MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

The Chase Ink Plus, one of the best business cards on the market, has long offered new applicants no annual fee for the first 12 months, then a $95 annual fee.

Today I noticed two other offers on the Ink Plus being split tested by Chase (and there may be more.) By repeatedly going to the Ink Plus’ page in a Chrome Incognito browser, I got three different offers.

They were:

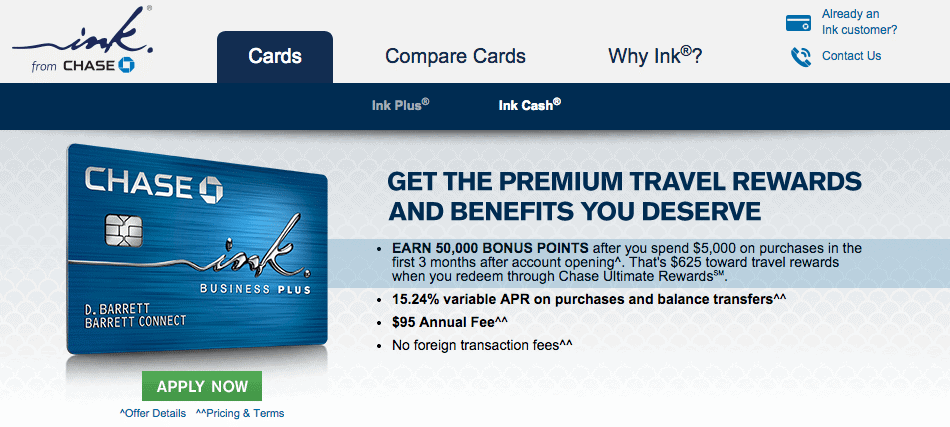

- $0 annual fee for first twelve months, then $95 (current standard offer)

- $95 annual fee (ie not waived for first 12 months)

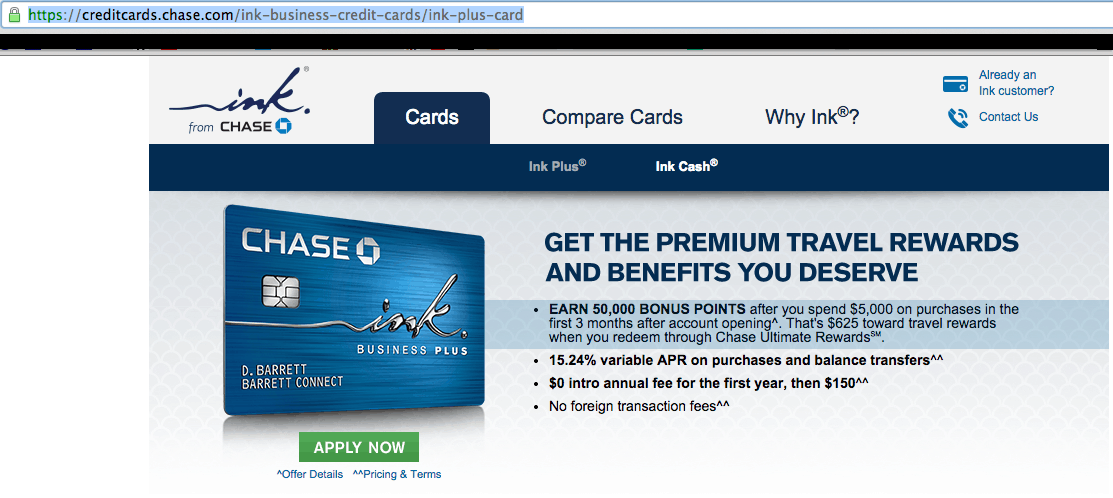

- $0 annual fee for first twelve months, then $150 (ie a bigger annual fee)

As far as I could tell, only the annual fee varied. Every other aspect of the offer was the same.

Here’s the non-waived annual fee offer.

Here’s the $150 annual fee (waived year one) offer.

