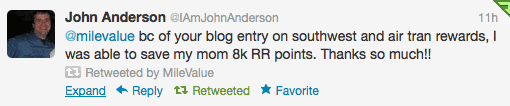

4. Don’t forget about the ability to transfer between Southwest points and AirTran credits. I outlined how a few instantaneous transfers can save you thousands of points five months ago, and the technique still works. See How to Exploit the Southwest-AirTran Merger.

A twitter follower saved 8k points using the trick yesterday!

5. My pet project has been opening up the SkyMiles Auction page every morning. I haven’t seen any good deals yet–even at my 1.2 cents per mile valuation. But I think it’s possible there is an occasional good deal since many of the auctions are experiences or the opportunity to meet someone you might be a big fan of. Most of the locations of the experiences are Delta hubs like Minneapolis or Cincinnati. That’s also where people have a ton of SkyMiles, so one obvious tip is to look outside those cities–like the Boston College football experience.

6. Just like last Friday I’m giving away a free GoGo single-flight inflight internet pass. Comment below for a chance to win a single-flight pass that expires 12/31/12.

Gogo internet is available on select planes on Air Canada, AirTran, Alaska, American, Delta, Frontier, United, US Airways, and Virgin America.

Would love a gogo!

That pass would be fantastic for my christmas trip to visit family in California.

Nice recap. Would love a Gogo pass.

The GoGo pass would be a nice bonus for an upcoming family flight!

The 18 month rule above – if it is a rule (seems to be a guideline as others have had widely varying results) – only applies to certain cards like the personal AAdvantage cards. The business card is churnable as often as every 60 days, and the Hilton cards can be churned at least every 90 days.

Thanks for the recap!

Thanks for the good info!

Thanks for the recap. I’ve enjoye following your site.

Would live a go-go!

The go-go pass would be great. I have never tried using internet in flight. Cool to be able to do that.

Would love the gogo pass!

I’d love a gogo pass.

Count me in for the gogo pass.

Thanks for the recap.

Fingers crossed for the gogo pass!

It would be great to stay productive whilst in the air…

i know from personal experience and other reports on FT that the personal AMEX Premier Gold and Business Gold that you do not have to wait one year from closure to reapply and get the bonus. Last year I closed the AMEX Personal Premier Gold and reapplied 1 week later and received the bonus. Others have reported same on business recently with some of their new bonus offers. One report the person still had the old account open and was able to get the bonus. For SPG AMEX and Delta AMEX the one year rule does seem to apply though.

Thanks for the summary. Would love a gogo pass. Thanks.

In-flight internet sounds amazing, please pick me!:)

Wake me up before you go-go!

Live your blog!

Toga! Gogo! Toga!

I have just started reading your site regularly, and it has been a big help understanding how to best use the points that I am working on accumulating. Now I am going back and working through your archives. Thanks.

I can’t seem to win a Lucky Seat go-go pass. Maybe I’ll have better luck here!

Go go please

1st time visitor to your site!Cool…….I’m cooler though.From the North,Canada ,eh.Don’t forget about us!LOL

The GoGo pass would be awesome!

Gogo gadget Sam!

What I would LOVE to see a blogger do is to elaborate what you started in point number 1. Something like a listing for ALL banks, churn “event dates” like you have and then, for the coup de grace, a list of any workaround tricks to facilitate faster churns. (These do exist!)