MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Some credit card offers in this post have expired, but they might come back. If they do they will appear –> Click here for the top current credit card sign up bonuses.

Bri wrote in her Free Credit Card Consultation:

2 passengers, to Lima, Peru. Anytime in July 2015 (hopefully stay 2 weeks). I would love to fly business class but I would like to err on the side of opening just 1 card, if possible. My friend is willing to also open a card. I’m thinking American Airlines or the US Airways offer, since its 50,000 miles, but I don’t know if that’s the best use of miles to get to South America and if there’s notoriously low availabilities for South America during the summer

I was expecting to suggest the Citi® / AAdvantage® Platinum Select® MasterCard® with 50,000 bonus American Airlines miles after spending $3,000 in the first 3 months or the US Airways card with 50,000 bonus miles after first purchase also. After all, I had suggested the American Airlines card to everyone as the Way to Get to Machu Picchu with Miles.

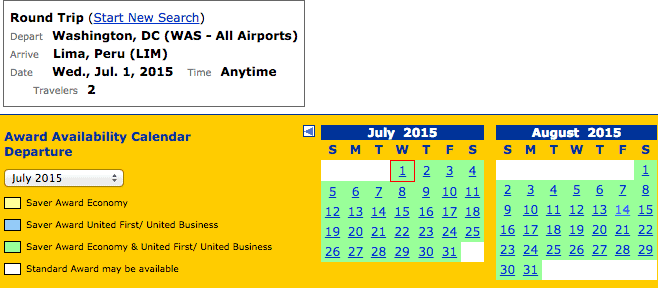

But as is often the case, I ran a quick search to see what award space I could find. I ended up finding award space every day in July to Lima, but not with American Airlines miles.

United miles are the ticket for Bri. I replied:

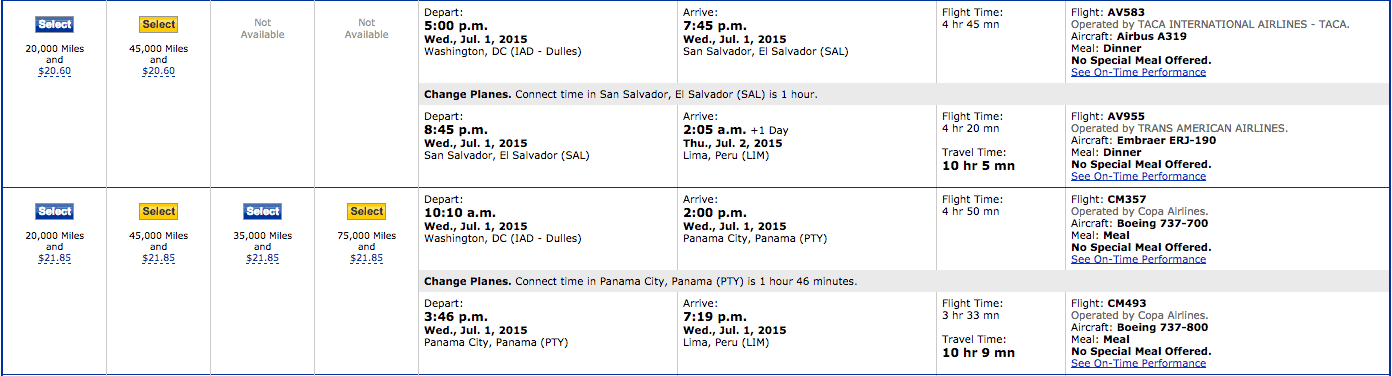

There is award space every day for two passengers from IAD-LIM, usually with an option to connect in El Salvador, flying TACA/Avianca, or Panama City, flying Copa. It is easily searchable and bookable at united.com. Each way is 20k in economy and 35k in Business, so opening one card is enough for one way in each cabin.

Most days have economy and business class award space available.

United isn’t releasing Saver space on itineraries via its daily flight from Houston. Instead, you fly on Copa and TACA/Avianca.

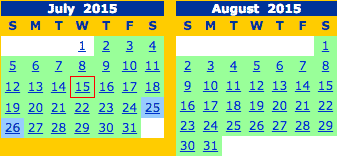

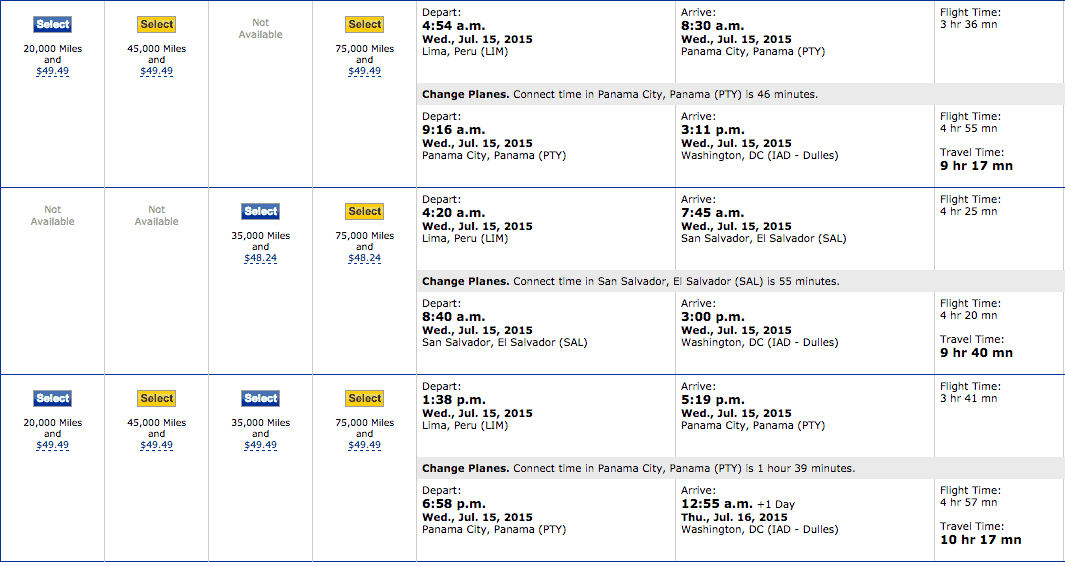

The return offers the same kind of itineraries.

Suggested Card

The best card to get United miles is the United card. Right now the public offer is 30k miles after $1k spending in the first three months plus 5k miles for adding an authorized user.

If you log into your United account, you may get a 50k offer after spending $2k in three months instead plus the same 5k miles for adding an authorized user.

If you don’t get that offer, you can probably get matched to that offer by applying for the public offer, then writing Chase a Secure Message saying you saw the 50k offer (it has been at Houston Airport in the last month) and asking to be matched to it.

In all cases, the $95 annual fee is waived the first 12 months.

If you get the 50k offer, that should be 57,000 United miles after spending $2,000, which is enough for one way to Peru in economy and one way in business class.

Bri and her friend can get to Lima next July for under $100 in taxes by opening one credit card each. It wasn’t the card she (or even I) expected to suggest. This is a cautionary tale to always start at the end and perform an award search before you apply for a credit card. Or just have me do it for you with a Free Credit Card Consultation.

I have had some issues with getting my United miles posted. I did the spending for the 30,000 point offer but nearly 60 days after, miles still not posted. I also did the secure message asking for the 50,000 points and was refused unless I can produce an offer code. Does anyone have the code from the offer found at the Houston airport? I phoned the rewards line and they said points can take up to 8 weeks after meeting the spend. Hoping I wil still be able to find award space for a trip to Belize in March! Good lesson on planning well in advance.