MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

This offer has expired. Click here for the current Starwood Preferred Guest American Express offer.

The Starwood Preferred Guest American Express Card temporarily increased its sign up bonus from 25,000 SPG points to 30,000 SPG points after $5,000 in spending within six months of getting the card. Here are the stats:

Issuing Bank: American Express

Absolute Value of the Sign Up Bonus: $732+

Rebate Percentage of the Sign Up Bonus: 14.6%+

This card’s sign up bonus is denominated in SPG points (Starpoints), the proprietary points of the Starwood Preferred Guest loyalty program. Starwood operates the most interesting hotel loyalty program by far because its points have a variety of valuable uses.

The three main uses are:

1) Transferring the points to tons of airlines. SPG points are transferable at a 1:1 ratio to almost every major airline–the notable exception being United. Plus if you transfer 20k SPG points, you get 5,000 bonus miles, so if you transfer in increments of 20k points, you get 25k miles, which is a fantastic 4:5 (1:1.25) ratio.

2) Using the points for “Free Nights.” Booking all points awards means no cash outlay on hotels.

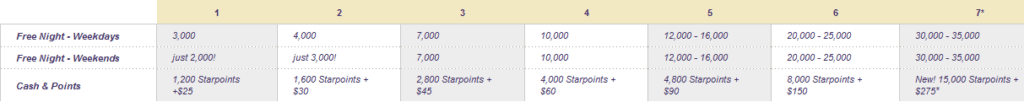

3) Using points as part of “Cash & Points” awards. For instance, instead of spending 10k SPG points on a Free Night at a category 4 hotel, you can spend 4k points and $60. The Free Nights and Cash & Points award chart is here.

How much value you get out of 30k SPG points will depend on how you use them, so before you can decide whether this is a good deal for you, you should have an idea how you’ll use the points.

Using the points for flights

If you’ll be transferring the points to airlines, I’d value them at 2.44 cents each.

The reason is that their highest value transfer option, according to my values, is US Airways at 1.95 cents per mile. If you transfer SPG points in tranches of 20k, you will get the 4:5 transfer ratio mentioned above, meaning each SPG point is worth 2.44 cents (1.25 * 1.95).

Of course, few people will transfer all their miles to US Airways, and I’m not suggesting you do. The best transfer strategy is to wait until you have an award in mind. (SPG transfers are NOT instant like Ultimate Rewards and Membership Rewards, but let’s gloss over that here.)

Then use the SPG points to top off an existing miles balance to get the award you have in mind. Using transferable points to top off is by far their best value because topping off takes a balance from not good enough to good enough–a huge marginal improvement.

When topping off, you should transfer in increments of exactly 20k Starpoints to get max value. I would say if my top off was 10k miles or more, I would just go ahead and transfer 20k to get the 5k transfer bonus as long as I thought I wouldn’t be orphaning the extra miles.

If my top off was smaller like 4k, then I might not make a full 20k transfer. There’s no firm cutoff here, but just be thinking about the 5k bonuses when transferring.

I don’t have a mathematically sound way to value the extra benefit of being able to top off multiple accounts from a transferable points program, but I’ll say that value is roughly cancelled out by the fact that sometimes you’ll transfer SPG points to less valuable programs like Delta or British Airways.

That means, if you intend to transfer the SPG points to airlines, the sign up bonus points are worth about 2.44 cents each, for an absolute value of $732 for the bonus.

Using the points for hotel stays

Using the points for hotel stays presents challenges in valuing them. I think the biggest challenge is valuing what a night at a hotel is worth. The maximum value for a hotel stay is the retail rate, but for most people, their subjective value should be much lower.

If you’re content staying in hostels, couchsurfing, using Priceline, or renting an apartment, you shouldn’t value a hotel room at the retail value. I wouldn’t pay more than $100/night to stay in any standard hotel room in most cases. I wouldn’t ordinarily pay more than $50 really, so I value the hotel redemptions very poorly.

I suspect many readers would value the chance to stay at very nice properties much more highly than I would, so I’ll lay out a framework for valuing SPG points when using the to get Free Nights or Cash & Points awards.

Free Nights

Free Nights awards are generally a worse value than Cash & Points awards unless you’re very cash poor and point rich. I’ll show you why on the Starwood chart:

Let’s look at the worst properties–category 1. A Free Night costs 3k SPG points. A Cash & Points Redemption costs 1,200 SPG points and $25. That means for $25 you save 1,800 Starpoints. Since Starpoints are worth 2.44 cents when transferring to airlines, saving 1,800 Starpoints is worth $43.92.

That means Cash & Points is a better deal than Free Nights in category 1. Doing the match for categories 2-7 achieves the exact same result that Cash & Points is a better value in all categories.

Cash & Points

But what value exactly does one get from a Cash & Points Redemptions? You can use my Mile Value Calculator to figure that out.

[wpcalculator idcalc=”1″]

In the Value box, use the lesser of the retail price and your subjective value of the room you’re getting. In Taxes and Fees Paid, put the cash contribution. In Miles Used, put SPG points used. And in Miles Foregone, put SPG points foregone by not booking a paid room.

The calculator will spit out how much value you are getting from each SPG point for your award. If this number is higher than 2.44 cents, Cash & Points awards are your best option for SPG points.

Most bloggers claim exactly this–that SPG points are best used for Cash & Points awards. That’s probably true for most people, but it’s not true at all if you–like me–never pay anywhere near retail for a hotel room.

Once you have your Cash & Points value, if it’s higher than your transfer-to-airlines value, multiply the cents per point times 300 to get the value of the sign up bonus for you.

Absolute Value

The absolute value of the sign up bonus for the Starwood Preferred Guest American Express is 300 times the cents per point value you’re using (or 30,000 * $/point). For me, there is no other adjustment because the card doesn’t have any other perks I value, and the annual fee is waived the first year.

One perk that many will value is that the card starts off your SPG elite status quest with two stay credits or five night credits.

I would use the card for airline-mile transfers so 30,000 points times 2.44 cents per points is $732. People using the points for Cash & Points awards will have a higher value.

Rebate Percentage Method

For low spenders like me, the rebate percentage method of valuing a sign up bonus is much more important than the flashier absolute value method as I explained last week. For this, divide your absolute value of the points by $5,000, the spending requirement.

For me, this produces a rebate percentage of 14.6%. That’s OK, but it’s far from spectacular and lags behind many cards with more modest spending requirements.

Final Verdict

I just had a churn last month, so I have two months to decide on this card–and who knows if this sign up bonus bump will last until October. It’s not in the top ten of absolute value bonuses for me. More importantly, it’s not in the top ten of rebate percentage bonuses.

But I have gotten a lot of the cards above it, and I love transferable points, so I might get this card, and I will keep you posted on my decision.

Should you get it? Well that depends on whether you’d use the points for airline transfers or Cash & Points nights, whether you’re a high spender looking at the absolute value of the offer or a low spender looking at the rebate percentage, and whether you’ve gotten the better cards.

Bonus

There is an identical business version of this card. It’s the same offer, so if one makes sense, why not get both? You probably have a business. 😉

the email i received from SPG states that this deal goes thru septemeber 4th.

[…] SPG Amex card–complete analysis–earns […]