MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

The Barclaycard AAdvantage Aviator Red World Elite MasterCard comes with 60,000 American Airlines miles, and you don’t even have to spend a large amount of money to earn the bonus. In fact, you hardly have to spend anything–only one purchase is required, along with the payment of the $95 annual fee–to trigger the 60k bonus. Little did you know Barclaycard also issues a business version of this card! It comes with 40,000 American Airlines miles after one purchase and paying the $95 annual fee. 40,000 AAdvantage miles is enough to fly anywhere in the world–that’s right, to ANY region–at least one way in economy.

Prefer to travel in style? The bonus is also an easy way to boost your balance for that premium cabin redemption you’ve been eyeing. Japan Airlines First Class to Tokyo, anyone?

Quick Facts

- Sign Up Bonus: 40,000 American Airlines miles after your first purchase

- Category Bonus: 2 American Airlines miles for every dollar spent on American Airlines purchases, as well as 2 American Airlines miles for every dollar spent at eligible office supply, telecom and car rental merchants

- First checked bag is free on domestic American Airlines flights for you and four others on the same reservation

- Preferred Boarding for you and up to four travel companions on your reservation when flying American Airlines

- 25% off of in-flight food, beverages, and headsets purchased on the card

- 10% rebate of redeemed American Airlines miles (maximum of 10,000 miles returned each calendar year)

- $99 Companion Certificate each year (after cardmember anniversary) that you spend $30k on the card

- $3,000 Elite Qualifying Dollars each calendar year that you spend $25,000 on your card

- Access to American Airlines’s Reduced Mileage Awards

- No foreign transaction fees

- Annual fee: $95, not waived the first year

The benefits of this card are very similar to those of the personal version. You can read a full breakdown of those benefits here.

If you’re trying to fly under 5/24 for the purpose of applying for Chase credit cards, then you might not want to apply for this card if you’re extremely risk averse. While most business cards don’t show up on your personal credit report, there is talk on the internet that business cards from Barclaycard sometimes do. That being said, I’ve only seen one data point that says a Barclays business card was actually reported as a new account. The rest of the data points I’ve seen are that Barclays performs a hard credit pull on your Transunion personal credit report, but not that it actually shows up as a new account.

Getting Real About AAdvantage

American Airlines has a nasty reputation for lack of SAAver Level award space on American Airlines, and for good reason. Beware that you might not find tons of options on the exact dates you want to travel when redeeming AAdvantage miles on American Airlines flights, especially domestically.

That doesn’t, however, mean they’re useless. American has tons of partners you can redeem their miles on–anyone in the oneworld alliance–and even valuable non-allied partners like Etihad (although do note that booking Etihad flights touching the United States with AA miles has proven difficult lately).

I myself have a healthy balance of American Airlines miles–I do actually put my money where my mouth is–and find them useful for travel between the United States and South America, as well as occasionally within South America on LATAM flights.

Whenever American Airlines Business Class award space opens up to popular destinations like Europe we try to cover it as quickly as possible here on the blog, so keep an eye out for notice.

What You Can Do with the 40k Sign Up Bonus

- Fly Qatar in economy one way to or from Windhoek (Namibia) for 35,000 miles + taxes only.

- Get another 5,000 miles and fly roundtrip to Europe in American Airlines economy during the off season (January 10 – March 14 as well as November 1 – December 14) for 45,000 miles + taxes only.

- Fly to Peru, Ecuador, Bolivia, Colombia or Manaus, Brazil roundtrip in economy on American Airlines or any oneworld carrier for 40,000 miles + taxes only.

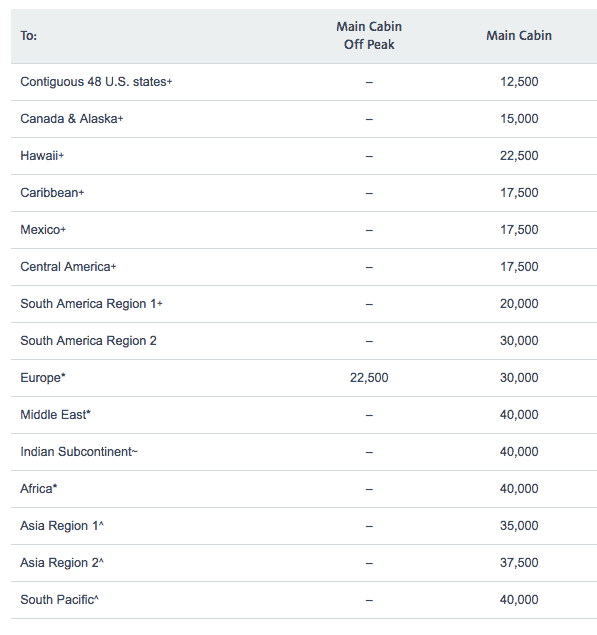

- Fly anywhere in the world in economy at least one way…

What You Can Do with the 60k Bonus Miles from the Personal Card

- Fly one way to or from Europe in American Airlines Business Class for 57,500 miles + taxes only (if you redeem on British Airways you’ll incur high fuel surcharges, stick to AA)

