MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

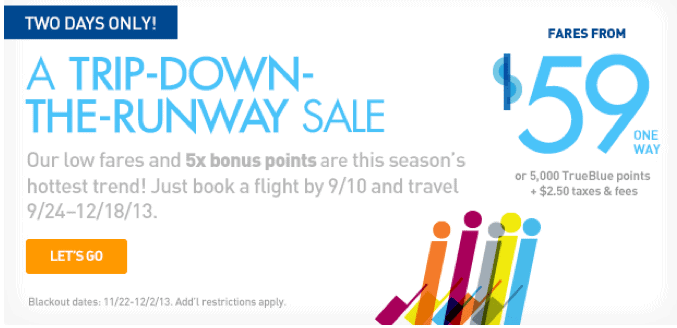

JetBlue has announced a 5x points promo on flights booked by Tuesday.

Ordinarily one earns 6 TrueBlue points per dollar on JetBlue bookings made online. That breaks down to 3 points for booking and 3 extra for booking online.

This promo quintuples the regular 3 points, but has no effect on the 3 extra points for booking online, bringing the total TrueBlue points earned to 18 points per dollar.

JetBlue points are worth about 1.3 cents each, so getting 18 per dollar is like getting a 23.4% rebate on your current JetBlue flight in the form of future travel.

Book now and fly 9/24 to 12/18 excluding Fridays, Sundays, and 11/22 – 12/2.

This is a very good deal if you have a JetBlue flight coming up. I love JetBlue because you always get one checked bag free, 3″ extra leg room compared to legacy carriers, and satellite TV at your seat (for a fee).

JetBlue’s own co-branded credit card is unimpressive, so the best card to earn free JetBlue flights is the Barclaycard Arrival Plus™ World Elite MasterCard®. Its sign up bonus is worth about $400 toward any flight on any airline any time, and it earns 2.22% back toward future flights on all purchases.

The Satellite TV is actually free!

The Satellite TV is actually free!

Actually, the Arrival card isn’t the best card

If you’re one of the 99.99% of people who don’t plan on putting 40K worth of spend annually on the Arrival card, it’s a superior option

The Cap 1 card is also superior for the 95% of people who don’t plan on putting more than 14K on the card

I think your analysis is flawed. The Arrival card sign up bonus is $444 and its annual fee is zero, then $89. The Capital 1 cards have a $100 sign up bonus, and their annual fee is zero then $59.

It would take 12 years of holding the card before the Arrival’s higher annual fee made it worse overall than the Capital 1 card because the sign up bonus differential is HUGE.

Add in Free Trip It Pro from the arrival card and the fact that you are allowed to cancel any time and avoid the annual fee, and it’s not even close. The Arrival card is the better cash back card.

Actually, the Arrival card isn’t the best card

If you’re one of the 99.99% of people who don’t plan on putting 40K worth of spend annually on the Arrival card, it’s a superior option

The Cap 1 card is also superior for the 95% of people who don’t plan on putting more than 14K on the card

I think your analysis is flawed. The Arrival card sign up bonus is $444 and its annual fee is zero, then $89. The Capital 1 cards have a $100 sign up bonus, and their annual fee is zero then $59.

It would take 12 years of holding the card before the Arrival’s higher annual fee made it worse overall than the Capital 1 card because the sign up bonus differential is HUGE.

Add in Free Trip It Pro from the arrival card and the fact that you are allowed to cancel any time and avoid the annual fee, and it’s not even close. The Arrival card is the better cash back card.

No, your analysis is flawed, because you bring up some mythical 12 year analysis when you can get that $444 arrival bonus while still getting rid of it within the first year.

Unless you spend more than 14K on your cash back card, cancelling the Arrival card after 364 days and putting all spend on Cap1 going forwards is better than keeping the Arrival

Unless you spend more than 40K on your cash back card, cancelling the Arrival card after 364 days and putting all spend on Fidelity going forwards is better than keeping the Arrival.

The statement “so the best card to earn free JetBlue flights is the Barclaycard Arrival World MasterCard” is flat out false except for your first year of having the Arrival card.

Considering your blog is supposed to be about “value”, it deserves mentioning, no?

Exactly, so in the battle of which card to get now for free JetBlue flights, we agree that the Arrival card is far better. And then cancelling it later is prudent if you don’t meet the spending thresholds you outlined. You definitely grasp the marginal value of spending on different cards, which presages my post tomorrow morning for people who haven’t grasped that concept.

No, your analysis is flawed, because you bring up some mythical 12 year analysis when you can get that $444 arrival bonus while still getting rid of it within the first year.

Unless you spend more than 14K on your cash back card, cancelling the Arrival card after 364 days and putting all spend on Cap1 going forwards is better than keeping the Arrival

Unless you spend more than 40K on your cash back card, cancelling the Arrival card after 364 days and putting all spend on Fidelity going forwards is better than keeping the Arrival.

The statement “so the best card to earn free JetBlue flights is the Barclaycard Arrival World MasterCard” is flat out false except for your first year of having the Arrival card.

Considering your blog is supposed to be about “value”, it deserves mentioning, no?

Exactly, so in the battle of which card to get now for free JetBlue flights, we agree that the Arrival card is far better. And then cancelling it later is prudent if you don’t meet the spending thresholds you outlined. You definitely grasp the marginal value of spending on different cards, which presages my post tomorrow morning for people who haven’t grasped that concept.

Wait, so you were referring to which card has the best sign-up bonus for Jetblue flights?

If that’s the case, it still isn’t the arrival card. Any of the 50,000K Amex offers (which transfers to 40000 Jetblue points worth >$500) is better than the Arrivals

Anyway you slice it, the Arrival card isn’t the best for sign-up bonus or for everyday spend except in the 1st year. And yet no disclosure of either of those extremely important facts (well, certainly the latter is important).

Wait, so you were referring to which card has the best sign-up bonus for Jetblue flights?

If that’s the case, it still isn’t the arrival card. Any of the 50,000K Amex offers (which transfers to 40000 Jetblue points worth >$500) is better than the Arrivals

Anyway you slice it, the Arrival card isn’t the best for sign-up bonus or for everyday spend except in the 1st year. And yet no disclosure of either of those extremely important facts (well, certainly the latter is important).