MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

This is the sixth post in a monthlong series that started here. Each post will take about two minutes to read and may include an action item that takes the reader another two minutes to complete. I am writing this for an audience of people who know nothing about frequent flyer miles, and my goal is that by the end, you know enough to fly for free anywhere you want to go.

The last few posts were about earning miles from credit cards, which is how I earn 90% of my miles. Folks who fly frequently for business or the occasional paid ticket for vacation should know the basics of earning miles from flying.

There are five takeaways that I want to impart so that you know

- when you earn miles from flying

- how many miles you earn from flying

- and what choices you need to make about where to credit the miles earned

Takeaway #1: You only earn miles on paid tickets

Paid tickets earn miles. Award tickets do not. That’s why I earn so few miles from flying, because I fly mostly award tickets.

One–sort of–exception to this rule is that award tickets booked with rewards from your Barclaycard Arrival PlusTM World Elite MasterCard® or Citi ThankYou® Premier Rewards Card do earn airline miles. The reason is that those cards earn fixed-value points that can be used to book any flight on any airline. The airline sees your ticket as a cash ticket because Barclaycard or Citi pay the airline cash for the seat.

Takeaway #2: Sometimes miles are earned based on the cost of the ticket.

Younger airlines like Southwest, JetBlue, and Virgin America have long awarded miles for paid flights based on the price of the ticket. Southwest gives you 6 points per dollar of the base fare, for instance.

Delta and United got in on the act this year, announcing that starting next year, you will earn miles on their paid tickets based on the price of the ticket and your status.

Takeaway #3: Sometimes miles are earned based on the miles flown.

American and US Airways (and Delta and United for the rest of the year) award miles based on the miles flown on your paid ticket plus percentage bonuses for cabin of service and status.

You can use a service like Great Circle Mapper to see the distance flown on each segment on a paid ticket and add up the miles earned from each segment.

When airfares were cheaper, routing rules were laxer, and the perks of status were greater, many people flew the most circuitous routings possible without worrying about the destination, just to earn miles and status. This is called mileage running.

Takeaway #4: Credit miles from flying to as few airlines as possible.

The key strategy mistake people make with earning miles from flying is to credit the miles to the airline they are flying automatically.

They end up with 10,000 Emirates miles here, 8,000 Lufthansa miles there, and so on. These orphan miles are usually useless because you need more miles for a redemption though not necessarily through the magic of transferable points (post #5).

Instead of crediting to airlines you’ll never fly again that have terrible loyalty programs, credit all your miles to their American partner. You can always credit miles flown on one airline to any other airline in its alliance and sometimes to non-alliance partners too. Just google “[airline name] partner airline” to see your options.

To credit miles to an airline simply type in your frequent flyer number with that airline when prompted to provide a frequent flyer number. Usually all of an airline’s partners are part of a dropdown menu at some point near the ticket purchase screen.

Takeaway #5: Not All Partners Credit Equally

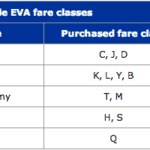

If you have a paid flight to Taiwan, you would not want to credit your miles to EVA Airlines. You’d want to credit to one of its Star Alliance partners with a better program like United or Singapore. (Seriously check out this Singapore award chart sweet spot.)

Which one you credit to could mean a difference of thousands of miles.

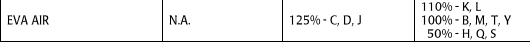

For instance, if your flight is in fare class K, and this information is on your ticket and receipt, you would get 110% of the miles flown if you credit to your Singapore account but only 100% if you credit to United.

But if your ticket were in fare class H, you’d get only 50% of the miles flown by crediting to Singapore and 75% by crediting to United.

Status

I’ve completely left out status considerations in this post because I’ll talk about airline and hotel status in another post. It is an important consideration in the where-to-credit-miles question for frequent flyers of paid flights, but not for people who fly fewer than 25,000 miles on paid tickets per year.

Bottom Line

While credit cards are the quickest and easiest way to earn hundreds of thousands of miles, you shouldn’t ignore miles you can earn from paid flights, and it breaks my heart when people fly paid flights without crediting those thousands of miles to a valuable frequent flyer program.

Make sure you sign up for the appropriate airline programs (post #2) to earn miles on your next paid flight.

Thanks for your post. I’m still a bit confused about the mechanics of changing the airline frequent flyer account to which a paid flight is credited. If it’s ok, I’ll give a concrete example for illustration. I have two upcoming flights on delta, one in the US one to China. I’d like to credit the miles to a more useful program. Can you recommend better partner airlines? Also, I have a lot of Amex MR points, so I’d like to credit the delta flights to airlines for which Amex MR points can be used. Finally, the two flights have been booked for me via an online travel agency (large employer, so they have their own private reservation system) by my employer, so I can’t automatically change the frequent flyer number from my Delta number. Can I make this change at the airport manually? Thanks in advance fir your guidance.

You can make the change by calling Delta or with an agent at the airport. I recommend NOT changing in this case though. Delta has the best program in its alliance, and MR transfer to Delta, so leaving it as Delta is your best bet.

[…] Earning Miles from Flying […]

[…] Earning Miles from Flying […]