MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Here are some of the day’s hot topics being discussed on the FlyerTalk and milepoint message boards.

Christmas Cutbacks from United and How to Deal With Them

The holidays are bringing some unfortunate consequences for people who book award flights on United around Thanksgiving, Christmas, and New Years, as seen in this FlyerTalk thread.

In January, I booked an award flight to the east coast on United-operated flights with US Airways miles for Thanksgiving weekend. That flight has been changed twice, and I blogged about my experience trying to change the flights after United changed them on me. See Award Change Negotiations with US Airways.

There are complaints of flights and tickets being abruptly cancelled sometimes several months in advance, flights that have altogether disappeared from United’s web portal for booking, and flights actually occurring on the holidays being moved without notice, shifted to a day prior or a day after.

One FlyerTalk user suggests that United is reducing its schedule because so few people are interested in flying on the holidays. Another reason has to do with perceived future understaffing caused by people calling in sick or taking personal time.

Obviously United is undertaking these cuts to be as profitable as possible. United should definitely balance their dollars-and-cents profitability from these moves with the goodwill they are losing by changing and cancelling people’s flights. If United steps up and accommodates people with reasonable options, then this can be mostly a non-story.

The majority of the people reporting issues with United changes had award tickets, though there are a few people–mostly those flying into the US from abroad–who are having problem with paid tickets.

Here are five social-engineering suggestions to get your itinerary the way you want it should United–or any airline, for that matter–try to cancel your flight:

- Get your flights rebooked as soon as possible.

- Be polite and patient with United reps. Make them want to help you. United reps always ask how you are. If you actually answer that question, ask them how they are, and respond to their answer, your chances of getting what you want go way up. Customer service jobs stink, and sometimes all you have to do is be nice to get what you want.

- That said, don’t be afraid to escalate. Ask to speak to a supervisor. Sometimes the people who answer phones are just that: people who answer phones. They don’t have the power to grant exceptions. The supervisors do have that power, and I can’t count the number of times a supervisor has offered me a one-time exception.

- Hang up; call again. If you don’t like the answer, try again. Consider a different time of day to get a different, more sympathetic shift.

- If you regretted a booking but didn’t want to pay a cancellation fee, this is your chance to cancel for free. One key here is to be vague. If United only made minor changes to your flight times, and you want to cancel, just stick with the line that the new times “don’t work for me.” Adding any more info will let them argue with you.

United LGA-SJC Mileage Run

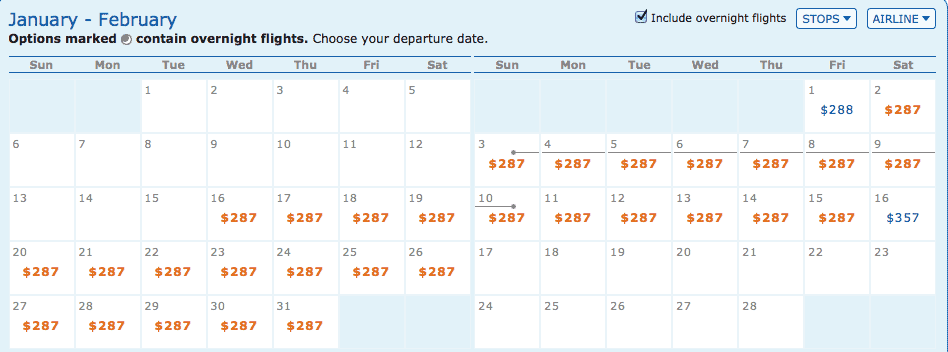

According to this thread on FlyerTalk, there’s a mileage run for United available originating out of New York (LGA) and touching down in San Jose, California (SJC). The original thread cites the price at $279 but I’m seeing the cheapest available, most frequently occurring option as $287. For example, check out seven day trips in January and February:

The flight is bookable through March 2013, with fairly relaxed availability throughout the week. This rate ends somewhere near the middle of March.

United, US Airways, Delta, and American are all within a few dollars of each other, so this can just barely qualify as a mileage run on any of the legacy carriers.

Routing from LaGuardia to San Jose through Charlotte and Phoenix would earn 5,878 status miles for $294, which is exactly 5 cents per mile for United or US Airways miles.

The fare allows you to book two stops within the itinerary. Though the additional mileage isn’t worth too much on its own, it opens up opportunities for bumps.

This is not an earth-shattering mileage run. But it is a rare run out of LaGuardia. As always, I don’t mileage run; I check the forum for cheap prices on flights I have to book for other reasons or impromptu vacation ideas.

