MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

This is the fifth post in a monthlong series that started here. Each post will take about two minutes to read and may include an action item that takes the reader another two minutes to complete. I am writing this for an audience of people who know nothing about frequent flier miles, and my goal is that by the end, you know enough to fly for free anywhere you want to go. Previously Award Wallet.

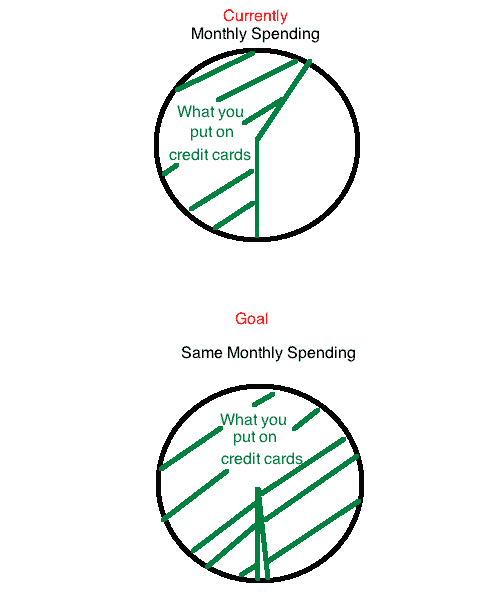

You’ve already opened your loyalty accounts and checked your credit report; today and tomorrow we figure out how much you can spend on credit cards each month and how you can increase that amount without actually increasing how much money you’re out of pocket each month.

Why is increasing credit card spending desirable? How is it possible to increase credit card spending without busting your budget?

This is one of the key concepts in miles–increasing spending on credit cards without increasing out-of-pocket spending. The reason is that spending on a credit card earns big miles and points, especially since many of the best credit card offers require you to spend a certain amount within a certain time period to unlock the bonus.

For instance, a great beginner’s card is the Barclaycard Arrival Plus™ World Elite MasterCard®. It comes with a 40,000 Arrival miles if you spend $3,000 in the first three months of having the card. That’s probably not a tough minimum spending requirement for you. But if you can spend more, you can unlock more big bonuses at a time meaning more free flights and vacations.

You should only apply for cards whose sign up bonuses you can clear, so you need to make sure that the combined minimum spend requirements of all the cards you apply for are within your normal monthly spending. And you need to be aware of ways to generate extra spending on your cards without spending more out of pocket, which is the subject of tomorrow’s post.

Let’s talk about all the normal expenses you can put on your cards. Look at your old credit and debit card statements to get an idea of your average monthly spending on cards. That’s the baseline, which we can probably increase quite a bit without spending any more money total. Here are 17 things to make sure you are putting on your cards:

- Everything that can be purchased with a credit card for the same price as cash.

- Reimbursable business expenses. Put them on your card and get reimbursed by your company. If you have a small, relaxed company, ask the boss if you can purchase some of the supplies for the company and be reimbursed.

- Almost every store purchase. The only exception is at shops that charge more for using a credit card or give a cash discount. The only places I find like this are non-chain convenience stores.

- Almost every restaurant purchase. See exception above.

- Almost every bar purchase. The only exception is a bar that has a minimum tab for credit cards. Don’t drink more just to hit that amount.

- Tolls. Set up an automated toll transponder in your car to avoid toll lines and to pay with a credit card.

- Taxis. Make sure there is no credit card surcharge though. There often is.

- Gift cards. Don’t buy gift cards for friends and family members as gifts–that’s a bad gift. Buy them for yourself to your favorite restaurants and stores from a gift card resale site like giftcardgranny.com. Not only do you move your spending forward in time, but you will get a big discount on the gift card–often 20%.

- Internet

- Cable

- Cell phone. Since most Americans have a two-year cell phone contract, you can call up and ask to prepay your bill. I have prepaid $800 before to meet a minimum spend, which I knew would be about the last ten months of my contract.

- Utilities. Don’t pay with a credit card if there is a fee to do so, but smart utilities let you set up an automatic payment card. The processing fee they pay is offset by the fact that fewer people who set up a payment card miss payments.

- Insurance

- Charitable Contributions. The charity will lose about 2% of your donation to the processing company, but you will clear a sign up bonus worth more than that.

- Home remodels. Tell the contractor you want to buy the building supplies yourself.

- Buy the whole dinner. If you’re out to dinner with a group, offer to pay the bill and have them pay cash. For me this rarely works, since no one seems to carry cash any more.

- Sports team registration. Your recreational sports league may require a team entry fee. Ask the captain if you can pay and collect the cash. Pro collection tip if you’re the softball captain: “You will bat at the bottom of the order until your fee is paid.” When I discovered this trick, I had everyone’s fee collected before the first game.

Hat Tip on some of these to Million Mile Secrets, who has a longer list.

Sub-Total

So now calculate how much you could spend on cards without increasing your total budget by adding together what you currently spend monthly on cards and what you now plan on shifting to cards.

Total

To get to the total amount that you can put on credit cards without spending more out of pocket, we’ll need to add in the amounts from three other places: Bluebird, Kiva, and Amazon Payments. I’ll talk about those tomorrow.

Many, but not all, charitable organizations have deals with the processing company so that they get the full donation.

I think it means that the processing company is donating that amount and then gets to claim it as contributions for tax. But I don’t really know.