- Fly one way to or from Southern South America (Brazil, Argentina, Uruguay, Chile, Paraguay) for 57,500 miles + taxes only

- Fly one way to or from Asia 1 in Japan Airlines Business Class (Japan, South Korea) for 60,000 miles + taxes only

- Fly roundtrip in American Airlines or LATAM Business Class for 60,000 + taxes only

- There are many sweet spots awards that don’t touch the United States on American’s chart flying premium partner products like Etihad, JAL, Qatar, Cathay Pacific and more… read Sweet Spots on New Devalued American Airlines Award Chart to learn more.

What You Can Do with the 100k Bonus Miles from the Personal & Business Card

- Fly one way to or from Southeast Asia in Business Class on Cathay Pacific for 80,000 miles + taxes only

- Fly one way or from Southeast Asia in First Class on Cathay Pacific for 110,000 miles + taxes only (so you need a few more thousand, but you’d be close!)

- Fly one way between London and Kuala Lumpur in Malaysia Airlines First Class for 90,000 miles + taxes only.

Need help spending your American Airlines miles? Consult our Award Booking Service.

Bottom Line

I value American Airlines miles at 1.5 cents, which makes a 40k bonus worth $600. All you need to do to unlock the bonus is make one purchase on the card, no minimum spending requirement required, and pay the first year’s $95 annual fee. That is a minimal amount of effort for a pretty large return.

It’s never wise to collect miles you don’t have a plan for since all miles depreciate over time. But if you have a trip in mind, the bonus from the AAdvantage Barclaycard Business card (as well as the personal version of the card) is super easy to earn and burn. If you want more American miles fast and also value American elite status/lounge access, the Citi / AAdvantage Executive World Elite MasterCard is offering 50,000 American Airlines miles for spending $5,000 within three months of opening the card.

Credit card links have been removed from posts and added to the menu bar at the top of every page of MileValue under the heading Top Travel Credit Cards. We do get commissions when you sign up for some cards, but not the AAdvantage Aviator cards. We just want you to be aware of the best deals.

Is the Business version counting against 5/24? I haven’t been able to see any real data on this one.

I haven’t either as far as a specific data point for this exact card. And I’ve only seen one data point on any Barclaycard period that says it showed up as a new account on their personal credit report (I think many people confuse a hard credit pull, which does appear on your credit report for a bit, as a new account–but they’re not the same thing. Only a new account would actually count against you in regards to 5/24). I updated the post to reflect this info. I think you can get away with opening this card without having it affect your count.

For a joke I got the 60k card brought a SMALL coffee from McD on sale for $1 and tax and paid the $95 fee and GOT the 60K ..Love my AA better then UAL no cost date change done that like 5x and 10% points rebate..

Banks are Insane card will be gone in 11 months.

CHEERs

Is this a new card? I got the personal card at 40k, then saw it go up to 50k, now it’s 60k…I wouldn’t want to get this card at 40k and see it do the same within a few months.

A link leaked last year, don’t think it was public however, then it disappeared. Was available only in-branch last year at some point, and now it’s publicly available and has been since November I believe–but is not highly publicized.

Thanks!

I have AA miles that have been sitting around unused for several years now. So hard to get saver-level seats! Even for an off-peak trip to Florida six months in advance with flexible dates I couldn’t quite make it work!

Yea, especially domestically they can be a real pain 🙁

Jason

Save the points for international Flts like I do…Fly SW if u can my SW flt MDW>CUN I just Re-booked 9K Rt. in Mar ??

CHEERs

Yeah, I fly SW whenever possible. Getting my new companion pass in a few weeks 😉

My Doc saved $6500 in one year with that .

Got it. Had to rebalance credit lines, but not too bad for another 40K

What u want to do is set yourself up for the next card . So as soon as u can(I lower credit limit to $5K when I get the card) so it shows up on ur credit report all $5K .It may takes months to show up.

U don’t want to miss a super card for a credit thing .

CHEERs

Applied for this card (and got it) in early Dec. 2017. Showed as a hard pull on my Transunion report, per CreditKarma, but it does not show on my list of accounts on Transunion (or Experian), also per CreditKarma

Thanks for the data point!