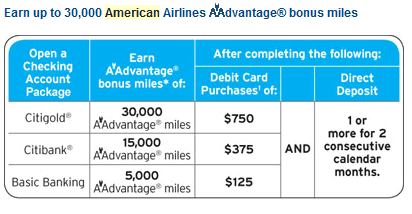

Up to 30,000 American Airlines Miles with Citibank Checking Account

I first saw that the Citi checking account deal was back from Mile Nerd last week. Then a few days ago, I got a letter in the mail inviting me to take advantage of the same offer, and I even had the same code as Mile Nerd.

And in this FlyerTalk thread, the next round of Citibank Checking Account promotions is discussed in detail. In order to qualify, you must open a checking account by October 31, 2012.

This is a pretty frequently occurring deal. What’s special this time?

In the past, Citibank has required a 1099 form for reporting miles earned from promotions, as they were considered a bonus. Since the new offer requires spending with your debit card, the miles are now considered a rebate. As a rebate, the miles are not taxable income, so no 1099 will be issued. (Just like your credit card airline miles aren’t taxable income.)

There are three types of accounts:

One thing to take into account when getting in on this deal is that you will be dinged a monthly fee if your account does not maintain a certain balance.

The Citigold Account package requires $50,000 for all linked deposit or retirement accounts to avoid the $30 monthly fee. I value the 30k sign up bonus at $531.

The Citibank Account package requires $15,000 for all linked deposit or retirement accounts to avoid the $20 monthly fee. I value the 15k sign up bonus at $265.50.

The Basic Banking package requires $1,500 for all linked deposit or retirement accounts OR the making of one direct deposit and one bill pay each month to avoid the $10 monthly fee. I value the 5k sign up bonus at $85.50.

The miles will be posted to your account within 90 days within the statement period where you meet all the requirements.

There are multiple ways to open an account. Apply online (at any of the previous links) and make sure the code CY4Y is in the offer code box, call 866-579-8496 and mention the code, or go to a physical Citibank branch. After opening, you have to meet the minimum spending amount with the debit card and set up direct deposit to the checking account.

I will have more on this deal in the following days as I attempt to set up my own Citi checking account.

Recap

The holidays are a tumultuous time for people flying places on United this year because United is changing and cancelling award reservations. Be aware of your itinerary and ways that you can circumvent problems that might come up by talking to phone representatives.

There’s a mileage run (LGA-SJC) for $287, through March 2013. It could be a good deal for people near LaGuardia who don’t get a lot of opportunities to mileage run. Or it could be a great chance for a vacation to San Jose.

Citibank has changed its policy regarding miles and their checking account promotion. Earning 30k AA miles no longer generates a 1099, which makes the entire procedure even more lucrative, though equally complicated if you have few liquid assets.

Funny thing about that Citigold checking account (I’m assuming it’s a non-interest bearing account) is if the monthly fee is $30, and the deposit needed to avoid it is $50,000, your opportunity cost of keeping that $50,000 in the checking account is going to be more than $30 a month. So you’re actually better off taking the $30 a month hit and keeping the $50k invested elsewhere.

good analysis. and there is no minimum amount required to open the account

RHennessy has a great point. The $30 fee is worth eating to avoid tying up so much money. Is there a minimum deposit needed to get the miles, or are the only requirements the debit card spend and the direct deposits?

no min deposit

Any idea if we can take advantage of this if we already have a citi checking account (it’s my primary checking account)

I have a Citi bank account already as well. Is this available for existing account holders? Especially if I were to open a different type of account? I currently still have a college student account. And can you open a Citigold account and downgrade it to a lower level after a few months?

I believe that if you have gotten a bonus in the last two years, you are ineligible.

Man…Too bad I have all my stuff with Citi already. I would love to take advantage of this promo. Anyone know if they can just “OPEN” a new account even if htey are existing clients?

so once you meet the minimal spending and other requirements you get the miles… but what then? do you keep earning miles for keeping a balance there? i guess not… so this is very different from BankDirect.

if you’re going to analyze this deal, could you please write about how it compares to a BankDirect account?

Thank you.

It’s the direct deposits that trick me up. Are there any ways to meet this requirement without going through one’s income source?

I’d like to know this also. Can one meet that direct deposit requirement by doing automatic transfers from other banks systems?

Excellent post, Scott. The one thing that was not included (that I am aware of) is that, for the Citibank account (15,000 AA bonus) it is possible to avoid the minimum balance requirement and not get the monthly fees *if* your employer is part of the Citi at Work program.

I was not able to find a listing of Citi at Work employers, but I called the 800# and sure enough my F500 employer was included. In this way, there is virtually zero opportunity cost (other than the $100 minimum deposit and de minimum direct deposit).

That’s a fantastic tip!