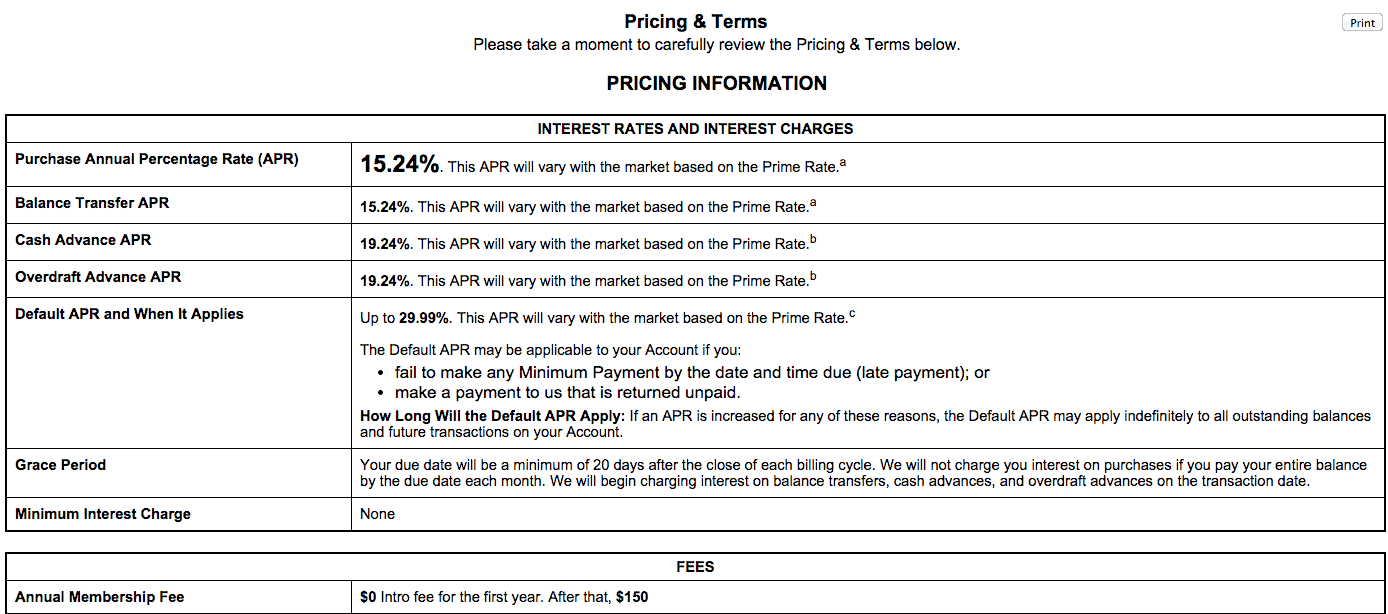

Clicking the Pricing & Terms link brought up this page, which confirmed the annual fee of $150.

You can access that page by clicking this link.

Companies split test offers all the time. If Chase finds that people sign up for the worse offers at the same rate as the better offer, they’ll surely switch to a worse offer as a profit-maximizing company. Let’s hope that doesn’t happen.

In the meantime, if you go through an affiliate link to get the Ink Plus, you will get the best offer of $0 annual fee for 12 months, then $95. Affiliate links are not being split-tested to my knowledge.

[…] that Chase is split testing higher annual fees for the card, so make sure you get the best […]

[…] that Chase is split testing higher annual fees for the card, so make sure you get the best […]

[…] MileValue, Chase is testing new annual fees for the Chase Ink Plus […]

[…] MileValue, Chase is testing new annual fees for the Chase Ink Plus […]

[…] But it seems Chase is getting a little tougher on new customers with some annual fee testing apparently in the works, which has been confirmed via screenshots at MileValue. […]

[…] But it seems Chase is getting a little tougher on new customers with some annual fee testing apparently in the works, which has been confirmed via screenshots at MileValue. […]