MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

This offer has expired. Click here for the top current credit card sign up bonuses.

—————————————–

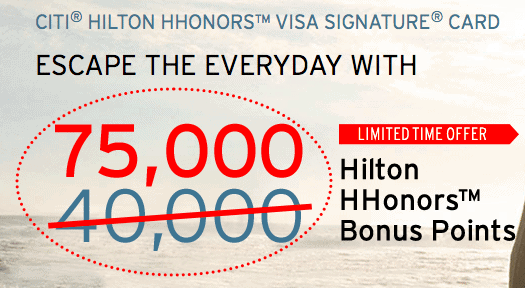

At 5 PM ET today (September 28, 2015), the 75,000 point sign up bonus on the Citi® Hilton HHonors™ Visa Signature® Card expires. For almost three months, the card has offered 75,000 bonus HHonors points after spending $2,000 in the first three months. This is enough points for 15-18 free nights at Hilton Category 1 hotels.

The normal offer on this card has historically been 40,000 points, so I do expect the sign up bonus to drop 47% today, but that’s just my speculation based on history.

How Can You Use the 75,000 Bonus Points?

Hilton points can be redeemed at all of the following brands.

This is the biggest sign up bonus ever offered on a no-annual-fee Hilton card.

The Citi® Hilton HHonors™ Visa Signature® Card comes with automatic Hilton Silver status, which earns a 15% points bonus on Hilton stays, late checkout, free access to fitness centers, and the 5th night free on award stays.

Better yet, if you complete four Hilton stays in the first 90 days of card membership, you get bumped up to Hilton Gold status, which earns a 25% points bonus on Hilton stays and maybe a little better treatment at the front desk.

And any year in which you spend $1,000 at Hilton hotels, you will get 10,000 more Hilton points.

After meeting the minimum spending requirement, you’ll have at least 79,000 Hilton points (more if you use the card’s category bonuses discussed below.) Eighty thousand points are enough for 20 free nights in a Hilton Category 1 hotel, 10 free nights in Category 2 Hiltons, or 5 free nights in Category 3 Hiltons. I stayed at an awesome DoubleTree in Kuala Lumpur that was a Category 2 Hilton.

The last big benefit of the card is that it has no annual fee. Very few rewards cards with no annual fee offer so much.

Sign Up Bonus

The Citi® Hilton HHonors™ Visa Signature® Card has a sign up bonus of 75,000 bonus points after spending $2,000 in three months on the card.

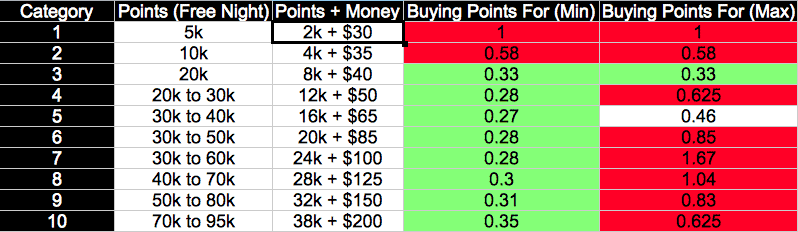

Seventy-five thousand points won’t get you even one night at a top tier Hilton, but it will get you up to 18 nights at the bottom categories, which have some gems. Super reader Jeremy has created the most valuable spreadsheet imaginable for the Hilton HHonors program that you can download for free here.

The spreadsheet lists:

- all 34 Category 1 hotels: 5,000 points per night

- all 131 Category 2 hotels: 10,000 points per night

His spreadsheet is sortable by city, state, country, or hotel name (which often starts with the hotel brand.) This can be very useful if you want to know if there is a Category 1 or 2 Hilton on the route of your next trip.

If you want to book higher category hotels, I recommend Points & Money awards. By paying some cash for award nights, you can get a steep reduction in the points needed, which would stretch your 75,000 point sign up bonus much farther.

Here is a full post on Hilton Points & Money awards.

Perks

The Citi® Hilton HHonors™ Visa Signature® Card comes with Silver Status and the chance to earn Gold Status with four paid Hilton stays in the first 90 days.

Spending

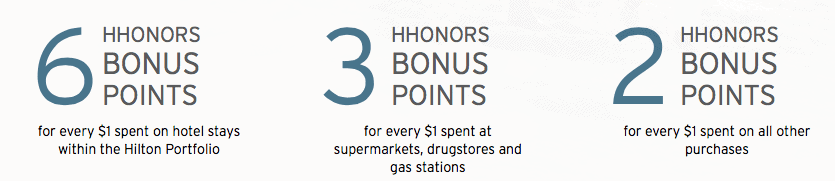

There are category bonuses for Hilton stays, supermarkets, drugstores, and gas stations though none of them impress me much.

- Earn 6 HHonors Bonus Points for each $1 spent at any participating hotel within the Hilton HHonors portfolio.*

- Earn 3 HHonors Bonus Points for each $1 spent on purchases at supermarkets, drugstores and gas stations.*

- Earn 2 HHonors Bonus Points for each $1 spent on all other purchases.*

Plus you get 10,000 bonus points any year in which you spend $1,000 or more at Hilton hotels.

Annual Fee and Foreign Transaction Fee

The Citi® Hilton HHonors™ Visa Signature® Card has no annual fee ever. For a card that gives you ongoing status, that’s unbeatable.

The card does charge a 3% foreign transaction fee, so never use it abroad.

Full Offer

The Hilton card is not for everyone. It should not be the card onto which you put all your spending. It shouldn’t be the card you get for the biggest sign up bonus.

It is ideal for folks who want a no-annual-fee card that rewards their loyalty to Hilton.

- Limited Time: Earn 75,000 Hilton HHonors Bonus Points after making $2,000 in purchases within the first 3 months of account opening*

- Earn 6 HHonors Bonus Points for each $1 spent at any participating hotel within the HiltonPortfolio.*

- Earn 3 HHonors Bonus Points for each $1 spent on purchases at supermarkets, drugstores and gas stations.*

- Earn 2 HHonors Bonus Points for each $1 spent on all other purchases.*

- Enjoy the benefits of HHonors Silver status as long as you are a cardmember*

- No annual fee.*

Application Link: Citi® Hilton HHonors™ Visa Signature® Card

When I saw this post today, I applied for the card following your link, completely forgetting that I had already signed up for it in July. I was asked to call Citi and talk to someone, who approved my application after a few administrative questions. So now I have 2 Hilton Honors cards. By the time I finish with spend requirement on card 2, I should have 150k bonus points total. Thanks! 🙂

Awesome news!

The Bridgetrack.com offer now says thru October 31, 2015. Good news for people (like me) who need to wait for the 8/65 clock after milking all the great Citi offers this summer.

Great news!